Best Amarillo, Texas Car Insurance (2026)

The average car insurance rates in Amarillo, Texas, are $510.83 per month for full coverage. Texas law requires a minimum of 30/60/25 of insurance coverage for bodily injury and property damage. Use our online comparison tool to compare rates for auto insurance in Amarillo based on age, driving record, and marital status.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Amarillo, TX City Stats | Stats |

|---|---|

| Population | 197,823 |

| Density | 2,200 per square mile |

| Average Cost of Insurance | $6,127.69 |

| Cheapest Car Insurance Company | USAA |

| Road Conditions | Fair |

The infamous Amarillo. A city dramatized by country singers and cowboys who roamed the open air. Amarillo has grown since the days of Willie and Waylon, but it still holds its historical value. The horse riding ranchers that inspired hundreds of songs still exist.

Amarillo will forever hold a piece of history, even while it grows.

From the Cadillac Ranch to the Palo Duro Canyon State Park, Amarillo is old Texas.

Fast forward to today, downtown now looks like your average city. Tall buildings and government offices overtook the vastness. Both worlds live peacefully together in Amarillo. Bright suburban villas make up the new world and the ranches that go as far as the eye can see make up the pieces of the past, allowing for a fitting, nostalgic and energized contrast.

With the population now at almost 200,000 people, the city of Amarillo has entered the 21st century. But the people will tell you how history holds more value than anything else.

The horses have been replaced by cars. The saloons replaced by clubs. But if Amarillo is on your mind, and you’ll be in Amarillo by morning, this article will help you insure those horses.

Car Insurance in Amarillo, Texas

You, of course, don’t have to insure your horse but your car does need insurance; even in old Amarillo. Most ways of finding the right coverage policy and affordable car insurance are complicated and take time.

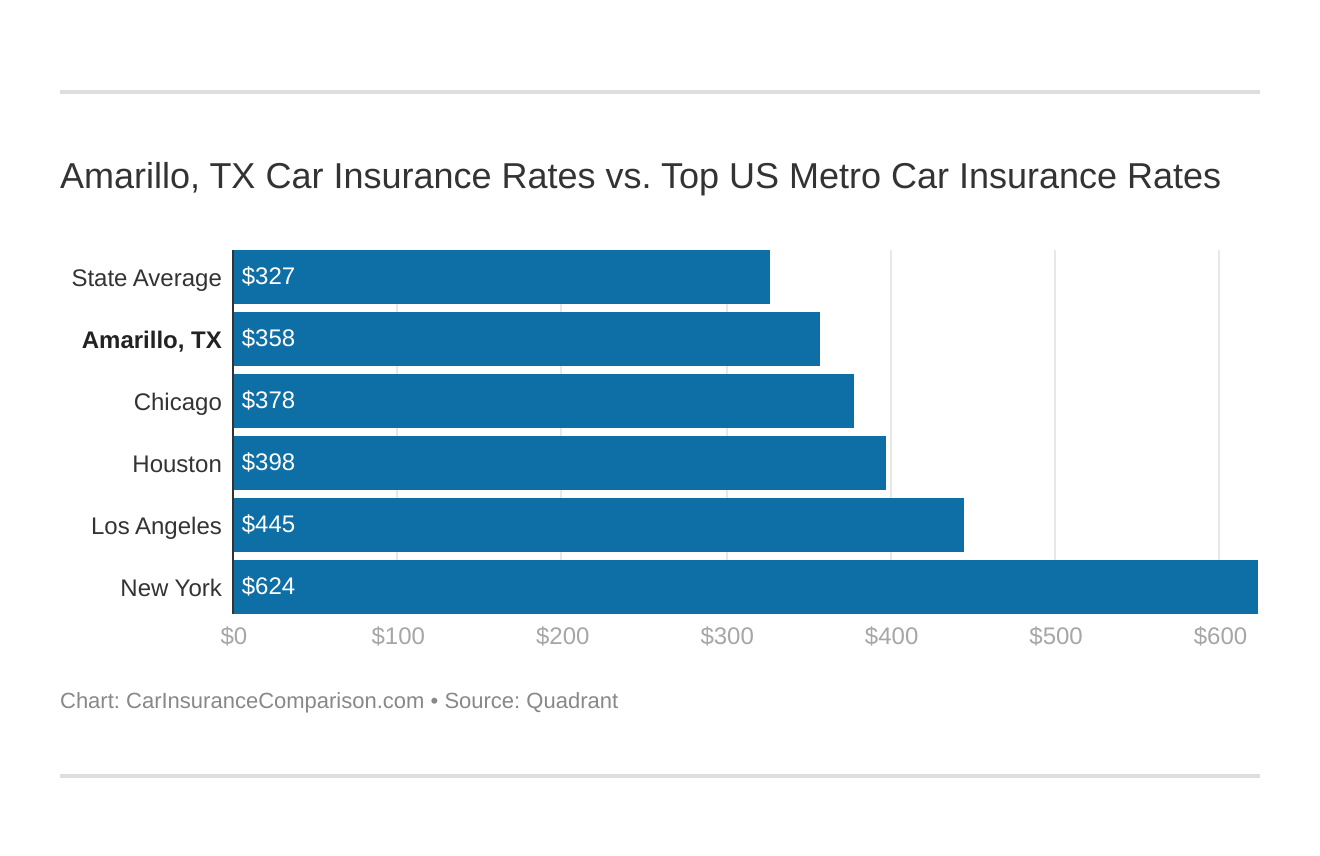

You might find yourself asking how does my Amarillo, TX stack up against other top metro auto insurance rates? We’ve got your answer below.

This article will help you understand the ins and outs of Amarillo and the auto insurance that is best for you. We’ll help to educate you on auto insurance in Amarillo and help you get to know the facts of the old town of ranchers.

Further, you’ll discover the company that gives you the best coverage that you can count on and great customer service that you can depend on.

If you’re thinking of moving to Amarillo or need a change of scenery, you have come to the right place to help you figure out that pesky car insurance.

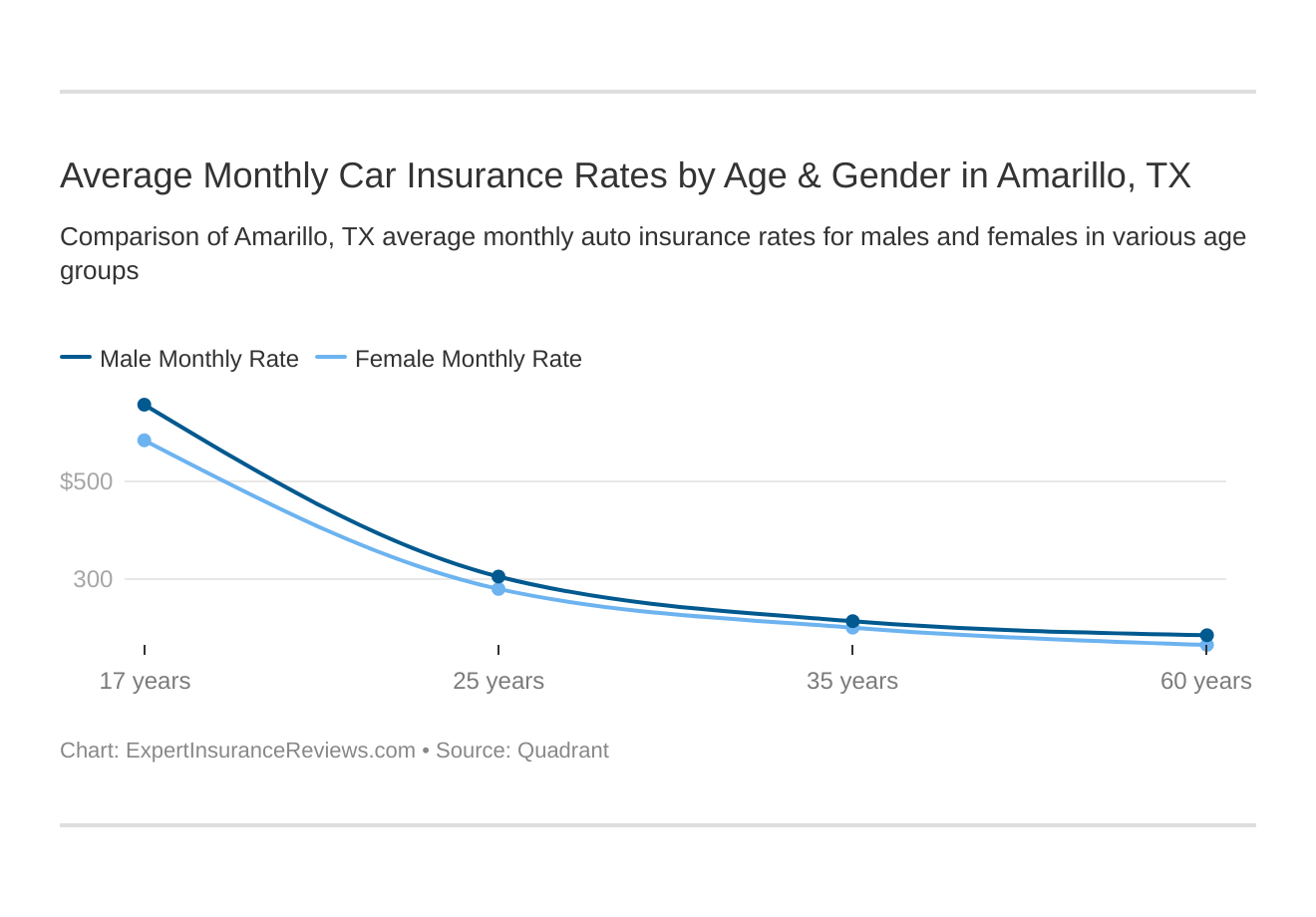

Male vs. Female vs. Age

At a median age of 33.7, Amarillo is a very diverse city. Car insurance deals a lot with a period. If you are a teen in any town, you will be paying more for your auto policy than any other demographic, especially senior drivers.

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor when it comes to auto coverage because young people behind the wheel are often considered to be high-risk drivers. Texas does use gender, so check out the average monthly auto insurance rates by age and gender in Amarillo, TX.

Insurance companies believe that experience on the road is a tremendous asset to have. For this reason, auto insurance policy prices range hugely when it comes to age.

As you can see by the table below, there is a difference of thousands of dollars annually between a person over the age of 60 and a person around the age of 25.

| Amarillo Rates by Age | Average Price |

|---|---|

| 17 | $8,175.38 |

| 25 | $3,534.98 |

| 35 | $2,845.72 |

| 60 | $2,622.85 |

The data shows the difference only ten years can make in annual premiums. Whether you’re male or female, if you’re above the age of 25 and have a clean record, you will find many competitive rates from top auto insurance providers. Responsible driving habits will ensure that you see cheap car insurance if they are reflected on your record.

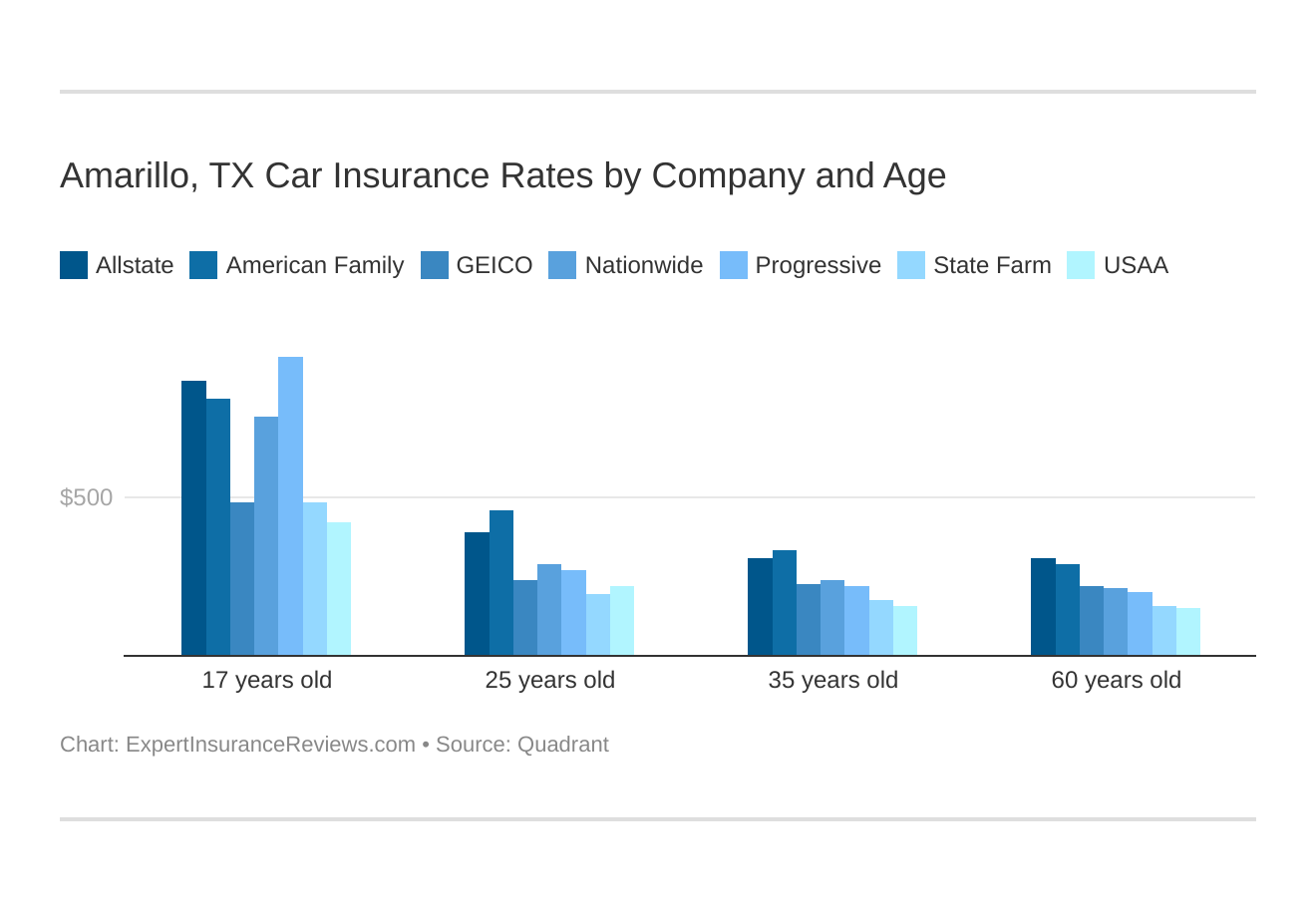

Amarillo, TX auto insurance rates by company and age is an essential comparison, as the top auto insurance company for one age group may not be the best company for another age group. Since the cost of auto insurance can vary so much, shopping around is your best chance of finding the cheapest car insurance rates.

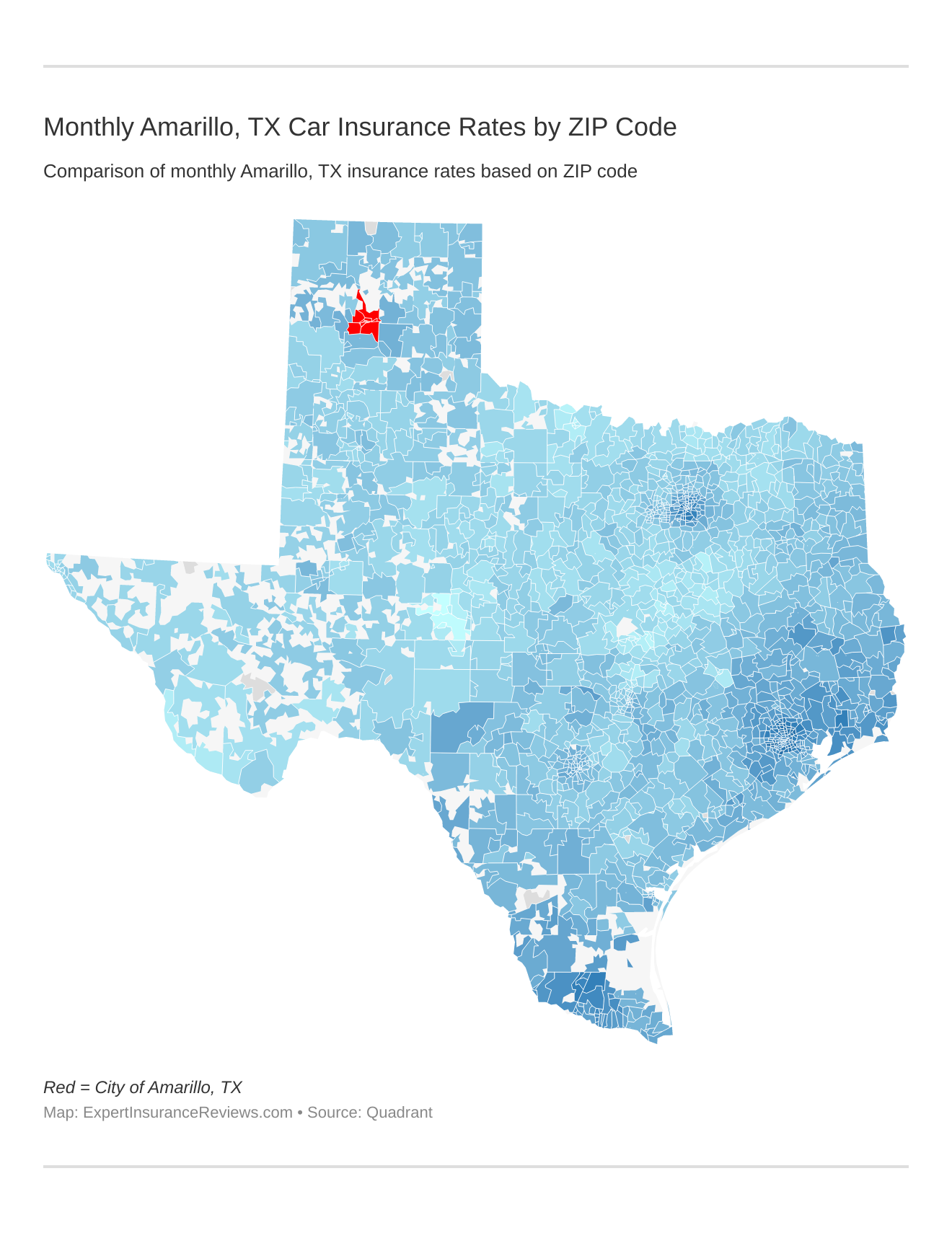

Cheapest Zip codes in Amarillo

Different zip codes bring different variables to auto insurance. Companies determine many things from zip codes such as; the rate of stolen vehicles in your area, cases of vandalism, amount of claims as well as fraudulent claims, and damaging weather.

Check out the monthly Amarillo, TX auto insurance rates by ZIP Code below:

Each city contains different zip-codes. Depending on which you’re in, you could get higher rates or lower rates.

A good rule of thumb in most cases is; the more the people, the higher the rate. The lowest rates typically are in less populated areas.

| Zip-code | Rate |

|---|---|

| 79118 | $5,973.65 |

| 79119 | $6,012.50 |

| 79101 | $6,022.60 |

| 79110 | $6,104.12 |

| 79106 | $6,105.64 |

79118 and 79119 are the cheapest zip-codes in the Amarillo city limits. These zip-codes are mostly out in the open areas of the panhandle.

From zip-code to zip-code, there may be different amounts of poverty as well, this affects the price companies charge for policies.

Best Car Insurance

Choosing the best car insurance is an exciting game. You can choose the cheapest one reasonably quickly, but what does that coverage get you? Sometimes the best car insurance isn’t the most affordable. Low, medium, and high coverage can make a great deal of difference.

That low coverage car insurance is proper on your pocketbook until you get in an at-fault accident.

Many different factors go into who has the best car insurance. There is usually no overall winner but the top insurance carriers, are top companies for a reason.

Sometimes that cheap rate is the best thing for you though. This section will help you choose the best coverage, the best company, and the best rate for your price range.

Cheapest Rates by Company

There are loads of car insurance companies that all claim they have the best coverage for the most affordable rate. Saving money is excellent, but if you’re getting the insurance that doesn’t cover anything, more money may end up coming out of your pocket.

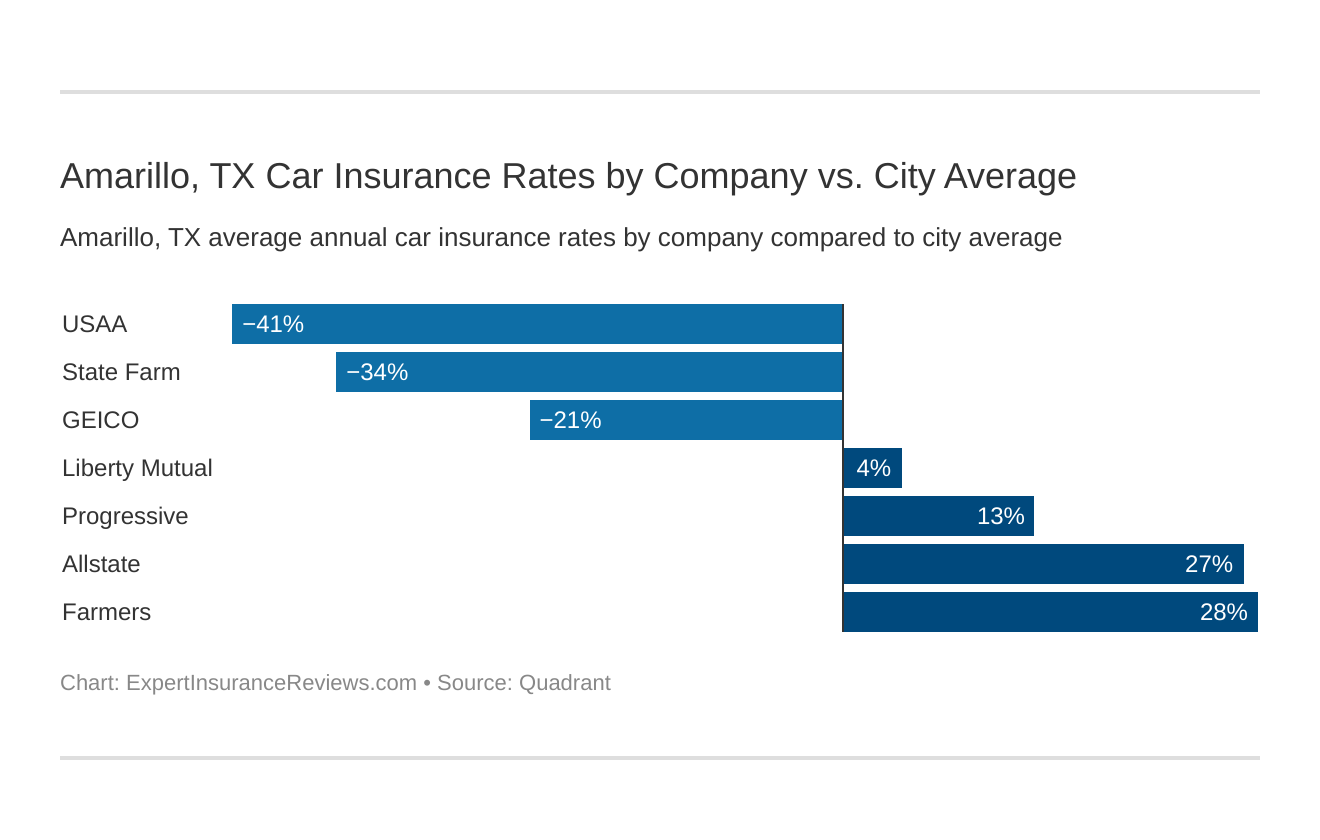

From company to company there is usually a base price for every age and sex as we mentioned before. Companies like Geico, USAA, and Nationwide aim to give you the best price you can pay. But other companies like Allstate and American Family shoot to give you the most coverage, but it will cost you more.

Military gets excellent treatment all over the U.S. (rightfully so) but especially in Texas. USAA is consistently the cheapest company in the state and Amarillo.

| Company | Average Rate |

|---|---|

| USAA | $2,848.92 |

| State Farm | $3,043.41 |

| Geico | $3,491.72 |

| Progressive | $4,901.79 |

| Nationwide | $4,481.73 |

| Allstate | $5,619.47 |

| American Family | $5,676.09 |

As you can see by the table, State Farm and Geico are the next best options. If you’re looking for the cheapest rate you can get, these companies are the ones to look for.

Which Amarillo, TX auto insurance company has the cheapest rates? And how do those rates compare against the average Texas auto insurance company rates? We’ve got the answers below.

Best Car Insurance by Commute

Commuting is becoming a big part of the American workday. In some cases, it can account for more than three hours of a person’s day.

Commuting is never fun. If you have a long drive every day, it can affect you mentally and physically. Car insurance companies recognize this as a problem in most cases. The longer you’re on the road, companies believe the more incidents can happen.

Some people will even have super-commutes which simply means commutes over 90 minutes one way. If you travel into Dallas for work, you might be a super-commuter.

| Best Insurance by Commute | 10 Mile Commute (6000 Annually) | 25 Mile Commute (12000 Annually) |

|---|---|---|

| USAA | $2,811.25 | $2,886.58 |

| State Farm | $3,043.41 | $3,043.41 |

| Geico | $3,422.41 | $3,561.01 |

| Nationwide | $4,481.73 | $4,481.73 |

| Progressive | $4,901.79 | $4,901.79 |

| Allstate | $5,490.76 | $5,748.19 |

| American Family | $5,676.09 | $5,676.09 |

The data shows that not every company increases its rates due to longer commutes, but some do. State Farm, Nationwide, and Progressive don’t change their rates, while Geico, Allstate, and USAA raise it hundreds of dollars annually.

While on the insurance search, if you know, you’ll have a long commute, be sure to choose a company that gives you a break.

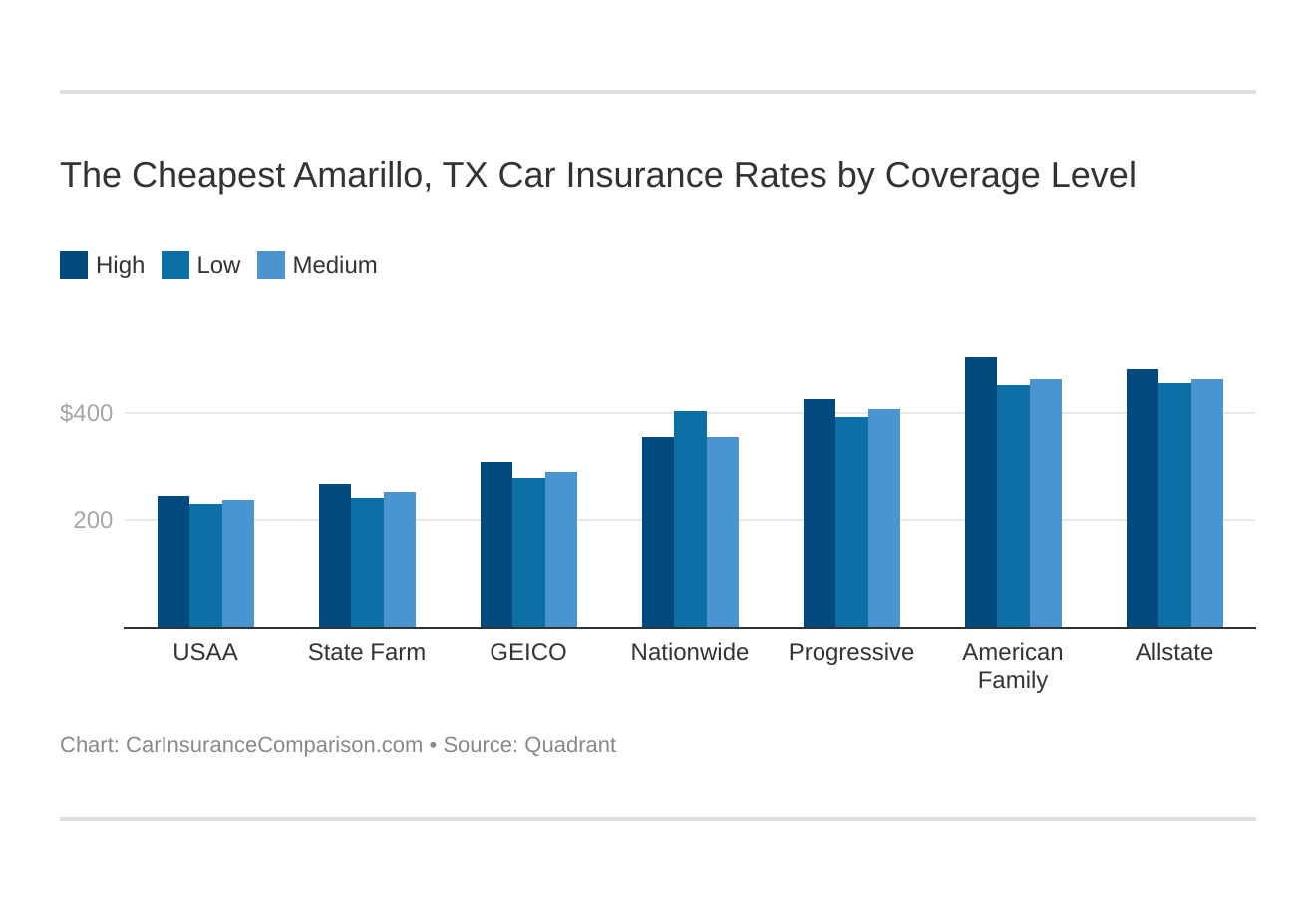

Best Car Insurance by Coverage Level

All car insurance policies have three different coverage levels. Low coverage is the base that most states require. Texas requires minimum liability insurance. This means you at least have to pay for the low coverage.

Your coverage level will play a major role in your Amarillo auto insurance rates. Find the cheapest Amarillo, TX auto insurance rates by coverage level below:

Buying different levels of coverage is a tricky task. Low coverage gives you what you need, but high coverage gives you a big safety net in case of an at-fault accident.

You’ll need to understand the common types of coverage available on a car insurance policy to pick the best one for you. The various types of car insurance coverage are available to help protect you, your vehicle, and your passengers if you’re involved in a car accident.

| Coverage Level Rates by Coverage | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| USAA | $2,773.71 | $2,840.80 | $2,932.23 |

| State Farm | $2,894.42 | $3,038.40 | $3,197.41 |

| Geico | $3,343.38 | $3,461.39 | $3,670.31 |

| Progressive | $4,717.74 | $4,882.047 | $5,105.55 |

| Nationwide | $4,876.44 | $4,285.10 | $4,283.65 |

| Allstate | $5,495.42 | $5,573.10 | $5,789.90 |

| American Family | $5,422.49 | $5,546.54 | $6,059.14 |

As you can tell in the data, each coverage level will increase about a thousand dollars annually. From company to company, those coverages might cover more. Medium coverage with American Family could be better than high coverage with Nationwide.

Assuring what you’re getting is one of the most important parts of finding the best policy for you.

Choosing the right coverage depends on a lot of different variables, so be sure to cover all your bases before choosing the lowest coverage just for a cheap rate.

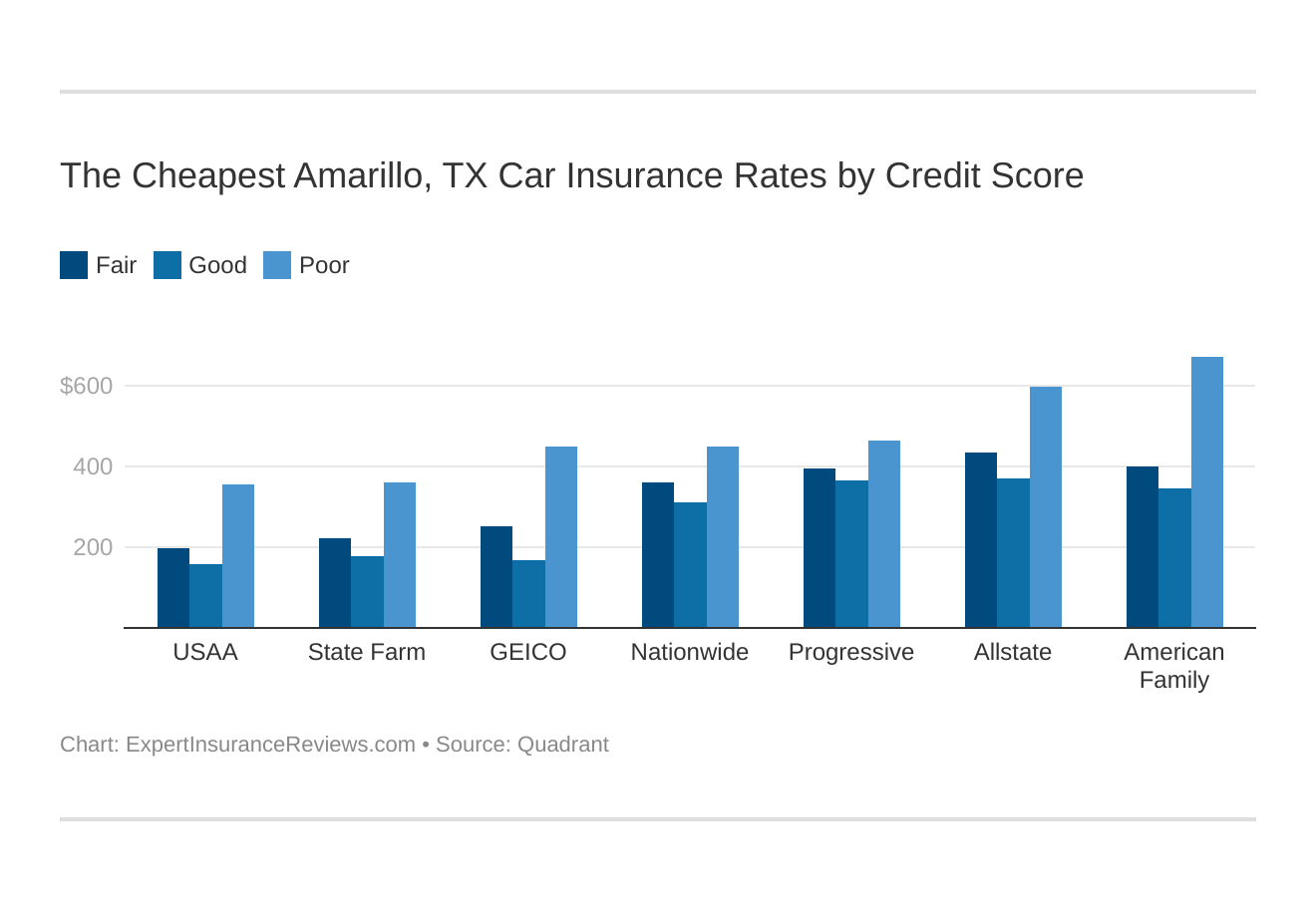

Best Car Insurance by Credit History

In today’s world, we are almost defined by a number. Our credit history tells almost everything there is to know. If you have a poor credit score car insurance companies will sky-rocket their rates. Just like buying a car, this is almost as important as your driving record.

Your credit score will play a major role in your Amarillo auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Amarillo, TX auto insurance rates by credit score below.

Some states are starting to make it illegal to raise rates based on credit history. Unfortunately, Texas is not one of those states. California, Massachusetts, and Hawaii are the only states that do not allow companies to change rates based on credit score. There is a conversation of more states following suit.

| Rates by Credit History | Poor | Fair | Good |

|---|---|---|---|

| USAA | $3,231.57 | $1,869.94 | $1,505.74 |

| State Farm | $3,791.34 | $2,362.12 | $1,883.42 |

| Geico | $4,175.99 | $2,380.42 | $1,600.15 |

| Nationwide | $3,635.72 | $2,929.65 | $2,553.54 |

| Progressive | $4,198.37 | $3,633.39 | $3,370.94 |

| American Family | $5,885.27 | $3,710.12 | $3,249.49 |

| Allstate | $6,312.38 | $4,640.46 | $3,975.00 |

According to the data, every major company raises their rates by at least two thousand dollars between poor and good credit. If you have a poor credit history, your chances of catching a good rate are slim to none.

Geico is notorious for having great prices. With poor credit even they have an average rate of over four thousand dollars.

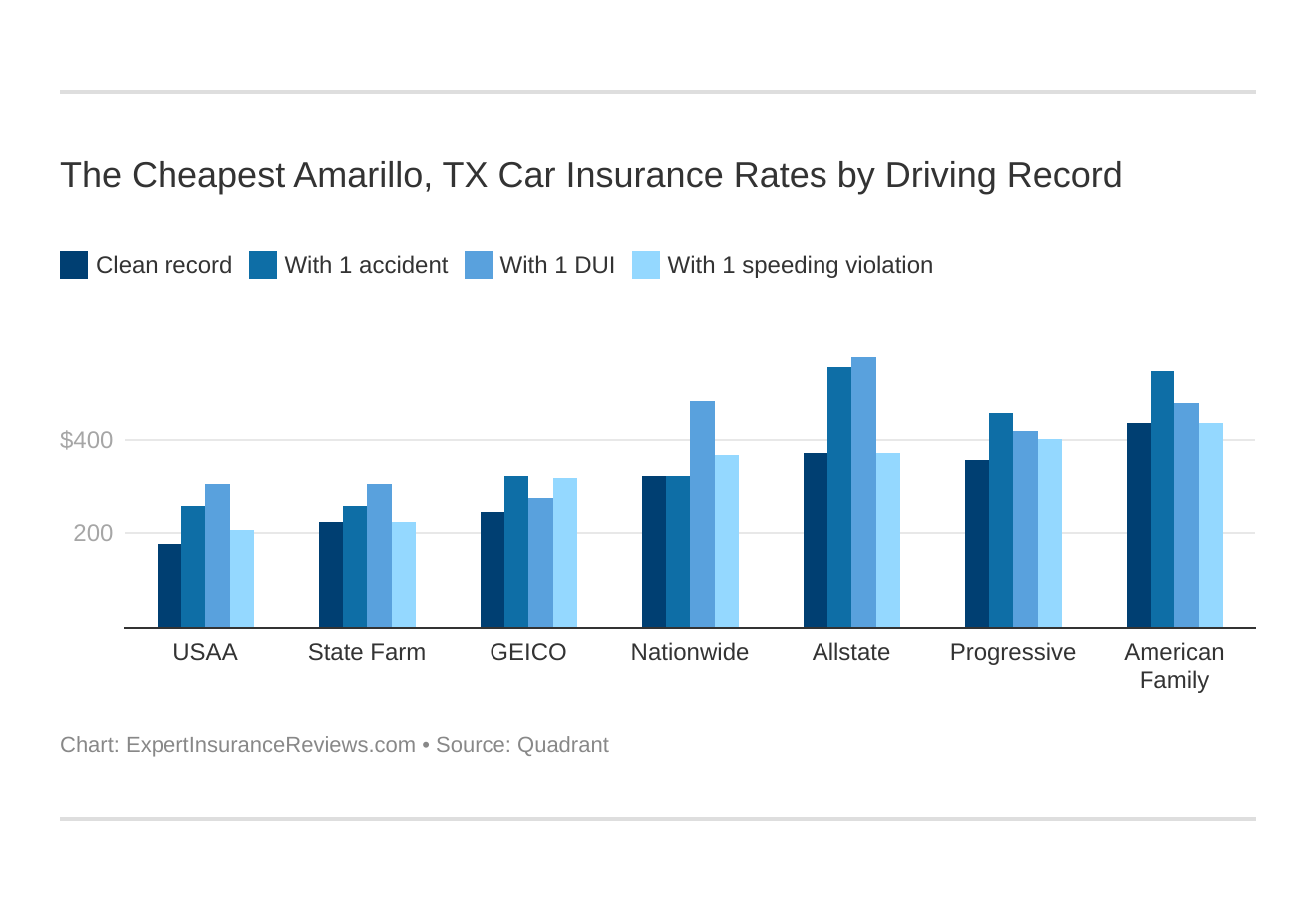

Best Car Insurance by Driving Record

Driving record is another important aspect of insurance companies rates. A clean record can buy you a lot of breathing room. Driving record will usually stay with a driver for 3-4 years depending on the company. DUI’s will last even longer.

With just one ticket, your rates could increase by hundreds annually.

| Rates by Driving Record | Clean Record | 1 Accident | 1 DUI | 1 Citation |

|---|---|---|---|---|

| USAA | $2,150.51 | $3,115.54 | $3,658.68 | $2,470.92 |

| State Farm | $2,701.58 | $3,102.21 | $3,668.27 | $2,701.58 |

| Geico | $2,960.44 | $3,878.97 | $3,299.02 | $3,828.47 |

| Nationwide | $3,864.86 | $3,864.86 | $5,809.10 | $4,388.09 |

| Progressive | $4,276.82 | $5,479.21 | $5,011.86 | $4,839.67 |

| Allstate | $4,448.65 | $6,668.71 | $6,911.67 | $4,448.65 |

| American Family | $5,209.70 | $6,541.99 | $5,742.97 | $5,209.70 |

Your driving record will play a major role in your Amarillo auto insurance rates. For example, other factors aside, a Amarillo, TX DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Amarillo, TX auto insurance rates by driving record.

A driving record isn’t nearly as important as good credit, but a DUI will most certainly ruin your rates. Nationwide nearly doubles their annual rate because of one DUI.

Some companies have accident forgiveness and give breaks on your first ticket. The rates for the companies will be a bit higher, but this could save you in the long run.

Driving safely every day will guarantee you a competitive rate from every company you get a quote from. But if your driving record is poor, some companies will reject you completely. If companies believe you are too much of a liability they will pass up on your money.

Car Insurance Factors in Amarillo

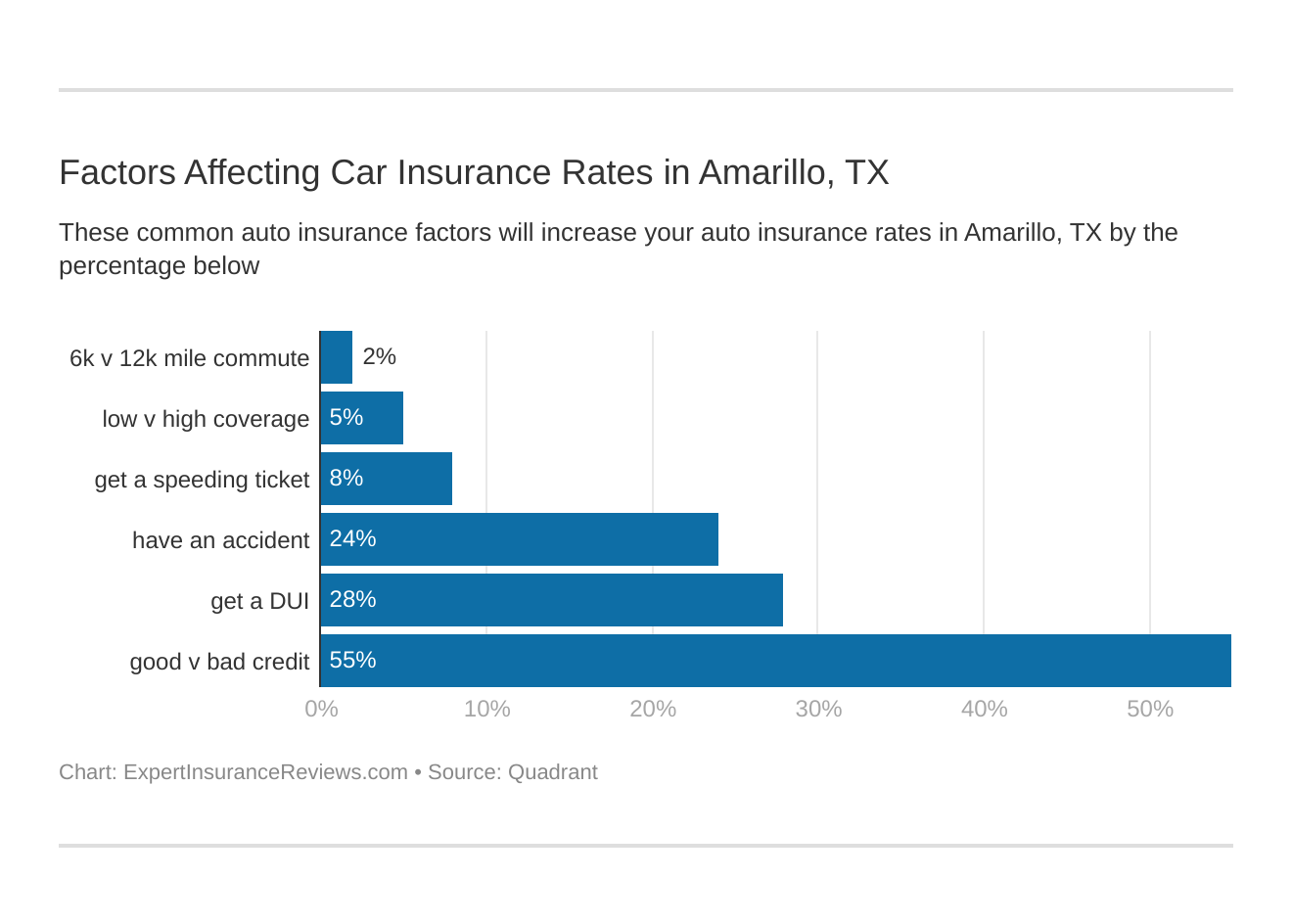

Companies use a lot of different ways to determine your rates. Credit history, driving record, and commute times are the top contenders, but there are also things that you don’t directly do that affect insurance rates. Amarillo lies within the walls of the Dallas/Fort-Worth metro which some of these statistics will be based on.

Factors affecting auto insurance rates in Amarillo, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Amarillo, Texas auto insurance.

Road conditions, student population, and renting properties all indirectly affect your rate.

The average income of the area you live in, the poverty rate, and the educational differences are also a big part of rates.

In this section, we’ll dissect what things around you make your insurance policies change so that you can understand fully why your rate is what it is.

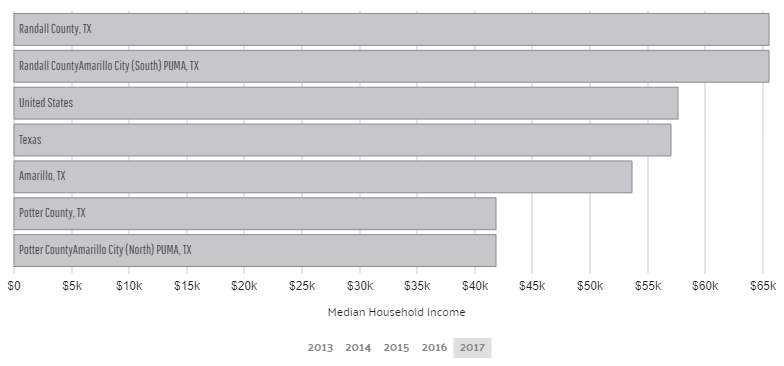

Median Household Income

Household income is vital in determining what insurance companies can charge you. If you live in a poor area, insurance will be less. If you live in an affluent area, rates will be through the roof.

This table shows how Amarillo compares to the U.S., Texas, and the neighboring cities.

The average household income of the 197,000 people in Amarillo is about 54,000 dollars yearly. This is nearly dead in the middle of the spectrum, which is a good thing for everyone.

Median household income gives insurance companies a base value of what the area can afford. Above all other factors, this will noticeably change car insurance rates.

Below you can use an insurance cost calculator to see what you can afford based on your income.

calculator

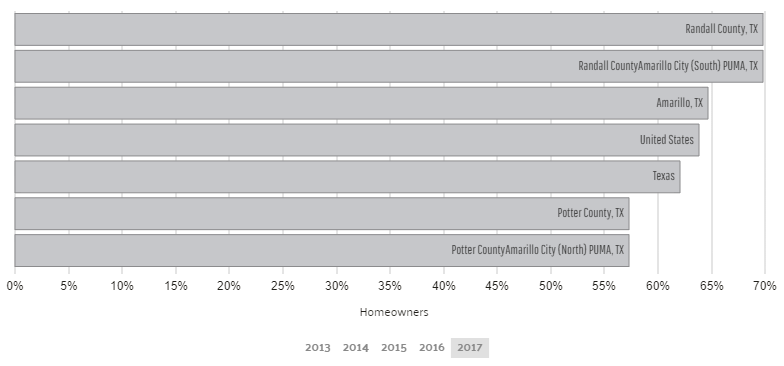

Homeownership

Homeownership refers to those people who actually live in the houses they own or if they rent out the houses they own. Renting is becoming a popular trend in our world with new Airbnb and other forms of short and long term stay.

In Amarillo, about 64 percent of all the houses are lived in by the homeowners. This right around the national average so shouldn’t cause you much of a headache when shopping for car insurance.

If companies believe there is a lot of renters living in homes, it’s a red flag. Renters are usually more reckless, care less about property value, and noisier.

This table demonstrates how Amarillo and the surrounding areas are with homeownership.

This can mean a headache for insurance companies. The more people who rent, the less likely they are to have multiple cars, a high income, etc.

Education

Student populations correlate with the age of drivers. Most students are in the age bracket of below 25. Remember, this age pays the most for car insurance. These statistics are based on them being the most reckless driving age. On average teens speed, text and drive, and drive distracted more often than any other age.

There are a few different universities in the Amarillo area. The student population of Amarillo is around 10,500 people. There are more than 6500 female students, accounting for one-third of people. In 2017 there were 1,960 degrees awarded.

Amarillo College is the most populated and accounts for most of the student population.

Knowing how many students there are in the area is essential for insurance. If there is a large number of student drivers in the area, that means rates will be higher.

For example, in Amarillo City by Amarillo College, the rates would be much higher due to the high amount of young drivers.

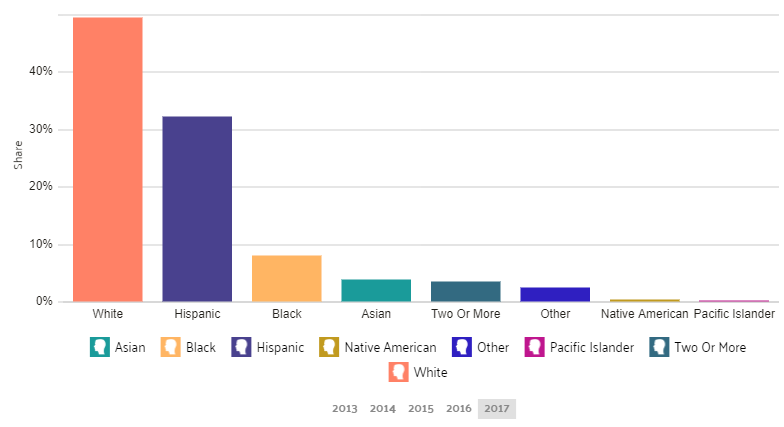

Wage by Race & Ethnicity

Wages change from city to city in every state. There are differences in them between gender, age and race.

Car insurance companies use ethnicity to give discounts on some occasions.

In Amarillo, as in nearly every part of the U.S., Asians earn the highest salary. This is followed by the white population and the American Indian population.

The reason this is worth mentioning is based purely off the average income of people in the city. If you are looking for car insurance and do not have a high salary, you will be forced to choose a lower coverage plan.

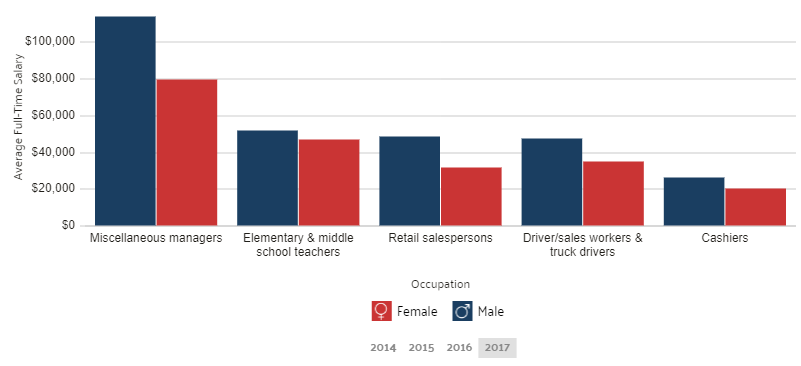

Wage by Gender

Gender is a significant factor in car insurance, so knowing how the different genders are weighing against each other is a great asset.

This graph shows that on average men make more than women in Amarillo in every category of everyday jobs. This translates to auto insurance by charging females less on their rates.

Due to the facts, women in Amarillo are making about $18,000 less a year than men; they will be charged a lower rate. Women are almost always safer drivers than men as well.

Poverty by Age & Gender

Poverty can be found in every city of every state in our nation. Amarillo is no exception.

As mentioned previously, based on demographics and ethnicity insurance companies determine what the base rate will be for you.

According to Data USA women between the age of 24-35 make-up, the largest portion of the demographic. This includes single mothers and pregnant wives in most cases.

Poverty by Race & Ethnicity

As you can see in the table, the white population is the majority of the poverty-stricken people in Amarillo. This has a lot to do with whites being the majority of the overall population as well.

Some insurance companies will offer lower rates to those on food stamps. Be sure to check these out if you live below the poverty line.

Employment by Occupations

The most common job groups, by the number of people living in Amarillo, are Office & Administrative jobs which are about 13,000 people. Sales & Retail areas are the next most common with about 11,000 people.

This affects rates due to things like commute, job security, and overall wealth.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Amarillo

Amarillo has large areas of ranches and farms, but two major highways in the Texas plains region run right through the heart of the city. This can mean some difficult traffic if you’re on the highways at the wrong time.

Traffic patterns, construction frequency, and road conditions all affect insurance companies rates.

In this section, we’ll dissect the roads, safety, and traffic congestion. Car insurance companies look at the same factors as they decide how high or low your rate will be. It is best to know the facts and questions to ask when deciding on insurance.

Roads in City

Roads are a huge part of the rates you receive from company to company. If there is a lot of construction and poor road conditions in the city, the rates will be hiked up.

In Amarillo, there is a lot of open space with long roads, but there are major highways as well.

In this section, we’ll dissect the roads, safety, and traffic congestion. Car insurance companies look at the same factors as they decide how high or low your rate will be. It is best to know the facts and questions to ask when deciding on insurance.

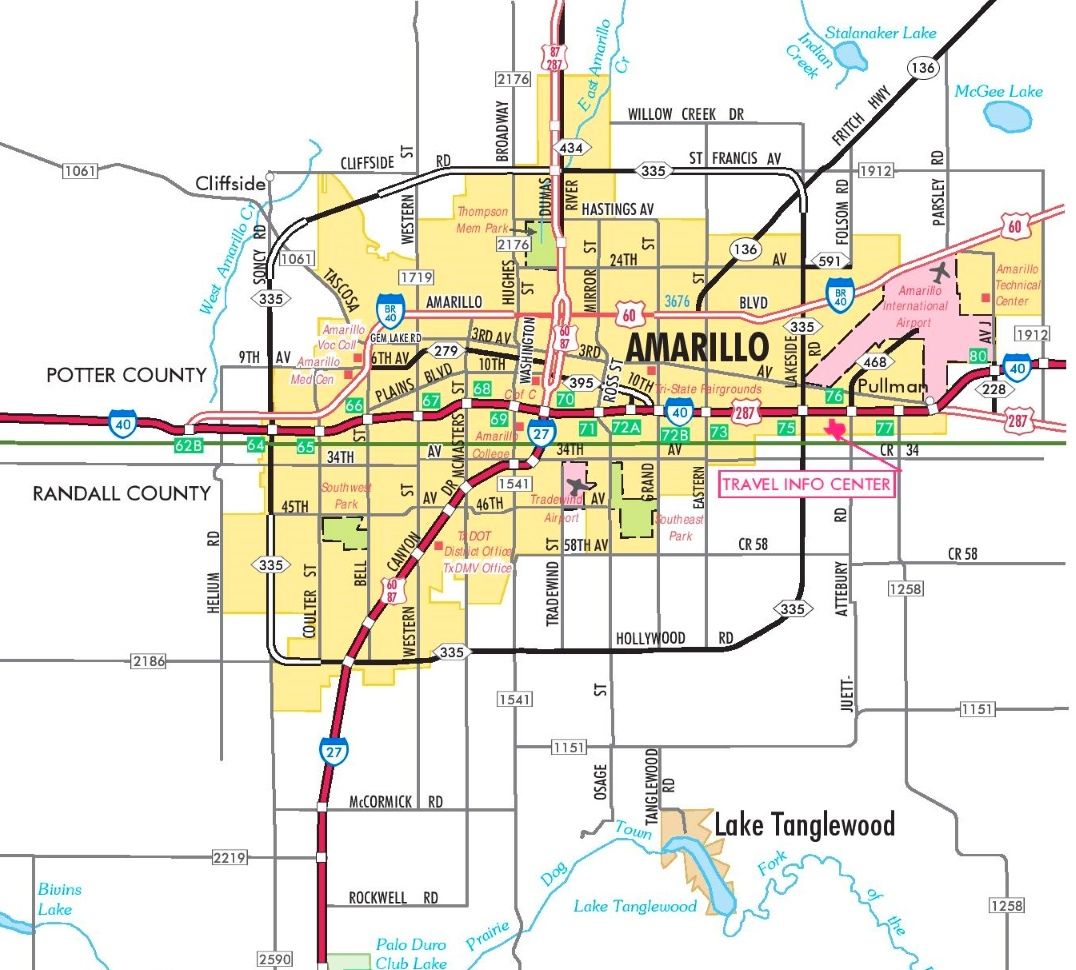

Major Highways

The two main highways in Amarillo are Interstate 40 running east and west and Interstate 27 running north and south.

Both of these Interstates connect you to Oklahoma and New Mexico. This means a solid amount of traffic for you at most times of the day in Amarillo.

Texas, in general, has 25 different active highway routes that span over 3,500 miles.

The map above shows Amarillo and the different roads throughout the city.

Popular Road Trips/Sites

Amarillo is a big and beautiful place. The Palo Duro Canyon State Park is the most traveled to destination in the city. Just behind the Grand Canyon in Arizona, the Palo Duro is the second largest canyon in the United States. It gives large open spaces and huge scenery. If you’re looking for a view, this is it.

Amarillo is known for it’s hiking trails as well. There are miles and miles of trails that will take you through deserts and ranchers alike.

The Wonderland Amusement Park and the Cadillac Ranch are also popular tourist destinations. This video shows the best things to do while in Amarillo.

Road Conditions

Road conditions are important in determining rates for insurance companies. If you live in a small town with a lot of dirt roads and old potholes that have haunted your family for generations; you will be paying a little more on rates.

We’ve all been plagued by bad roads a time or two. A popped tire because you didn’t have the heart to ask for directions.

If you live in a city with brand new roads in most areas, you will pay less. Safety and precautions are the main reason for this insurance adjustment. If your city has a high probability of blown tires, broken axels, and ruined alignment insurance companies will charge more.

Read more: Does my car insurance cover damage caused by a blown tire?

Overall, Amarillo has a mix of both good and bad roads. The Jason Aldean “, Amarillo Sky” part of the city, is vast and long open dirt roads are king. On the other hand, in the heart of the city, most of the roads are in good condition.

Speeding or Red Light Cameras?

Governor Greg Abbott recently signed a bill that took effect in the entire state of Texas. The bill outlaws red-light and speeding cameras.

For some reason, Amarillo is still using theirs, however. Sooner than later, there will be no more speeding or red light cameras in all of Texas.

This fact could save you a lot of money in rises in car insurance rates. As mentioned before, just one traffic citation can raise your rates by hundreds of dollars.

Vehicles in City

In every city, there are many different modes of transportation. Classic cars, motorcycles, buses, and public transits. The type of vehicle you drive can drastically affect your insurance rates.

Classic car insurance is often double the cost of regular car insurance.

In this section, we’ll discuss the most popular vehicle in Amarillo, and the facts of vehicles in the city.

Most Popular Vehicles

Everything is bigger in Texas. Surprisingly the most popular car is not an oversize pickup. It’s a Dodge Challenger.

After watching this video, the challenger is big for other reasons than size. The Challenger will raise those insurance prices because it’s a sports car, and due to safety issues. When a car can go as fast as Challengers do, it’s an issue for insurance companies.

Amarillo has a lot of farms and ranches, so there are loads of pickups on the road as well.

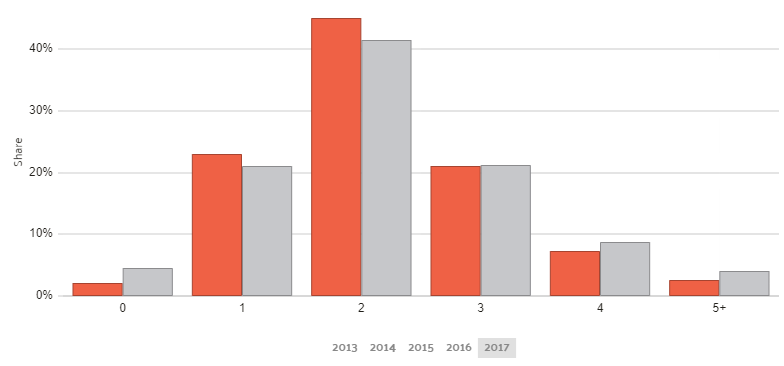

Cars Per Household

As in nearly every city in America, most households have two cars.

According to the chart, more than 45 percent of households owned two cars in 2017. One car households at 27 percent follow it.

Of those two-car households, most of the cards have multiple people on insurance.

Households Without a Car

In Amarillo, 4.2 percent of houses have no cars at all. This is quite a bit higher than average. This helps you out in the long run. Fewer cars on the road mean lower commute times, and fewer chances for a traffic incident.

Speed-Traps

Speed traps are never fun. But they make the roads safer and make people recognize slowing down. Remember, a ticket is just extra money on your monthly insurance rate.

Stay in tune with speed traps and where they may be, or just go the speed limit.

Vehicle Theft

Vehicle theft is a big issue in every state. Texas is a huge state, so the theft rates are higher due to the population being so high.

Out of the 197,000 people living in Amarillo, there were 695 reported motor vehicle thefts in 2013.

This is a very high number for the population. With the population increasing every year, more vehicles are hitting the road. This number generally increases steadily.

Rates of theft are growing as the costs of living rise. The FBI has found this has been a consistent trend in the past decades. According to the FBI, there were an estimated 765,484 thefts of motor vehicles nationwide in 2016. That left the rate to about 236 thefts per 100,000 people.

Bishop Hills is the safest neighborhood in Amarillo, with the least amount of reported vehicle thefts.

Traffic

Amarillo is not notorious for traffic like other spots in Texas like Dallas and Houston, but with two major highways running through it, traffic can certainly get worse.

Insurance companies adjust based on the amount of traffic, and the congestion it causes. The longer people are on the road, the more chance they have of getting in some kind of driving incident.

In this section, we’ll show what areas have the worst amount of traffic, and where the busiest highways run. This can help you decide if not only Amarillo but Texas as well is the place for you.

Traffic Congestion in Texas

Each year it is estimated that $1,065 is spent per driver on congestion issues.

During the morning and evening rush hour times, the average speed of travel is only 33 mph. The Dallas area is known for some of the worst traffic in the state and the entire nation. Super-commutes are a big part of life in the Dallas metro.

Houston and Austin will be the next cities with the most traffic. Houston and Dallas are neck and neck when it comes to traffic problems. With four huge highways in the surrounding area, it is no wonder why Dallas is so heavy in traffic.

According to Inrix‘s traffic scorecard, Amarillo is not even in the top 200 cities in America for traffic. This is great news for anybody thinking of moving.

In terms of car insurance, companies will know all these statistics. The rates per policy will certainly be lower due to low traffic and less time on the road. Knowing them yourself will only benefit you.

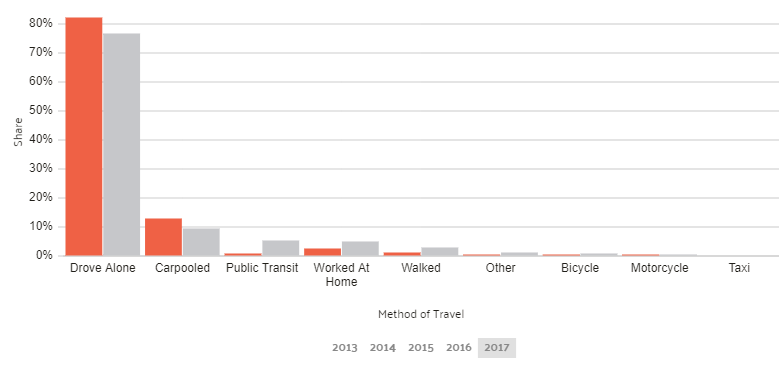

Transportation

The average commute time for Amarillo is 17.3 minutes. That is significantly lower than the average in the United States at 25.1 minutes. Great news for any 9-5 worker.

Of the people on the road in Amarillo, over 80 percent of them drive alone. This is a huge number, but most people in the U.S. drive alone, Amarillo is no different.

Driving alone is a good thing for insurance companies. The fewer people in the car, the less liable the insurance company may be.

Road Safety

| Texas Traffic Safety Stats 2017 | Amount |

|---|---|

| Fatalities (All Crashes) | 3,722 |

| Fatalities (Drunk Driving Cases) | 1,468 |

| Fatalities (Single Vehicle Crashes) | 1,914 |

| Fatalities (Speeding Crashes) | 1,029 |

| Pedestrian Fatalities | 607 |

| Motorcycle Fatalities | 490 |

Road safety is a major concern in every city in every country. It is a topic on the lips of every politician. How do we keep our roads safer?

It’s an endless question, but it starts with each person. Don’t drink and drive. Put down your cell phone. Slow down to the speed limit. Those main tips would save countless lives.

In the table above, you can see how many traffic fatalities there were in Texas in 2017. In one year 3,722 people died in auto-related accidents. Of those 3,722, nearly 40 percent of them involved an intoxicated driver.

Allstate America’s Best Drivers Report

Every year Allstate comes out with their Best Drivers Report. This shows the best drivers based on cities in America. They take into account many different things, but the main three are as follows:

- Years between claims (per driver)

- Likelihood of claims

- Hard-Braking incidents

Amarillo is ranked 18th for best drivers in America. A great statistic to know for insurance companies. Rates will be lower due to the good driving of the entire city.

If Amarillo is on your mind, you may be making a good decision to move when it comes to traffic and road safety.

Ridesharing

Ridesharing is becoming a huge epidemic in the United States and the whole world. Uber and Lyft are creating a new wave of people who aren’t even buying cars.

Be careful whose car you get into though, some Uber drivers may not have insurance that covers you if you were to get in an accident.

Some policies do not automatically cover everyone who is in a car. In downtown Amarillo, buses are also fairly popular. Taking the bus is a cost-effective mode of transportation if you’re on a budget. It is also one of the safest ways to travel.

Read more: Uber Eats Car Insurance: What to Know & How to Save

Estar Repair Shops

Estar is a system developed by Esurance to be a sort of repair/customer service shop. You can find the locations of them in many places throughout the U.S.

Esurance is all about making your life easier. That’s where the idea came from. You can file a claim and find a repair shop within miles, all through your cell phone.

Car insurance can get tough; this is Esurance’s tactic to help you out.

Weather

Amarillo is in an interesting spot in the U.S. in terms of weather. It can get brutally hot with temperatures sometimes reaching 100 degrees. But it can also get very cold with temperatures in the 20s.

The average yearly temperatures are mostly fair in the panhandle of Texas. Amarillo’s average high per year is 70.9 degrees, and the average low per year is 43.7.

Natural disasters can play a small role in life in Amarillo. Most of which are tornado issues. Being just below tornado alley is never a good thing. There will hardly ever be a hurricane that makes it that far up Texas.

There were 13 natural disasters in 2016, which is on par for the nation’s average. Being aware of the daily weather will keep you safe. Knowing if a natural disaster is coming is half the battle.

Public Transit

The best way to get anywhere quickly in Amarillo is by car. As mentioned before, traffic is some of the best in the country within the city walls, but the metro area of Dallas is some of the worst in the country. Not everyone can afford to buy a car, so public transit is available.

Dallas has one of the best bus systems in America called DART or Dallas Area Rapid Transit. It has as many buses as New York City has cabs. DART will have buses that reach all the way to Amarillo for your convenience.

Most of the public modes of transportation will be that bus system. This may cost you a few dollars a day for an all-day pass to as far as the bus will go.

Due to Amarillo’s size and some of the far reach plains and ranches, walking might be part of your commute if you take the bus.

Alternate Transportation

Popping up everywhere are new modes of travel. Amarillo itself may not have many, but the downtown Dallas area certainly will. Scooters and bikes are available for rent to get you from one place to another much faster than walking.

Amarillo is not a huge city, so Lime’s scooters have not completely taken over yet. A bicycle is always a good call but watch out for the weather.

In the downtown area, there are some places to rent a scooter, which only costs a few dollars. Of course, the best mode of transportation is always by car. Finding a good parking spot may be the trickiest part of your day though.

Parking in Metro Areas

The downtown area of Amarillo is a great area to visit. It is built well with plenty of room to park. On some occasions if there’s an event though, showing up early may be a good idea.

In the metro area of Dallas/Fort Worth, parking is always a pain. But the city seems to be doing it’s best to help the situation. Most parking lots are monitored and are ran by Online App Meters so they can be paid through your phone.

Some more out of the way areas may still be pay change by meter on the street, which can leave your car at risk. Your level of coverage can determine if your parked car is at risk or not.

Air Quality

Vehicle emissions are a huge part of air quality in the entire world. The more cars on the road, the less clean the air is going to be.

Amarillo has light traffic as we learned earlier, so the air quality is also very good.

According to the EPA’s Air Quality Index Report, this year, there have been 99 perfect days for Amarillo. Some of the highest in the country.

Military/Veterans

In Texas, the military and its veterans are honored greatly. Remember, USAA has the lowest insurance rates across the board in Amarillo.

From the Arlington National Cemetery to the Presidents who have come from Texas, there is a rich history of military.

Car insurance does not take that for granted. Companies other than USAA also offer military and veteran discounts. With the Fort Worth Base Camp just miles from Irving, it is a popular area for veterans and current military personnel.

If you’re prior or, the current military makes sure to check out which insurance companies offer a discount if you choose not to go with USAA.

Unique City Law

Laws in the United States can get weird. There are laws in place for things that make next to no sense at all.

Texas is full of laws that are odd at best. Here are a few that are at the top of the weird scale.

- You cannot eat out of somebody else’s garbage without their permission. It seems different that they even need to say this at all.

- The entire Encyclopedia Britannica is banned in Texas because it contains a formula for making beer at home.

Amarillo is a great place to live, but watch out for those quirky Texas laws.

Read more: Texas Car Insurance Laws

Frequently Asked Questions

How much insurance does Texas require?

Texas state law states that every driver must have at least liability coverage.

How do I lower my auto insurance costs?

A clean driving record, good credit score, and old age are the best ways to get lower rates.

Why do insurance companies use my prior insurance information?

Insurance companies use this information to see what kind of customer you were. They look at how many claims you may have had and how many incidents you may have had.

What kinds of discounts are available in Texas?

There are discounts for loads of things. If you took drivers-ed in high school, you get a discount. Military personnel gets a discount. Safe driving gets you a refund. Asking your company is the best way to know.

How do I compare auto insurance quotes?

Some sites will compare quotes from many different companies based on where you want to buy. Lucky for you, you’re already on one of those sites. Here’s a way to do that:

How do I know which car insurance policy is best for me in Amarillo, Texas?

The best car insurance policy for you in Amarillo, Texas depends on your driving habits, the type of vehicle you own, and your budget. It’s recommended to compare policies from different insurers and select the one that offers the best coverage for your needs.

What types of car insurance policies are available in Amarillo, Texas?

The types of car insurance policies available in Amarillo, Texas include liability coverage, collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage.

How can I lower my car insurance premium in Amarillo, Texas?

You can lower your car insurance premium in Amarillo, Texas by maintaining a clean driving record, choosing a higher deductible, driving a vehicle with safety features, bundling your policies, and taking advantage of any available discounts.

What is personal injury protection?

Personal injury protection is car insurance that covers medical expenses and lost wages if you or your passengers are injured in an accident, regardless of who is at fault.

What is uninsured/underinsured motorist coverage?

Uninsured/underinsured motorist coverage is car insurance that covers damages and injuries caused by a driver who does not have insurance or who has inadequate insurance.

Can I customize my car insurance policy in Amarillo, Texas?

Yes, you can customize your car insurance policy in Amarillo, Texas by selecting the type and amount of coverage you need, as well as any additional features or benefits you want.

What factors affect my car insurance premium in Amarillo, Texas?

Factors that affect your car insurance premium in Amarillo, Texas include your age, driving record, type of vehicle, location, and coverage amount.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.