Best Tennessee Car Insurance (2026)

Tennessee minimum car insurance requirements are 25/50/15 for bodily injury and property damage. Tennessee auto insurance rates average $73, but there are many discounts available for car insurance in Tennessee. State Farm offers the cheapest car insurance in TN, while SAFECO has the highest car insurance rates in Tennessee.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Tennessee car insurance laws require all drivers to carry at least 25/50/15 for bodily injury and property damage

- The cheapest auto insurance company in Tennessee is State Farm

- To find the cheapest car insurance rates in TN, make sure to compare multiple Tennessee car insurance quotes

| Tennessee Summary Statistics | Details |

|---|---|

| Annual Road Miles | Total in State: 95,561 Vehicle Miles Driven: 7.23 billion |

| Vehicles | Registered in State: 5.33 million Total Stolen: 12,599 |

| State Population | 6,770,010 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | 20% State Rank: 5th |

| Total Driving Fatalities | 2008-2017 Speeding: 2,094 Drunk Driving: 2,726 |

| Annual Premiums | Liability: $413.91 Collision: $309.07 Comprehensive: $148.45 |

| Cheapest Provider | State Farm |

Tennessee is the home of “the soundtrack of America.” Its two biggest cities, Nashville and Memphis, are known as the heart of country music, blues, and early rock-and-roll.

Nashville features the historic Grand Ole Opry and the Country Music Hall of Fame and Museum, while Memphis hosts Elvis Presley’s Graceland, together with Beale Street blues clubs and the legendary Sun Studio.

The state also has a rich political history, having been a major Civil War battleground and the home of controversial U.S. Presidents Andrew Jackson and Andrew Johnson. Johnson, Vice President under Abraham Lincoln and his successor, was the first American president to be impeached.

Tennessee is also known for its growing population and auto industry. As we’ll cover later, the state has several car museums. With more and more cars on Tennessee roads, the need for good auto insurance coverage is increasing, too.

In this best Tennessee car insurance review, we’ve found rates by age and gender, collected company ratings, gathered information about state laws, and so much more.

You’ll find everything you need here to help you shop for car insurance. And while you search, enter your ZIP code for a free car insurance quote.

Tennessee Car Insurance Coverage & Rates

Shopping for car insurance can be stressful. The mere thought of spending hours researching companies and rates can make us procrastinate when it comes time to decide which coverage to buy.

But you don’t have to sweat it out. As Ben Franklin once said, “Don’t put off until tomorrow what you can do today.” The good news is we’ve done all the hard work for you. In this section, you’ll find all you need to know about the state minimum insurance requirements, additional liability insurance, and coverage you can buy.

So, why not get started now? Scroll on to learn more.

Tennessee’s Minimum Coverage

In Tennessee, drivers who cause an accident are responsible or “at fault” for any personal injury or property claims. As such, drivers there must carry the following coverage for each registered vehicle:

| Insurance Type | Insurance Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $15,000 minimum |

These minimum liability coverages will pay for the costs of medical bills, property damage, and other losses from an accident you cause. Your insurance will pay these expenses up to your coverage limits.

If you don’t have enough insurance coverage, however, you may have to pay the bills yourself. That’s why it makes sense to buy more coverage than the state minimum requirements to protect yourself in case of an accident.

Read more: Understanding Liability Car Insurance

The law firm video below goes over Tennessee car insurance laws:

Forms of Financial Responsibility

Tennessee’s Financial Responsibility Law requires drivers to show proof of insurance when a law enforcement officer pulls them over. An officer can make a routine traffic stop or pull you over if there’s been an injury, death, or property damage exceeding $400.

Acceptable forms of financial responsibility in Tennessee include:

- Your insurance policy binder

- Your insurance card from an insurer licensed and authorized to do business in the state

- Your insurance policy declaration’s page

- Electronic proof of insurance

Failure to provide proof of financial responsibility upon request is a Class C misdemeanor. Penalties include suspension of your driver’s license, fines, and potentially being unable to renew your vehicle registration if a “STOP” is put on your car.

You may also have to file an SR-22 Proof of Financial Responsibility form with the Tennessee Driver Services Center to show you will maintain the state-mandated coverage for five years minimum. The DMV may lift the SR-22 filing requirement if you don’t receive any more suspensions in those five years.

Read more: Understanding SR-22 Insurance: What is it and who is it for?

Premiums as a Percentage of Income

Every insured driver in Tennessee must pay a certain amount of their income for premiums every year. The table below details how much the average resident’s disposable income (after taxes) paid for auto insurance from 2012 – 2014.

| Year | Full Coverage | Disposable Income | Insurance as Percentage of Income |

|---|---|---|---|

| 2012 | $794.53 | $35,916.00 | 2.21% |

| 2013 | $829.38 | $35,668.00 | 2.33% |

| 2014 | $855.56 | $36,909.00 | 2.32% |

As shown, the average cost of Tennesseans’ premiums increased slightly in those three years. But every insured driver nationwide saw increases during that time.

In 2014, the average annual cost of car insurance nationwide was $981.77, which was more than $100 more than the 2014 Tennessee average of $855.56.

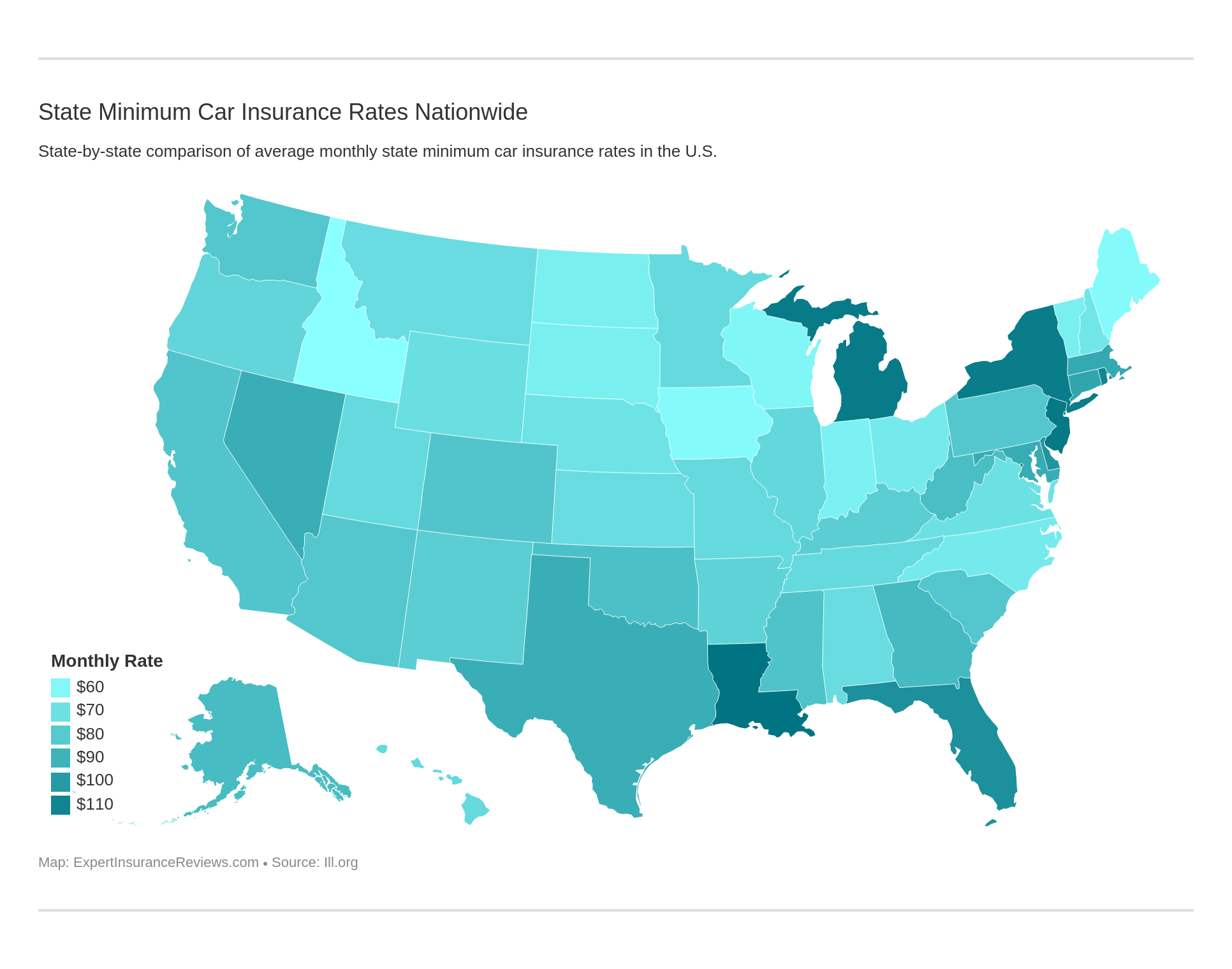

Tennessee borders Kentucky and Virginia to the north, North Carolina to the east, Mississippi, Alabama, and Georgia southward, and Arkansas and Missouri to the west. Compared to Tennessee, North Carolina residents paid the lowest premiums, under $800 yearly, while Alabamians had the second-lowest rates.

Nearby Missourians paid an average of $10 less than Tennesseans yearly, while Arkansans, Mississippi residents, and Georgians paid higher premiums, at $900 or more yearly.

How much do you pay for car insurance? Try our free calculator below to find out.

CalculatorPro

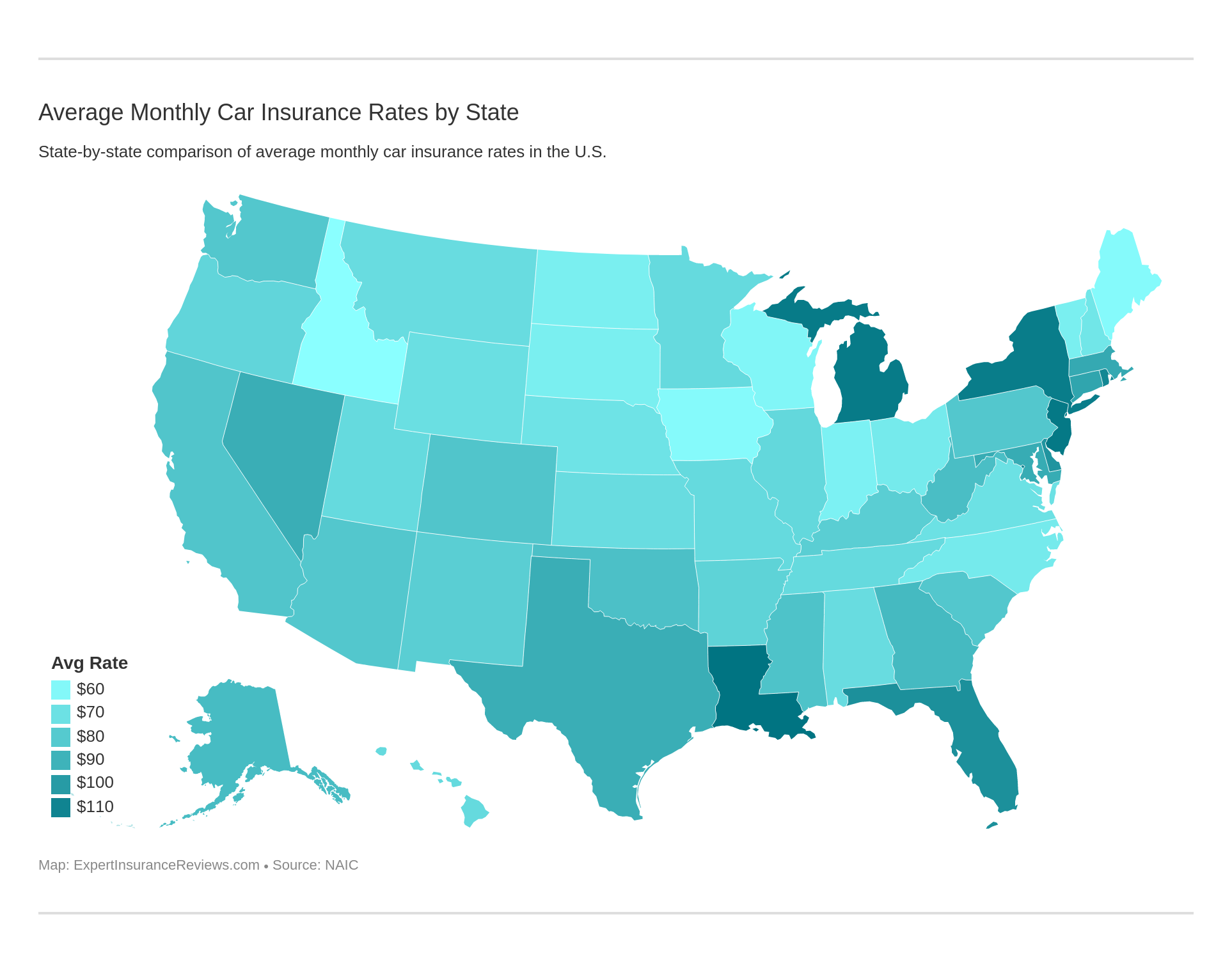

Average Monthly Car Insurance Rates in TN (Liability, Collision, Comprehensive)

What is the average cost of car insurance in TN? Is car insurance expensive in Tennessee? The coverage level data below comes from the National Association of Insurance Commissioners (NAIC).

| Coverage Type | Annual Costs |

|---|---|

| Liability | $413.91 |

| Collision | $309.07 |

| Comprehensive | $148.45 |

| Full Coverage | $871.43 |

You should expect rates to increase in 2019 and onward.

Next, let’s explore more liability coverage options you can add to your policy.

Additional Liability

Additional liability will cover expenses beyond a standard policy. It includes the following:

- Personal injury protection – It helps cover medical expenses for anyone involved in an accident, regardless of who is at fault.

- Medical payments (MedPay) coverage – It pays for medical expenses for you and anyone else listed on your policy, regardless of who is responsible.

- Uninsured/underinsured motorist coverage – It pays if you’re in an accident with an uninsured or underinsured driver.

Read more:

- Best Personal Injury Protection (PIP) Car Insurance Company

- What is medical payments coverage in car insurance?

- What is uninsured motorist coverage?

The table below shows the average insurer’s loss ratio in Tennessee, based on NAIC data. A company’s loss ratio reveals how much it earns compared to the premiums it writes. A loss ratio higher than 100% means the company pays more in premiums and is taking losses on them. If it’s well below 100%, the company pays few claims.

| Loss Ratio | 2014 | 2013 | 2012 |

|---|---|---|---|

| Medical Payments (MedPay) | 69.12 | 71.17 | 75.43 |

| Uninsured/Underinsured Motorist Coverage | 68.06 | 68.13 | 67.06 |

The loss ratios above show that Tennessee car insurance companies have a good profit versus loss ratio for MedPay and uninsured/underinsured motorist coverage.

Tennessee currently ranks fifth nationwide for the highest number of uninsured drivers. Nearly 20% of motorists there take the wheel without coverage.

With so many uninsured drivers on the road, unfortunately, you never know what can happen. To protect yourself, your loved ones, and those around you, we recommend you buy uninsured/underinsured motorist and additional liability coverage.

When you figure that every fifth car you pass on the road in Tennessee isn’t insured, it’s a good idea for Tennessee drivers to add uninsured motorist coverage, which could cost as little as $10 a month.

Daniel Walker Licensed Insurance Agent

Add-Ons, Endorsements, & Riders

The following are more types of coverage you can add to a basic car insurance policy in Tennessee:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Car Insurance Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance (MBI)

- Non-Owners Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

Read more:

- Does my car insurance cover rental reimbursement if my car is being replaced?

- Does my car insurance cover towing and roadside assistance?

- Can I get car insurance for a car that is modified or customized?

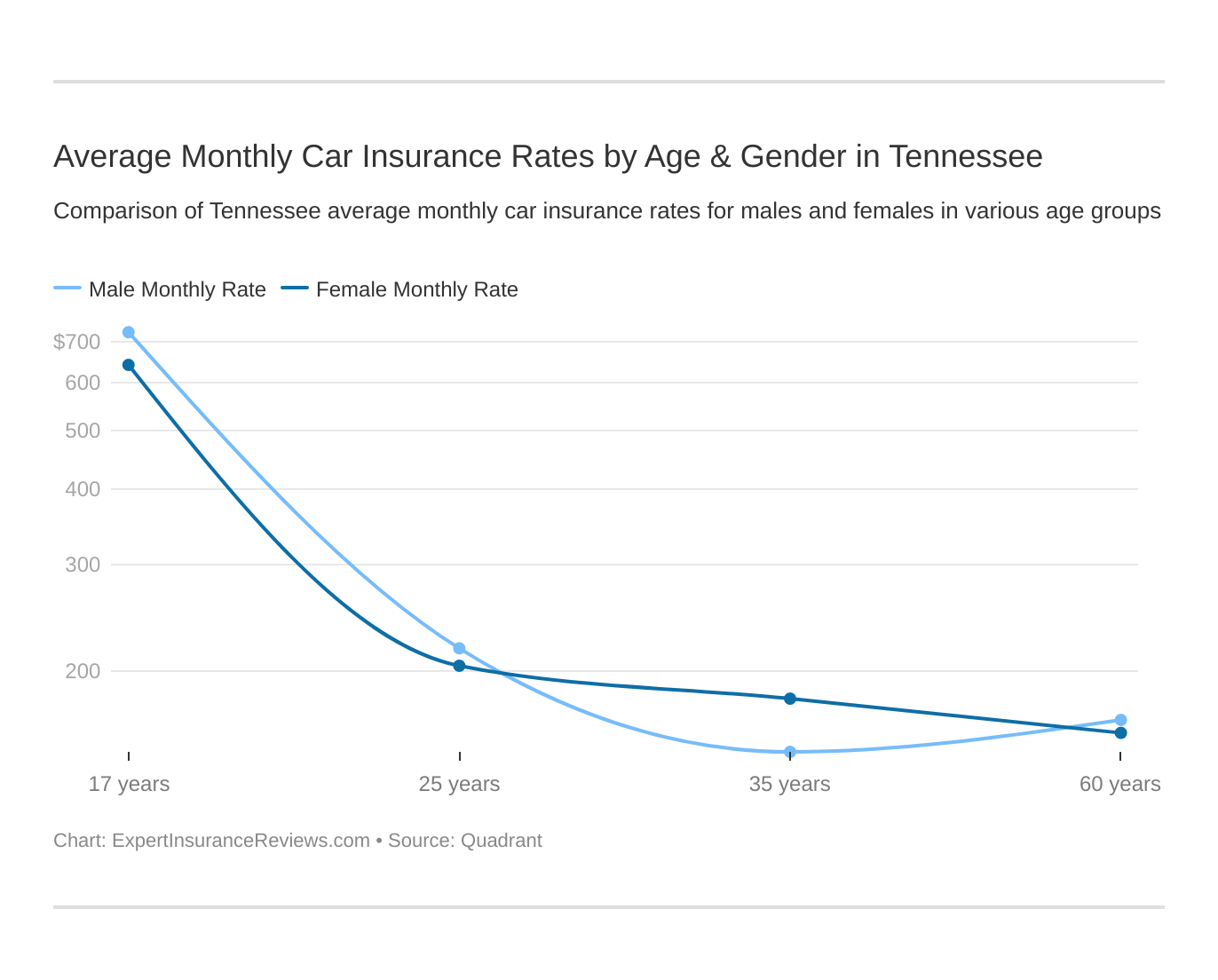

Average Monthly Car Insurance Rates by Age & Gender in TN

We’ve partnered with Quadrant to bring you the data below. It’s based on coverage the state population has purchased and includes rates for high-risk drivers and those who choose to buy more than the state minimum. It also includes other types of insurance the state doesn’t require.

As you’ll notice below, age, rather than gender, is a major factor in car insurance rates.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,796.09 | $2,684.61 | $2,516.49 | $2,612.46 | $10,516.65 | $11,441.86 | $2,980.14 | $3,082.46 |

| Mid-Century Ins Co | $1,817.48 | $1,850.03 | $1,631.91 | $1,788.38 | $7,410.65 | $7,883.17 | $2,457.63 | $2,601.27 |

| Geico General | $2,182.11 | $2,202.22 | $2,010.58 | $2,010.58 | $6,620.63 | $6,739.05 | $2,216.18 | $2,286.01 |

| SAFECO Ins Co of IL | $3,639.40 | $129.00 | $2,991.77 | $3,342.39 | $14,916.05 | $16,572.79 | $3,902.85 | $4,159.27 |

| Nationwide Mutual | $2,192.98 | $2,211.90 | $1,964.40 | $1,997.15 | $6,012.22 | $7,760.40 | $2,520.95 | $2,739.66 |

| Progressive Hawaii | $1,864.12 | $1,757.10 | $1,519.40 | $1,588.93 | $8,386.68 | $9,440.45 | $2,246.65 | $2,451.94 |

| State Farm Mutual Auto | $1,612.16 | $1,612.16 | $1,452.60 | $1,452.60 | $4,907.17 | $6,139.77 | $1,821.23 | $2,116.70 |

| Travelers Prop Cas Ins Co | $1,767.42 | $1,860.42 | $1,606.70 | $1,710.20 | $4,956.52 | $6,143.14 | $1,882.49 | $1,981.27 |

| USAA | $1,548.81 | $1,577.29 | $1,397.27 | $1,398.41 | $5,501.37 | $6,309.85 | $2,023.45 | $2,157.82 |

Insurers tend to charge 17-year-olds, the youngest and least experienced drivers, the highest rates. Rates decrease dramatically by age 25 — by as much as $6,000 for females. From ages 25 – 60 in Tennessee, on average, the price gaps amount to hundreds, not thousands, of dollars.

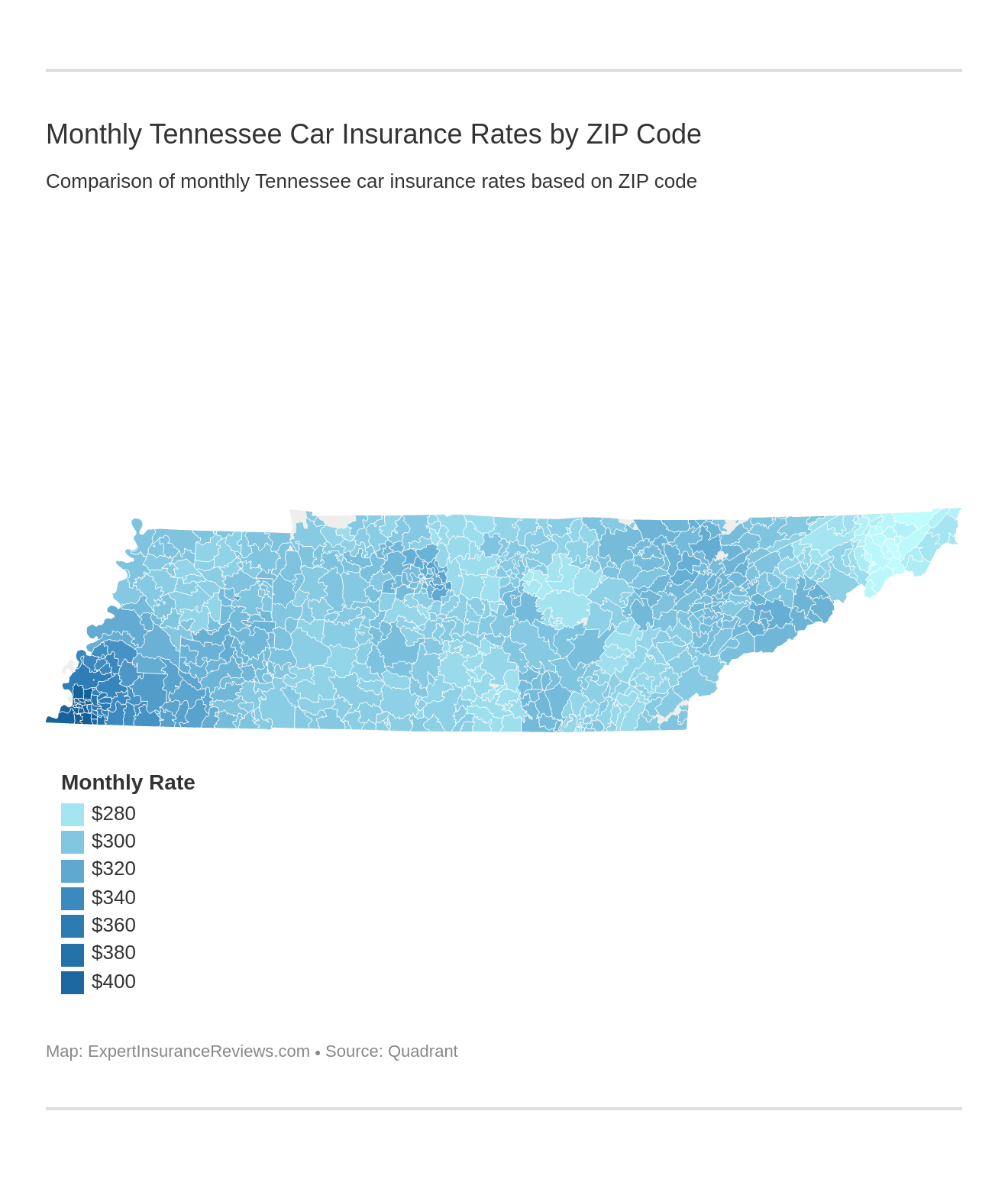

Cheap Car Insurance Rates by ZIP Code

Where you live can affect how much you pay for your car insurance premiums.

Generally, drivers in the bigger cities of Nashville and Memphis (ZIP code 38118 and others) pay more for car insurance than their countryside cousins (like in Dickson). And, as you can see, the rates vary greatly among insurers. In Memphis, for instance, with Travelers and USAA, residents come close to paying the state average, $3,660.89.

Cheap Car Insurance Rates by City

According to our data, annual car insurance for Memphis drivers averages $3,699.11, while in Nashville, it’s up to $4,745.79 — a $1,100 difference.

Best Car Insurance Companies for Tennessee

One of the perks of modern life is freedom of choice. But, if you like to think carefully about major decisions, such as buying car insurance, having a lot of options can be more of a curse than a blessing.

So, to ease your decision-making process, below we give you data about the financial strength of the top insurers and company reviews and ratings. These are not soft skills to make a business run. These are heavy hitters.

Are you ready to learn more?

The Largest Companies’ Financial Rating

A.M. Best evaluates insurance companies and ranks them based on their financial stability. Companies with a good score are more likely to be able to pay customers’ claims. These are A.M. Best’s ratings for the 10 largest insurers in the Volunteer State.

| Insurance Company | AM Best Rating |

|---|---|

| State Farm | A++ |

| Tennessee Farmers Group | A+ |

| Geico | A++ |

| Progressive | A+ |

| Allstate | A+ |

| USAA | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Erie Insurance Group | A+ |

| Travelers | A++ |

State Farm, USAA, Geico, and Travelers have earned the highest rating of “A++,” a sign that these established companies have a solid financial footing.

Read more:

- State Farm Insurance Review & Complaints: Car Insurance

- USAA Insurance Review & Complaints: Life, Home, & Auto Insurance

- Geico Insurance Review & Complaints

Companies with Best Ratings

J.D. Power’s Auto Insurance Study rates the top insurance companies based on their overall customer satisfaction. These are their rankings for insurers in the Southeast region, including Tennessee.

Farm Bureau Insurance was the only company to receive five “Power Circles,” which means that it’s “among the best.”

Another vital factor in customer satisfaction is the number of complaints an insurer gets. Let’s see which companies have the most.

Read more: Farm Bureau Insurance Review & Complaints: Auto, Home, Life, Health, & Farm Insurance

Companies with Most Complaints in Tennessee

A complaint ratio reveals how many complaints a company receives per $1 million of business.

Even the best customer relationships don’t always end with total satisfaction. When a consumer is dissatisfied, they can file a complaint. Those complaints add to a company’s complaint ratios, and some are based on general customer satisfaction and are averaged together.

The table shows the NAIC’s most recent complaint data for the 10 largest Tennessee car insurance companies.

| Insurance Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| State Farm | 1 | 0.44 | 1,482 |

| Tennessee Farmers Group | 1 | 0.67 | 39 |

| Geico | 1 | 0.68 | 333 |

| Progressive | 1 | 0.75 | 120 |

| Allstate | 1 | 0.5 | 163 |

| USAA | 1 | 0.74 | 296 |

| Liberty Mutual | 1 | 5.95 | 222 |

| Nationwide | 1 | 0.28 | 25 |

| Erie Insurance Group | 1 | 0.7 | 22 |

| Travelers | 1 | 0.09 | 2 |

All of the companies listed, except Liberty Mutual, fell below the national average of “one.” The company’s complaint ratio was nearly six times worse than the national average. Bear in mind, however, that their market share in the state is fairly low, at 5%.

If you have a complaint against an insurance company in Tennessee, you may file one online.

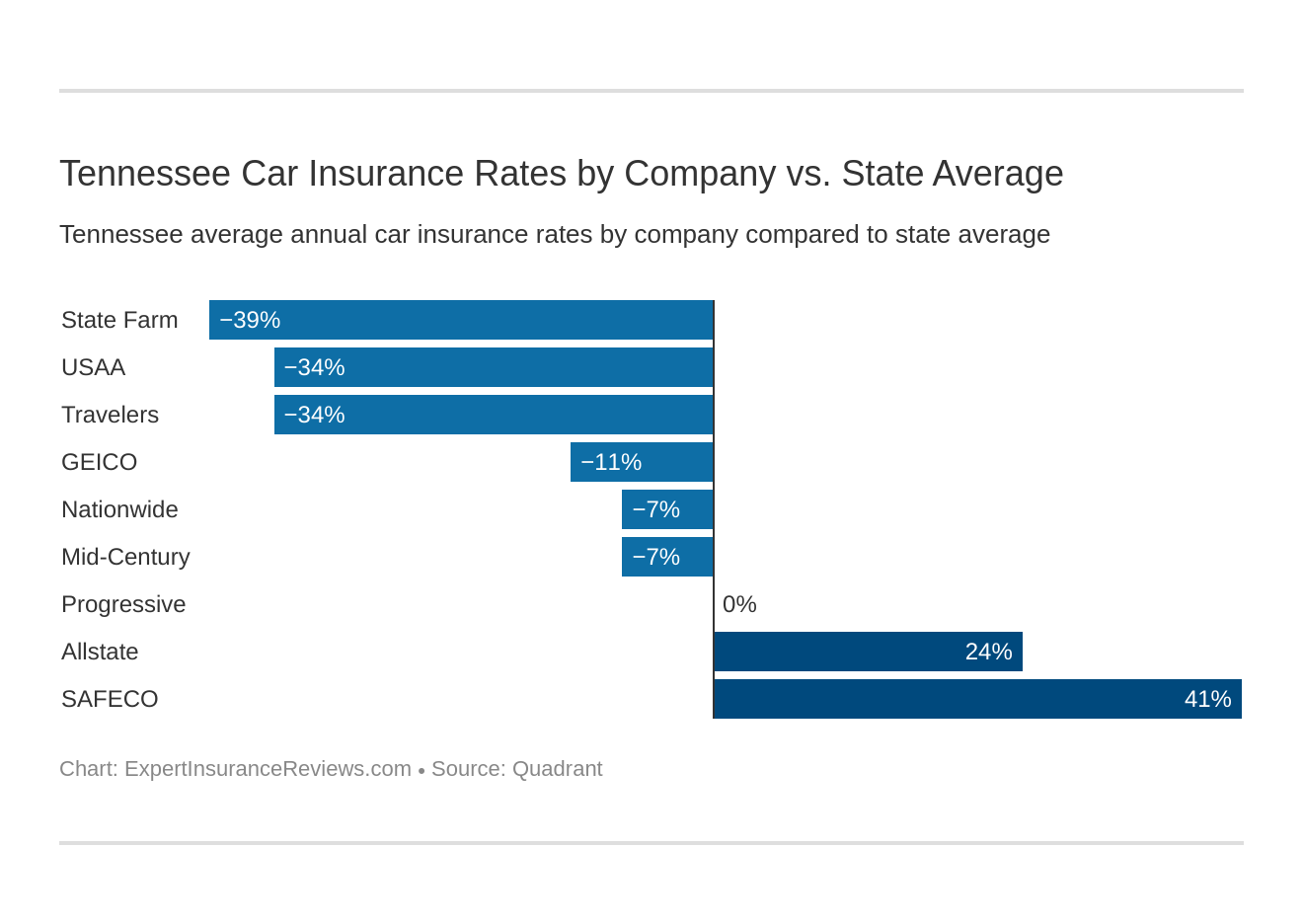

Cheapest Companies in Tennessee

Who has the cheapest car insurance rates in Tennessee? We’re going to explore which carriers, on average, provide the best rates statewide.

| Company | Average Annual Rate | Compared to State Average | Percentage |

|---|---|---|---|

| Allstate P&C | $4,828.85 | $1,167.96 | 24.19% |

| Mid-Century Ins Co | $3,430.07 | -$230.82 | -6.73% |

| Geico General | $3,283.42 | -$377.47 | -11.50% |

| SAFECO Ins Co of IL | $6,206.69 | $2,545.80 | 41.02% |

| Nationwide Mutual | $3,424.96 | -$235.93 | -6.89% |

| Progressive Hawaii | $3,656.91 | -$3.98 | -0.11% |

| State Farm Mutual Auto | $2,639.30 | -$1,021.59 | -38.71% |

| Travelers Prop Cas Ins Co | $2,738.52 | -$922.37 | -33.68% |

| USAA | $2,739.28 | -$921.60 | -33.64% |

Compared to the average annual statewide premium cost of $3,660.89, SAFECO had the highest rates in Tennessee, while State Farm had the lowest. Overall, there was a $4,000 price difference between the two carriers.

Commute Rates by Companies

Here’s how the top insurers in the state compare for average commute times.

| Group | 10-mile commute. 6,000 annual mileage. | 25-mile commute. 12,000 annual mileage. |

|---|---|---|

| Allstate | $4,828.85 | $4,828.85 |

| Farmers | $3,430.06 | $3,430.06 |

| Geico | $3,263.57 | $3,303.27 |

| Liberty Mutual | $6,206.69 | $6,206.69 |

| Nationwide | $3,424.96 | $3,424.96 |

| Progressive | $3,656.91 | $3,656.91 |

| State Farm | $2,576.56 | $2,702.04 |

| Travelers | $2,630.93 | $2,846.10 |

| USAA | $2,661.90 | $2,816.66 |

As it turns out, many of the carriers listed don’t change their rates for 10-mile versus 25-mile commutes. Among those who do, Geico had the lowest price difference between the two mileages, at only $40.

Coverage Level Rates by Companies

The amount of coverage you have, whether it’s liability, collision, comprehensive, or full, factors into your car insurance premium costs. Let’s see how much the price may vary among the different coverage levels.

| Group | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $4,645.25 | $4,816.41 | $5,024.87 |

| Farmers | $3,236.69 | $3,413.80 | $3,639.71 |

| Geico | $3,125.46 | $3,276.37 | $3,448.43 |

| Liberty Mutual | $5,938.19 | $6,204.78 | $6,477.10 |

| Nationwide | $3,450.27 | $3,350.97 | $3,473.64 |

| Progressive | $3,428.80 | $3,657.30 | $3,884.63 |

| State Farm | $2,492.73 | $2,651.21 | $2,773.95 |

| Travelers | $2,576.37 | $2,736.50 | $2,902.69 |

| USAA | $2,651.70 | $2,729.45 | $2,836.70 |

The price difference between the highest and lowest coverage levels can be as high as $500 with Liberty Mutual, or as low as $23 with Nationwide. So, full coverage — the best option for the most protection — is quite affordable, depending on the carrier you choose.

Read more:

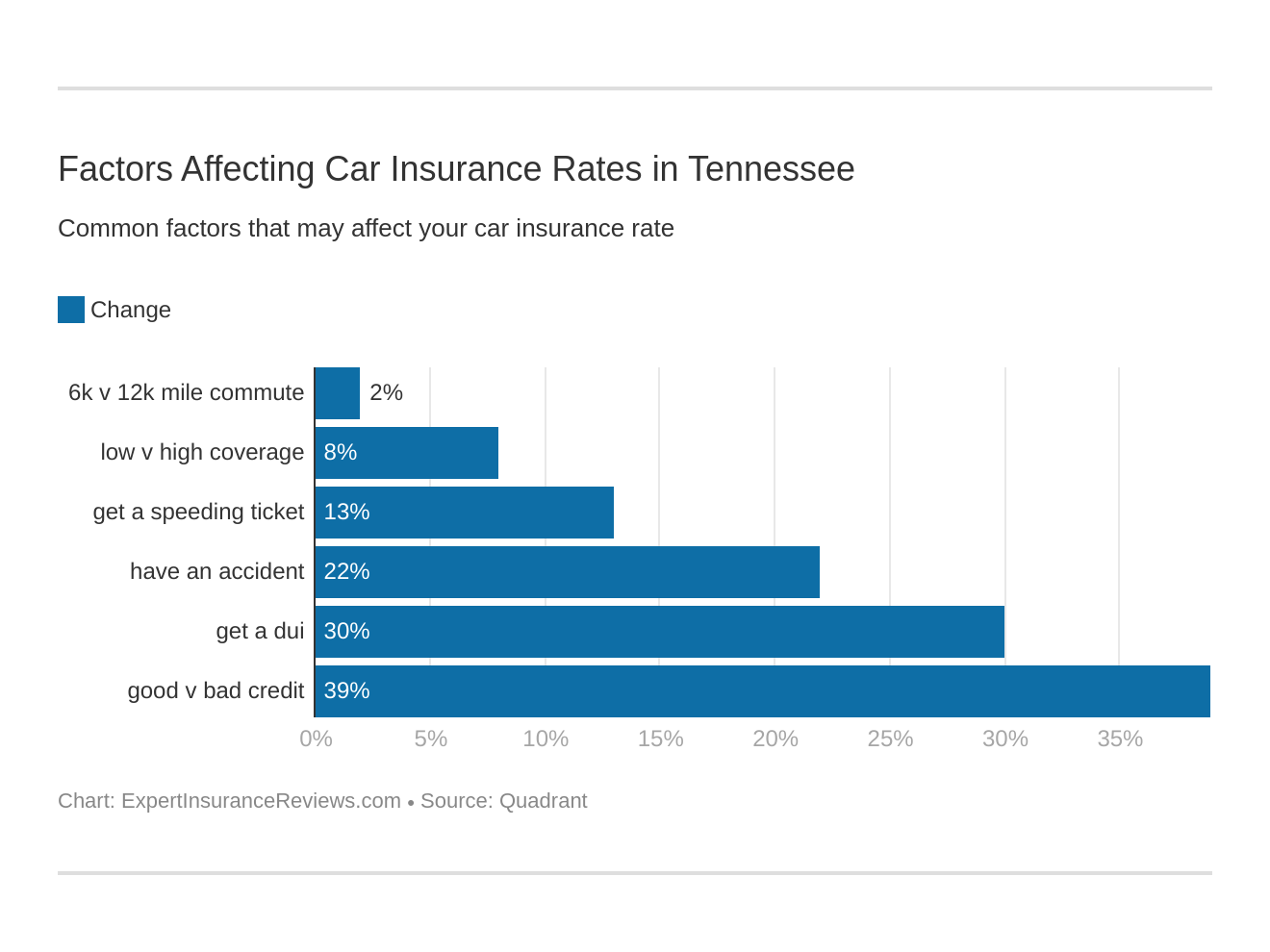

Credit History Rates by Companies

Your credit history can affect your ability to get a job, rent an apartment, qualify for a mortgage, or buy car insurance.

A study by Experian reveals that the average Tennessean has a credit card VantageScore of 662 and around 2.77 credit cards in their name. The average consumer there carries a credit card balance of $5,975. The average state credit score falls just under the national average of 675.

The data below reveals just how much poor, fair, and good credit scores can affect your car insurance rates.

| Group | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Allstate | $3,604.43 | $4,718.43 | $6,163.68 |

| Farmers | $3,019.09 | $3,191.56 | $4,079.54 |

| Geico | $2,933.59 | $3,190.30 | $3,726.36 |

| Liberty Mutual | $4,266.12 | $5,455.32 | $8,898.63 |

| Nationwide | $2,894.15 | $3,265.47 | $4,115.26 |

| Progressive | $3,314.09 | $3,545.77 | $4,110.86 |

| State Farm | $1,785.62 | $2,299.30 | $3,832.98 |

| Travelers | $1,996.22 | $2,735.47 | $3,483.87 |

| USAA | $1,918.82 | $2,326.47 | $3,972.56 |

Again, not all insurers charge the same prices. With Liberty Mutual, for drivers with poor and good credit scores, there’s a $4,600 difference in car insurance costs. But, with Progressive, the difference is as low as $800.

Driving Record Rates by Companies

Your driving history also affects how much you pay for car insurance premiums. As you can see below, even one DUI will skyrocket your rates by a thousand dollars or more.

| Group | Clean Record | One Speeding Violation | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,043.94 | $4,625.86 | $4,821.64 | $5,823.95 |

| Farmers | $2,930.61 | $3,457.46 | $3,622.99 | $3,709.20 |

| Geico | $2,386.13 | $2,386.13 | $3,197.12 | $5,164.31 |

| Liberty Mutual | $5,031.00 | $5,789.80 | $7,257.06 | $6,748.89 |

| Nationwide | $2,961.85 | $3,322.14 | $2,961.85 | $4,454.01 |

| Progressive | $3,221.09 | $3,794.09 | $4,182.08 | $3,430.36 |

| State Farm | $2,406.95 | $2,639.30 | $2,871.65 | $2,639.30 |

| Travelers | $2,220.52 | $2,731.56 | $2,851.81 | $3,150.18 |

| USAA | $1,992.65 | $2,470.89 | $2,984.18 | $3,509.42 |

Depending on the severity of the driving offense, your rates may not increase much. For the most serious offense of a DUI, Geico raises rates by nearly $3,000.

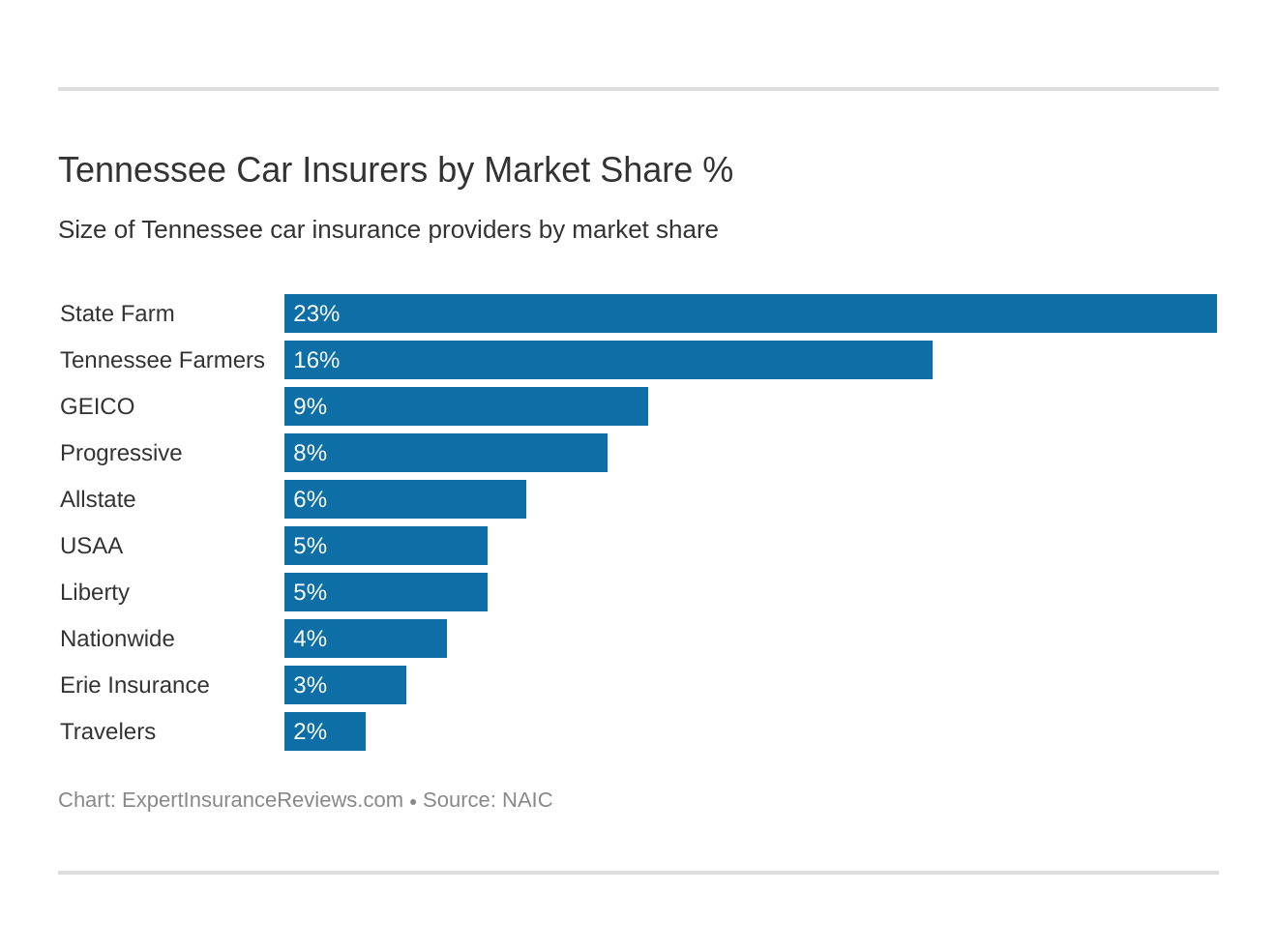

Largest Car Insurance Companies in Tennessee

The data below uses market share, loss ratio, and the number of direct premiums written to show which top insurers are the largest.

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $948,604 | 62.03% | 23.23% |

| Tennessee Farmers Group | $654,613 | 74.33% | 16.03% |

| Geico | $348,059 | 69.97% | 8.52% |

| Progressive | $311,706 | 61.15% | 7.63% |

| Allstate | $254,285 | 47.23% | 6.23% |

| USAA | $221,585 | 71.72% | 5.43% |

| Liberty Mutual | $211,928 | 62.66% | 5.19% |

| Nationwide | $171,166 | 68.01% | 4.19% |

| Erie Insurance Group | $114,508 | 76.69% | 2.80% |

| Travelers | $84,329 | 64.98% | 2.06% |

State Farm car insurance — also the top insurer nationwide — ranks first, with a decent loss ratio and the largest market share (23% ) and number of direct premiums written (close to a million).

Number of Insurers in Tennessee

Foreign companies were formed in other states but are licensed to operate in Tennessee, while domestic insurers were incorporated in the Volunteer State.

| Property & Casualty Insurance | Amount |

|---|---|

| Domestic | 15 |

| Foreign | 930 |

| Total | 945 |

Most of the insurers in Tennessee were founded in other states but do business there.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Tennessee Laws

Laws control many parts of daily life, including car insurance and the claims process. Ignorance of the law, as they say, is no excuse. If you’re not aware of local laws, you might not know that you have certain rights that protect you.

This section is here to inform you about the car insurance and related laws in the Volunteer State, including windshield coverage, high-risk insurance, and insurance fraud. Best of all, it’s in plain English, not legalese.

Read on to find out more.

Car Insurance Laws

State laws have considerable influence on auto insurance. Let’s discover how they’re determined.

How State Laws for Insurance Are Determined

Each state determines the type of tort law and threshold (if any) that applies, the type and amount of liability insurance to require, and the system they use to approve insurer rates and forms.

Insurance companies in Tennessee are subject to the regulations the state insurance commissioner sets per the fair competition standards of the National Association of Insurance Commissioners (NAIC). To set rates and file forms, insurers in the Volunteer State must get prior approval from the Tennessee Department of Commerce and Insurance.

Windshield Coverage

According to CarWindshields.Info, Tennessee doesn’t have any specific laws regarding windshield replacement (including parts) or repair.

In the Volunteer State, however, it’s illegal to drive with a windshield that obstructs your view of the road. So, if you have major cracks or chips in your windshield, a police officer may pull you over and give you a ticket.

You may be able to get a zero-deductible with windshield coverage under a comprehensive car insurance policy. Not every carrier offers it, but you may be able to find the right policy for you. While you research plans, look at how the different insurance providers handle windshield claims.

High-Risk Insurance

High-risk insurance helps drivers with a history of accidents or traffic violations who can’t buy coverage through a standard insurance carrier.

If you couldn’t get insurance in the past 60 days and have a valid driver’s license and a vehicle registered in Tennessee, you may qualify for the Tennessee Automobile Insurance Plan (TNAIP).

This state-administered program lets insurance companies share the risk associated with your policy among a pool of other insurers. You may, however, end up paying more for insurance compared to standard premiums.

To apply for TNAIP, contact any licensed car insurance agent, and they will help you fill out and submit an application.

To qualify, you must also meet the following requirements:

- Confirm in your application that you applied for car insurance through the open market in the past 60 days and were denied coverage.

- Complete the application thoroughly and truthfully. If a carrier can’t validate your information, they could deny you coverage.

- Pay any money you owe on prior premiums 12 months before your application.

- For car damage coverage, have your vehicle undergo an inspection.

If TNAIP rejects your application, you must wait another 12 months before you can reapply.

If you qualify for insurance through TNAIP, your policy will be active for three years. During those three years, if you qualify for better insurance coverage through another carrier, you may switch. You must notify your current insurance provider before you do so. The insurer must refund any outstanding premiums, minus a 10% early-termination fee.

You may pay for your TNAIP auto insurance premiums in the following ways:

- Pay the full amount owed upfront

- Pay 30% of the premium when you submit your application and the rest after 30 days.

- Pay 25% of the premium at the start, and the remainder spread out over five monthly installment payments after six months.

Installment plans carry a $4 processing fee.

Low-Cost Insurance

Though Tennessee has a program to help high-risk drivers, it doesn’t have one for low-income drivers.

California, Hawaii, and New Jersey are the only states with government-funded programs to help low-income drivers pay for their car insurance.

Automobile Insurance Fraud in Tennessee

Insurance fraud is the second-largest economic crime in America. It affects premium rates and the prices consumers pay for goods and services. If those fraud numbers continue to rise, it’s more likely that insurers will pass some of the costs in investigating them on to you in higher premiums.

There are two types of fraud: hard and soft.

- Hard Fraud: A purposefully fabricated claim or accident

- Soft Fraud: A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40% of consumers admitted to lying to their insurers about one of the following:

- The number of annual miles driven

- The number of drivers in the household

- How they will use the vehicle

Even the little white lie you tell to get a lower rate has consequences. That intentional misrepresentation of facts is known as “rate evasion” and costs auto insurers $16 billion annually. They pass those costs onto consumers in the form of higher premiums.

In Tennessee, committing insurance fraud through intentionally misrepresenting facts or making false claims for money or other benefits is a crime. Based on the severity of the offense, the criminal penalties for insurance fraud are as follows:

- Class A Misdemeanor: For $500 or less in services or property gained, fewer than 11 months and 29 days in jail and a fine of no more than $2,500

- Class E Felony: For $500 – $1,000 gained, 1 – 6 years in prison and a fine no more than $3,000

- Class D Felony: For $1,000 – $10,000 gained, 2 – 12 years in prison and a fine no more than $5,000

- Class C Felony: For $10,000 – $60,000 gained, 3 – 15 years in prison and a fine no more than $10,000

- Class B Felony: For $60,000 or more gained, 8 – 30 years in prison and a fine no more than $25,000

Those convicted of insurance fraud may also owe restitution to their victims. Insurance fraud crimes can also be processed administratively and through civil court.

The Department of Commerce and Insurance’s Fraud Investigation unit and the Tennessee Attorney General’s Office investigate insurance fraud. You can report fraud through an online form or call (800) 792-7573.

You are also welcome to file a complaint in person at the State of Tennessee Department of Commerce and Insurance, Davy Crockett Building, 500 James Robertson Parkway, 6th Floor in Nashville.

Statute of Limitations

The statute of limitations is the time you have left to file a legal claim. In Tennessee, drivers have three years to file an insurance fraud claim. Below are the limits for accident and related claims:

- Personal injury claims: one year from the date of the accident.

- Wrongful death claims: one year from the date of the victim’s death.

Evidence can degrade and witnesses can be hard to keep track of over time, so it’s best to file sooner rather than later.

The law firm video below goes into more detail about Tennessee’s statute of limitations for personal injury claims:

Vehicle Licensing Laws

In this section, we’ll go over Volunteer State laws for getting and renewing a driver’s license and the state’s “points” system for penalties.

REAL ID

Tennessee is among the states that comply with the federal REAL ID program of verified identity protection for driver’s licenses and state IDs.

The proposed federal program slated to go into effect on Oct. 1, 2020, allows REAL ID holders to enter federal buildings and board domestic flights. The program stems from national security measures and federal identification standards adopted after the Sept. 11, 2001, terrorist attacks in the U.S.

To get a REAL ID–compliant license, visit a Tennessee Driver Services Center and bring the following documents:

- Proof of your social security number

- Proof of your U.S. citizenship, lawful permanent resident status, or authorized stay in the U.S.

- Proof of any name changes (if applicable)

- Two proofs of state residency from within the past four months — these must include your name and physical address; the Center won’t accept P.O. box addresses

Once you have your first REAL ID–compliant license, you’ll be able to renew online, at a self-service kiosk, or through the County Clerk’s Office.

The news report below goes into more detail about REAL ID:

Penalties for Driving Without Insurance

As we mentioned earlier, you must carry an acceptable form of proof of insurance in case of a car accident or whenever law enforcement pulls you over.

Driving without car insurance or proof of financial responsibility is a Class C misdemeanor. Drivers who commit this offense may face the following penalties:

- Fines up to $300

- Suspension of their driver’s licenses

- A STOP on their cars, preventing them from renewing their registrations

Drivers who can’t provide proof of insurance must pay a $25 coverage failure fee in 30 days. If they don’t pay this fee, they will be charged an additional $100 and have their licenses and registrations revoked. Reinstatement costs $115 in total. They may also need to pass another licensing exam.

After any conviction leading to a driver’s license suspension, your insurance carrier must file an SR-22 on your behalf with the Tennessee Department of Safety. The SR-22 is proof of insurance that can be filed for five years but may be canceled after three if you have no more suspensions.

The state of Tennessee uses an online insurance verification system. If a driver shows up as uninsured, the Department of Revenue will request they provide proof of insurance within 15 days.

If you get into an accident that causes bodily injury or death while you’re uninsured, you could be charged with a Class A misdemeanor and face more penalties. A conviction carries fines up to $2,500 and up to 11 months and 29 days in jail, and other potential expenses if the injured party decides to sue.

Teen Driver Laws

Teen drivers in Tennessee must go through a graduated licensing program that grants them a permit before they qualify for a full license. Below are the state requirements for getting a learner’s permit.

At age 15, young drivers can qualify for a learner’s permit. To move to an intermediate license, they must:

- Hold their learner’s permit for at least six months

- Complete a minimum of 50 hours of supervised driving, 10 of which must be at night

To graduate to the intermediate licensing stage, young drivers must be at least 16 years old. These are the restrictions during the intermediate stage:

- No unsupervised driving from 11 p.m. – 6 a.m.

- No more than one non-family member passenger

These restrictions can be lifted after 12 months when the driver is at least 17 years old or once the driver turns 18, whichever happens first.

Older Driver & General Population License Renewal Procedures

According to the Insurance Institute for Highway Safety, these are Tennessee license renewal procedures for older drivers and the general public:

- Renew once every eight years

- Proof of adequate vision isn’t required

- You can renew by mail or online

The commissioner may issue an initial license or renew a license that shall remain valid for three to eight years to transition from a five-year to an eight-year license.

New Residents

After you move to the Volunteer State, you have 30 days to apply for a Tennessee driver’s license. You must apply in person and bring the following documents:

- Your current driver’s license or other acceptable ID or certified copy of your driving record. A certified copy, called a Motor Vehicle Record or MVR, must be original and have been issued at least 30 days before your application.

- Proof of name change (if applicable), such as a marriage certificate, certified court order, or divorce decree.

- Two proofs of Tennessee residency, such as a utility bill, voter registration, or lease agreement with your name and residential address. The documents must be from the past four months.

- Proof of U.S. Citizenship, Lawful Permanent Residence Status, Proof of Authorized Stay, or Temporary Legal Presence in the U.S.

- Your social security number or a sworn affidavit stating you haven’t been issued one

When you apply for a Tennessee license, you will need to give up your out-of-state license and undergo a vision screening. If your license has been expired for six months or more, you’ll also need to take the Tennessee knowledge exam and road skills test.

Negligent Operator Treatment System (NOTS)

The Tennessee Department of Safety and Homeland Security assigns points for driving offenses, which can ultimately lead to a driver’s license suspension or revocation. These are some of the points the state assigns for common driving offenses:

- Speeding over the posted limit by:

- 1 – 5 mph: 1 point

- 6 – 15 mph: 3 points

- 16 – 25 mph: 4 points

- Reckless driving: 4 points

- Careless or negligent driving: 4 points

- Failure to signal direction or to reduce speed suddenly: 3 points

- Blocking traffic: 3 points

- Distracted driving: 3 points

- Driving without a license: 3 points

- Improper passing: 4 points

- Operating a vehicle while using a cellphone (under 18): 6 points

Tennessee’s Driver Improvement program was established to monitor the driving records of Tennessee drivers who have amassed several points.

Adult drivers who gain 12 or more points on their records in 12 months will receive a notice of proposed suspension. The Tennessee Department of Safety will also give them a chance to attend an administrative hearing. If the driver fails to attend, the Department will suspend their driving privileges for six to 12 months.

Those who request a hearing can attend a defensive driving class in lieu of suspension or a reduction of suspension time.

Drivers younger than age 18 who accumulate six or more points on their records in 12 months will receive a notice of proposed suspension. The Department of Safety will also place them in the Driver Improvement Program.

Young drivers will need to attend an administrative hearing with a parent or guardian, and as a result, the Department may decide to take certain actions.

To check the status of points on your license, you can log in to the Tennessee Department of Safety and Homeland Security’s online services or call 615-251-5166.

For a full driving history, you may order a report at a driver service center or by mail at Tennessee Dept. of Safety and Homeland Security, MVR Request, P.O. Box 945, Nashville, TN, 37202.

Rules of the Road

These are some of the laws you should obey for safe driving and to avoid severe penalties.

Fault vs. No-Fault

As we explained earlier, drivers who cause accidents in Tennessee are “at fault” or responsible for paying medical bills, lost income, property damage, and other losses. If the “at-fault” driver has insurance, their insurer will pay for those losses up to the policy limits, and the driver will likely pay the rest.

Regarding filing accident claims or lawsuits, Tennessee follows modified comparative fault in assigning a percentage of blame for damage awards.

The state uses a “50% rule.” Under this rule, an accident victim may only collect damages if a judge or jury determines that the plaintiff’s fault for the injury is 49 percent or below. If they find the plaintiff’s percentage of liability is 50% or more, they won’t receive an award.

This law firm video explains more about the state’s comparative fault law:

Seat Belt & Car Seat Laws

The Insurance Institute for Highway Safety reports that drivers and passengers in the front seat age 16 years and older must wear a seat belt in Tennessee. Otherwise, they may face fines of up to $30 for a first offense.

The state’s car seat and child-seating laws are as follows:

- Children younger than one year and 19 pounds or less must sit in a rear-facing car seat

- Children between one and three years old who weigh 20 pounds or more must sit in a forward-facing car seat with a harness

- Children between four and eight years old and less than 4 feet 9 inches tall must sit in a forward-facing booster seat

- Children aged nine or any child 12 or younger who is at least 4 feet 9 inches tall must sit in a standard seat with a seat belt; an adult belt is allowed for children ages nine to 15, and any child 12 or younger taller than 4 feet 9 inches

- Children nine years and younger and less than 4 feet 9 inches tall must sit in the backseat of a vehicle if one is available. The state prefers that children sit in the back seat until they reach age 12.

The fine for a first offense is $50.

Regarding cargo areas of pick up trucks, Tennessee lets passengers sit there if they’re age 12 or older. If the vehicle is being driven on city or county roads, children ages 6 – 11 can sit in the cargo area (unless local laws prohibit it). Other situations where restrictions are lifted include agricultural activities and parades if the vehicle is traveling slower than 20 mph.

Keep Right & Move Over Laws

“Keep right” laws: Tennessee’s “Slow Poke” or Keep Right Law prohibits drivers from traveling in the passing lane on an interstate or multilane, divided highway with three or more lanes in each direction. An exception to this rule is when a driver is overtaking or passing a vehicle in a “non-passing” lane. Violators receive a $50 fine.

Drivers are expected to move to the right if they’re driving slower than other drivers around them to let faster traffic pass.

“Move over” laws: Drivers nearing a stationary emergency, municipal, utility, recovery, or maintenance vehicle with flashing lights going in the same direction must slow down and move to the closest lane, if safe to do so.

Speed Limits

The maximum posted speed limits in Tennessee are as follows:

- 70 mph on rural and urban interstates

- 70 mph on other limited-access roads

- 65 mph on other roads

It’s not just illegal to drive over the posted speed limit in Tennessee, it’s also unlawful to drive under it. You may slow down, however, when driving conditions change because of weather or heavy traffic. You should lower your speed at those times to drive safely and protect yourself and others.

Ridesharing

Like other states, Tennessee has certain insurance and driving regulations for rideshare drivers, as follows:

- Drivers must always carry proof of insurance that notes they drive for a Transportation Network Company (TNC)

- Any time a TNC driver is logged into their company app but not ridesharing, they must carry minimum liability insurance: $50,000 for injury per one person, $100,000 for injuries per accident, and $25,000 in property damage per accident

- Any time a TNC driver is logged into their company app and ridesharing, they must have minimum liability insurance of $1,000,000 for death, injury, and property damage

- Drivers may not conduct any cash transactions

- Drivers must show a photo of themselves and their license plate number

- Drivers must maintain two years of trip records

A driver’s insurance carrier may choose not to offer coverage when the driver provides ridesharing services. So, rideshare drivers may need two insurance policies — one for personal and one for professional driving.

Automation on the Road

Tennessee allows autonomous vehicles on its roads. The operator doesn’t need to be licensed or in the car but must maintain liability insurance of at least $5,000,000.

Other state laws regulating automated vehicles include:

- When a car is in autonomous mode, it is legal for them to include a visible integrated electronic display for drivers

- When the autonomous function in a vehicle is correctly engaged and operated, the autonomous function can be considered the driver from a liability perspective

Safety Laws

Below are more regulations controlling safe driving in Tennessee: DUI laws, marijuana laws, and distracted driving laws.

DUI Laws

Drinking and driving remain a problem nationwide and in the Volunteer State. Responsibility.org reports that 251 alcohol-related fatalities occurred there in 2017 alone.

The blood alcohol (BAC) limit in Tennessee is 0.08, and a high BAC (HBAC) is 0.2.

The table below details the state’s penalties for DUIs:

| Tennessee DUI Laws | Penalties |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.2 |

| Criminal Status by Offense | 1st-3rd are class A misdemeanors. 4th+ in 10 years is a class E felony. |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years |

| 1st Offense - ALS or Revocation | 1 year. |

| 1st Offense - Imprisonment | 48 hours to 11 months. With a HBAC: min 7 consecutive days. |

| 1st Offense - Fine | $350 - $1,500. |

| 1st Offense - Other | DUI school is required. The court may require an IID and/or addiction treatment. |

| 2nd Offense - DL Revocation | 2 years, restricted license available after 1 year. |

| 2nd Offense - Imprisonment | 45 days to 11 months. |

| 2nd Offense - Fine | $600 to $10,000. |

| 2nd Offense - Other | DUI school required, possible vehicle seizure, treatment may be required by court. An IID is required for 6 months after license reinstatement. |

| 3rd Offense - DL Revocation | 6 to 10 years and no restricted license available. |

| 3rd Offense - Imprisonment | 120 days to 11 months. |

| 3rd Offense - Other | DUI school required, possible vehicle seizure. An IID is required for 6 months after license reinstatement, treatment may be required by court. |

| 4th Offense - DL Revocation | 5 years and no restricted license available. |

| 4th Offense - Imprisonment | 1 year with minimum 150 consecutive days served. |

| 4th Offense - Fine | $3,000 to $15,000. |

| 4th Offense - Other | Possible vehicle seizure, DUI school required, treatment may be required by court, IID required for 6 months after license reinstatement. |

| Mandatory Interlock | All offenders. |

In Tennessee, a DUI will stay on your record for 10 years. Don’t take the risk of driving after you’ve been drinking — you’ll harm others and face severe penalties.

Marijuana-Impaired Driving Laws

According to DISA, marijuana is illegal in Tennessee, medical use included. There are currently no laws in Tennessee that regulate driving under the influence of marijuana.

Distracted Driving Laws

The state of Tennessee now bans all drivers from texting and using handheld devices. Drivers with learner’s permits or intermediate licenses are prohibited from using mobile devices entirely.

The fine for a first offense is $50. If an officer catches you in a work or school zone, that fee quadruples to $200. For multiple offenses or an accident you cause through handheld use, there is a $100 fine.

Read more: How to Prevent Distracted Driving: An Expert Guide

Find out more about Tennessee’s new “hands-free” law in the news report below:

Driving in Tennessee

A driver’s license gives you freedom, but the privilege comes with some risks. Most importantly, you’re responsible for driving safely to protect yourself and others. In this section, we feature data about some of the worst hazards of car ownership — vehicle thefts and fatal accidents.

It’s easy to get caught up in the numbers. After all, these statistics are sobering and remind us of the dangers on the road in the Volunteer State.

So, read on to find out the truth about some of the biggest hazards on and off the road.

Vehicle Theft in Tennessee

The table below shows the top 10 stolen vehicles in Tennessee as of 2016, together with the most popular model year.

| Make/Model | Year of Vehicle | Number of Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1999 | 690 |

| Ford Pickup (Full Size) | 1997 | 510 |

| Honda Accord | 1996 | 383 |

| Nissan Altima | 2015 | 297 |

| Dodge Pickup (Full Size) | 2001 | 264 |

| Chevrolet Impala | 2008 | 263 |

| Honda Civic | 2000 | 258 |

| Toyota Camry | 2016 | 238 |

| GMC Pickup (Full Size) | 2000 | 221 |

| Nissan Maxima | 1997 | 206 |

Older pickups, instead of cars, topped the list — the 1999 Chevrolet and 1997 Ford full-size versions. The Honda Accord and the Civic model made the top five, and they remain popular with vehicle thieves in other states, too.

Vehicle Theft by City

Now, let’s see where vehicle thefts occur most often in Tennessee. The following Federal Bureau of Investigation (FBI) data from 2017 shows the number of vehicles stolen in various towns and cities across Tennessee.

| City/Town | Population | Motor Vehicle Theft |

|---|---|---|

| Adamsville | 2,207 | 5 |

| Alamo | 2,452 | 2 |

| Alcoa | 10,128 | 49 |

| Alexandria | 974 | 3 |

| Algood | 4,323 | 2 |

| Ardmore | 1,218 | 0 |

| Ashland City | 4,642 | 13 |

| Athens | 13,783 | 77 |

| Atoka | 9,197 | 3 |

| Baileyton | 434 | 2 |

| Bartlett | 58,895 | 57 |

| Baxter | 1,413 | 2 |

| Bean Station | 3,090 | 6 |

| Belle Meade | 2,975 | 2 |

| Bells | 2,423 | 3 |

| Benton | 1,307 | 1 |

| Berry Hill | 536 | 2 |

| Big Sandy | 533 | 1 |

| Blaine | 1,879 | 2 |

| Bluff City | 1,651 | 8 |

| Bolivar | 5,066 | 18 |

| Bradford | 989 | 0 |

| Brentwood | 43,468 | 17 |

| Brighton | 2,949 | 5 |

| Bristol | 27,176 | 74 |

| Brownsville | 9,698 | 23 |

| Bruceton | 1,427 | 1 |

| Burns | 1,475 | 0 |

| Calhoun | 498 | 0 |

| Camden | 3,546 | 6 |

| Carthage | 2,283 | 1 |

| Caryville | 2,161 | 15 |

| Celina | 1,487 | 2 |

| Centerville | 3,564 | 2 |

| Chapel Hill | 1,481 | 0 |

| Charleston | 678 | 0 |

| Chattanooga | 178,753 | 1,342 |

| Church Hill | 6,739 | 4 |

| Clarksburg | 384 | 0 |

| Clarksville | 153,294 | 241 |

| Cleveland | 44,778 | 225 |

| Clifton | 2,653 | 2 |

| Clinton | 10,146 | 48 |

| Collegedale | 12,005 | 15 |

| Collierville | 49,790 | 31 |

| Collinwood | 963 | 3 |

| Columbia | 38,031 | 79 |

| Cookeville | 32,860 | 135 |

| Coopertown | 4,455 | 1 |

| Cornersville | 1,252 | 1 |

| Covington | 8,909 | 24 |

| Cowan | 1,678 | 1 |

| Cross Plains | 1,736 | 1 |

| Crossville | 11,555 | 55 |

| Crump | 1,390 | 3 |

| Cumberland City | 298 | 0 |

| Dandridge | 2,983 | 4 |

| Dayton | 7,262 | 12 |

| Decatur | 1,571 | 9 |

| Decaturville | 876 | 3 |

| Decherd | 2,426 | 0 |

| Dickson | 15,637 | 55 |

| Dover | 1,450 | 0 |

| Dresden | 2,825 | 2 |

| Dunlap | 5,185 | 31 |

| Dyer | 2,225 | 4 |

| Dyersburg | 16,612 | 44 |

| Eagleville | 674 | 0 |

| East Ridge | 21,351 | 91 |

| Elizabethton | 13,771 | 37 |

| Elkton | 541 | 0 |

| Englewood | 1,530 | 9 |

| Erin | 1,277 | 0 |

| Erwin | 5,894 | 9 |

| Estill Springs | 2,031 | 3 |

| Ethridge | 482 | 0 |

| Etowah | 3,512 | 11 |

| Fairview | 8,648 | 6 |

| Fayetteville | 7,099 | 23 |

| Franklin | 76,995 | 30 |

| Friendship | 658 | 0 |

| Gadsden | 461 | 0 |

| Gainesboro | 944 | 1 |

| Gallatin | 36,689 | 22 |

| Gallaway | 653 | 2 |

| Gates | 611 | 0 |

| Gatlinburg | 4,247 | 17 |

| Germantown | 39,086 | 27 |

| Gibson | 376 | 0 |

| Gleason | 1,381 | 2 |

| Goodlettsville | 17,119 | 31 |

| Gordonsville | 1,209 | 7 |

| Grand Junction | 275 | 0 |

| Graysville | 1,525 | 0 |

| Greenbrier | 6,853 | 7 |

| Greeneville | 15,065 | 66 |

| Greenfield | 2,077 | 0 |

| Harriman | 6,196 | 19 |

| Henderson | 6,589 | 3 |

| Hendersonville | 58,034 | 44 |

| Henry | 462 | 2 |

| Hohenwald | 3,666 | 22 |

| Hollow Rock | 685 | 0 |

| Hornbeak | 386 | 0 |

| Humboldt | 8,210 | 12 |

| Huntingdon | 3,899 | 4 |

| Jacksboro | 1,929 | 0 |

| Jackson | 67,031 | 149 |

| Jamestown | 1,964 | 0 |

| Jasper | 3,371 | 9 |

| Jefferson City | 8,351 | 10 |

| Jellico | 2,219 | 6 |

| Johnson City | 67,193 | 158 |

| Jonesborough | 5,378 | 7 |

| Kenton | 1,208 | 0 |

| Kimball | 1,387 | 6 |

| Kingsport | 52,810 | 204 |

| Kingston | 5,823 | 10 |

| Kingston Springs | 2,765 | 0 |

| Knoxville | 187,539 | 1,036 |

| Lafayette | 5,251 | 15 |

| La Follette | 6,897 | 26 |

| Lawrenceburg | 10,780 | 27 |

| Lebanon | 32,248 | 84 |

| Lenoir City | 9,187 | 22 |

| Lewisburg | 11,684 | 12 |

| Lexington | 7,792 | 27 |

| Livingston | 4,061 | 6 |

| Lookout Mountain | 1,892 | 0 |

| Loretto | 1,760 | 6 |

| Loudon | 5,811 | 5 |

| Madisonville | 4,805 | 25 |

| Manchester | 10,702 | 19 |

| Martin | 10,656 | 5 |

| Maryville | 28,918 | 44 |

| Mason | 1,574 | 2 |

| Maury City | 664 | 2 |

| Maynardville | 2,348 | 6 |

| McEwen | 1,712 | 2 |

| McKenzie | 5,610 | 5 |

| McMinnville | 13,786 | 42 |

| Medina | 4,290 | 2 |

| Memphis | 652,765 | 4,002 |

| Middleton | 641 | 1 |

| Milan | 7,780 | 8 |

| Millersville | 6,792 | 7 |

| Millington | 10,944 | 40 |

| Minor Hill | 519 | 0 |

| Monteagle | 1,169 | 1 |

| Monterey | 2,867 | 12 |

| Morristown | 29,774 | 111 |

| Moscow | 524 | 0 |

| Mountain City | 2,431 | 1 |

| Mount Carmel | 5,427 | 3 |

| Mount Juliet | 34,888 | 52 |

| Mount Pleasant | 4,902 | 11 |

| Munford | 6,079 | 8 |

| Murfreesboro | 136,102 | 269 |

| Nashville Metropolitan | 674,942 | 2,565 |

| Newbern | 3,288 | 1 |

| New Johnsonville | 1,909 | 1 |

| New Market | 1,366 | 2 |

| Newport | 6,816 | 32 |

| New Tazewell | 2,754 | 9 |

| Niota | 724 | 3 |

| Nolensville | 7,889 | 3 |

| Norris | 1,645 | 3 |

| Oakland | 7,884 | 0 |

| Oak Ridge | 29,355 | 65 |

| Obion | 1,064 | 1 |

| Oliver Springs | 3,255 | 18 |

| Oneida | 3,716 | 8 |

| Paris | 10,194 | 25 |

| Parsons | 2,355 | 3 |

| Petersburg | 544 | 0 |

| Pigeon Forge | 6,254 | 62 |

| Pikeville | 1,656 | 5 |

| Piperton | 1,725 | 3 |

| Pittman Center | 582 | 1 |

| Plainview | 2,035 | 2 |

| Pleasant View | 4,382 | 6 |

| Portland | 12,710 | 11 |

| Pulaski | 7,742 | 13 |

| Puryear | 672 | 1 |

| Red Bank | 11,838 | 36 |

| Red Boiling Springs | 1,142 | 3 |

| Ridgely | 1,693 | 3 |

| Ridgetop | 2,061 | 0 |

| Ripley | 8,067 | 8 |

| Rockwood | 5,424 | 24 |

| Rocky Top | 1,779 | 23 |

| Rogersville | 4,367 | 8 |

| Rossville | 848 | 1 |

| Rutherford | 1,101 | 1 |

| Rutledge | 1,201 | 2 |

| Saltillo | 500 | 6 |

| Savannah | 7,023 | 28 |

| Scotts Hill | 986 | 3 |

| Selmer | 4,476 | 8 |

| Sevierville | 16,991 | 67 |

| Sharon | 897 | 1 |

| Shelbyville | 21,618 | 47 |

| Signal Mountain | 8,624 | 0 |

| Smithville | 4,717 | 15 |

| Smyrna | 50,091 | 106 |

| Sneedville | 1,340 | 2 |

| Soddy-Daisy | 13,264 | 26 |

| Somerville | 3,139 | 5 |

| South Carthage | 1,348 | 1 |

| South Fulton | 2,238 | 1 |

| South Pittsburg | 3,097 | 6 |

| Sparta | 5,101 | 13 |

| Spencer | 1,634 | 1 |

| Spring City | 1,990 | 0 |

| Springfield | 16,869 | 31 |

| Spring Hill | 39,366 | 11 |

| St. Joseph | 790 | 0 |

| Sunbright | 544 | 0 |

| Surgoinsville | 1,785 | 1 |

| Sweetwater | 5,957 | 24 |

| Tazewell | 2,291 | 8 |

| Tellico Plains | 952 | 6 |

| Tiptonville | 4,331 | 2 |

| Toone | 335 | 0 |

| Townsend | 445 | 1 |

| Tracy City | 1,418 | 8 |

| Trenton | 4,116 | 0 |

| Trezevant | 831 | 0 |

| Trimble | 621 | 0 |

| Troy | 1,275 | 0 |

| Tullahoma | 19,386 | 29 |

| Tusculum | 2,672 | 1 |

| Union City | 10,544 | 27 |

| Vonore | 1,506 | 7 |

| Wartburg | 903 | 1 |

| Wartrace | 658 | 0 |

| Watertown | 1,537 | 0 |

| Waverly | 4,139 | 8 |

| Waynesboro | 2,347 | 6 |

| Westmoreland | 2,328 | 1 |

| White Bluff | 3,483 | 2 |

| White House | 11,591 | 10 |

| White Pine | 2,270 | 3 |

| Whiteville | 4,481 | 1 |

| Whitwell | 1,720 | 9 |

| Winchester | 8,573 | 14 |

| Winfield | 957 | 0 |

| Woodbury | 2,799 | 5 |

Larger cities like Clarksville and Chattanooga tended to have more vehicle thefts than smaller cities and towns.

Road Fatalities in Tennessee

Weather, light condition, impaired drivers, and speed are among the biggest causes of deaths on the highways.

Let’s look at how many have occurred throughout the Volunteer State.

Most Fatal Highway in Tennessee

Geotab reports that I-40 — which connects Tennessee’s three largest cities — is the most fatal highway, with more than 43 crash deaths every year.

Fatal Crashes by Weather Condition & Light Condition

Let’s see how weather and light conditions have affected accident fatalities throughout the Volunteer State.

| Weather Condition | Daylight | Dark, but Lit | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 443 | 134 | 236 | 22 | 3 | 838 |

| Rain | 51 | 18 | 24 | 3 | 0 | 96 |

| Snow/Sleet | 1 | 0 | 1 | 0 | 0 | 2 |

| Other | 1 | 4 | 6 | 3 | 0 | 14 |

| Unknown | 2 | 1 | 2 | 0 | 4 | 9 |

| TOTAL | 498 | 157 | 269 | 28 | 7 | 959 |

Most deaths occurred under normal daylight conditions.

Fatalities (All Crashes) by County

Below is the National Highway Traffic Safety Administration (NHTSA) Crash Report data on road fatalities in Tennessee by county from 2013 – 2017.

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalilties 2015 | Total Fatalities 2016 | Total Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Anderson County | 10 | 18 | 6 | 15 | 11 | 13.29 | 23.96 | 7.95 | 19.85 | 14.42 |

| Bedford County | 15 | 9 | 12 | 7 | 4 | 32.91 | 19.46 | 25.59 | 14.76 | 8.31 |

| Benton County | 11 | 6 | 5 | 3 | 2 | 67.25 | 37.09 | 30.88 | 18.68 | 12.51 |

| Bledsoe County | 0 | 0 | 1 | 0 | 7 | 0 | 0 | 6.9 | 0 | 47.56 |

| Blount County | 25 | 23 | 27 | 18 | 16 | 20.02 | 18.28 | 21.29 | 14.04 | 12.31 |

| Bradley County | 8 | 9 | 20 | 11 | 15 | 7.86 | 8.75 | 19.27 | 10.54 | 14.21 |

| Campbell County | 9 | 12 | 15 | 11 | 1 | 22.38 | 30.08 | 37.8 | 27.73 | 2.52 |

| Cannon County | 3 | 0 | 6 | 1 | 3 | 21.89 | 0 | 43.62 | 7.19 | 21.1 |

| Carroll County | 9 | 7 | 4 | 6 | 5 | 31.48 | 24.68 | 14.31 | 21.49 | 17.95 |

| Carter County | 6 | 3 | 6 | 7 | 5 | 10.54 | 5.33 | 10.64 | 12.4 | 8.85 |

| Cheatham County | 4 | 7 | 6 | 5 | 7 | 10.17 | 17.67 | 15.16 | 12.59 | 17.36 |

| Chester County | 3 | 3 | 3 | 1 | 1 | 17.57 | 17.54 | 17.56 | 5.85 | 5.84 |

| Claiborne County | 6 | 9 | 5 | 11 | 5 | 18.98 | 28.55 | 15.86 | 34.85 | 15.82 |

| Clay County | 2 | 1 | 1 | 2 | 2 | 25.95 | 13.09 | 13.02 | 26.01 | 25.96 |

| Cocke County | 10 | 6 | 8 | 11 | 3 | 28.31 | 17.04 | 22.81 | 31.29 | 8.44 |

| Coffee County | 10 | 12 | 14 | 13 | 17 | 18.76 | 22.42 | 25.88 | 23.88 | 30.89 |

| Crockett County | 3 | 2 | 2 | 2 | 3 | 20.54 | 13.66 | 13.72 | 13.82 | 20.73 |

| Cumberland County | 11 | 9 | 15 | 19 | 7 | 19.19 | 15.56 | 25.81 | 32.46 | 11.85 |

| Davidson County | 71 | 64 | 76 | 71 | 75 | 10.76 | 9.55 | 11.16 | 10.31 | 10.85 |

| Decatur County | 2 | 4 | 1 | 3 | 8 | 17.15 | 34.25 | 8.62 | 25.62 | 68.08 |

| Dekalb County | 6 | 3 | 5 | 1 | 6 | 31.39 | 15.61 | 25.94 | 5.14 | 30.22 |

| Dickson County | 10 | 6 | 15 | 16 | 16 | 19.95 | 11.89 | 29.22 | 30.82 | 30.27 |

| Dyer County | 7 | 6 | 6 | 11 | 9 | 18.38 | 15.87 | 15.88 | 29.25 | 24.02 |

| Fayette County | 5 | 6 | 3 | 12 | 9 | 12.88 | 15.37 | 7.65 | 30.32 | 22.48 |

| Fentress County | 3 | 4 | 5 | 1 | 8 | 16.75 | 22.42 | 28 | 5.57 | 44.11 |

| Franklin County | 7 | 7 | 9 | 5 | 5 | 17 | 16.96 | 21.78 | 12.03 | 12 |

| Gibson County | 6 | 6 | 5 | 8 | 5 | 12.16 | 12.15 | 10.16 | 16.29 | 10.18 |

| Giles County | 9 | 9 | 11 | 10 | 8 | 31.24 | 31.22 | 38 | 34.32 | 27.21 |

| Grainger County | 3 | 7 | 6 | 6 | 5 | 13.19 | 30.61 | 26.26 | 25.96 | 21.6 |

| Greene County | 15 | 11 | 15 | 22 | 18 | 21.96 | 16.07 | 21.9 | 32.09 | 26.16 |

| Grundy County | 10 | 4 | 0 | 2 | 1 | 74.36 | 29.91 | 0 | 15.06 | 7.48 |

| Hamblen County | 12 | 10 | 6 | 10 | 12 | 19.05 | 15.89 | 9.47 | 15.69 | 18.67 |

| Hamilton County | 43 | 42 | 42 | 39 | 27 | 12.32 | 11.98 | 11.87 | 10.89 | 7.47 |

| Hancock County | 1 | 2 | 0 | 2 | 9 | 15.09 | 30.19 | 0 | 30.32 | 136.36 |

| Hardeman County | 5 | 5 | 2 | 5 | 6 | 19.02 | 19.28 | 7.76 | 19.63 | 23.58 |

| Hardin County | 4 | 10 | 3 | 9 | 8 | 15.43 | 38.77 | 11.65 | 34.94 | 30.95 |

| Hawkins County | 6 | 14 | 9 | 11 | 14 | 10.61 | 24.84 | 16 | 19.52 | 24.8 |

| Haywood County | 13 | 10 | 9 | 3 | 8 | 71.41 | 55.05 | 50.08 | 16.85 | 45.52 |

| Henderson County | 9 | 4 | 9 | 14 | 9 | 32.2 | 14.29 | 32.18 | 50.37 | 32.43 |

| Henry County | 4 | 4 | 9 | 3 | 13 | 12.41 | 12.4 | 28 | 9.3 | 40.06 |

| Hickman County | 8 | 5 | 4 | 5 | 13 | 33.06 | 20.47 | 16.42 | 20.28 | 52.28 |

| Houston County | 5 | 1 | 5 | 1 | 1 | 60.45 | 12.17 | 61.56 | 12.32 | 12.18 |

| Humphreys County | 5 | 4 | 6 | 7 | 8 | 27.4 | 22.04 | 33.07 | 38.08 | 43.28 |

| Jackson County | 2 | 3 | 4 | 2 | 6 | 17.32 | 26.04 | 34.71 | 17.24 | 51.38 |

| Jefferson County | 16 | 11 | 11 | 7 | 8 | 30.71 | 21 | 20.76 | 13.17 | 14.87 |

| Johnson County | 6 | 3 | 4 | 0 | 6 | 33.34 | 16.73 | 22.43 | 0 | 33.92 |

| Knox County | 60 | 56 | 54 | 70 | 57 | 13.51 | 12.5 | 11.96 | 15.35 | 12.34 |

| Lake County | 1 | 0 | 1 | 1 | 1 | 12.99 | 0 | 13.2 | 13.28 | 13.39 |

| Lauderdale County | 5 | 5 | 4 | 6 | 7 | 18.14 | 18.27 | 14.85 | 23.67 | 27.7 |

| Lawrence County | 4 | 5 | 8 | 6 | 6 | 9.54 | 11.85 | 18.85 | 13.96 | 13.83 |

| Lewis County | 0 | 1 | 2 | 1 | 4 | 0 | 8.41 | 16.83 | 8.39 | 33.24 |

| Lincoln County | 8 | 6 | 7 | 9 | 6 | 23.9 | 17.96 | 20.86 | 26.84 | 17.78 |

| Loudon County | 7 | 11 | 6 | 8 | 14 | 13.91 | 21.77 | 11.8 | 15.6 | 26.84 |

| Macon County | 7 | 5 | 4 | 8 | 6 | 30.97 | 21.8 | 17.3 | 34.11 | 24.92 |

| Madison County | 16 | 16 | 18 | 13 | 13 | 16.21 | 16.32 | 18.46 | 13.33 | 13.31 |

| Marion County | 6 | 11 | 5 | 9 | 9 | 21.2 | 38.8 | 17.62 | 31.78 | 31.66 |

| Marshall County | 8 | 1 | 4 | 2 | 1 | 25.75 | 3.2 | 12.68 | 6.26 | 3.04 |

| Maury County | 17 | 19 | 10 | 18 | 19 | 20.35 | 22.26 | 11.44 | 20.09 | 20.62 |

| Mcminn County | 7 | 13 | 11 | 16 | 12 | 13.38 | 24.74 | 20.98 | 30.38 | 22.69 |

| Mcnairy County | 8 | 4 | 10 | 7 | 5 | 30.74 | 15.37 | 38.67 | 27.12 | 19.23 |

| Meigs County | 6 | 5 | 4 | 7 | 4 | 51.5 | 42.74 | 33.94 | 58.59 | 33.15 |

| Monroe County | 11 | 11 | 10 | 9 | 13 | 24.34 | 24.24 | 21.89 | 19.58 | 28.11 |

| Montgomery County | 22 | 28 | 27 | 28 | 30 | 11.95 | 14.82 | 14.02 | 14.37 | 14.99 |

| Moore County | 1 | 2 | 0 | 0 | 2 | 15.92 | 31.76 | 0 | 0 | 31.33 |

| Morgan County | 6 | 2 | 8 | 3 | 6 | 27.7 | 9.22 | 37.23 | 13.81 | 27.73 |

| Obion County | 6 | 6 | 2 | 2 | 4 | 19.35 | 19.47 | 6.54 | 6.55 | 13.16 |

| Overton County | 8 | 6 | 5 | 3 | 4 | 36.41 | 27.34 | 22.66 | 13.65 | 18.17 |

| Perry County | 3 | 5 | 0 | 5 | 4 | 38.08 | 63.95 | 0 | 63.36 | 50.16 |

| Pickett County | 1 | 2 | 0 | 0 | 2 | 19.98 | 39.46 | 0 | 0 | 39.42 |

| Polk County | 5 | 6 | 6 | 2 | 7 | 30.06 | 35.96 | 35.79 | 11.93 | 41.77 |

| Putnam County | 7 | 7 | 5 | 17 | 10 | 9.46 | 9.34 | 6.66 | 22.33 | 12.87 |

| Rhea County | 4 | 3 | 9 | 2 | 6 | 12.32 | 9.22 | 27.85 | 6.17 | 18.35 |

| Roane County | 10 | 11 | 11 | 13 | 14 | 18.83 | 20.82 | 20.85 | 24.57 | 26.4 |

| Robertson County | 13 | 11 | 8 | 16 | 11 | 19.34 | 16.21 | 11.69 | 23.13 | 15.67 |

| Rutherford County | 27 | 35 | 25 | 43 | 39 | 9.61 | 12.13 | 8.39 | 13.98 | 12.3 |

| Scott County | 2 | 3 | 5 | 5 | 10 | 9.09 | 13.65 | 22.85 | 22.84 | 45.48 |

| Sequatchie County | 1 | 2 | 5 | 3 | 3 | 6.88 | 13.67 | 34.17 | 20.35 | 20.36 |

| Sevier County | 13 | 16 | 16 | 15 | 20 | 13.93 | 16.92 | 16.75 | 15.53 | 20.48 |

| Shelby County | 99 | 107 | 120 | 132 | 122 | 10.55 | 11.4 | 12.79 | 14.09 | 13.02 |

| Smith County | 8 | 9 | 8 | 2 | 7 | 42.02 | 47.3 | 41.61 | 10.27 | 35.65 |

| Stewart County | 3 | 4 | 6 | 6 | 1 | 22.56 | 30.26 | 45.46 | 45.54 | 7.49 |

| Sullivan County | 27 | 23 | 15 | 16 | 17 | 17.28 | 14.7 | 9.6 | 10.23 | 10.82 |

| Sumner County | 14 | 15 | 11 | 22 | 10 | 8.3 | 8.71 | 6.28 | 12.28 | 5.45 |

| Tipton County | 13 | 10 | 5 | 6 | 5 | 21.13 | 16.24 | 8.13 | 9.81 | 8.15 |

| Trousdale County | 3 | 2 | 0 | 3 | 1 | 38.46 | 25.02 | 0 | 30.15 | 9.92 |

| Unicoi County | 3 | 5 | 2 | 0 | 2 | 16.63 | 27.93 | 11.25 | 0 | 11.26 |

| Union County | 3 | 5 | 4 | 4 | 4 | 15.74 | 26.33 | 20.88 | 20.8 | 20.57 |

| Van Buren County | 0 | 3 | 1 | 2 | 4 | 0 | 53.07 | 17.57 | 34.99 | 69.66 |

| Warren County | 14 | 6 | 4 | 8 | 17 | 35.12 | 15.02 | 9.95 | 19.8 | 41.82 |

| Washington County | 12 | 8 | 18 | 8 | 10 | 9.57 | 6.36 | 14.28 | 6.29 | 7.82 |

| Wayne County | 4 | 6 | 3 | 2 | 4 | 23.74 | 35.74 | 17.99 | 12 | 24.12 |

| Weakley County | 10 | 3 | 6 | 8 | 2 | 29.29 | 8.83 | 17.73 | 23.83 | 6 |

| White County | 7 | 6 | 7 | 6 | 6 | 26.75 | 22.88 | 26.55 | 22.68 | 22.43 |

| Williamson County | 17 | 16 | 10 | 13 | 25 | 8.54 | 7.8 | 4.73 | 5.94 | 11.05 |

| Wilson County | 20 | 20 | 16 | 23 | 19 | 16.41 | 15.98 | 12.46 | 17.37 | 13.93 |

Shelby, Davidson, and Knox Counties were among those with the most crash deaths during the five years. They increased most from 2016 – 2017.

Traffic Fatalities

Below are the number of urban and rural traffic fatalities in Tennessee from 2013 – 2017.

| Type | Number of Fatalities |

|---|---|

| Rural Traffic Fatalities | 500 |

| Urban Traffic Fatalities | 538 |

In recent years, many of the traffic fatalities happened in urban areas. In 2017, there was almost a tie — rural areas had just 38 fewer deaths than urban areas in Tennessee.

Fatalities by Person Type

These are the number of fatalities for 2013 – 2017 based on the type of person and vehicle.

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 771 |

| Motorcyclists | 134 |

| Nonoccupants | 135 |

Most of the deaths involved passenger car and light pickup truck occupants, which may reflect a higher amount of these types of vehicles on the road.

Fatalities by Crash Type

Here is more information about the types of vehicles and the accidents that led to fatalities from 2013 – 2017.

| Crash Type | Number |

|---|---|

| Single Vehicle | 585 |

| Involving a Large Truck | 136 |

| Involving Speeding | 166 |

| Involving a Rollover | 261 |

| Involving a Roadway Departure | 665 |

| Involving an Intersection (or Intersection Related) | 158 |

Most of the fatal crashes involved single vehicles and roadway departures — another reminder to drive safely at all times and in all conditions.

Five-Year Trend For the Top 10 Counties

These are the numbers of fatalities in the most populated Tennessee counties from 2013 – 2017.

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 |

|---|---|---|---|---|---|

| Shelby County | 99 | 107 | 120 | 132 | 122 |

| Davidson County | 71 | 64 | 76 | 71 | 75 |

| Knox County | 60 | 56 | 54 | 70 | 57 |

| Rutherford County | 27 | 35 | 25 | 43 | 39 |

| Montgomery County | 22 | 28 | 27 | 28 | 30 |

| Hamilton County | 43 | 42 | 42 | 39 | 27 |

| Williamson County | 17 | 16 | 10 | 13 | 25 |

| Sevier County | 13 | 16 | 16 | 15 | 20 |

| Maury County | 17 | 19 | 10 | 18 | 19 |

| Wilson County | 20 | 20 | 16 | 23 | 19 |

Many of the counties, including Shelby and Rutherford, saw increases in traffic fatalities in the five-year period.

Fatalities Involving Speeding by County

These stats highlight where you should pay the most attention to speeders.

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Anderson County | 3 | 4 | 2 | 3 | 2 | 3.99 | 5.32 | 2.65 | 3.97 | 2.62 |

| Bedford County | 6 | 2 | 2 | 1 | 0 | 13.16 | 4.32 | 4.27 | 2.11 | 0 |

| Benton County | 2 | 0 | 0 | 1 | 1 | 12.23 | 0 | 0 | 6.23 | 6.26 |

| Bledsoe County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 13.59 |

| Blount County | 7 | 10 | 3 | 3 | 3 | 5.61 | 7.95 | 2.37 | 2.34 | 2.31 |

| Bradley County | 1 | 6 | 6 | 3 | 4 | 0.98 | 5.84 | 5.78 | 2.87 | 3.79 |

| Campbell County | 4 | 1 | 3 | 0 | 0 | 9.95 | 2.51 | 7.56 | 0 | 0 |

| Cannon County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 7.03 |

| Carroll County | 4 | 1 | 0 | 0 | 0 | 13.99 | 3.53 | 0 | 0 | 0 |

| Carter County | 0 | 2 | 2 | 0 | 1 | 0 | 3.55 | 3.55 | 0 | 1.77 |

| Cheatham County | 1 | 3 | 0 | 0 | 1 | 2.54 | 7.57 | 0 | 0 | 2.48 |

| Chester County | 1 | 0 | 1 | 0 | 0 | 5.86 | 0 | 5.85 | 0 | 0 |

| Claiborne County | 1 | 2 | 2 | 2 | 0 | 3.16 | 6.34 | 6.35 | 6.34 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cocke County | 0 | 0 | 2 | 2 | 2 | 0 | 0 | 5.7 | 5.69 | 5.62 |

| Coffee County | 2 | 2 | 1 | 7 | 0 | 3.75 | 3.74 | 1.85 | 12.86 | 0 |

| Crockett County | 0 | 1 | 0 | 0 | 0 | 0 | 6.83 | 0 | 0 | 0 |

| Cumberland County | 2 | 2 | 2 | 3 | 1 | 3.49 | 3.46 | 3.44 | 5.13 | 1.69 |

| Davidson County | 15 | 14 | 20 | 21 | 9 | 2.27 | 2.09 | 2.94 | 3.05 | 1.3 |

| Decatur County | 0 | 2 | 0 | 0 | 3 | 0 | 17.12 | 0 | 0 | 25.53 |

| Dekalb County | 1 | 0 | 1 | 0 | 0 | 5.23 | 0 | 5.19 | 0 | 0 |

| Dickson County | 6 | 2 | 0 | 1 | 0 | 11.97 | 3.96 | 0 | 1.93 | 0 |

| Dyer County | 2 | 0 | 0 | 0 | 3 | 5.25 | 0 | 0 | 0 | 8.01 |

| Fayette County | 0 | 2 | 0 | 1 | 1 | 0 | 5.12 | 0 | 2.53 | 2.5 |

| Fentress County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Franklin County | 4 | 2 | 4 | 1 | 1 | 9.72 | 4.85 | 9.68 | 2.41 | 2.4 |

| Gibson County | 2 | 0 | 0 | 1 | 1 | 4.05 | 0 | 0 | 2.04 | 2.04 |

| Giles County | 1 | 4 | 1 | 2 | 0 | 3.47 | 13.88 | 3.45 | 6.86 | 0 |

| Grainger County | 0 | 2 | 0 | 0 | 0 | 0 | 8.75 | 0 | 0 | 0 |

| Greene County | 7 | 2 | 1 | 4 | 2 | 10.25 | 2.92 | 1.46 | 5.83 | 2.91 |

| Grundy County | 2 | 3 | 0 | 2 | 0 | 14.87 | 22.43 | 0 | 15.06 | 0 |

| Hamblen County | 4 | 3 | 2 | 0 | 2 | 6.35 | 4.77 | 3.16 | 0 | 3.11 |

| Hamilton County | 12 | 12 | 13 | 16 | 7 | 3.44 | 3.42 | 3.67 | 4.47 | 1.94 |

| Hancock County | 0 | 0 | 0 | 1 | 4 | 0 | 0 | 0 | 15.16 | 60.61 |

| Hardeman County | 0 | 1 | 0 | 4 | 1 | 0 | 3.86 | 0 | 15.7 | 3.93 |

| Hardin County | 1 | 2 | 0 | 0 | 0 | 3.86 | 7.75 | 0 | 0 | 0 |

| Hawkins County | 2 | 4 | 1 | 1 | 1 | 3.54 | 7.1 | 1.78 | 1.77 | 1.77 |

| Haywood County | 0 | 3 | 1 | 0 | 1 | 0 | 16.52 | 5.56 | 0 | 5.69 |

| Henderson County | 1 | 1 | 0 | 0 | 0 | 3.58 | 3.57 | 0 | 0 | 0 |

| Henry County | 1 | 1 | 1 | 1 | 1 | 3.1 | 3.1 | 3.11 | 3.1 | 3.08 |

| Hickman County | 2 | 0 | 1 | 0 | 0 | 8.26 | 0 | 4.1 | 0 | 0 |

| Houston County | 2 | 0 | 0 | 0 | 0 | 24.18 | 0 | 0 | 0 | 0 |

| Humphreys County | 1 | 0 | 1 | 0 | 0 | 5.48 | 0 | 5.51 | 0 | 0 |

| Jackson County | 0 | 1 | 0 | 0 | 0 | 0 | 8.68 | 0 | 0 | 0 |

| Jefferson County | 1 | 5 | 2 | 2 | 1 | 1.92 | 9.54 | 3.77 | 3.76 | 1.86 |

| Johnson County | 2 | 1 | 1 | 0 | 2 | 11.11 | 5.58 | 5.61 | 0 | 11.31 |

| Knox County | 9 | 10 | 11 | 20 | 12 | 2.03 | 2.23 | 2.44 | 4.38 | 2.6 |

| Lake County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 13.28 | 0 |

| Lauderdale County | 1 | 0 | 0 | 0 | 1 | 3.63 | 0 | 0 | 0 | 3.96 |

| Lawrence County | 2 | 1 | 0 | 0 | 1 | 4.77 | 2.37 | 0 | 0 | 2.3 |

| Lewis County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Lincoln County | 1 | 1 | 0 | 1 | 1 | 2.99 | 2.99 | 0 | 2.98 | 2.96 |

| Loudon County | 3 | 1 | 1 | 0 | 0 | 5.96 | 1.98 | 1.97 | 0 | 0 |

| Macon County | 1 | 1 | 1 | 2 | 0 | 4.42 | 4.36 | 4.33 | 8.53 | 0 |

| Madison County | 4 | 2 | 1 | 2 | 1 | 4.05 | 2.04 | 1.03 | 2.05 | 1.02 |

| Marion County | 2 | 4 | 0 | 1 | 2 | 7.07 | 14.11 | 0 | 3.53 | 7.04 |

| Marshall County | 1 | 0 | 0 | 1 | 0 | 3.22 | 0 | 0 | 3.13 | 0 |

| Maury County | 3 | 3 | 0 | 3 | 1 | 3.59 | 3.52 | 0 | 3.35 | 1.09 |

| Mcminn County | 3 | 6 | 3 | 3 | 3 | 5.73 | 11.42 | 5.72 | 5.7 | 5.67 |

| Mcnairy County | 3 | 0 | 3 | 1 | 0 | 11.53 | 0 | 11.6 | 3.87 | 0 |

| Meigs County | 0 | 2 | 1 | 4 | 0 | 0 | 17.1 | 8.49 | 33.48 | 0 |

| Monroe County | 1 | 2 | 2 | 2 | 0 | 2.21 | 4.41 | 4.38 | 4.35 | 0 |

| Montgomery County | 8 | 7 | 8 | 10 | 9 | 4.35 | 3.7 | 4.15 | 5.13 | 4.5 |

| Moore County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Morgan County | 3 | 0 | 0 | 0 | 2 | 13.85 | 0 | 0 | 0 | 9.24 |

| Obion County | 3 | 0 | 0 | 1 | 0 | 9.67 | 0 | 0 | 3.28 | 0 |

| Overton County | 1 | 0 | 0 | 1 | 0 | 4.55 | 0 | 0 | 4.55 | 0 |

| Perry County | 1 | 2 | 0 | 2 | 0 | 12.69 | 25.58 | 0 | 25.34 | 0 |

| Pickett County | 0 | 1 | 0 | 0 | 0 | 0 | 19.73 | 0 | 0 | 0 |

| Polk County | 3 | 1 | 2 | 0 | 3 | 18.03 | 5.99 | 11.93 | 0 | 17.9 |

| Putnam County | 1 | 1 | 2 | 0 | 2 | 1.35 | 1.33 | 2.66 | 0 | 2.57 |

| Rhea County | 1 | 1 | 2 | 0 | 2 | 3.08 | 3.07 | 6.19 | 0 | 6.12 |

| Roane County | 2 | 1 | 0 | 1 | 4 | 3.77 | 1.89 | 0 | 1.89 | 7.54 |

| Robertson County | 2 | 2 | 2 | 1 | 0 | 2.98 | 2.95 | 2.92 | 1.45 | 0 |

| Rutherford County | 8 | 4 | 6 | 6 | 7 | 2.85 | 1.39 | 2.01 | 1.95 | 2.21 |

| Scott County | 0 | 2 | 0 | 0 | 0 | 0 | 9.1 | 0 | 0 | 0 |

| Sequatchie County | 0 | 0 | 3 | 1 | 2 | 0 | 0 | 20.5 | 6.78 | 13.57 |

| Sevier County | 3 | 5 | 6 | 2 | 3 | 3.22 | 5.29 | 6.28 | 2.07 | 3.07 |

| Shelby County | 21 | 28 | 36 | 21 | 28 | 2.24 | 2.98 | 3.84 | 2.24 | 2.99 |

| Smith County | 1 | 5 | 0 | 0 | 2 | 5.25 | 26.28 | 0 | 0 | 10.19 |

| Stewart County | 1 | 1 | 3 | 0 | 0 | 7.52 | 7.57 | 22.73 | 0 | 0 |

| Sullivan County | 6 | 3 | 3 | 2 | 6 | 3.84 | 1.92 | 1.92 | 1.28 | 3.82 |

| Sumner County | 4 | 0 | 0 | 0 | 4 | 2.37 | 0 | 0 | 0 | 2.18 |

| Tipton County | 1 | 2 | 2 | 0 | 0 | 1.63 | 3.25 | 3.25 | 0 | 0 |

| Trousdale County | 1 | 0 | 0 | 0 | 0 | 12.82 | 0 | 0 | 0 | 0 |

| Unicoi County | 0 | 2 | 1 | 0 | 1 | 0 | 11.17 | 5.62 | 0 | 5.63 |

| Union County | 2 | 2 | 1 | 0 | 1 | 10.5 | 10.53 | 5.22 | 0 | 5.14 |

| Van Buren County | 0 | 1 | 0 | 0 | 0 | 0 | 17.69 | 0 | 0 | 0 |

| Warren County | 7 | 2 | 1 | 2 | 2 | 17.56 | 5.01 | 2.49 | 4.95 | 4.92 |

| Washington County | 5 | 4 | 4 | 3 | 2 | 3.99 | 3.18 | 3.17 | 2.36 | 1.56 |

| Wayne County | 0 | 1 | 0 | 1 | 0 | 0 | 5.96 | 0 | 6 | 0 |

| Weakley County | 0 | 1 | 0 | 2 | 0 | 0 | 2.94 | 0 | 5.96 | 0 |

| White County | 3 | 1 | 2 | 0 | 1 | 11.46 | 3.81 | 7.59 | 0 | 3.74 |

| Williamson County | 3 | 1 | 0 | 1 | 3 | 1.51 | 0.49 | 0 | 0.46 | 1.33 |

| Wilson County | 11 | 3 | 6 | 2 | 2 | 9.02 | 2.4 | 4.67 | 1.51 | 1.47 |

In recent years, the more populated counties, such as Shelby and Hamilton, had among the highest speeding-related crash deaths.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

These figures reveal just how deadly drunk driving can be, as it doesn’t affect just you, but those around you.