Best Frisco, Texas Car Insurance (2026)

Average Frisco car insurance rates in Texas are $466.37/mo while the cheapest Frisco car insurance costs come in at $193.39/mo for 60-year-old drivers. Frisco car insurance requirements follow the state's 30/60/25 minimum coverage requirements for injury and property damages. To find the best Frisco car insurance companies, shop around for Frisco car insurance quotes using our comparison tool below.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Frisco City Summary | Stats |

|---|---|

| Population | 155,363 |

| Density | 2,615 per square mile |

| Average Cost of Car Insurance | $5,596.44 |

| Cheapest Car Insurance | $2,320.68 |

| Road Conditions | Fair |

Just 20 miles outside the Dallas International Airport sits Frisco, Texas. The city is known for its antique shops and museums. The original birthplace of the patty melt, Frisco has blessed us with one of the United States favorite handheld masterpieces.

Part of the Dallas/Fort-Worth Metro area, Frisco is on the rise. It is part of one of the fastest-growing cities in the country.

Considering how quickly the city has grown, having strong car insurance while driving around town is important. Knowing how to compare car insurance companies could save you hundreds of dollars every year on Frisco, Texas car insurance

Enter your ZIP code in our FREE tool above to get an insurance quote today.

Car Insurance in Frisco, Texas

Car insurance is never fun, but this article will help educate you on insurance in all of Texas and Frisco specifically.

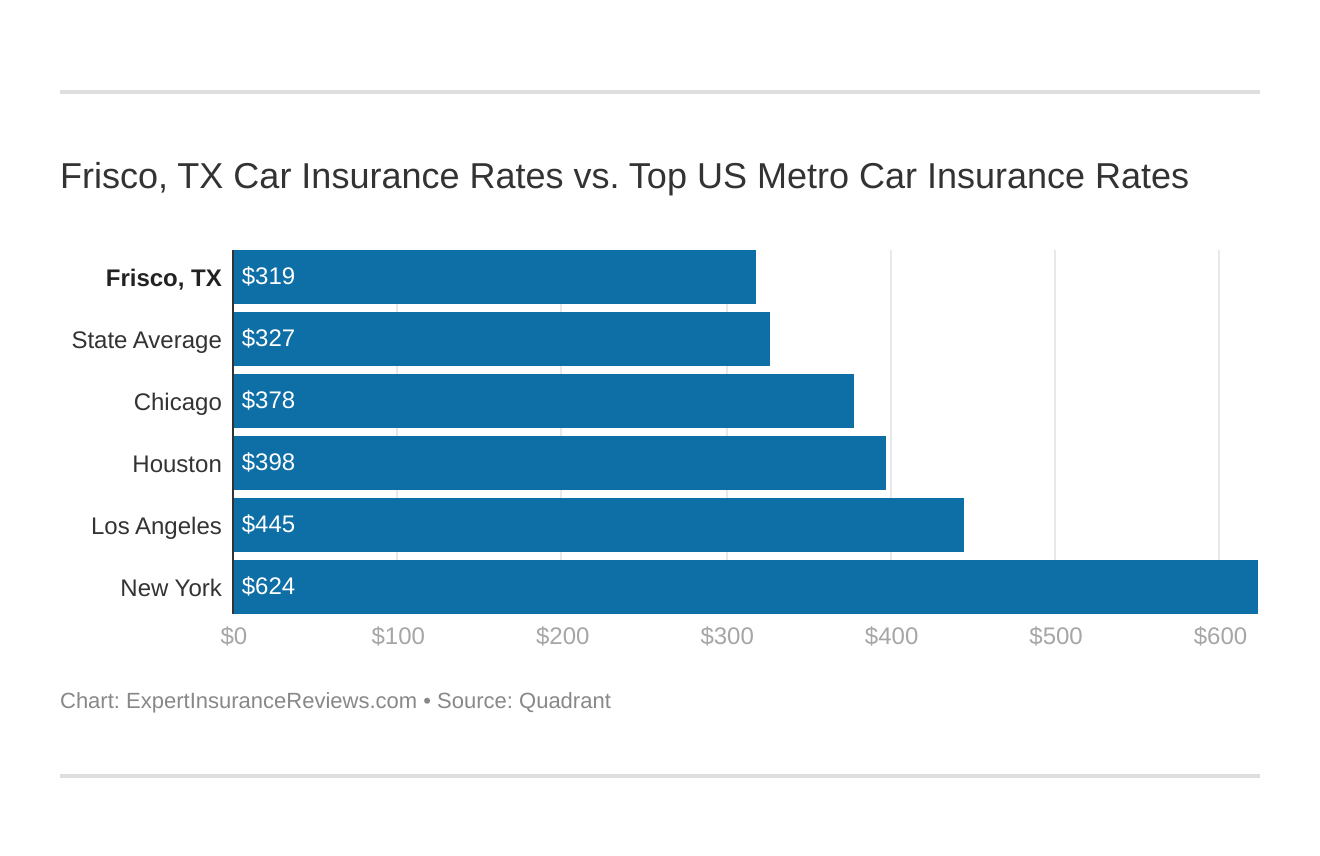

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Frisco, Texas against other top US metro areas’ auto insurance rates.

Whether you’re planning on moving, or have been in Frisco since birth, you’ll learn the facts about car insurance and what you need to know to get the best policy for the best average rate.

Male vs. Female vs. Age

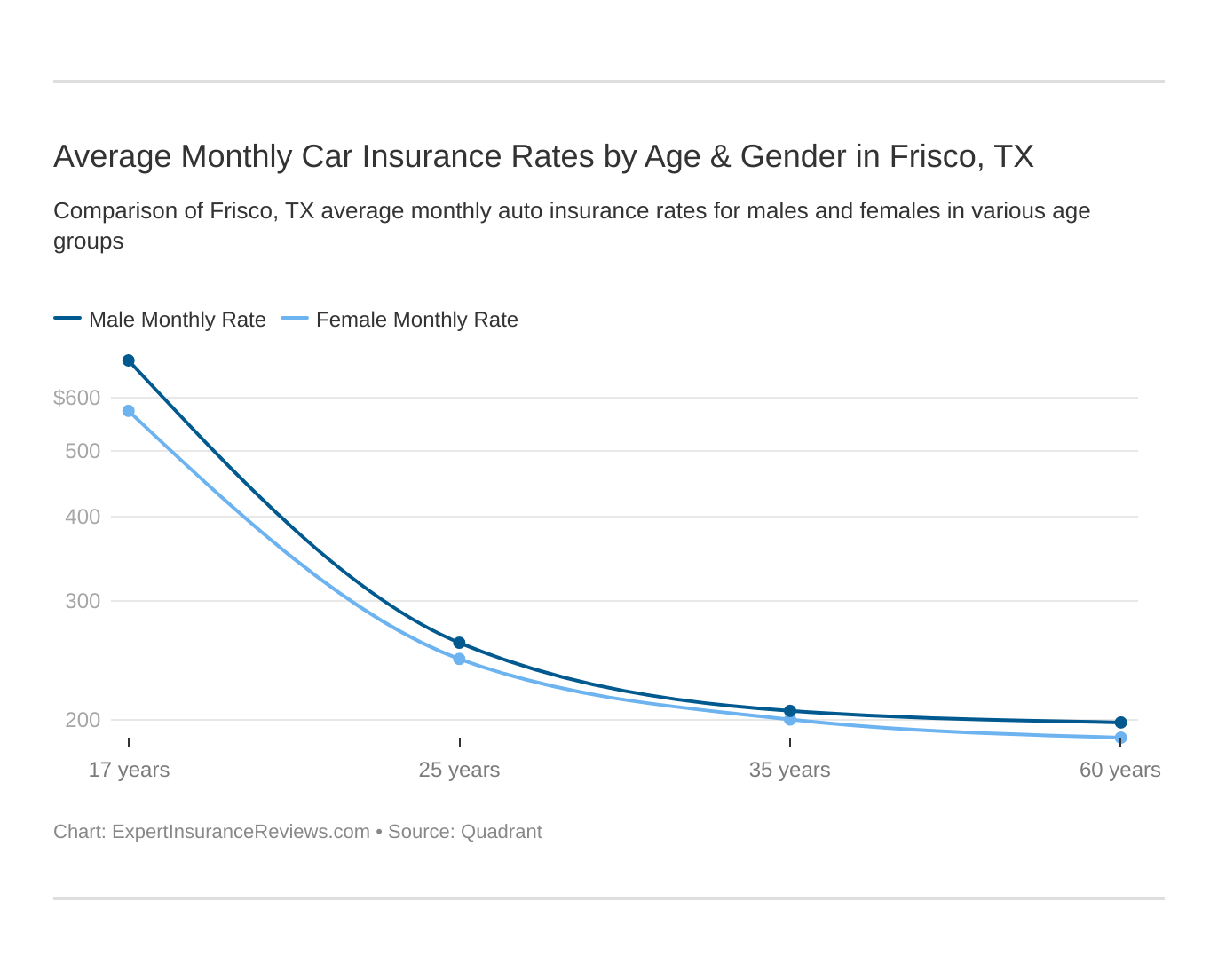

At a median age of 36.5, Frisco is a relatively older city. This a great thing for car insurance rates. The older you get, usually the lower your car insurance rate.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Frisco. Texas does use gender, so check out the average monthly auto insurance rates by age and gender in Frisco, TX.

Female drivers and people over the age of 60 receive the lowest rates on average. Insurance companies take this stance purely on statistics. Those between the age of 60 and 75 are the safest drivers on the road. Women drivers are consistently in less fatal accidents than men.

| Frisco Rates by Age | Average Cost |

|---|---|

| 17 | $7,538.40 |

| 25 | $3,037.35 |

| 35 | $2,441.63 |

| 60 | $2,320.68 |

As you can see from the table, teens are charged thousands of dollars more a year than every other age bracket. Teens have next to no experience on the road and are the highest volume age group to be pulled over for speeding.

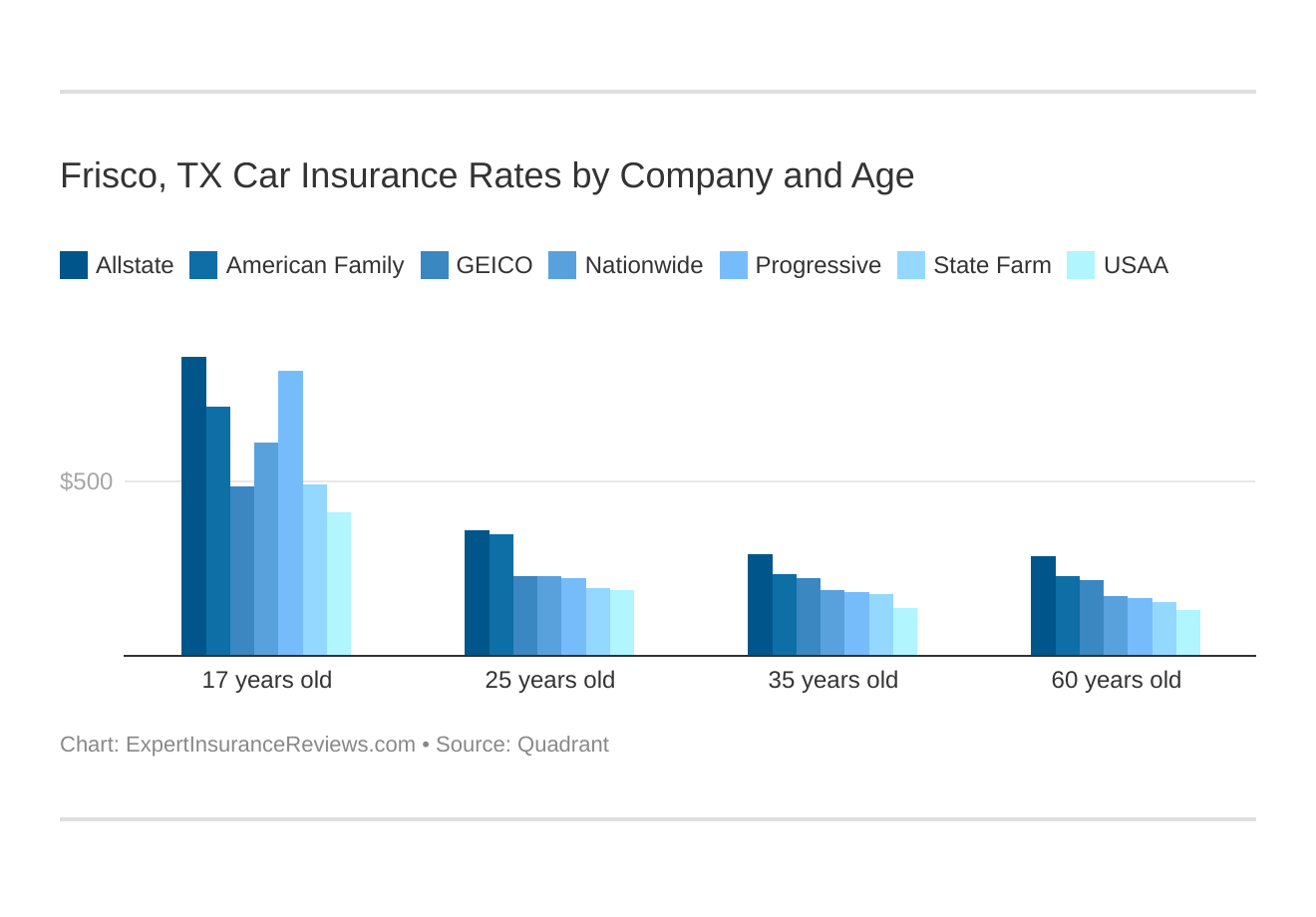

Frisco, Texas auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

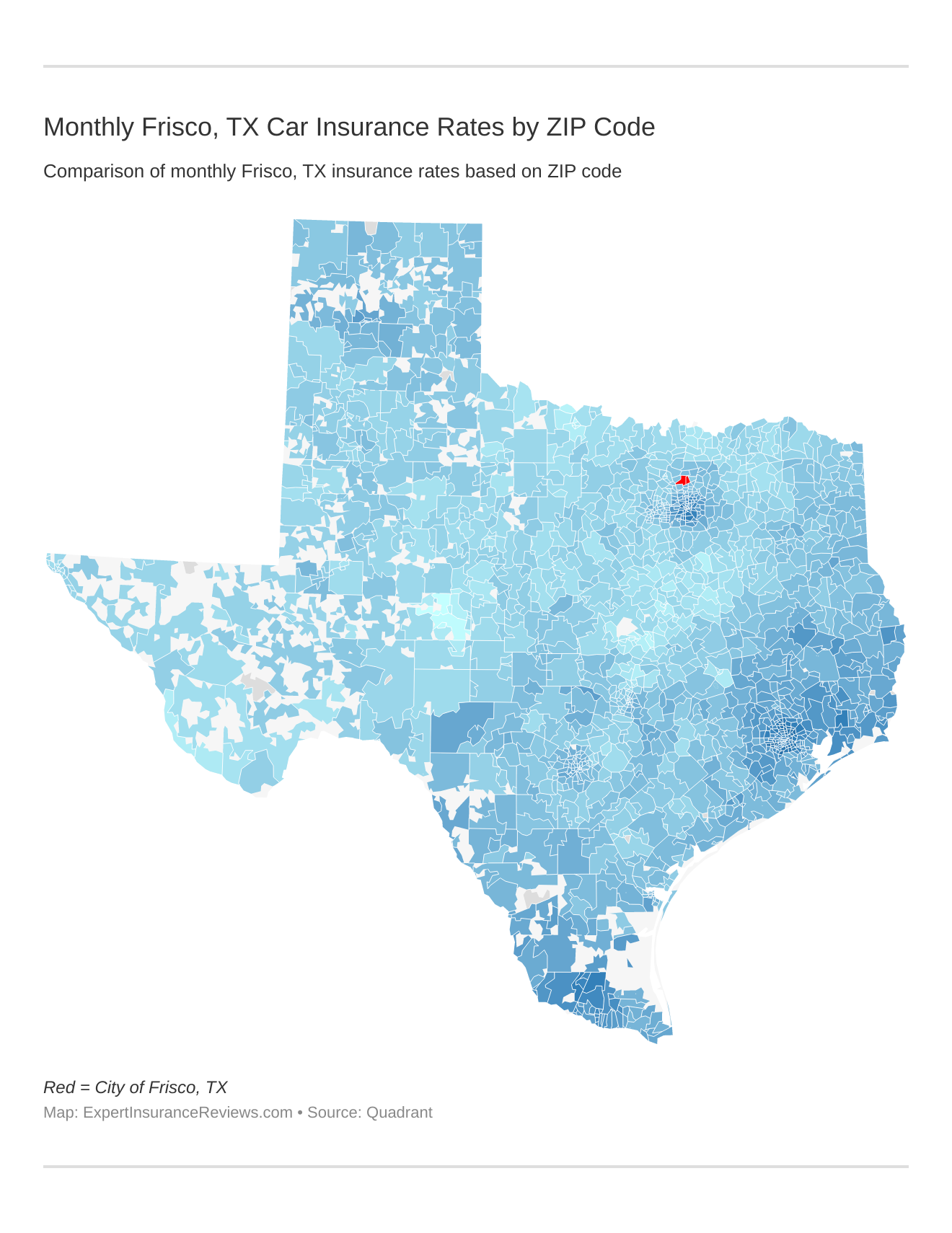

Cheapest ZIP codes in Frisco

The cheapest ZIP code in Frisco is 75035 at an average annual auto insurance rate of $5,596.94. Rates by ZIP code vary due to many different variables such as how many teen drivers are in the area, how many clean driving records are in the area, and the number of elderly drivers in the area.

| Zip-Code | Rate |

|---|---|

| 75033 | $5,622.59 |

| 75034 | $5,689.38 |

| 75035 | $5,596.94 |

75035 may have the lowest rate because there are fewer teens and more drivers with experience and clean records.

Find more info about the monthly Frisco, TX car insurance rates by ZIP Code below:

Sometimes these rates depend on poverty as well, however; so if you’re planning on moving to be sure to choose the right area.

Affordable Frisco, Texas Car Insurance

Finding the best rate and company is the toughest part of shopping for car insurance. The cheapest price is always the most appealing to people, but it could end up hurting your pocketbook in the end.

The cheapest rate could mean you have NO coverage in case of an at-fault accident.

There is low, medium, and high coverage policies. Investing in the high coverage policy will cost more each month, but when it comes to your long term money, it can be your best friend. In some cases, if you’re a trustworthy driver, that cheap rate is the best for you.

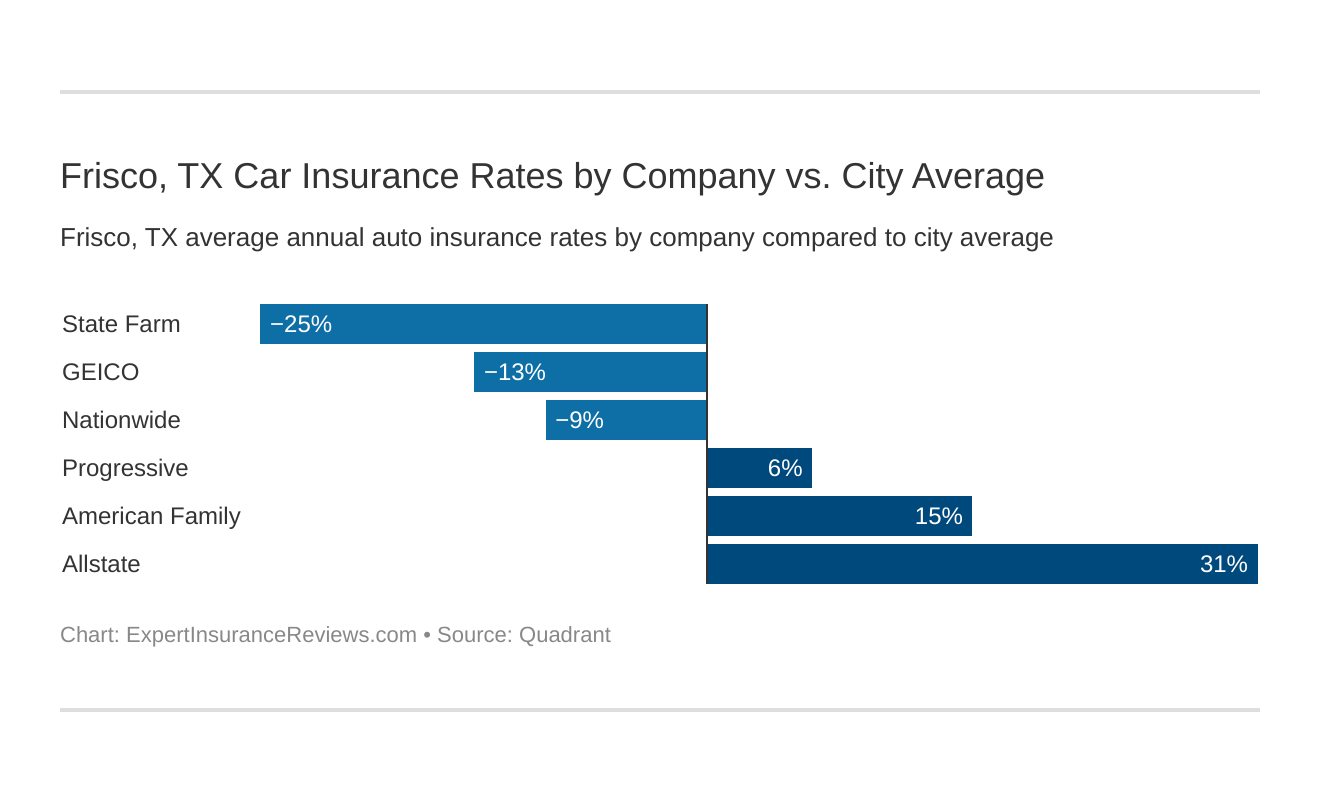

Frisco, Texas Car Insurance Companies

There are hundreds of different insurance companies that show commercials on our favorite shows every day. Sometimes the most popular car insurance company isn’t the best route to go, and may not have the most affordable rates. In this table, you’ll see the top insurance companies in Frisco and their most competitive rate.

| Car Insurance Company | Average Annual Rates |

|---|---|

| USAA | $2,594.28 |

| State Farm | $3,063.06 |

| Geico | $3,456.46 |

| Nationwide | $3,600.52 |

| Progressive | $4,168.87 |

| American Family | $4,577.35 |

| Allstate | $5,381.07 |

The cheapest Frisco, TX auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Texas auto insurance company rates?” We cover that as well.

Military gets excellent treatment all over the U.S. (rightfully so) but especially in Texas. USAA is consistently the cheapest insurance company in the state and Frisco.

If you aren’t military, there are plenty of companies offering competitive rates; search carefully, and you should be able to save some money.

Best Car Insurance by Commute

Many insurance companies take into account your daily commute to determine your auto insurance policy rate.

The more you are on the road, the more chances you have to get in an accident or any other insurance-related situation. Knowing this, companies try to protect themselves from heavy commuters by raising rates.

Some companies don’t raise for commutes, however. So, if you know, you’re going to be in the rush hour traffic, try to find the companies that won’t raise their price tag.

This table shows the companies that will increase rates for a long commute and which ones do not.

| Best Car Insurance by Commute | 10 Miles (6,000 Annually) | 25 Miles (12,000 Annually) |

|---|---|---|

| USAA | $2,561.83 | $2,626.73 |

| State Farm | $3,063.06 | $3,063.06 |

| Geico | $3,394.54 | $3,518.38 |

| Nationwide | $3,600.52 | $3,600.52 |

| Progressive | $4,168.87 | $4,168.87 |

| American Family | $4,577.35 | $4,577.35 |

| Allstate | $5,245.00 | $5,517.14 |

State Farm, Nationwide, and Progressive don’t raise their rates at all, but Geico, USAA, and Allstate do. Be sure to check the best policy for your commute.

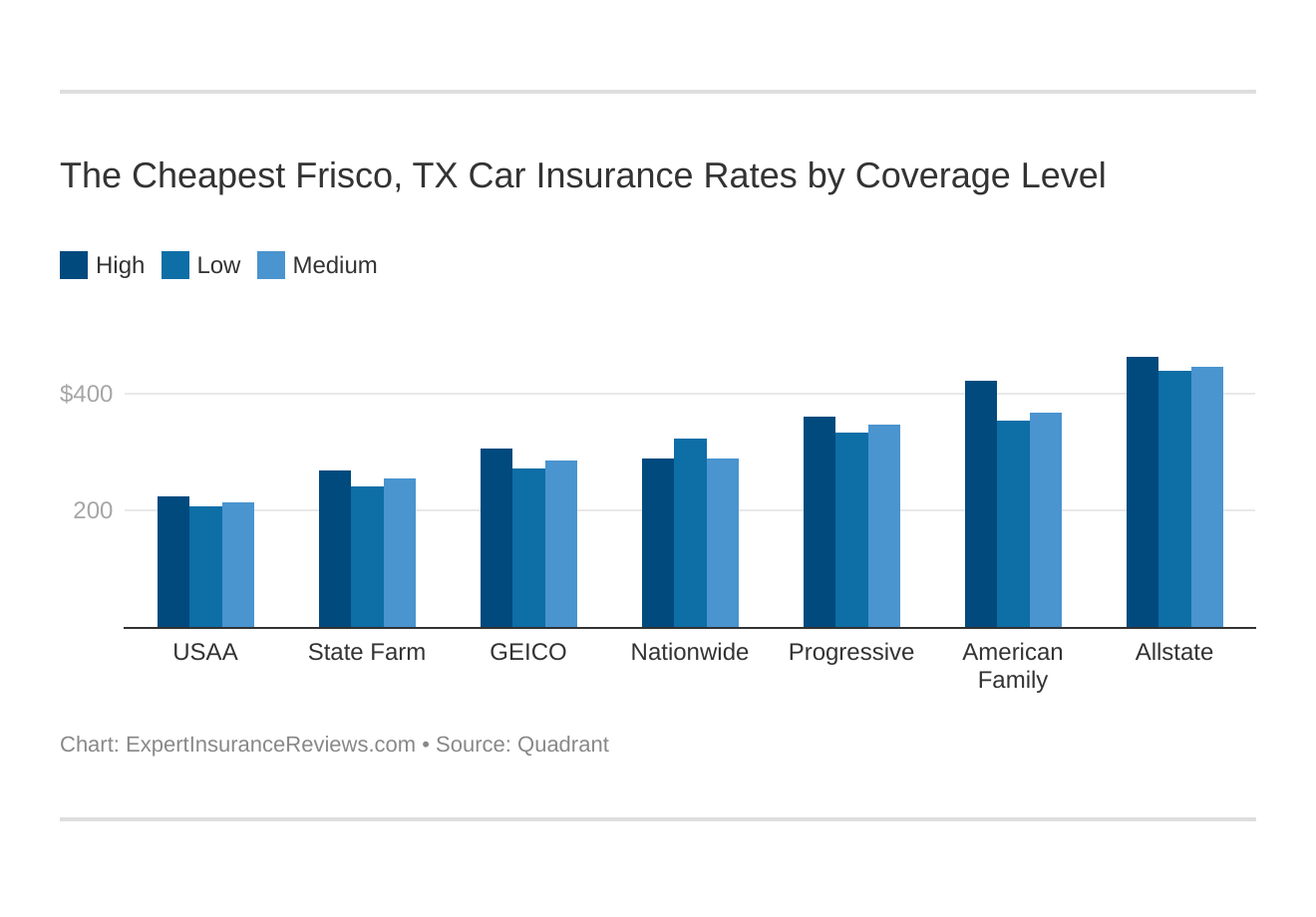

Best Car Insurance by Coverage Level

Low coverage will save your pocketbook monthly, but high coverage will save you in case of an accident, or citation.

Coverage levels come in three different packages low, medium, and high. Low levels are the most basic while higher levels provide more comprehensive coverage. The difference between them ranges from company to company.

Your insurance coverage level will play a significant role in your Frisco, TX auto insurance rates. Find the cheapest Frisco, Texas auto insurance rates by coverage level below:

Some companies may offer their high coverage at a good annual price, which could save you a lot of money in an at-fault situation. Be careful of the low coverage, in most states, it is all the law requires, but it could leave you high and dry if you get in an incident on the road.

| Company Rates by Coverage Levels | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| USAA | $2,499.27 | $2,583.33 | $2,700.23 |

| State Farm | $2,894.94 | $3,056.82 | $3,237.42 |

| Geico | $3,266.88 | $3,418.35 | $3,684.14 |

| Nationwide | $3,281.16 | $3,451.60 | $3,468.80 |

| Progressive | $4,008.92 | $4,154.74 | $4,342.95 |

| American Family | $4,256.52 | $4,407.84 | $5,067.70 |

| Allstate | $5,254.13 | $5,333.46 | $5,555.62 |

This table shows the price difference for each company between each level of coverage. In most cases, low to high coverage is only a difference of a few hundred bucks.

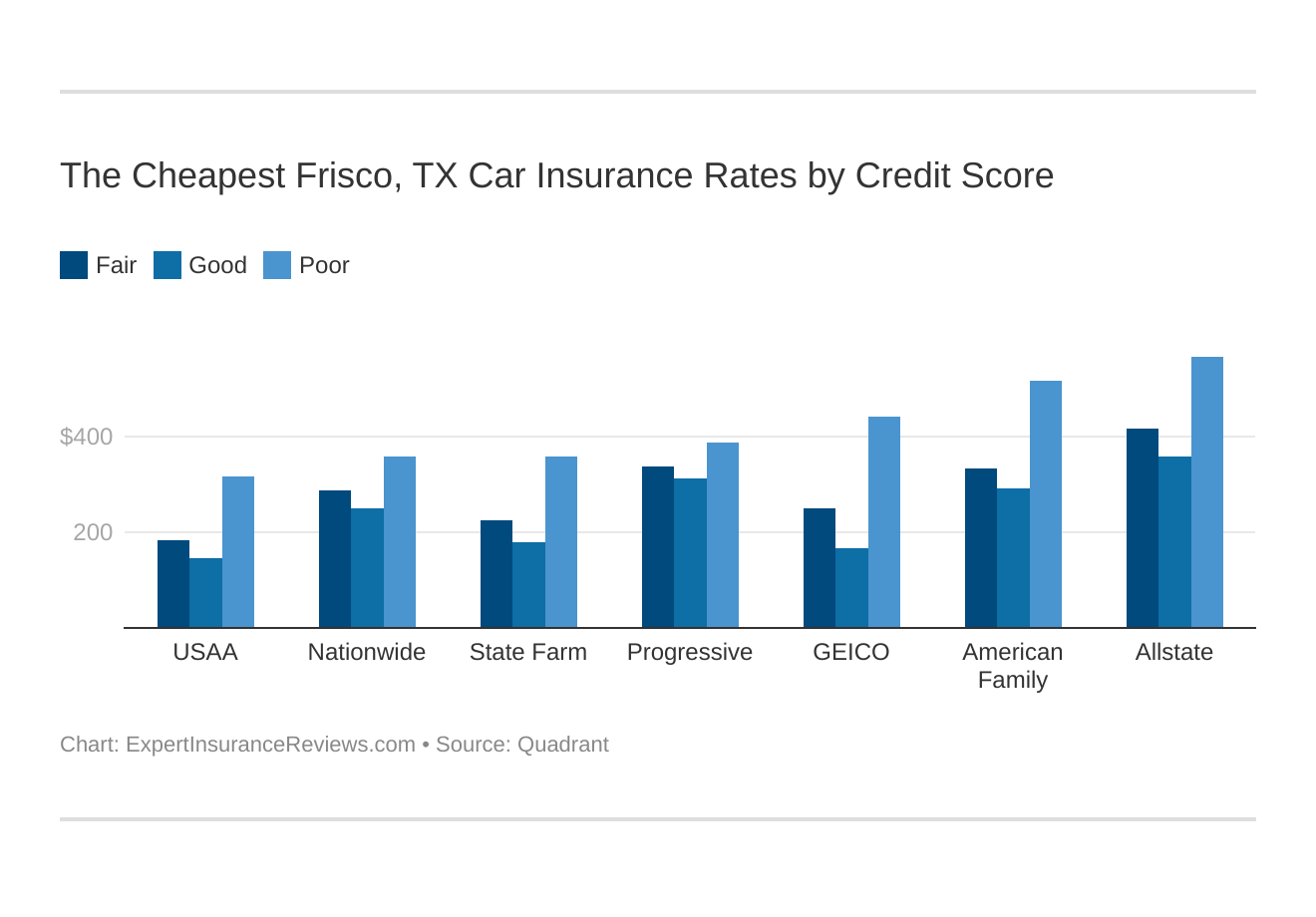

Best Car Insurance by Credit History

Credit history is the most important factor in raising your rates. It can sometimes mean thousands of dollars.

Your credit score will play a major role in your Frisco, TX auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Frisco, Texas auto insurance rates by credit score below.

In today’s world, we are defined by a number. Our credit history tells almost everything there is to know. If you have a poor credit score car insurance companies will sky-rocket their rates. Just like buying a car, this is probably the most important factor in policy rates.

| Company Rates by Credit History | Poor | Fair | Good |

|---|---|---|---|

| USAA | $3,791.04 | $2,209.53 | $1,782.27 |

| State Farm | $4,335.77 | $2,700.56 | $2,152.85 |

| Geico | $5,341.49 | $3,018.65 | $2,009.23 |

| Nationwide | $4,304.57 | $3,474.48 | $3,022.31 |

| Progressive | $4,687.19 | $4,056.58 | $3,762.74 |

| American Family | $6,228.35 | $4,007.12 | $3,496.58 |

| Allstate | $6,825.62 | $5,015.61 | $4,301.97 |

As you can see in the table, nearly every company raises its prices by upwards of 3,000 dollars between poor and good credit. Geico raises its rates on average by 3,332.26 dollars.

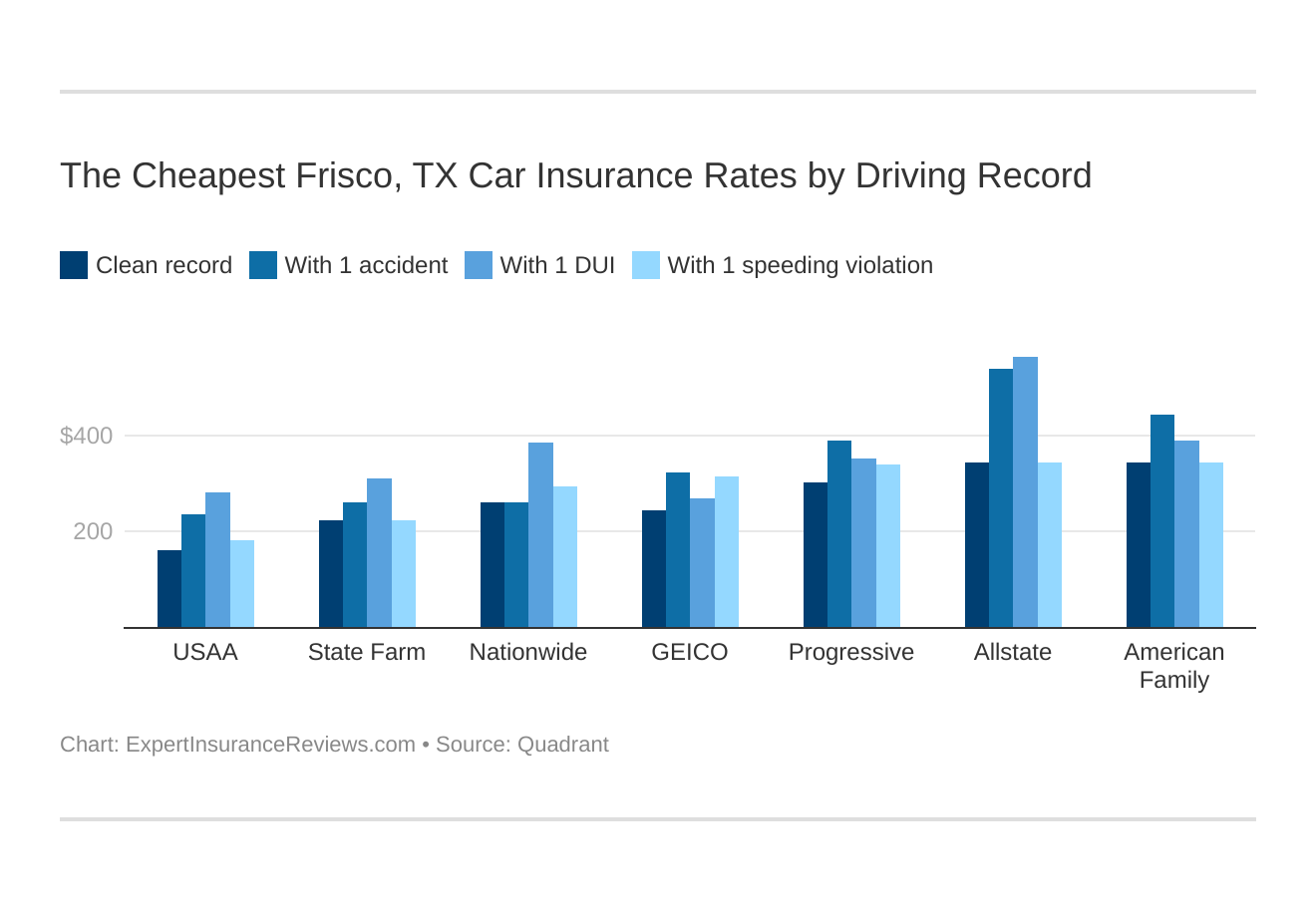

Best Car Insurance by Driving Record

A clean driving record can buy you a great rate from every company you shop with.

| Company Rates by Driving Record | Clean Record | 1 Accident | 1 DUI | 1 Citation |

|---|---|---|---|---|

| USAA | $1,921.70 | $2,859.43 | $3,389.51 | $2,206.47 |

| State Farm | $2,704.05 | $3,124.45 | $3,719.69 | $2,704.05 |

| Geico | $2,929.75 | $3,904.04 | $3,222.13 | $3,769.92 |

| Nationwide | $3,123.55 | $3,123.55 | $4,627.83 | $3,527.14 |

| Progressive | $3,639.93 | $4,691.83 | $4,243.03 | $4,100.68 |

| American Family | $4,153.49 | $5,337.40 | $4,665.03 | $4,153.49 |

| Allstate | $4,125.40 | $6,489.16 | $6,784.31 | $4,125.40 |

While your credit score is the most important factor in getting a good rate, your driving record is a close second. Companies take this into account to see how much money they may need to spend on you. A bad driver means more money out of the company’s wallet.

Your driving record will affect your Frisco auto insurance rates. For example, a Frisco, TX DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Frisco, TX auto insurance rates by driving record.

The table above shows that most companies raise their rates by almost $1,000 for one accident.

A DUI will most certainly ruin your rates. Nationwide nearly doubles their annual rate because of one DUI.

Some companies have accident forgiveness and give breaks on your first ticket. The rates for the companies will be a bit higher, but this could save you in the long run.

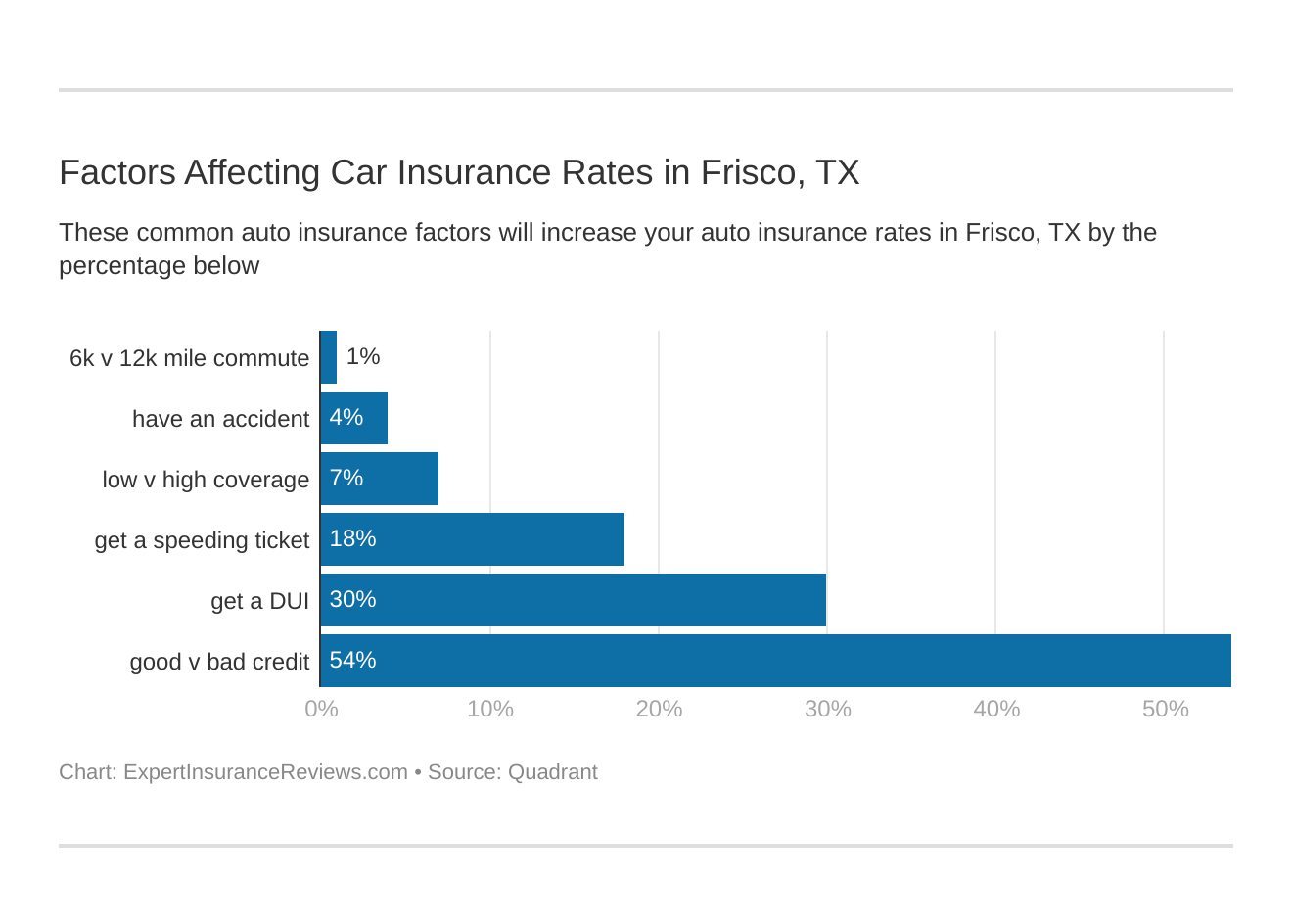

Car Insurance Factors in Frisco

Frisco resides within the confines of the Dallas/Fort Worth Metro area. This area has been growing like wildfire and is prospering greatly.

Many things affect your car insurance rates. We’ve already explained how the things YOU do affect them, but how do your SURROUNDINGS affect them?

Factors affecting auto insurance rates in Frisco, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Frisco, Texas auto insurance.

In this section, we’ll dive into the many ways insurance companies create policy prices and what factors you cannot change that make those prices.

Growth & Prosperity

According to the Metro Monitor from 2010 to 2015, the metropolitan area of Dallas/Fort Worth is ranked 11th in increase and 15th in prosperity. This is an excellent sign for everyone in the city. But could also mean a bit of a hike in insurance prices.

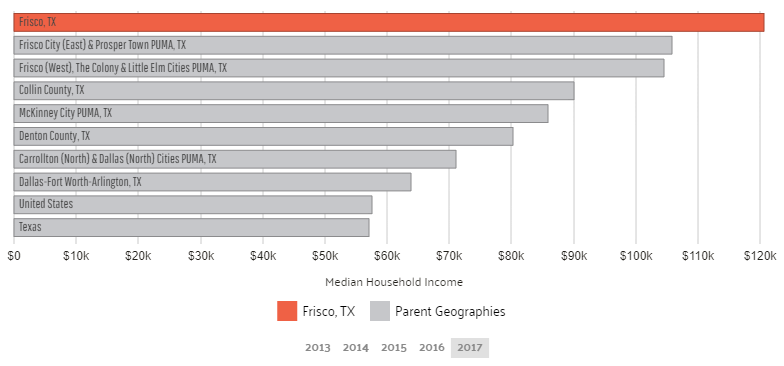

Median Household Income

The median household income in Frisco is enormous. Standing at a whopping 120,701 a year, it is DOUBLE what the rest of the United states median income is.

This is an excellent thing for your home; it means prices are exploding, and you can make a lot of money if you sell. However, it does mean that insurance prices will be higher since clearly, the city has the money.

This chart shows just how big of a difference the household income of Frisco is than surrounding cities, the state, and the U.S.

If you live in a place with a high average income per household you will pay more for your car insurance.

Median household income gives insurance companies a base value of what the area can afford.

Below you can use an insurance cost calculator to see what you can afford based on your income.

CalculatorPro

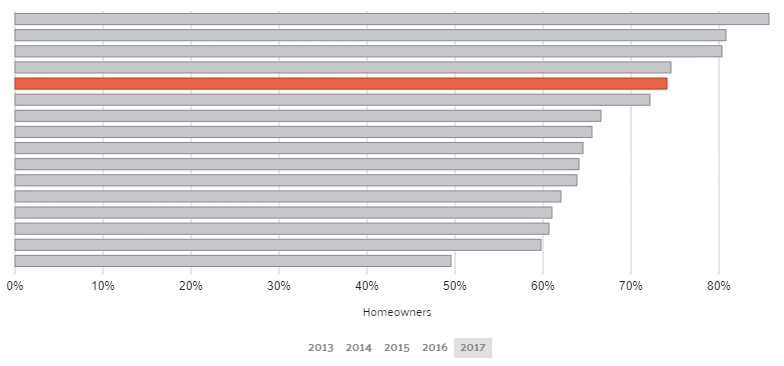

Homeownership

This section involves the percentages of renting vs. owning in Frisco. At 74 percent homeownership, Frisco has one of the highest rates of owning in all of Texas. It is also among the highest in the nation.

This helps significantly with car insurance companies. Renters, as most know, can be a riff-raff crowd. Insurance companies also know this. The more renters there are in a particular area, the more companies raise policies. This is based on safety mainly.

This chart details the homeownership percentage of neighboring cities around Frisco. The more people who rent, the less likely they are to have multiple cars, a high income, etc.; which puts Frisco in an excellent spot to save some money on insurance.

Education

There are a few different universities in the metro area just outside of Frisco. There are no universities directly in Frisco.

Northlake College is the most populated and accounts for most of the student population in the surrounding area.

Knowing how many students there are in the area is essential for insurance. If there is a large number of student drivers in the area, that means rates will be higher.

For example, in Austin by the University of Texas, the rates there would be much higher due to the high amount of young drivers.

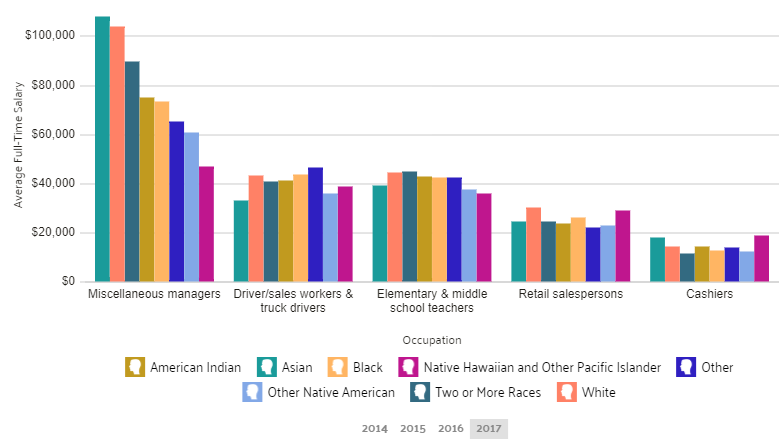

Wage by Race & Ethnicity

As you can see in the chart, Asian peoples have the highest salaries among general occupations. This is consistent in almost every city in America.

Asian workers made 1.25 times the amount of the next highest-paid workers.

The reason this is worth mentioning is based purely off the average income of people in the city. If you are looking for car insurance and do not have a high salary, you will be forced to go with the minimum legal coverage.

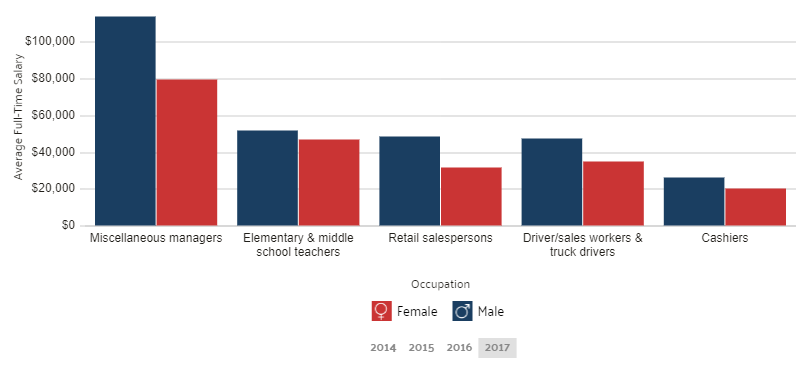

Wage by Gender

Gender is a significant factor in car insurance, so knowing how the different genders are weighing against each other is a great asset.

As mentioned before, almost every car insurance company charges less to female drivers. This is due to female drivers being significantly safer in virtually every statistical category and males making a higher wage in most jobs.

On average men made 1.41 times the amount women established in 2017.

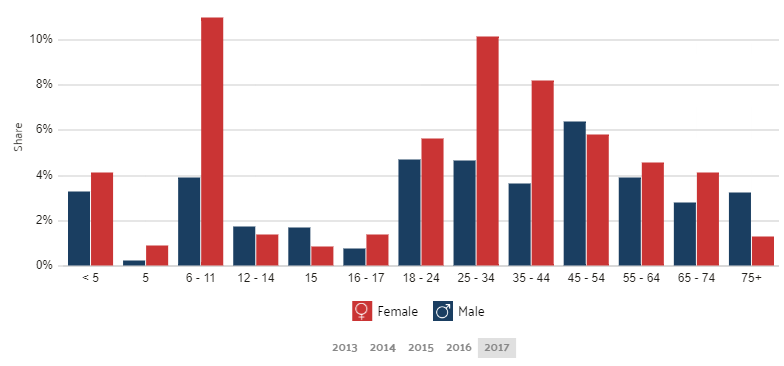

Poverty by Age & Gender

Debt is an overwhelming epidemic in our country. Every city and state has its fair share. Frisco is quite a bit lower than average. In fact, the town is 13,4 percent lower than the national average.

Females age 6-11 experience the most poverty in Frisco. This could leave you with some questions.

The Census Bureau defines poverty if a family’s total income is less than the family’s threshold than that family, and every individual in it is considered to be living in poverty. So if a household is living in poverty and has three daughters between the age of 6-11, all of them are considered impoverished.

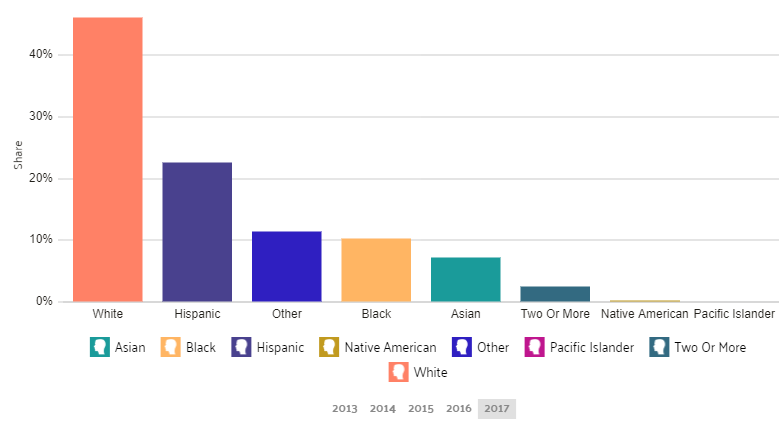

Poverty by Race & Ethnicity

The table from Data USA shows that whites and Hispanics are the most impoverished races in Frisco. This is a robust statistic due to the tracks that make up most of the population. Whites and Hispanics make up a majority of the community; so, of course, they are the most impoverished.

Employment by Occupations

Frisco actually has a low number of employees but also a relatively small population as well.

In 2017 there were 77,600 employees in Frisco. Of those, the most common job groups are Management Occupations (14,843 people), and Sales & Related Occupations (10,710 people).

Frisco is growing nicely also. The number of employees grew at a rate of 6.88 percent, from 72,600 employees in 2016.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Frisco

Frisco is far enough away from the urban city of Dallas that the traffic is not horrible whatsoever. But, if you travel closer to the city and the Dallas/Fort-Worth International airport, you’re asking for trouble.

Traffic in morning and night rush-hour will be above average, traveling at about 33 mph.

In this section, we’ll dissect the roads, safety, and traffic congestion. Car insurance companies look at the same factors as they decide how high or low your rate will be. It is best to know the facts and questions to ask when deciding on insurance.

Roads in City

Here are some of the ways the streets in the city affect the rates that companies offer. Things like road conditions and possibilities of ticketing can change policy rates.

Major Highways

Texas, in general, has 25 different active highway routes that span over 3,500 miles.

The most traveled highways include I-635 or LBJ Highway, SH-114 or John Carpenter Freeway and SH-183 or the Airport Freeway. Going on these roads is where you will encounter the most congestion in the area.

The Dallas North and the Sam Rayburn Tollway’s are also some of the most traveled in Frisco. Avoid these roads, and your traffic problems will be at a minimum.

Popular Road Trips/Sites

Road trips are always fun, especially in a state more significant than the entire country of France. In Frisco, there are places to visit, like the National Soccer Hall of Fame, national parks, and many other historical sites.

Frisco is well-known for its old railways that have been in service since the early 1900s to the present day.

Road Conditions

Road conditions in all of Texas vary.

Each broad area containing more than 500,000 people has statistics on how their pavement rates. So, Frisco will not be on the last. However, the Dallas/Fort Worth area has as follows:

- Poor Roads – 21 percent

- Mediocre Roads – 31 percent

- Fair Roads – 20 percent

- Good Roads – 28 percent

Each area also does an average of extra vehicle costs called VOC’s, which averages out how much you may have to spend on your vehicle due to road conditions. This does not include gas and other basic things every car needs.

The Dallas/Fort Worth area that includes Frisco has a VOC of $609.

Speeding or Red Light Cameras?

Though they have been outlawed by the governor, some red-light cameras by municipalities are in operation; even on the highways.

Irving no longer issues or enforces photographic enforcement citations. Speeding and red light cameras are now only used as warnings to be aware.

On June 2, 2019, Irving’s Red Light Camera Safety Program ended. Governor Greg Abbott signed on it to lower costs.

Vehicles in City

In every city, there are many different modes of transportation. Classic cars, motorcycles, buses, and Uber. The type of vehicle you drive can drastically affect your insurance rates.

Classic car insurance is often double the cost of regular car insurance. Sports cars will cost you more. A soccer-mom-minivan will cost you much less.

Most Popular Vehicles

Everything is bigger in Texas. Surprisingly the most popular car is not an oversize pickup with Longhorns glued to the hood. It’s a Dodge Challenger.

After watching this video, the challenger is big for other reasons than size. The Challenger will raise those insurance prices because it’s a sports car, and due to safety issues. When a car can go as fast as Challengers do, it’s an issue for insurance companies. It creates higher liability for them.

In the Dallas/Fort Worth area, 47 percent of cars are American made.

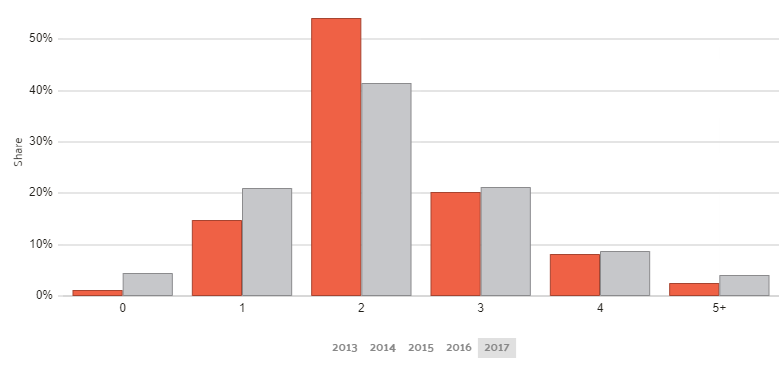

Cars Per Household

On average, the United States has two cars per household. These statistics matter simply because of the number of people on the road. If a city has an average of three cars per household, that means there are many more cars on the road.

As you can see, Frisco is right alongside the rest of the nation. The city does have about 10 percent more households with three cars though, which means two things. Frisco has some wealthy people living in it, and there may be more cars on the road than you think.

Households Without a Car

In 2016, only 2 percent of households in Frisco did not own a car. That is a very low number, which is a good thing for the city. That stat is in relation to poverty. Places like Chicago, where there is a lot of poverty, those numbers can reach upwards of 10 percent.

Speed-Traps

Speed-traps can ruin your day if you have a lead foot. They can also ruin your insurance rate quickly.

Not speeding everywhere can have a huge benefit on you and everyone driving near you. Frisco is not big enough to have a statistic on reported speed traps, but in the Dallas/For-Worth area, there were a reported seven speed traps in the past five years.

Vehicle Theft

Vehicle theft is usually a hard thing to deal with. In Frisco, it seems to be much lower than average.

According to the FBI, there were an estimated 765,484 thefts of motor vehicles nationwide in 2016. That left the rate to about 236 thefts per 100,000 people.

According to the neighborhood scout, the safest neighborhoods in Frisco are off County Road 22 and County Road 114. This area is otherwise known as Brinkmann Ranch.

Traffic

Traffic is an issue in every city unless you live in the mountains or the cornfields.

While Texas does have a lot of open lands, Frisco will still have its share of traffic.

With the Dallas/Fort Worth International Airport just outside Frisco, traffic can get a bit hairy. Insurance companies adjust rates based on the amount of traffic, and the congestion it causes. The longer people are on the road, the more chance they have of getting in some driving incident.

In this section, we’ll show what areas have the worst amount of traffic, and where the busiest highways run. This can help you decide if not only Frisco but Texas as well is the place for you.

Traffic Congestion in Texas

Frisco itself will not be a leader in any category of traffic. Since Frisco is just a few miles outside the Dalla/Fort Worth area, let’s take a look at facts about congestion in that area of Texas.

Dallas is the 122nd most congested city in the entire world. It is in the top 25 most congested cities in the U.S. Frisco will surely get some run-off from this but mainly on the major highways.

Each year it is estimated that $1,065 is spent per driver on congestion issues in the Dallas/Fort Worth area.

Frisco is outside of Dallas, and you may not have to drive through the city to get to work, some of that traffic will be heading your way though say stay alert.

In terms of car insurance, companies will know all the statistics. Knowing them yourself will only benefit you.

Transportation

Frisco is outside of the major areas of Dallas/Fort Worth but the transportation into the city where most of Frisco works can get bad as mentioned before.

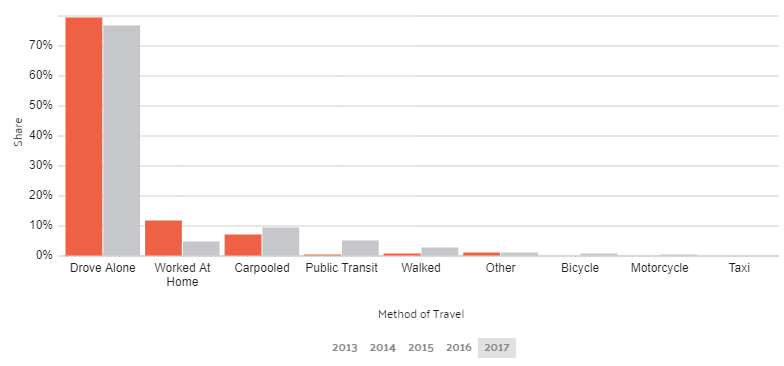

As with most other cities, most people travel alone. In Frisco, almost 80 percent of people drive alone.

Road Safety

| Texas Traffic Safety Stats 2017 | Amount |

|---|---|

| Fatalities (All Crashes) | 3,722 |

| Fatalities (Drunk Driving Cases) | 1,468 |

| Fatalities (Single Vehicle Crashes) | 1,914 |

| Fatalities (Speeding Crashes) | 1,029 |

| Pedestrian Fatalities | 607 |

| Motorcycle Fatalities | 490 |

It is a topic on the lips of every politician. How do we keep our roads safer?

It’s an endless question, but it starts with each person. Don’t drink and drive. Put down your cell phone. Slow down to the speed limit. Those main tips would save countless lives.

In the table above, you can see how many traffic fatalities there were in Texas in 2017. Almost every case involves distracted driving in some manner.

Allstate America’s Best Drivers Report

Every year Allstate comes out with their Best Drivers Report. This shows the best drivers based on cities in America. They take into account many different things, but the main three are as follows:

- Years between claims (per driver)

- Likelihood of claims

- Hard-Braking incidents

If you’re thinking of moving to the Dallas metropolitan, you may want to consider the Best-Drivers Report. Frisco is ranked 135th in the entire U.S., which is neither good nor bad. It is at least on the list.

Some things can affect this rating system like the population. There were probably much fewer accidents in Frisco than some of the safer cities, but since their population is higher it all just a ratio.

Ridesharing

Uber and Lyft are developing rapidly in every city in the nation. The closer you get to Dallas or Fort Worth, the more drivers there will be, but if you don’t plan on purchasing a car Uber can be the best mode of transportation.

Ridesharing offers many positives to owning a car. You don’t have to pay for gas, insurance, or possibly paying for out of pocket accidents.

Be careful whose car you get into though, some Uber drivers may not have insurance that covers you if you were to get in an accident.

EStar Repair Shops

EStar is a system developed by esurance to be a sort of customer service repair shop. You can find the locations of them in many places throughout the U.S. They are growing quite rapidly and easily findable as well.

Esurance is all about making your life easier, which is where the idea came from. You can process Frisco, Texas car insurance claims and find a repair shop within miles, all through your cell phone.

Car insurance can get tough; this is Esurance’s tactic to help you out.

Weather

The weather in Frisco is enjoyable. On average, the high temperature is about 77 degrees, and the low is about 57 degrees. Those are averages so it, of course, gets hotter and colder depending on the season.

| Weather In Frisco, TX | Stats (FAHRENHEIT) |

|---|---|

| Annual High Temperature | 76.4 |

| Annual Low Temperature | 55.7 |

| Average Temperature | 66.5 |

| Average Annual Rainfall | 36.19 inches |

Tornados and hurricanes can be a concern for those in Frisco, just like the surrounding areas. But Frisco and the Dallas/Fort-Worth metro do sit in a good window. It takes a lot for a tornado to make it down from the midwest, and it takes a lot more for a hurricane to make it up from the Gulf of Mexico.

Public Transit

The best way to get around most places in the U.S. is by car; Frisco is no different. In the downtown Dallas/Fort Worth area, there is a public railway system.

It will not take you to every spot in the city like it would in Boston or New York, but it can do the job fairly well.

If you’re not looking to buy a car or insurance, the bus may be your best bet.

Alternate Transportation

Many people drive motorcycles, but new means of transportation are popping up everywhere. Frisco will not have many alternate forms of transportation except bus and rideshare, but the nearby downtown Dallas area certainly will.

Scooters and bikes are available for rent in the city to get you from one place to another much faster than walking.

If you’re living in Frisco and want to catch a Dallas Stars game, then Uber to just outside the city, and find yourself a scooter the rest of the way. Its an enjoyable time for any age.

Parking in Metro Areas

Though Frisco is outside the city is part of the metro of Dallas/Fort Worth. Parking can get tricky when an event is going on downtown. But the Dallas/Fort Worth Metro seems to be doing as best as they can.

Most parking lots are monitored and are ran by Online App Meters so they can be paid through your phone. Some areas will still have coin meters to pay for parking.

Air Quality

The quality of air always depends on the emissions being put out by the cars we drive.

Air quality in the Dallas/Fort Worth Metro area is surprisingly good. According to the American Lung Association, it is ranked 17 out of 228 for high ozone days. It is tied for 1st for the cleanest metro area in the country for pollution.

It is tied for 1st for the cleanest metro area in the country for pollution.

Military/Veterans

In Texas, the military and its veterans are honored greatly. Remember, USAA has the lowest insurance rates across the board in Frisco.

From the Arlington National Cemetery to the Presidents who have come from Texas, there is a rich history of military.

Car insurance does not take that for granted. Companies other than USAA also offer military and veteran discounts. With the Fort Worth Base Camp just miles from Irving, it is a popular area for veterans and current military personnel.

If you’re prior or, the current military makes sure to check out which insurance companies offer a discount if you choose not to go with USAA.

Unique City Laws

The Dallas area is full of different laws that make you scratch your head. Some that make no sense to anyone and some that are plain outrageous. Here are some of the weirdest:

In Fort Worth, you are only allowed one garage sale sign, and it must be on your property. How do you make any money if only your neighbors know about your sale?

In Irving, you can only smoke inside nine different buildings. No wonder the air is so nice. In the entire city of over 236,000 people, there are only nine buildings to smoke inside.

In Fort Worth, if you don’t use your parking brake every single time you park, you can be ticketed up to $185.

Weird laws are everywhere, but these seem to be very weird, and oddly, there is a lot more than just these.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frisco Car Insurance FAQs

There’s always loads of questions to be asked about car insurance, but here are some of the most frequent.

How much insurance does Texas require?

Texas state law states that every driver must have at least liability coverage.

How do I lower my auto insurance costs?

A clean driving record, good credit score, and old age are the best ways to get lower rates.

Why do insurance companies use my prior insurance information?

Insurance companies use this information to see what kind of customer you were. They look at how many claims you may have had and how many incidents you may have had.

What kinds of auto insurance near me has discounts?

There are discounts for loads of things. If you took drivers-ed in high school, you get a discount. Military personnel gets a discount. Safe driving gets you a refund. Asking your company is the best way to know.

How do I compare auto insurance quotes?

Some sites will compare quotes from many different companies based on where you want to buy. Lucky for you, you’re already on one of those sites. Enter your ZIP code in our FREE comparison tool.

Frequently Asked Questions

What is the best car insurance company in Frisco, Texas?

The best car insurance company in Frisco, Texas will depend on individual preferences, driving history, and other factors. It’s recommended to compare quotes from multiple insurance providers to find the best coverage and rates for your specific needs.

What factors affect car insurance rates in Frisco, Texas?

Car insurance rates in Frisco, Texas are affected by several factors, including the driver’s age, gender, marital status, driving record, credit score, the make and model of the car, and the amount of coverage requested.

What is the minimum car insurance coverage required in Frisco, Texas?

The minimum car insurance coverage required in Frisco, Texas is liability insurance with the following minimum limits: $30,000 bodily injury per person, $60,000 bodily injury per accident, and $25,000 property damage per accident.

What additional car insurance coverage should I consider in Frisco, Texas?

In addition to the minimum liability insurance, it’s recommended to consider additional coverage options such as collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. It’s important to discuss your coverage needs with an insurance agent to determine the best options for you.

How can I save money on car insurance in Frisco, Texas?

To save money on car insurance in Frisco, Texas, consider bundling multiple insurance policies with the same provider, opting for a higher deductible, maintaining a good driving record, taking a defensive driving course, and comparing quotes from multiple insurance companies.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.