Best Chicago, Iillinois Car Insurance (2024)

The average Chicago car insurance rates are $317.75/mo, and the cheapest rates are $236/mo. The purpose of this guide is to give general information about Chicago while guiding you to an affordable car insurance premium. Use this information to your advantage as you shop for car insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Chicago Summary | Stats |

|---|---|

| City Population | 2,722,389 |

| City Density | 11,960 people per square mile |

| Average Cost of Car Insurance | $3,813 |

| Cheapest Car Insurance Company | Liberty Mutual: $2,832 |

| Road Conditions | Poor Share: 28 % Mediocre Share: 35 % Fair Share: 14 % Good Share: 22 % Vehicle Operating Cost (VOC): $627 |

Chicago is one of the most popular cities in the U.S., known for its awesome nightlife, professional hockey, and the famed Michael Jordan statue in front of the United Center. The Windy City is also known to have the highest car insurance rates in the state of Illinois.

Cheaper rates are available, however. This city review will guide you to the cheapest car insurance rates and the companies that have them.

Just enter your ZIP code in our quote box in this guide to start comparing rates.

The Cost of Car Insurance in Chicago

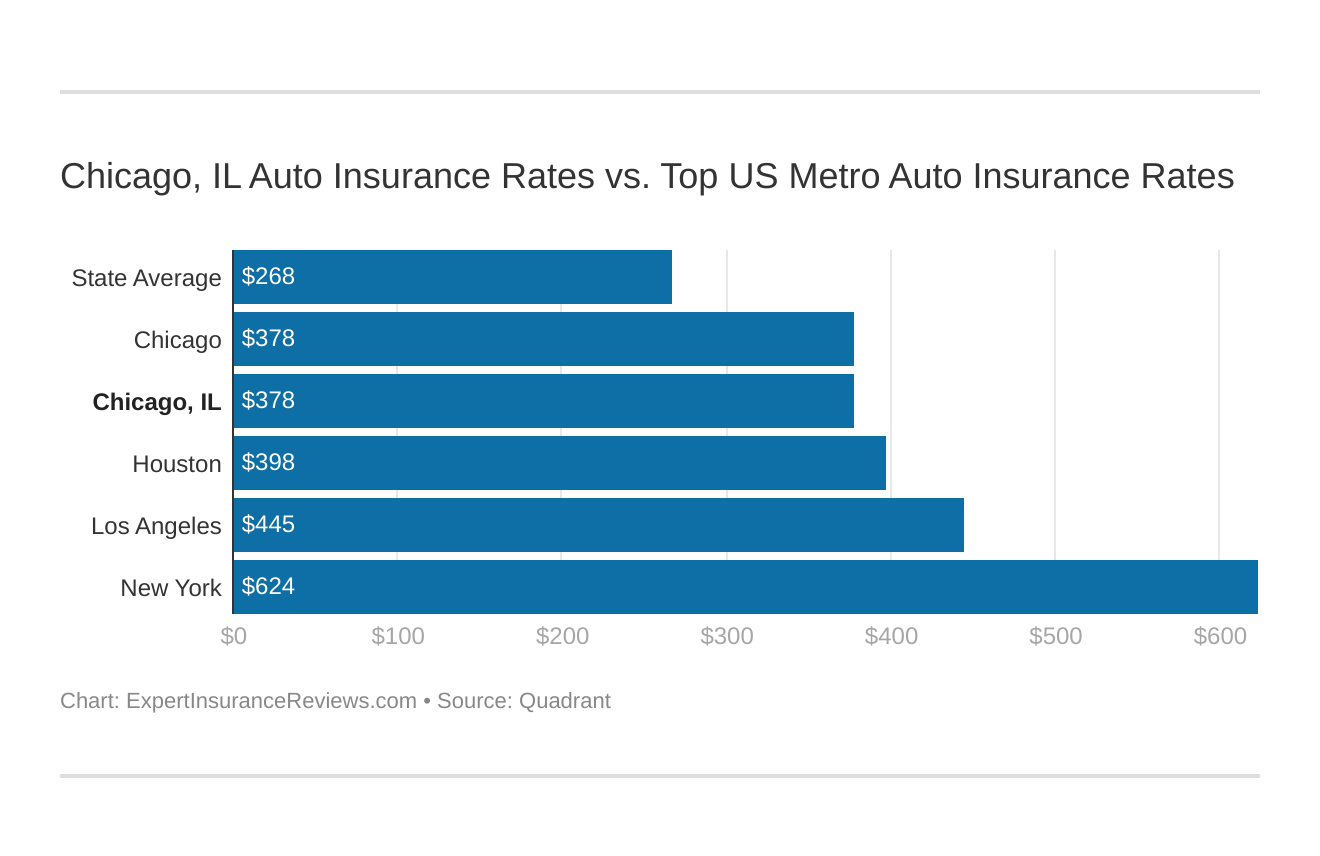

The average cost of car insurance by U.S. state is much different than the cost of insurance for highly populated areas like Chicago. Between taxes and cost of living, car insurance is likely to be higher-than-average in the Windy City.

You might find yourself asking how does my Chicago, IL stack up against other top metro auto insurance rates? We’ve got your answer below.

The next step is to search for the cheapest and most effective coverage options. But first, let’s examine some average annual rates in Chicago and compare them to assess what rate meets your needs.

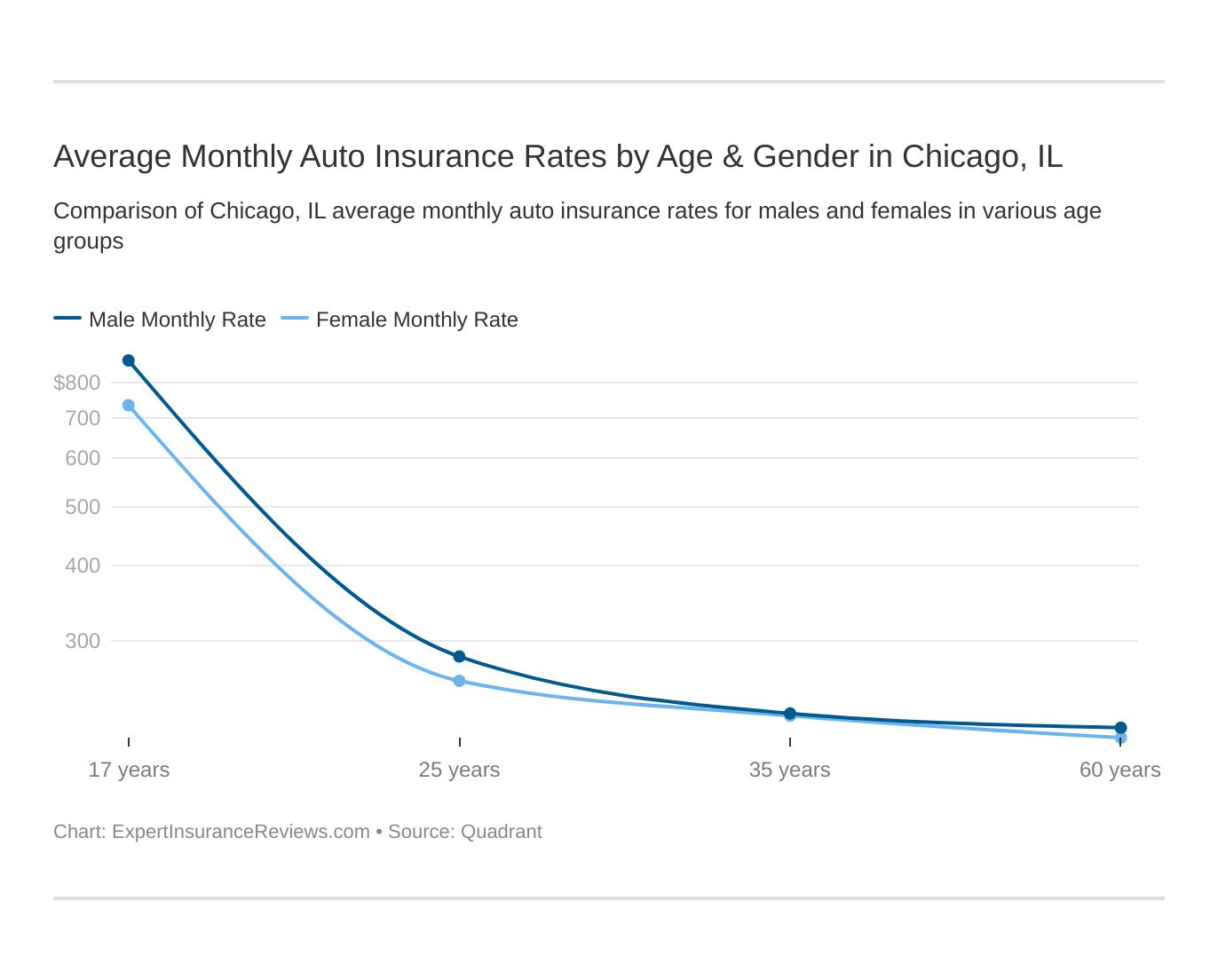

Male vs. Female vs Age

Teen drivers have the highest car insurance coverage regardless of the company you’re with. Statistics show that teens take more risks and have less driving experience, making it more difficult for this demographic of high-risk drivers to find cheap car insurance. Male drivers are likely to pay more on car insurance, also. However, the older a motorist gets, the lower the car insurance premium.

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. IL does use gender, so check out the average monthly car insurance rates by age and gender in Chicago, IL.

The median age in Chicago, IL, is 35 years old, so most drivers are paying an affordable rate per year. Let’s look at some of those affordable rates.

| City | 17 Years Old | 25 Years Old | 35 Years Old | 60 Years Old | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|---|

| Chicago | $9,627.05 | $3,248.57 | $2,721.02 | $2,545.51 | $2,545.51 | 60 |

Sixty-year-old motorists see the most competitive rates in Chicago. They often take fewer risks and drive less often, making for a desirable driver profile.

When we narrow our outlook, we’ll see a difference between female and male annual rates.

| City | Male | Female | Cheaper |

|---|---|---|---|

| Chicago | $4,536 | $4,278 | Female |

There’s not a huge difference in annual car insurance rates, but males pay more money for car insurance.

What would it look like if we considered age, gender, and marital status as factors in determining car insurance rates per year? The data is provided below.

| Demographic | Annual Rate |

|---|---|

| Single 17-year old female | $8,808.60 |

| Single 17-year old male | $10,445.50 |

| Single 25-year old female | $3,098.36 |

| Single 25-year old male | $3,398.79 |

| Married 35-year old female | $2,708.30 |

| Married 35-year old male | $2,733.75 |

| Married 60-year old female | $2,494.91 |

| Married 60-year old male | $2,596.11 |

| City Average | $4,535.54 |

Seventeen-year-old single males have to pay over $10,000 for car insurance per year, while 17-year-old females pay nearly $2,000 less for car insurance rates per year, allowing for them to see a more affordable option. Married motorists pay $1,000 less for annual car insurance.

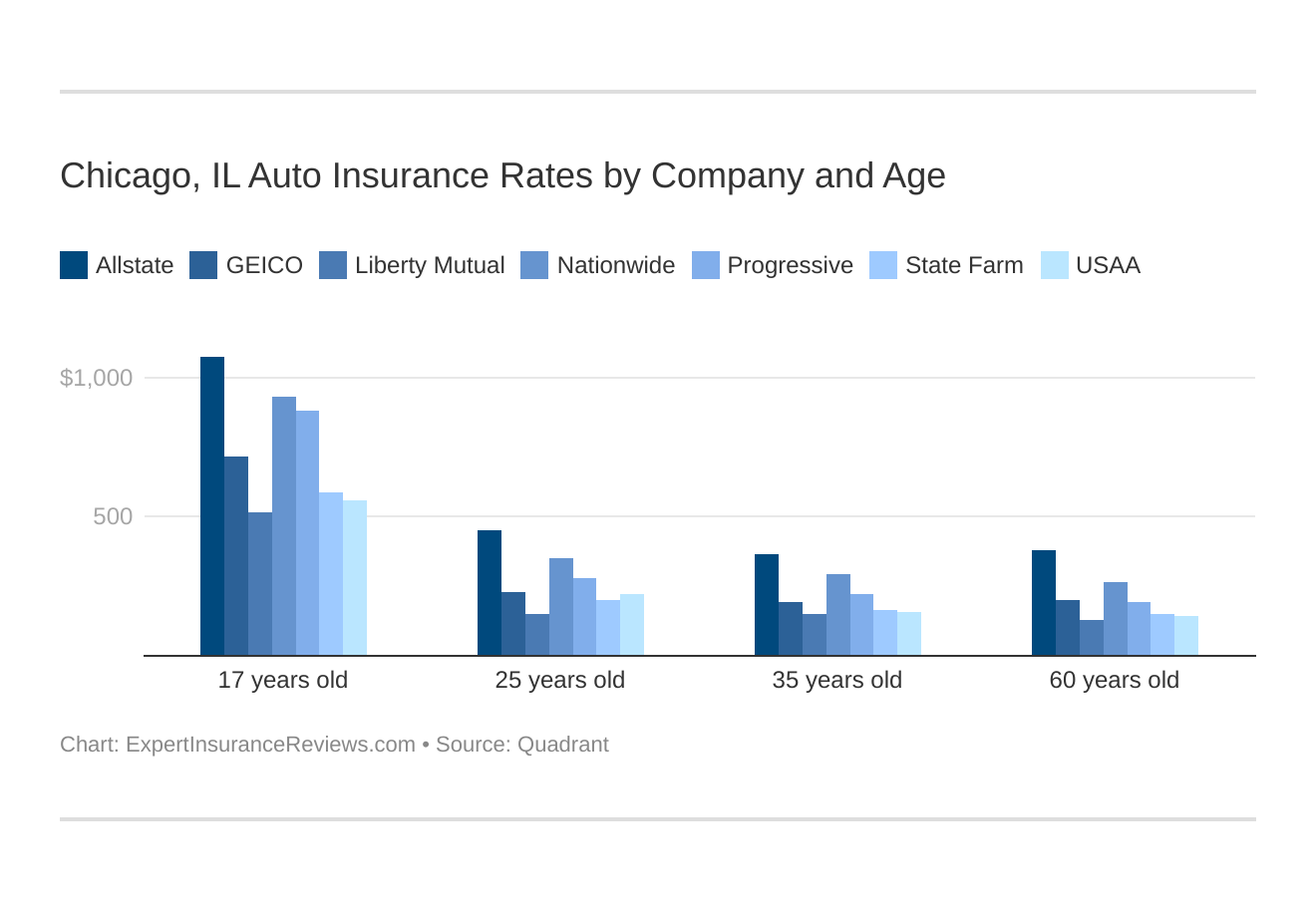

Chicago, IL auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

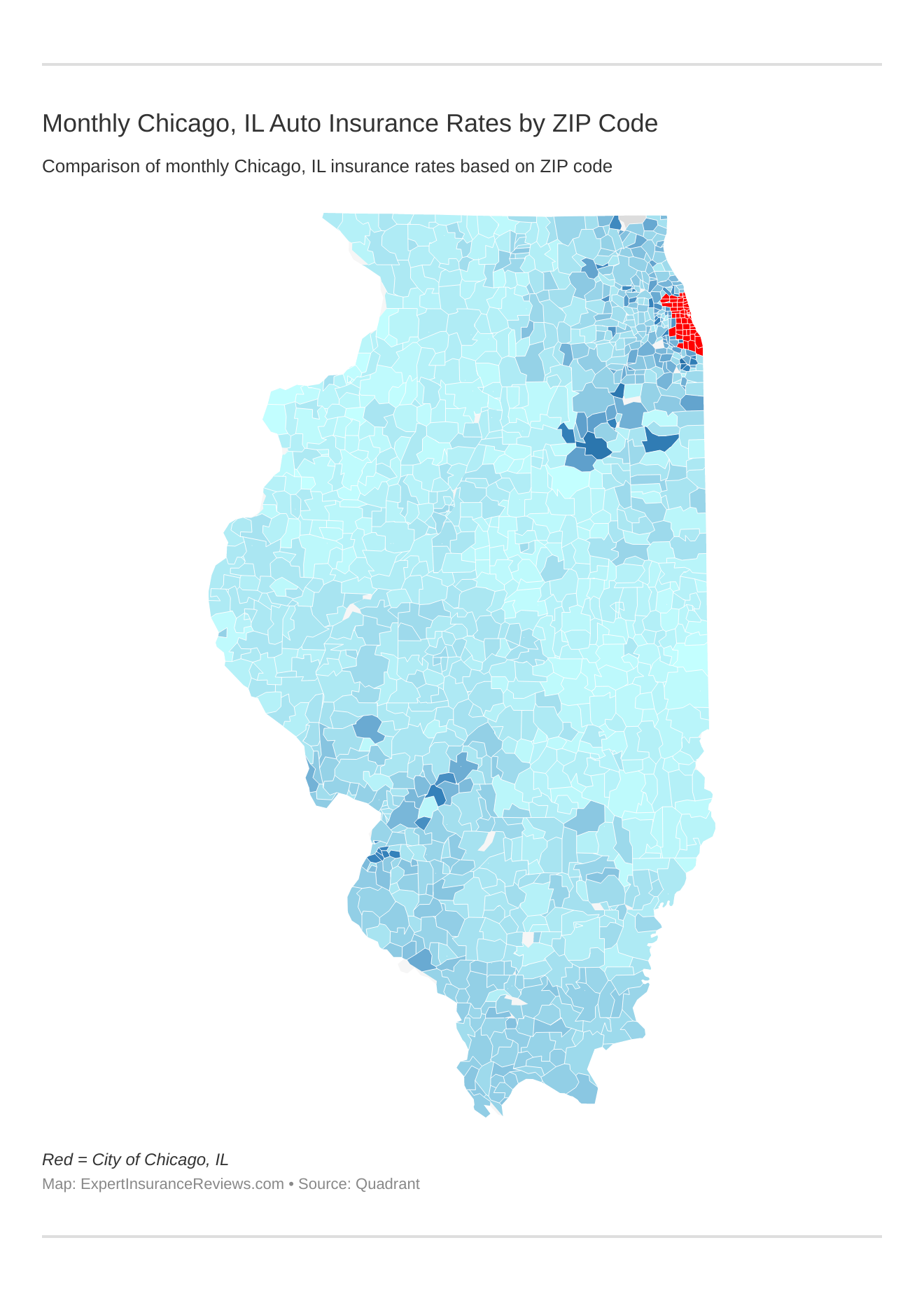

Cheapest ZIP Codes in Chicago

The Chicago area you live in can determine your car insurance rate, also. Specific ZIP codes have different annual rates. We’ve collected those rates and placed them in the data table below. You can search for your ZIP code by typing into the search box at the top right of the table.

| Zip | Average Annual Rate |

|---|---|

| 60657 | $3,813.21 |

| 60614 | $3,837.67 |

| 60601 | $3,853.01 |

| 60661 | $3,863.33 |

| 60602 | $3,866.67 |

| 60611 | $3,885.20 |

| 60606 | $3,901.06 |

| 60654 | $3,925.77 |

| 60610 | $3,937.50 |

| 60605 | $3,976.26 |

| 60604 | $3,991.79 |

| 60603 | $4,006.24 |

| 60613 | $4,055.80 |

| 60699 | $4,113.14 |

| 60631 | $4,144.64 |

| 60656 | $4,184.23 |

| 60640 | $4,199.50 |

| 60618 | $4,263.32 |

| 60607 | $4,263.61 |

| 60646 | $4,278.23 |

| 60701 | $4,320.08 |

| 60660 | $4,329.47 |

| 60622 | $4,329.78 |

| 60625 | $4,340.72 |

| 60630 | $4,349.39 |

| 60647 | $4,352.72 |

| 60642 | $4,365.00 |

| 60655 | $4,371.46 |

| 60626 | $4,446.26 |

| 60615 | $4,456.26 |

| 60645 | $4,468.13 |

| 60634 | $4,478.10 |

| 60616 | $4,509.45 |

| 60659 | $4,542.39 |

| 60643 | $4,566.04 |

| 60707 | $4,572.14 |

| 60633 | $4,587.01 |

| 60641 | $4,599.02 |

| 60638 | $4,605.84 |

| 60608 | $4,656.33 |

| 60652 | $4,664.85 |

| 60617 | $4,751.21 |

| 60632 | $4,806.57 |

| 60612 | $4,821.18 |

| 60609 | $4,880.99 |

| 60653 | $4,900.13 |

| 60629 | $4,910.08 |

| 60628 | $4,962.87 |

| 60637 | $4,979.15 |

| 60619 | $5,004.51 |

| 60639 | $5,010.63 |

| 60620 | $5,106.75 |

| 60649 | $5,112.76 |

| 60621 | $5,252.39 |

| 60644 | $5,295.93 |

| 60651 | $5,302.29 |

| 60624 | $5,308.33 |

| 60623 | $5,319.98 |

| 60636 | $5,370.32 |

Check out the monthly Chicago, IL auto insurance rates by ZIP Code below:

The most expensive rate in Chicago is ZIP code 60636 (Cook County, Illinois) with an annual rate of $5,370. The cheapest ZIP code 60657 (also Cook County, Illinois) with an annual rate of $3,813.

What’s the best car insurance company in Chicago?

The best insurance company for you is the company that can meet your needs. Consider all the important factors when shopping for your policy, such as the number of drivers, the type of coverage you need, the level of coverage, and certain demographics that could influence your annual premium.

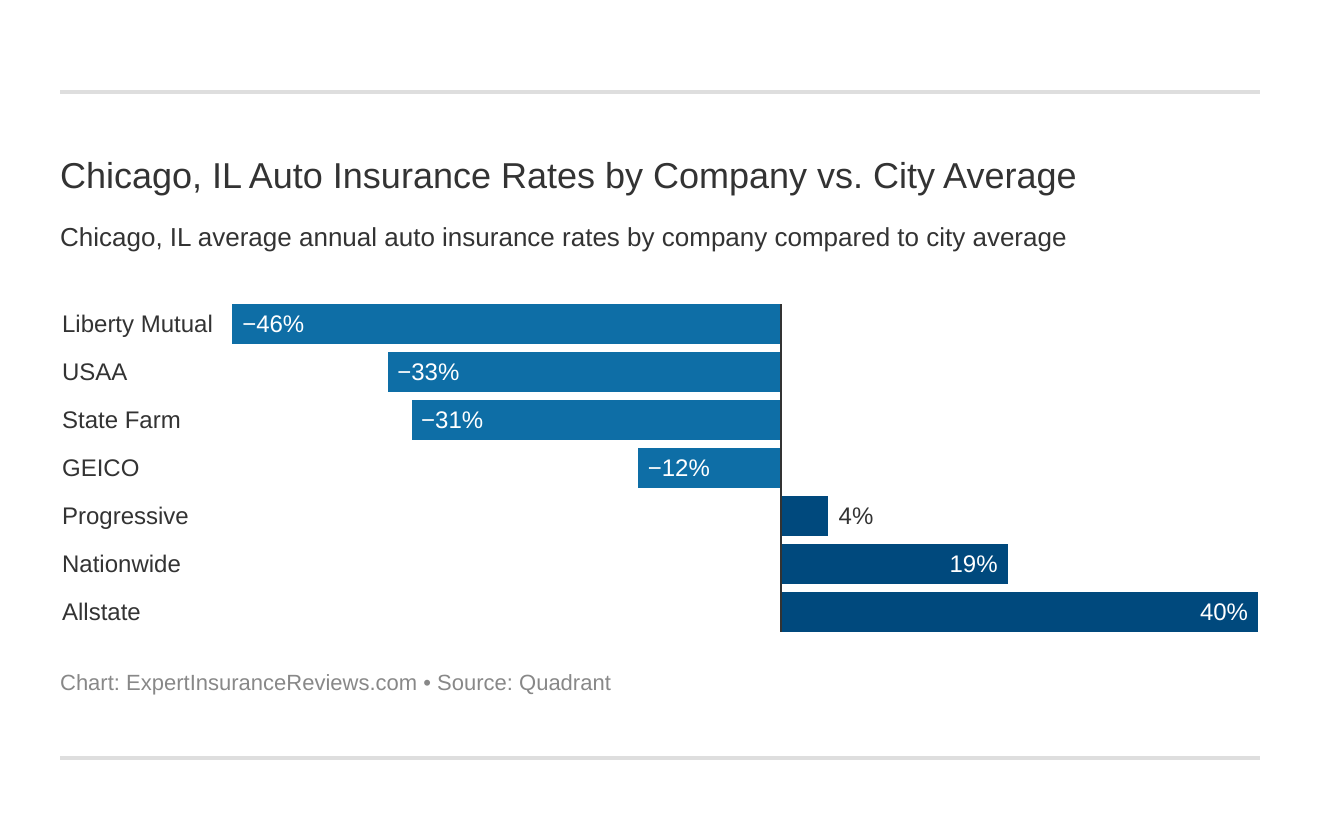

Which Chicago, IL auto insurance company has the cheapest rates? And how do those rates compare against the average Illinois auto insurance company rates? We’ve got the answers below.

Cheapest Car Insurance Rates by Company

Speaking of coverages, let’s explore the cheapest car insurance rates by each major car insurance company in Chicago. We added a special bonus to this table by providing some demographic data, also.

| Company | Average | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $6,804.11 | $11,231.74 | $14,600.87 | $5,208.28 | $5,625.14 | $4,333.53 | $4,352.02 | $4,540.66 | $4,540.66 |

| American Family | $5,080.51 | $8,974.54 | $12,401.20 | $3,145.58 | $4,060.93 | $3,145.58 | $3,145.58 | $2,885.32 | $2,885.32 |

| Farmers | $6,380.21 | $14,812.77 | $15,388.81 | $3,859.47 | $4,010.07 | $3,387.50 | $3,381.94 | $3,004.95 | $3,196.16 |

| GEICO | $4,031.65 | $8,440.81 | $8,809.84 | $2,693.02 | $2,820.22 | $2,321.81 | $2,386.47 | $2,260.32 | $2,520.72 |

| Liberty Mutual | $2,831.86 | $5,831.92 | $6,480.50 | $1,794.62 | $1,880.23 | $1,730.29 | $1,870.12 | $1,446.38 | $1,620.84 |

| Nationwide | $5,511.54 | $9,762.62 | $12,530.53 | $4,061.93 | $4,401.39 | $3,468.49 | $3,526.47 | $3,079.05 | $3,261.83 |

| Progressive | $4,718.69 | $9,987.55 | $11,206.27 | $3,228.33 | $3,487.78 | $2,707.83 | $2,546.29 | $2,236.73 | $2,348.70 |

| State Farm | $3,319.18 | $6,256.93 | $7,886.52 | $2,248.18 | $2,602.06 | $1,985.18 | $1,985.18 | $1,794.69 | $1,794.69 |

| Travelers | $3,434.07 | $6,437.19 | $8,161.97 | $2,226.23 | $2,347.05 | $2,097.28 | $2,214.09 | $1,929.63 | $2,059.15 |

| USAA | $3,243.56 | $6,349.91 | $6,988.44 | $2,517.96 | $2,752.99 | $1,905.51 | $1,929.33 | $1,771.37 | $1,733.00 |

Liberty Mutual and USAA have the cheapest rates in Chicago. Their annual rates were less than $3,000, which would be an ideal choice for those who are looking for cost-efficient car insurance coverage.

Best Car Insurance for Commute Rates

Sometimes your annual rate can be determined by how many miles you drive your car vehicle per year. This is known as commute rates.

Most Illinois motorists average at least 12,500 commute miles per year.

So what does that look like annually in regard to rates? Let’s examine the amount you’re likely to spend based on commute rates.

| Company | Average | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|---|

| Allstate | $6,804.11 | $6,804.11 | $6,804.11 |

| American Family | $5,080.51 | $5,015.74 | $5,145.27 |

| Farmers | $6,380.21 | $6,380.21 | $6,380.21 |

| GEICO | $4,031.65 | $3,960.79 | $4,102.51 |

| Liberty Mutual | $2,831.86 | $2,831.86 | $2,831.86 |

| Nationwide | $5,511.54 | $5,511.54 | $5,511.54 |

| Progressive | $4,718.69 | $4,718.69 | $4,718.69 |

| State Farm | $3,319.18 | $3,238.09 | $3,400.27 |

| Travelers | $3,434.07 | $3,296.21 | $3,571.93 |

| USAA | $3,243.57 | $3,152.50 | $3,334.63 |

Five out of the 11 companies in the table don’t charge additional rates for longer commutes during the year. This may be a ploy to attract potential policyholders, which can be effective for those looking to be more cost-efficient.

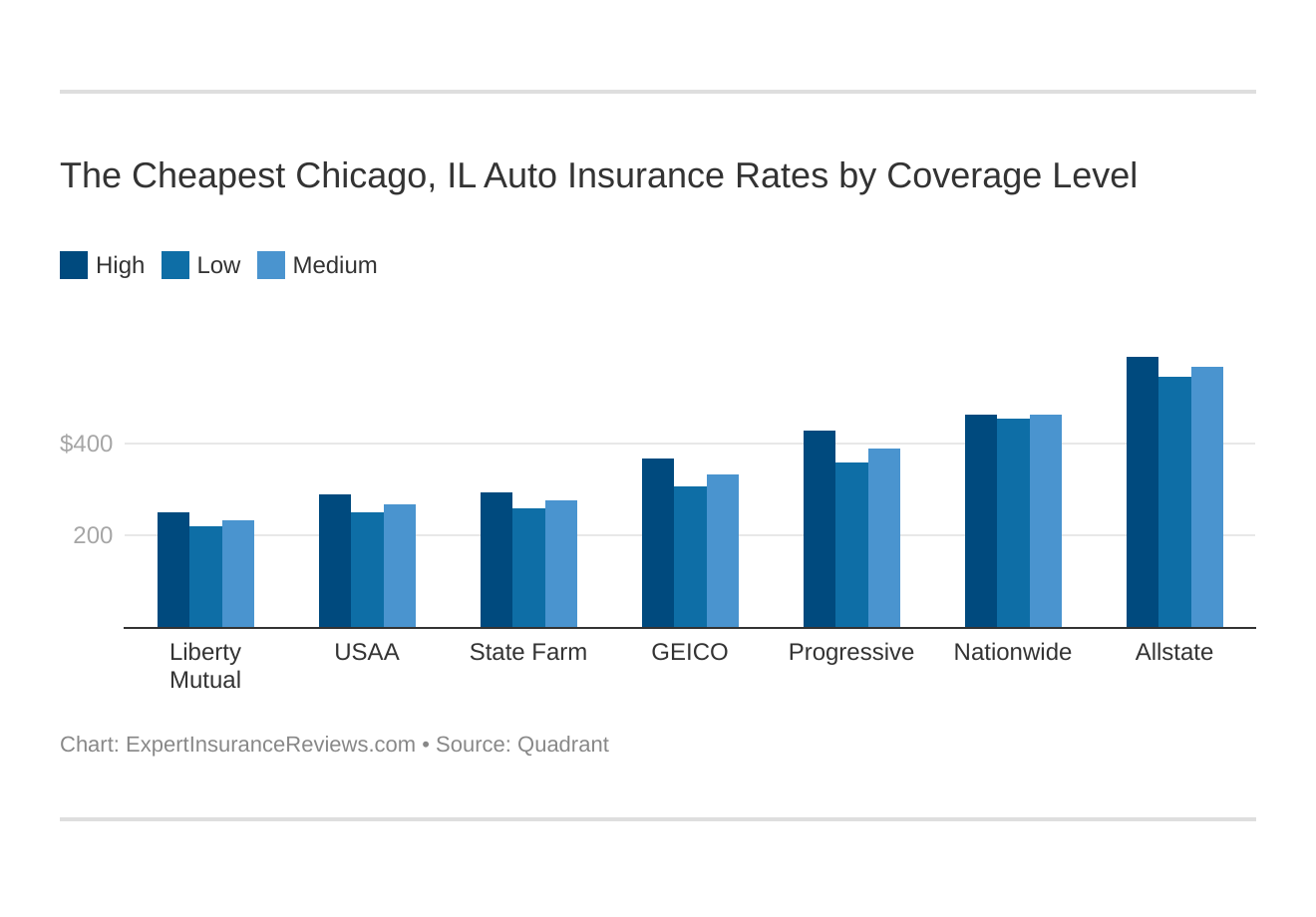

Best Car Insurance for Coverage Level Rates

The minimum coverage you require is liability coverage, which is $20,000 for bodily injury (BI) per person and $40,000 for bodily injury (BI) per accident, and $15,000 for property damage (PD) per accident.

Your coverage level will play a major role in your Chicago auto insurance rates. Find the cheapest Chicago, IL auto insurance rates by coverage level below:

How is this relevant to coverage levels? If you believe the minimum coverage level isn’t enough to cover the cost of an accident in which you’re at fault, you may want to increase your coverage level.

For example, if the minimum coverage level (low) is 20/40/15 as described above and you need more coverage, a car insurance company may issue a medium coverage level of $40,000 for BI per person and $75,000 for BI per accident, and $30,000 for PD per accident (or 40/75/30).

Each company is different, so optional coverages are likely to vary as you shop for auto insurance coverage. What you pay annually for premiums can be estimated by companies. These rates are rough estimates of what you’ll pay each year based on the coverage level you need.

| Group | Average | Low | Medium | High |

|---|---|---|---|---|

| Allstate | $6,804.11 | $6,554.63 | $6,794.49 | $7,063.22 |

| American Family | $5,080.51 | $4,891.45 | $5,084.55 | $5,265.52 |

| Farmers | $6,380.21 | $6,038.73 | $6,220.45 | $6,881.44 |

| GEICO | $4,031.65 | $3,664.19 | $4,021.90 | $4,408.86 |

| Liberty Mutual | $2,831.86 | $2,649.53 | $2,823.75 | $3,022.31 |

| Nationwide | $5,511.54 | $5,440.40 | $5,536.22 | $5,557.99 |

| Progressive | $4,718.69 | $4,323.70 | $4,694.73 | $5,137.63 |

| State Farm | $3,319.18 | $3,123.99 | $3,323.39 | $3,510.15 |

| Travelers | $3,434.07 | $3,192.61 | $3,429.25 | $3,680.36 |

| USAA | $3,243.56 | $3,026.74 | $3,241.46 | $3,462.49 |

Annual rates increase depending on the coverage level. High coverage levels can guarantee that BI and PD are totally covered if you’re ever at fault in an accident.

Again, assess your needs as you decide which coverage level is best.

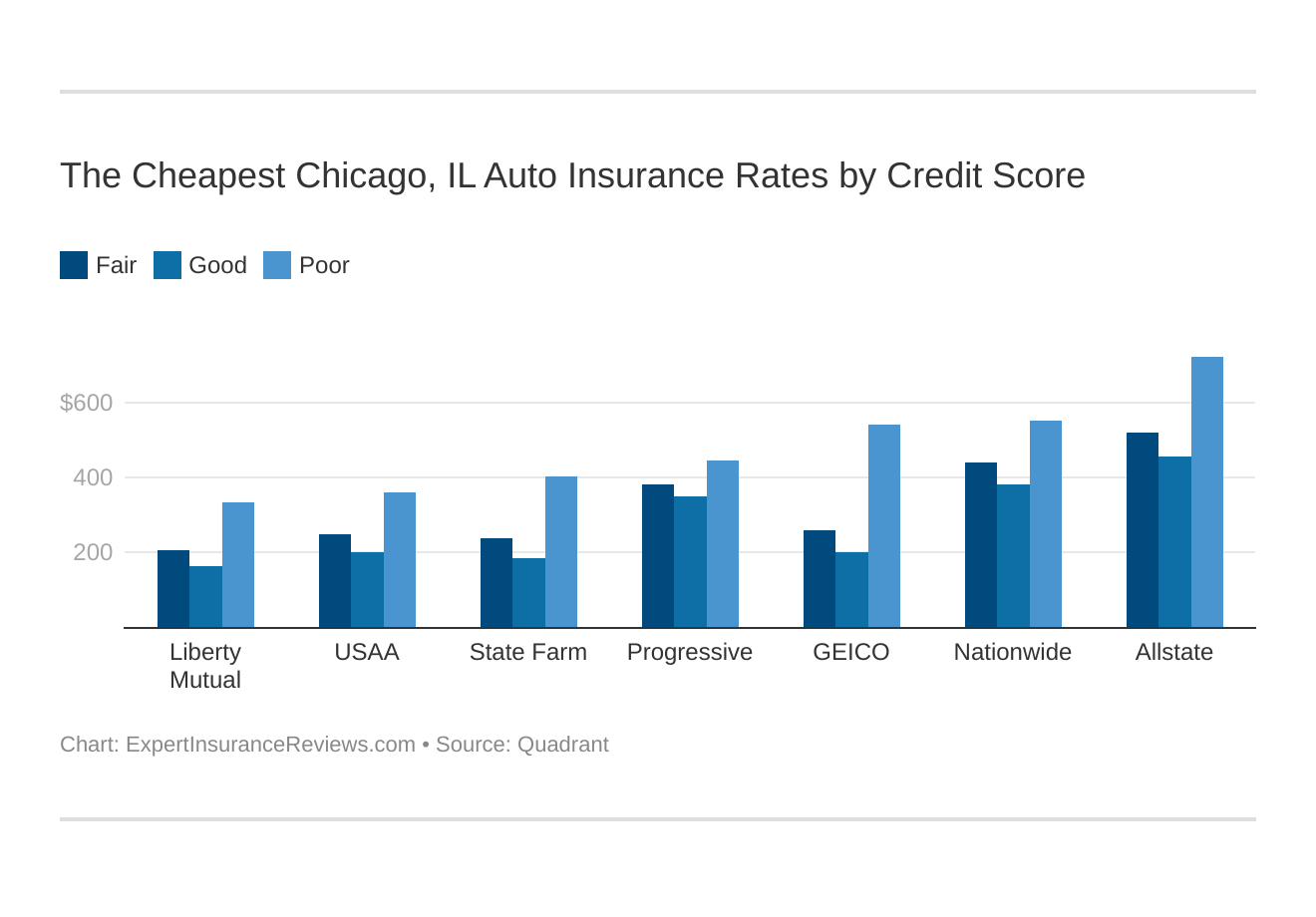

Best Car Insurance for Credit History Rates

Maintaining good credit is extremely helpful. Stable credit has many benefits, especially when you’re shopping for car insurance. One of the benefits of good and fair credit is cheaper annual rates. Examine the rates in the data table below to get an idea of what you can expect.

| Group | Average | Poor | Fair | Good |

|---|---|---|---|---|

| Allstate | $6,804.11 | $8,678.71 | $6,251.36 | $5,482.26 |

| American Family | $5,080.51 | $6,744.63 | $4,601.42 | $3,895.47 |

| Farmers | $6,380.21 | $7,257.41 | $6,091.61 | $5,791.61 |

| GEICO | $4,031.65 | $6,512.89 | $3,145.68 | $2,436.38 |

| Liberty Mutual | $2,831.86 | $4,019.53 | $2,497.44 | $1,978.61 |

| Nationwide | $5,511.54 | $6,621.39 | $5,303.02 | $4,610.20 |

| Progressive | $4,718.69 | $5,370.12 | $4,562.63 | $4,223.32 |

| State Farm | $3,319.18 | $4,816.48 | $2,892.70 | $2,248.35 |

| Travelers | $3,434.07 | $4,178.22 | $3,385.59 | $2,738.41 |

| USAA | $3,243.56 | $4,314.10 | $2,968.82 | $2,447.77 |

Your credit score will play a major role in your Chicago auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Chicago, IL auto insurance rates by credit score below.

Those who have poor credit pay thousands of dollars more than those with fair and good credit scores. Credit scores, of course, are based on your performance to pay off debts. If you happen to frequently miss payments from car insurance companies, it could also hurt your chances for affordable rates.

If your credit improves during your policy, alert the insurer (car insurance company) about your improved credit to receive a possible discount.

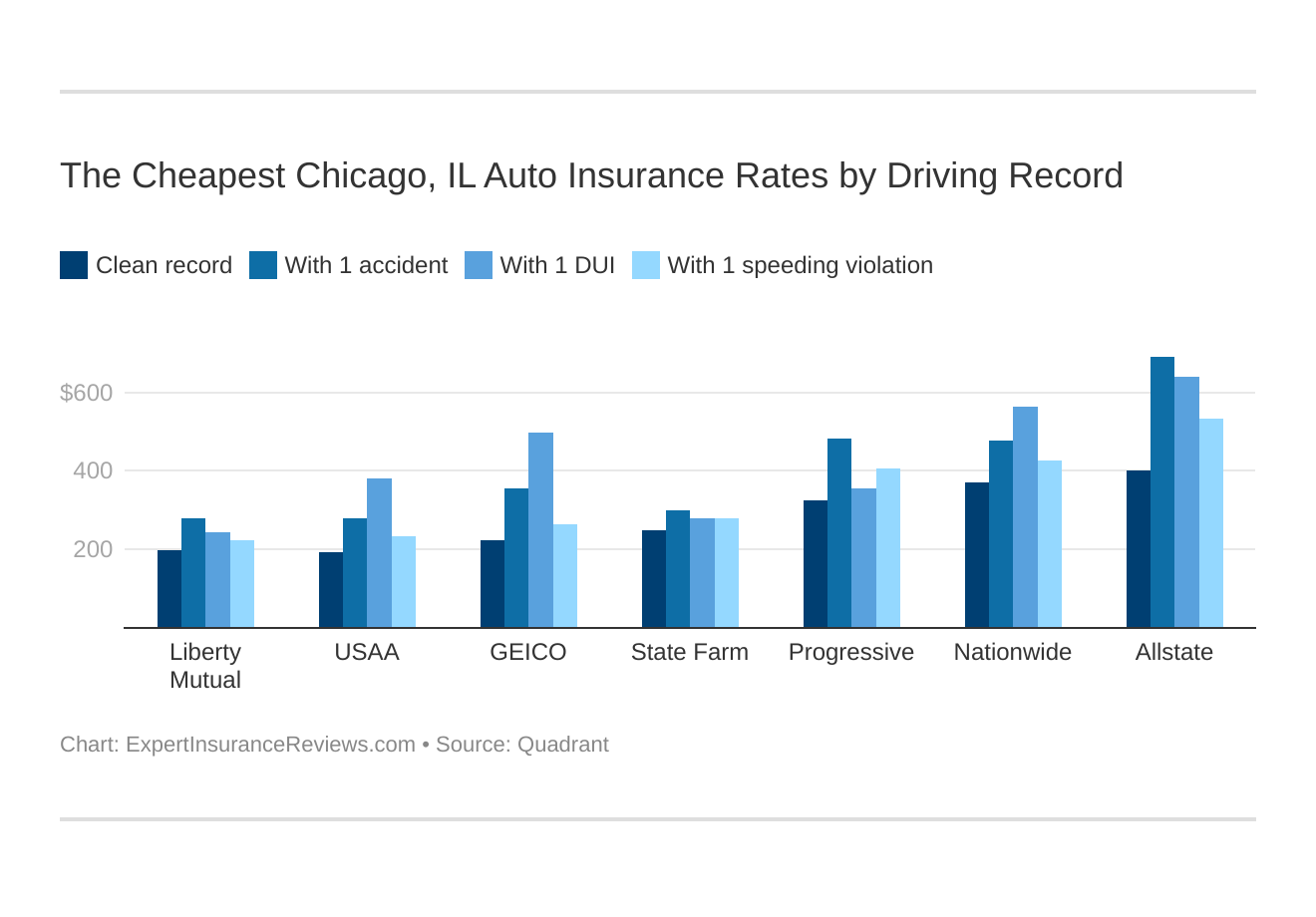

Best Car Insurance for Driving Record Rates

A questionable driving record may leave questions for car insurance companies when they want to issue car insurance rates based on your driving record. Here are some rates by each major company in Chicago.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $4,847.32 | $8,304.43 | $7,673.75 | $6,390.94 | $6,941.83 |

| American Family | $3,751.26 | $5,256.77 | $7,062.35 | $4,251.65 | $5,356.79 |

| Farmers | $5,379.72 | $6,954.75 | $6,784.43 | $6,401.94 | $6,372.97 |

| GEICO | $2,701.97 | $4,290.39 | $5,952.39 | $3,181.85 | $4,314.92 |

| Liberty Mutual | $2,348.76 | $3,360.15 | $2,942.07 | $2,676.46 | $2,883.66 |

| Nationwide | $4,427.20 | $5,751.44 | $6,770.90 | $5,096.60 | $5,649.85 |

| Progressive | $3,875.10 | $5,791.98 | $4,299.50 | $4,908.17 | $4,655.53 |

| State Farm | $3,015.20 | $3,623.17 | $3,319.17 | $3,319.17 | $3,319.18 |

| Travelers | $2,710.07 | $3,581.97 | $4,023.28 | $3,420.97 | $3,438.44 |

| USAA | $2,297.61 | $3,329.15 | $4,569.11 | $2,778.39 | $3,398.62 |

Your driving record will play a major role in your Chicago auto insurance rates. For example, other factors aside, a Chicago, IL DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Chicago, IL auto insurance rates by driving record.

Allstate and Farmers have the most expensive rates, even for motorists with a clean driving record. However, Liberty Mutual, Geico, and USAA have more affordable rates. You don’t really see any increases until a motorist has had an accident.

Some car insurance companies have something called accident forgiveness. It may cost more on your premium, but it’s definitely worth looking into.

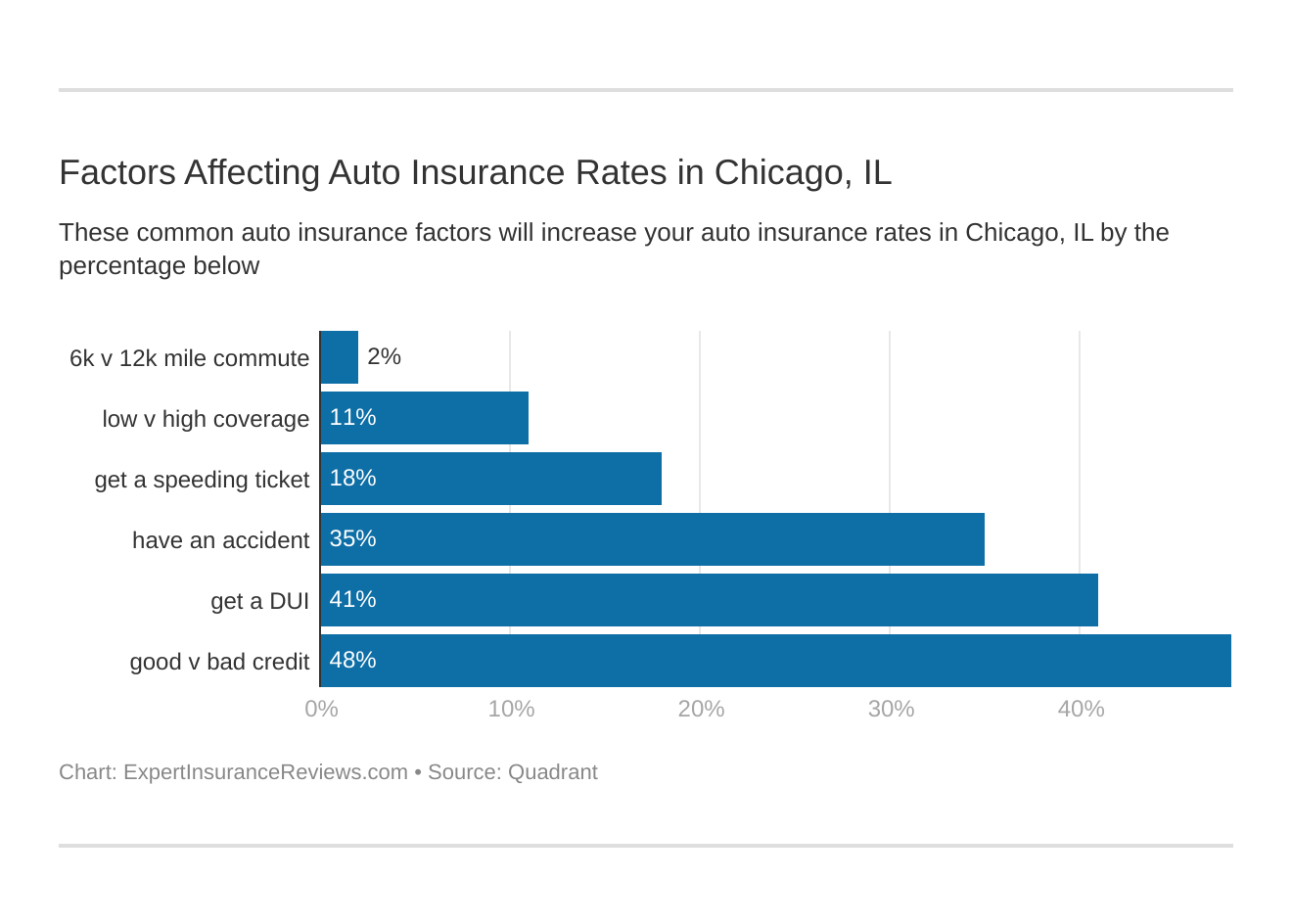

Car Insurance Factors in Chicago

A lot goes into determining car insurance. Age, gender, marital status, credit, driving record, and commute are some of the factors, but they aren’t the only thing that determines car insurance rates.

The wide range of affecting auto insurance rates in Chicago, IL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Chicago, Illinois auto insurance for drivers.

As the population grows within a city like Chicago, so too will the cost of living and risks for motorists who live and visit Chi-Town.

This sub-section will explore the additional factors of how car insurance companies determine annual rates and show why they issue these rates.

Metro Report – Growth & Prosperity

A city’s growth and prosperity percentages are two factors that can determine car insurance, also. The Brookings Institute, a non-profit research group, gives us a comprehensive outlook on Chicago’s growth and prosperity.

They use a rating system where one through 20 indicates the best performance, and 81 through 100 as the worst performance. So how does Chicago rank in these factors?

| 1-Year Change (2016-17) | Percentage | Brooking Rating Overall Prosperity: 18 out of 100 Overall Growth: 65 out of 100 |

|---|---|---|

| Percentage change in productivity | +2.0 % | 15 out of 100 |

| Percentage change in standard of living | +3.0 % | 9 out of 100 |

| Percentage change in average annual wage | +1.0 % | 46 out of 100 |

| Percentage change in jobs | +0.8 % | 72 out of 100 |

| Percentage change in GMP | +2.8 % | 38 out of 100 |

| Percentage change in jobs at young firms | +0.9 % | 74 out of 100 |

Within a one-year change, 2016 to 2017 respectively, the percentage of change in productively increase by 2 percent, which carries a rate of 15 out of 100.

Growth, on the other hand, saw the lowest increase within a year with only 0.8 percent in job growth, which is rated 72 out of 100.

But how does it look when we examine a 10-year outlook of prosperity and growth?

| 10-Year Change (2007-17) | Percentage | Brooking Rating Overall Prosperity: 57 out of 100 Overall Growth: 72 out of 100 |

|---|---|---|

| Percentage change in productivity | +4.7 % | 58 out of 100 |

| Percentage change in standard of living | +5.2 % | 38 out of 100 |

| Percentage change in average annual wage | +3.6 % | 73 out of 100 |

| Percentage change in jobs | +2.6 % | 68 out of 100 |

| Percentage change in GMP | +7.4 % | 70 out of 100 |

| Percentage change in jobs at young firms | -19.5 % | 62 out of 100 |

Over the last 10 years, you can see that Chicago’s prosperity doesn’t perform well, but they appear to perform well by individual year.

Overall, Chicago rates at 57 out of 100, which indicates they are moderately performing in prosperity. For growth, however, Chicago scores 72 out of 100, indicating they performed poorly overall in the last decade.

Median Household Income

Data USA reported that the average household income for Chicago residents is approximately $55,300. How does car insurance coverage impact annual household income?

If you’re very detail-oriented when it comes to spending, you can determine the percent that affects your annual household income. To do that, you must divide your annual premium into your annual household.

For example, let’s say your annual premium for car insurance is $3,430, and your annual household income (salary) is $55,300. If you divide $3,430 by $55,300, you’ll get 0.0620. Move the decimal over twice, and you’ll get 6.2 percent.

Therefore, your car insurance premium per year will take at least 6.2 percent of your annual household income.

You can determine the percentage that affects your annual household income by using the calculating tool below. Use the prompts and click calculate to see your results.

Homeownership in Chicago

Approximately 45 percent of Chicago residents own their homes, which is 19 percent less than the national average for homeownership. The average price of homes in Chicago is roughly $256,000.

How is homeownership a factor in car insurance premiums? Car insurance companies may increase your car insurance rates per year if you rent, rather than own, a home in Chicago.

According to a news report by the Chicago Sun-Times, renting rather than owning a home, or working in an unskilled job, could mean an extra $117 to $175 a year.

The Chicago Sun-Times added that motorists who don’t own homes are asked to pay higher car insurance premiums even when the renter lived on the same street as the homeowner.

Based on the information from Data USA, 55 percent of people living in Chicago are subject to pay more for car insurance.

Education in Chicago

The student population of Chicago, IL, is skewed toward women, with 95,638 male students and 129,670 female students.

A Data USA report stated the average tuition costs in Chicago, IL, is roughly $26,800 for private four-year colleges. Public four-year colleges and universities have in-state tuition that costs $7,500 and out-of-state tuition that costs $15,000.

What’s the ethnicity outlook for college students that graduate from the city of Chicago? Let’s look at some numbers and percentages.

| Ethnicity | Percentage | # of Students |

|---|---|---|

| White | 46 % | 27,000 |

| Hispanic or Latino | 18 % | 11,000 |

| Black | 18 % | 10,400 |

| Asian | 9 % | 5,400 |

Most students that graduate from colleges in Chicago are white followed by Hispanic and black students. Asian students have the lowest graduating percentage. These numbers aren’t because of retention rates, it’s due to the percentage of the college population by ethnicity.

Speaking of graduation, which college or university has the highest number of degrees awarded? We’ve provided data on those numbers.

| College or University | Degrees Awarded | Percentage |

|---|---|---|

| University of Illinois at Chicago | 7,500 | 12 % |

| DePaul University | 6,400 | 10 % |

| DeVry University-Illinois | 6,040 | 9 % |

The University of Chicago in Illinois had the most graduates in the state of Illinois in 2017. The university had over 7,500 total graduates, which accounted for 12 percent of Illinois overall graduate total.

DePaul University and the DeVry University of Illinois followed with 10 percent and 9 percent, respectively.

There are countless majors for each degree. Chicago is known for its strong culinary arts majors, but Data USA reflects something much different.

The most popular majors in Chicago were General Business Administration and Management, Liberal Arts and Sciences, and Accounting.

Let’s examine how many students enrolled in college with those majors.

| Major | Students Enrolled | % of Students Enrolled |

|---|---|---|

| General Business Administration & Management | 5,200 | 8 % |

| Liberal Arts & Sciences | 2,500 | 4 % |

| Accounting | 1,700 | 3 % |

More than 5,200 students enrolled in General Business Administration and Management in 2017. Only 1,700 students enrolled in Accounting at colleges and universities.

Wage by Race & Ethnicity in Common Jobs

Despite Chicago’s high performance in prosperity, there are several wage disparities in the region. When we narrowed the search by ethnicity, we can see the income disparities, which we’ve provided in a data table.

Pay close attention to the premiums as a percent of income, because it reflects the impact car insurance has on an individual’s income.

| Ethnicity | Miscellaneous Managers Income | Premium as % of Income | Registered Nurses Income | Premium as % of Income | Drivers/Sales Workers & Truck Drivers Income | Premium as % of Income | Elementary & Middle School Teachers Income | Premium as % of Income | Cashiers Income | Premium as % of Income |

|---|---|---|---|---|---|---|---|---|---|---|

| Asian | $116,096 | 3.30% | $73,478 | 5.19% | $29,099 | 13.10% | $47,214 | 8.10% | $15,713 | 24.30% |

| Black | $64,106 | 6.00% | $54,148 | 7.04% | $46,085 | 8.27% | $47,968 | 8.00% | $15,616 | 24.42% |

| Other | $60,349 | 6.32% | $65,762 | 5.80% | $34,848 | 11.00% | $51,040 | 7.50% | $11,138 | 34.23% |

| Two or more ethnicities | $72,232 | 5.30% | $69,497 | 5.50% | $54,642 | 7.00% | $44,171 | 8.63% | $33,798 | 11.28% |

| White | $99,541 | 3.83% | $61,397 | 6.21% | $46,943 | 8.12% | $50,982 | 7.48% | $14,561 | 26.18% |

Chicago’s Asian population earns more than the white population in manager and medical-related fields despite having fewer population numbers. Black and Other ethnicities have the lowest average annual incomes.

Those with below-poverty-level-income pay a significant amount per year from their annual income. Cashiers in the Other ethnicity category are likely to spend 34 percent of their income on car insurance.

Wage by Gender in Common Jobs

What about gender? Is there a wage disparity among males and females in Chicago? The additional data collected here will show the major difference in pay between males and females.

| Gender | Miscellaneous managers | Premiums as % of Income | Registered nurses | Premiums as % of Income | Driver/sales workers & truck drivers | Premiums as % of Income | Elementary & middle school teachers | Premiums as % of Income | Cashiers | Premiums as %of Income |

|---|---|---|---|---|---|---|---|---|---|---|

| Female | $83,028.05 | 4.59% | $67,020.89 | 5.70% | $35,665.56 | 10.69% | $54,606.28 | 7.00% | $24,940.37 | 15.29% |

| Male | $110,352.64 | 3.46% | $85,310.26 | 4.47% | $51,235.84 | 7.44% | $58,779.46 | 6.49% | $29,562.26 | 12.90% |

Even though women pay less for car insurance premiums per year, women are likely to pay more as a percent of income. Take elementary and middle teachers, for example.

Companies will indeed charge the female less money, but the female motorist will pay more percentage-wise.

Poverty by Age & Gender

An estimated 550,000 people in Chicago live in poverty. That’s nearly 21 percent of the city’s population, which is higher than the national average poverty percent (13.4 percent).

The largest number of people who live in poverty are females between the ages of 25 to 34.

The highest male poverty percentage is men between the age of 18 to 24, with a 6.03 percent share in Chicago’s poverty population.

Poverty by Race & Ethnicity

What’s the poverty percentage for each ethnicity? There are some disparities in this subject poverty, also.

| Ethnicity | # of People affected by Poverty | % of People affected by Poverty |

|---|---|---|

| Asian | 31,267 | 4.35% |

| Black | 295,625 | 36.10% |

| Hispanic | 168,182 | 23.40% |

| Native American | 1,596 | 0.22% |

| Other | 67,060 | 9.33% |

| Pacific Islander | 170 | 0.02% |

| Two or More Ethnicities | 13,506 | 1.88% |

| White | 177,208 | 24.70% |

At least 36 percent of black residents living in Chicago live in poverty. Twenty-five percent of white residents live in poverty, which is 177,208 out of 2.72 million people in Chicago.

Employment by Occupations

Chicago’s job growth over recent years has been a gradual increase. Remember the Brookings 2019 Metro Monitor Report? Job growth has only grown by 2.9 percent. Data USA reports that employment in Chicago grew at a 0.413 percent rate, which didn’t increase the number of overall employees from 2016 to 2017.

The common jobs in Chicago are office and administrative support occupations, management occupations, and sales and related occupations.

Chicago has an exceptionally high number of residents working in the legal system, firefighting and fire prevention, arts, design, entertainment, sports, and media occupations.

The highest-paid individuals in Chicago are those who work in law enforcement, attorneys, paralegals, and IT professionals.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Chicago

Chicago is a major metropolitan area with buildings that rival other cities. Motorists have to be extremely careful, as traffic can get tight. Roadways are unpredictable, so it’s better to be cautious.

This section will give you a preview of what to expect along the roadways of Chicago. We’ll talk about major highways, popular Chicago streets, road conditions in Chicago, and red light cameras. Next, we’ll examine some facts about the most popular vehicle in Chicago and how many cars do most Chicago residents own. Also, we’ll include alternative methods of transportation.

Roads in Chicago

Chicago’s roads vary. This video will give you a visual of what you can expect to see in the Windy City.

Major Highways in Chicago

Illinois has 24 active interstate routes totaling 2,203 miles of roadway. Six of those interstates travel to Chicago, which are I-55, I-57, I-88, I-90, and I-94.

Here’s another video showing a closer look at I-90 and I-94.

What about toll roads? Most drivers prefer to divert away from them, but toll roads can get you to a destination much faster.

Chicago has about five toll roads.

There two ways Chicago motorists can pay and access toll roads. The first is using cash and coin at each toll road kiosk. Chicago is part of Illinois’s I-Pass/EZ-Pass system.

This system is connected to a user-fee web service where motorists can sign up and add money to an account designed to pay for toll road fees. The fees are used for maintenance and other fixes on Illinois roadways.

No state or federal money is used for the maintenance of Illinois roads. Chicago motorists are expected to pay up to $50 per year in toll road fees.

Popular Road Trips/Sites

One of the most popular places in Chicago is the United Center. The arena is where the NBA’s Chicago Bulls and NHL’s Chicago Blackhawks host their games.

Perhaps you want to see an area that’s greener and full of art. Chicago’s Millennium Park draws thousands of tourists per year. It’s hard to put into words about how popular these places are. Expedia provides an excellent guide in a short video, which can be viewed below.

Road Conditions

Good road conditions make commuting easier for all motorists.

According to data from a nonprofit national transportation research group called TRIP, most of Chicago’s roadways are mediocre, which stands at 35 percent.

Twenty-eight percent of Chicago roadways are considered poor, while fair roadways stand at 14 percent, and 22 percent of other roadways are measured as good roadways.

Why is this important? Road conditions are important because they can estimate changes in vehicle travel speeds and delays, which in turn affects vehicle operating costs (VOCs).

VOCs are costs that change with vehicle use, such as fuel, tires, repairs, and mileage-dependent depreciation costs.

The average VOC in Chicago is $627.

Does Chicago use speeding or red light cameras?

Chicago traffic officials claim red light cameras have curved traffic-related injuries by 10 percent.

An IIHS article reported large cities with red light cameras reduced the fatal red light-running crash rate by 21 percent and the rate of all types of fatal crashes at signalized intersections by 14 percent.

The penalty for getting caught running a red light in Chicago, Illinois, is a fine not to exceed $100. The motorist will have to complete a traffic education program. Sometimes, you may have to take the program and pay the fine.

Your driver’s license could possibly be suspended if you fail to pay any fine or have multiple offenses. These offenses are not considered a traffic violation and will not appear on your driving record.

Even though there are reports that show how they prevent crashes, there’s criticism on red light camera use. This short video from Vox shares their criticism of red light cameras.

Vehicles in Chicago

With so many people in Chicago, you’re likely to see an array of vehicles from Chevy to Tesla. Some say the most unusually popular car in Chicago is the Monte Carlo. But Chicago’s choice car isn’t narrowed down to just one vehicle make and model. Chicagomag.com lists multiple vehicles that Chicago motorists prefer.

Also, we’ll include some facts about the average number of vehicles owned, households without a vehicle, speed traps, and vehicle theft in Chicago.

Vehicles Most Popular Vehicles Owned

The top three vehicles owned in Chicago are Chevrolet, Ford, and Toyota. The Times of Northwest Indiana argues that the top vehicles in recent years are Honda, Toyota, and Nissan.

Some of the most popular vehicles in Chicago are the Honda Accord, Toyota Corolla, and the Chevy Impala. These sedans are known for their fuel economy and longevity on the road. They’re quite popular among drivers of various ages and genders.

Also, Honda, Toyota, and Chevy sedans are practical vehicles for long commute along interstates and regular commutes throughout the town.

How Many Cars Per Household

Only 39.4 percent of Chicago residents own one vehicle per household. The national average for vehicle ownership shows that most U.S. citizens own two cars. Forty-one percent of households in the U.S. own two cars, while households in Chicago that own two cars stand at 29 percent.

Households Without a Car

Households without a car in Chicago is higher than the national average. Approximately 17 percent of households in Chicago do not own a vehicle, which is 13 percent higher than the U.S. average in 2017.

In 2015, 27 percent of households in Chicago didn’t own a vehicle. By 2016, households without a car increased to 28 percent.

The 15 percent drop in households without a car shows some Chicago residents are doing better economically despite the levels of poverty in the city.

Speed Traps in Chicago

What are speed traps?

Speed traps are a law enforcement tactic where one or several police officers hide intentionally to catch drivers who are speeding on roadways.

The latest speed trap reported was on February 21, 2019. A Chicago motorist listed a speed trap on I-94 East and Cicero Avenue going south.

The question of whether speed traps are legal depends on the state. In Chicago, it’s legal. Lawmakers see speed traps as similar to the red light camera surveillance system, in which motorists are penalized for breaking the law even if they are not aware they’re being watched by law enforcement.

Vehicle Theft in Chicago

The Federal Bureau of Investigations (FBI) reported over 10,000 vehicle thefts in the city of Chicago. That’s more than any other city in the state of Illinois. Check out this Chicago theft report from CBS Chicago.

What are the safest neighborhoods in Chicago?

Crime is everywhere, but there are a lot of safe neighborhoods in Chicago. The top three safest neighborhoods in Chicago, IL:

- N Ozanam Ave / N Avondale Ave

- W Devon Ave / N Central Ave

- N Caldwell Ave / N Lehigh Ave

According to Neighborhood Scout, your chances of becoming a victim of a crime in Chicago is one in 91. The chances of becoming a victim in the state of Illinois, however, is one in 228.

For every 1,000 residents in Chicago, 11 people are victims of violent crime. For cities across the U.S., the national average of victims of violent crimes per 1,000 residents is four.

Neighborhood Scout crime analysts list Chicago as eight on the Crime Index, where 100 is the safest rating.

Chicago’s annual crime numbers are 119,060 at a rate of 44 per 1,000 who are victims of crime.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Traffic

If you’re traveling to Chicago or seeking permanent residence, expect longer-than-usual commute times than you’re used to. Five major highways lead to Chicago, and two of them flow right through the metropolitan area.

This sub-section of the guide will alert you on the average commute times in Chicago, traffic congestion levels, common methods of travel, a list of the busiest highways, some fatalities data, and other facts that’ll help you prepare for Chicago’s roadways.

Traffic Congestion in Chicago

The city of Chicago accounts for most of the traffic congestion in the State of Illinois, due to the city’s massive population. To this in real-time, we’ve collected information from three online traffic congestion agencies that record and analyze traffic congestions for major cities around the world. Those agencies are known as Inirix, TomTom, and Numbeo. Check out their stats below.

Here’s the data from Inirix.

| Chicago's INRIX Traffic Scorecard | |||||||

|---|---|---|---|---|---|---|---|

| City | U.S. Traffic Congestion Ranking | 2018 Impact Rank (2017) | Hours Lost in Congestion | Year over Year Change | Cost of Congestion (per driver) | Inner City Travel Time (minutes) | Inner City Last Mile Speed (mph) |

| Chicago | 3 | 23 (24) | 138 (64) | 4% (increase) | $1,920 | 5 | 12 |

The data listed is annual data. For example, “hours lost in congestion” occurs over the course of a year rather than a day. Therefore, a motorist will likely spend 138 hours in traffic congestion in Chicago, Illinois.

Next is TomTom’s traffic congestion numbers. Check out the data below to see if there’s a disparity between Inirix.

| Chicago's TomTom Traffic Congestion | |

|---|---|

| United States Traffic Congestion Ranking | 14 |

| Congestion Level | 26% |

| Morning Peak Congestion | 36% |

| Evening Peak Congestion | 57% |

| Highway Congestion | 20% |

| Non-Highway Congestion | 31% |

| Extra Travel Time | 29 min/day and 111 hr/year |

| Highway Road Length | 1,023 km |

| Non-Highway Road Length | 45,712 km |

TomTom ranks Chicago, Illinois, as 14. TomTom analyzed the total hours of extra driving time into one day. So, the extra time spent in traffic congestion, according to TomTom, is nearly 30 minutes.

Finally, let’s examine Numbeo’s analysis of Chicago’s traffic congestion.

| Chicago's Numbeo Traffic Congestion | |

|---|---|

| United States Traffic Congestion Ranking | 13 |

| Traffic Index | 183.5 |

| Time Index (in minutes) | 40.99 |

| Time Exp. Index | 1913.33 |

| Inefficiency Index | 193.84 |

| CO2 Emission Index | 7198.04 |

There’s not much of a difference in this data. Numbeo’s ranking of U.S. cities is close to TomTom’s ranking, and the hours spent in traffic per year is similar to Inirix’s calculation.

Now that you see the analyzed data, watch this short video from CBS Chicago. It compares Chicago traffic congestion to Los Angeles and how traffic in Chicago is surpassing the City of Angels.

Transportation

Commuting through Chicago can be a joy or a chore. Motorists who just moved to Chicago should expect longer-than-average commute times. Any super commute (travel times longer than 90 minutes) through Chicago will increase time even further.

Speaking of commute times, did you know the Chicago commute time is seven minutes more than the national average commute, which is 26 minutes. During peak traffic hours, expect Chicago 33 minute commute time to increase.

Since Chicago has so many streets, highways, and high population numbers, your method of travel could affect your commute time. More than 48 percent of Chicago residents drive alone to work, while 28 percent use public transportation. About 8 percent of Chicagoans carpool.

Busiest Highways

Interstate-53 (I-53) and Interstate (I-90) are the busiest highways in Chicago. Both highways have 12 lanes. These highways can be extremely congested during morning and evening peak hours.

How safe are Chicago streets & roads?

It’s not easy measuring the safety of Chicago’s roadways. You’ll run across various opinions as you search online, but you can come to a definitive opinion once you see the facts regarding Chicago’s motor vehicle fatality rates.

To be clear, no state or city within the U.S. has gone without a motor vehicle fatality. At some point in recent years, there have been a few. This sub-section will reveal those fatalities rates in Chicago by county.

The first data table is the total number of crashes in Illinois by county. This comprehensive table will allow you to compare Chicago’s counties (Cook County, DuPage County, Will County, Kane County, Kendall County, and Lake County) to other counties in the state of Illinois.

| County | # of Total Fatal Crashes |

|---|---|

| Adams County | 6 |

| Alexander County | 1 |

| Bond County | 4 |

| Boone County | 7 |

| Brown County | 0 |

| Bureau County | 7 |

| Calhoun County | 0 |

| Carroll County | 7 |

| Cass County | 3 |

| Champaign County | 14 |

| Christian County | 6 |

| Clark County | 3 |

| Clay County | 3 |

| Clinton County | 6 |

| Coles County | 12 |

| Cook County | 287 |

| Crawford County | 4 |

| Cumberland County | 4 |

| De Witt County | 6 |

| Dekalb County | 11 |

| Douglas County | 5 |

| Dupage County | 40 |

| Edgar County | 3 |

| Edwards County | 0 |

| Effingham County | 2 |

| Fayette County | 3 |

| Ford County | 2 |

| Franklin County | 4 |

| Fulton County | 11 |

| Gallatin County | 0 |

| Greene County | 5 |

| Grundy County | 4 |

| Hamilton County | 0 |

| Hancock County | 1 |

| Hardin County | 2 |

| Henderson County | 1 |

| Henry County | 8 |

| Iroquois County | 6 |

| Jackson County | 12 |

| Jasper County | 1 |

| Jefferson County | 10 |

| Jersey County | 3 |

| Jo Daviess County | 3 |

| Johnson County | 2 |

| Kane County | 31 |

| Kankakee County | 18 |

| Kendall County | 10 |

| Knox County | 7 |

| La Salle County | 18 |

| Lake County | 47 |

| Lawrence County | 4 |

| Lee County | 5 |

| Livingston County | 10 |

| Logan County | 5 |

| Macon County | 12 |

| Macoupin County | 6 |

| Madison County | 45 |

| Marion County | 6 |

| Marshall County | 5 |

| Mason County | 2 |

| Massac County | 3 |

| Mcdonough County | 3 |

| Mchenry County | 33 |

| Mclean County | 12 |

| Menard County | 2 |

| Mercer County | 1 |

| Monroe County | 1 |

| Montgomery County | 2 |

| Morgan County | 6 |

| Moultrie County | 3 |

| Ogle County | 5 |

| Peoria County | 13 |

| Perry County | 5 |

| Piatt County | 1 |

| Pike County | 3 |

| Pope County | 1 |

| Pulaski County | 2 |

| Putnam County | 1 |

| Randolph County | 7 |

| Richland County | 4 |

| Rock Island County | 7 |

| Saline County | 4 |

| Sangamon County | 18 |

| Schuyler County | 2 |

| Scott County | 0 |

| Shelby County | 3 |

| St. Clair County | 35 |

| Stark County | 4 |

| Stephenson County | 5 |

| Tazewell County | 10 |

| Union County | 10 |

| Vermilion County | 16 |

| Wabash County | 3 |

| Warren County | 3 |

| Washington County | 7 |

| Wayne County | 2 |

| White County | 3 |

| Whiteside County | 7 |

| Will County | 59 |

| Williamson County | 12 |

| Winnebago County | 23 |

| Woodford County | 6 |

Cook County and DuPage County have the highest number of total crash fatalities in Illinois.

Let’s narrow our search and examine Chicago’s DUI related fatalities in 2017.

| County Name | DUI Fatalities (2017) |

|---|---|

| Adams County | 1 |

| Alexander County | 0 |

| Bond County | 2 |

| Boone County | 3 |

| Brown County | 0 |

| Bureau County | 2 |

| Calhoun County | 0 |

| Carroll County | 3 |

| Cass County | 0 |

| Champaign County | 3 |

| Christian County | 1 |

| Clark County | 0 |

| Clay County | 1 |

| Clinton County | 2 |

| Coles County | 3 |

| Cook County | 109 |

| Crawford County | 2 |

| Cumberland County | 0 |

| De Witt County | 0 |

| Dekalb County | 2 |

| Douglas County | 0 |

| Dupage County | 7 |

| Edgar County | 0 |

| Edwards County | 0 |

| Effingham County | 0 |

| Fayette County | 1 |

| Ford County | 1 |

| Franklin County | 0 |

| Fulton County | 4 |

| Gallatin County | 0 |

| Greene County | 1 |

| Grundy County | 3 |

| Hamilton County | 0 |

| Hancock County | 1 |

| Hardin County | 0 |

| Henderson County | 0 |

| Henry County | 3 |

| Iroquois County | 0 |

| Jackson County | 2 |

| Jasper County | 1 |

| Jefferson County | 3 |

| Jersey County | 1 |

| Jo Daviess County | 2 |

| Johnson County | 0 |

| Kane County | 7 |

| Kankakee County | 8 |

| Kendall County | 3 |

| Knox County | 0 |

| La Salle County | 6 |

| Lake County | 18 |

| Lawrence County | 0 |

| Lee County | 2 |

| Livingston County | 2 |

| Logan County | 3 |

| Macon County | 1 |

| Macoupin County | 2 |

| Madison County | 14 |

| Marion County | 1 |

| Marshall County | 2 |

| Mason County | 0 |

| Massac County | 3 |

| Mcdonough County | 0 |

| Mchenry County | 12 |

| Mclean County | 4 |

| Menard County | 2 |

| Mercer County | 0 |

| Monroe County | 0 |

| Montgomery County | 0 |

| Morgan County | 4 |

| Moultrie County | 0 |

| Ogle County | 2 |

| Peoria County | 4 |

| Perry County | 1 |

| Piatt County | 0 |

| Pike County | 1 |

| Pope County | 0 |

| Pulaski County | 0 |

| Putnam County | 0 |

| Randolph County | 3 |

| Richland County | 0 |

| Rock Island County | 2 |

| Saline County | 1 |

| Sangamon County | 3 |

| Schuyler County | 1 |

| Scott County | 0 |

| Shelby County | 0 |

| St. Clair County | 15 |

| Stark County | 1 |

| Stephenson County | 1 |

| Tazewell County | 1 |

| Union County | 5 |

| Vermilion County | 6 |

| Wabash County | 1 |

| Warren County | 0 |

| Washington County | 2 |

| Wayne County | 1 |

| White County | 1 |

| Whiteside County | 3 |

| Will County | 21 |

| Williamson County | 5 |

| Winnebago County | 5 |

| Woodford County | 0 |

When we compare Cook County and DuPage County to other counties in Illinois, we see that Chicago had more DUI related crashes than any other county.

The information provided in this table below is more concentrated on counties in Chicago. We’ve added the total number of crashes throughout 2017 to show Chicago’s share in total crashes over the years.

| Counties in Chicago | Chicago's Single Vehicle Fatalities in 2017 | Total |

|---|---|---|

| Cook County | 141 | 766 |

| DuPage County | 15 | 78 |

In four years, Chicago had over 700 single-vehicle crashes. There’s a great disparity between Cook and DuPage County.

Let’s expand our data table once more and look at all the counties in Illinois with speed fatality numbers.

| County Name | 2017 Speed Fatalities |

|---|---|

| Adams County | 4 |

| Alexander County | 1 |

| Bond County | 2 |

| Boone County | 3 |

| Brown County | 0 |

| Bureau County | 3 |

| Calhoun County | 0 |

| Carroll County | 2 |

| Cass County | 2 |

| Champaign County | 5 |

| Christian County | 1 |

| Clark County | 3 |

| Clay County | 0 |

| Clinton County | 3 |

| Coles County | 5 |

| Cook County | 143 |

| Crawford County | 4 |

| Cumberland County | 3 |

| De Witt County | 1 |

| Dekalb County | 4 |

| Douglas County | 1 |

| Dupage County | 17 |

| Edgar County | 1 |

| Edwards County | 0 |

| Effingham County | 0 |

| Fayette County | 1 |

| Ford County | 0 |

| Franklin County | 0 |

| Fulton County | 1 |

| Gallatin County | 0 |

| Greene County | 3 |

| Grundy County | 1 |

| Hamilton County | 0 |

| Hancock County | 1 |

| Hardin County | 1 |

| Henderson County | 0 |

| Henry County | 4 |

| Iroquois County | 1 |

| Jackson County | 1 |

| Jasper County | 0 |

| Jefferson County | 5 |

| Jersey County | 1 |

| Jo Daviess County | 1 |

| Johnson County | 0 |

| Kane County | 18 |

| Kankakee County | 11 |

| Kendall County | 5 |

| Knox County | 1 |

| La Salle County | 7 |

| Lake County | 20 |

| Lawrence County | 1 |

| Lee County | 3 |

| Livingston County | 3 |

| Logan County | 4 |

| Macon County | 3 |

| Macoupin County | 1 |

| Madison County | 18 |

| Marion County | 1 |

| Marshall County | 4 |

| Mason County | 0 |

| Massac County | 3 |

| Mcdonough County | 0 |

| Mchenry County | 9 |

| Mclean County | 5 |

| Menard County | 1 |

| Mercer County | 0 |

| Monroe County | 0 |

| Montgomery County | 2 |

| Morgan County | 4 |

| Moultrie County | 2 |

| Ogle County | 1 |

| Peoria County | 3 |

| Perry County | 1 |

| Piatt County | 0 |

| Pike County | 2 |

| Pope County | 0 |

| Pulaski County | 0 |

| Putnam County | 0 |

| Randolph County | 2 |

| Richland County | 0 |

| Rock Island County | 1 |

| Saline County | 0 |

| Sangamon County | 4 |

| Schuyler County | 0 |

| Scott County | 0 |

| Shelby County | 2 |

| St. Clair County | 13 |

| Stark County | 1 |

| Stephenson County | 2 |

| Tazewell County | 2 |

| Union County | 5 |

| Vermilion County | 11 |

| Wabash County | 1 |

| Warren County | 1 |

| Washington County | 4 |

| Wayne County | 2 |

| White County | 1 |

| Whiteside County | 3 |

| Will County | 34 |

| Williamson County | 4 |

| Winnebago County | 7 |

| Woodford County | 0 |

The most fatalities involving speed in Illinois are in Chicago’s counties. The most speed fatalities were in Cook County, with 143 speed-related fatalities.

Next, we’ll examine roadway departures and intersection fatalities. Road departures are events where vehicles veer off the road as a result of a collision or other related accidents. Here’s the data.

| Counties in Chicago | Chicago's Road Departure Fatalities in 2017 | Chicago's Intersection Fatalities in 2017 |

|---|---|---|

| Cook County | 88 | 111 |

| DuPage County | 19 | 22 |

In Cook County, 88 vehicles veered off the road following fatal car accidents in 2017, but more crash fatalities occurred in Cook County intersections.

Who’s likely to be affected by a fatal accident? Is it pedestrians, cyclists, or people in vehicles? When we take all of these factors into consideration, we see how pedestrians, cyclists, and people in vehicles are affected per year. Here are their numbers.

| Counties in Chicago | Chicago 2017 PASSENGER CAR OCCUPANT FATALITIES | Chicago 2017 PEDESTRIAN FATALITIES | Chicago 2017 PEDALCYCLIST FATALITIES |

|---|---|---|---|

| Cook County | 120 | 76 | 8 |

| Dupage County | 13 | 9 | 0 |

The most fatalities occurred while motorists were driving their vehicles.

What type of road do crash fatalities occur on? Do they happen more on urban roads or highways? Let’s look at some data to determine this.

| Road Type | # of Fatalities |

|---|---|

| Rural Interstate | 53 |

| Urban Interstate | 87 |

| Freeway/Expressway | 10 |

| Other | 375 |

| Minor Arterial | 257 |

| Collector Arterial | 217 |

| Unknown | 6 |

There were more crash fatalities on other access roads in Chicago. Urban interstates were second in crash fatalities rates.

The U.S. Department of Transporation (USDOT) records crash fatality data that involves trains. We’ve narrowed our search once again and provided data related to Chicago’s most populated county.

| Highway User Speed | Calendar Year | County | Highway | Highway User Type | Rail Equipment Type | Non-Suicide Fatality | Non-Suicide Injury |

|---|---|---|---|---|---|---|---|

| 10 | 2012 | COOK | 111TH STREET | Automobile | Commuter | 0 | 1 |

| - | 2012 | COOK | 95TH STREET | Pedestrian | Commuter | 1 | 0 |

| 10 | 2012 | COOK | 83RD STREET | Automobile | D | 0 | 1 |

| 15 | 2012 | COOK | 103RD ST | Automobile | Freight Train | 0 | 1 |

| 10 | 2012 | COOK | LAFLIN STREET | Automobile | C | 0 | 0 |

| 10 | 2012 | COOK | PRIVATE | Truck-trailer | Cut of Cars | 0 | 1 |

| 2 | 2012 | COOK | PRIVATE YARD | Truck-trailer | Freight Train | 0 | 1 |

| 1 | 2012 | COOK | PRIVATE | Truck-trailer | Yard/Switch | 0 | 0 |

| 0 | 2012 | COOK | 87TH/PULASKI | Automobile | C | 0 | 0 |

| 5 | 2012 | COOK | 115TH ST | Automobile | C | 1 | 2 |

| 20 | 2012 | COOK | 55TH AND KENTON | Automobile | Freight Train | 0 | 0 |

| 15 | 2012 | COOK | 115TH ST | Automobile | Commuter | 0 | 1 |

| 10 | 2012 | COOK | CORNELL AVE | Automobile | D | 0 | 1 |

| - | 2013 | COOK | WELLINGTON AVE | Pedestrian | B | 1 | 0 |

| 0 | 2013 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| 15 | 2013 | COOK | FAU1592/E 130TH ST | Automobile | Freight Train | 0 | 0 |

| 40 | 2013 | COOK | CARONDLET | Automobile | Freight Train | 0 | 0 |

| 16 | 2013 | COOK | 5345 S. LONG AVE. | Automobile | Freight Train | 0 | 1 |

| 12 | 2013 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| 0 | 2013 | COOK | SOUTHWEST HWY | Automobile | Freight Train | 0 | 0 |

| 0 | 2013 | COOK | EGGLESTON AVE. | Automobile | D | 0 | 0 |

| 0 | 2013 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| - | 2013 | COOK | STATE STREET | Pedestrian | Light Loco(s) | 1 | 0 |

| - | 2013 | COOK | 74TH STREET | Pedestrian | D | 0 | 0 |

| 10 | 2013 | COOK | MONTEREY AVE | Automobile | Commuter | 0 | 1 |

| 10 | 2013 | COOK | 95TH STREET | Automobile | Psgr Train | 0 | 0 |

| 0 | 2013 | COOK | PRIVATE | Van | Light Loco(s) | 0 | 0 |

| 10 | 2013 | COOK | 119TH STREET | Automobile | C | 0 | 1 |

| 5 | 2013 | COOK | PRIVATE RD | Truck-trailer | Light Loco(s) | 0 | 0 |

| 0 | 2013 | COOK | 95TH STREET | Truck-trailer | C | 0 | 0 |

| 5 | 2013 | COOK | 105TH STREET | Automobile | Special MOW Eq | 0 | 0 |

| 5 | 2013 | COOK | CHAPPEL AVE | Automobile | C | 0 | 0 |

| 5 | 2013 | COOK | THROOP STREET | Automobile | C | 0 | 1 |

| 0 | 2013 | COOK | FAU1592/E 130TH ST | Automobile | Freight Train | 0 | 0 |

| 0 | 2013 | COOK | RACINE AVE | Automobile | Freight Train | 0 | 0 |

| 1 | 2013 | COOK | PRIVATE | Automobile | Yard/Switch | 0 | 0 |

| 5 | 2014 | COOK | MONTEREY AVENUE | Automobile | Commuter | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Van | Yard/Switch | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Van | Yard/Switch | 0 | 0 |

| 0 | 2014 | COOK | SAYRE AVE | Truck-trailer | C | 0 | 0 |

| 0 | 2014 | COOK | 99TH ST | Pick-up truck | Freight Train | 0 | 1 |

| 0 | 2014 | COOK | RACINE AVE | Automobile | Light Loco(s) | 0 | 0 |

| 0 | 2014 | COOK | 97TH STREET | Automobile | Freight Train | 0 | 2 |

| - | 2014 | COOK | BRYN MAWR AVENUE | Pedestrian | Commuter | 1 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Yard/Switch | 0 | 0 |

| 0 | 2014 | COOK | KILBOURN AVENUE | Automobile | Commuter | 0 | 0 |

| 10 | 2014 | COOK | 95TH STREET | Automobile | Light Loco(s) | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| 0 | 2014 | COOK | W 104TH ST | Automobile | Freight Train | 0 | 0 |

| 1 | 2014 | COOK | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Freight Train | 0 | 0 |

| 10 | 2014 | COOK | KILBOURNE AVE | Truck-trailer | Commuter | 0 | 0 |

| 0 | 2014 | COOK | NARRAGANSETT AVENUE | Van | Commuter | 0 | 0 |

| 0 | 2014 | COOK | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| 15 | 2015 | COOK | 115TH STREET | Automobile | Commuter | 0 | 0 |

| 0 | 2015 | COOK | PRIVATE | Truck-trailer | Yard/Switch | 0 | 0 |

| 0 | 2015 | COOK | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| 0 | 2015 | COOK | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| - | 2015 | COOK | HARLEM AVE | Pedestrian | Commuter | 0 | 1 |

| 10 | 2015 | COOK | CLYDE AVENUE | Automobile | D | 0 | 0 |

| 30 | 2015 | COOK | KILBOURNE AVENUE | Automobile | Light Loco(s) | 0 | 1 |

| 0 | 2015 | COOK | 72ND STREET | Automobile | D | 0 | 2 |

| 10 | 2015 | COOK | 76TH STREET | Van | D | 0 | 0 |

| 5 | 2015 | COOK | CITY ST/STONEY ISLAN | Truck-trailer | Freight Train | 0 | 0 |

| - | 2015 | COOK | FAU2867/RACINE AVE | Pedestrian | Freight Train | 0 | 1 |

| 0 | 2015 | COOK | NARRAGANSETT AVENUE | Automobile | Commuter | 0 | 0 |

| 0 | 2015 | COOK | 115TH STREET | Automobile | Commuter | 0 | 1 |

| 5 | 2015 | COOK | 87TH PULASKI | Automobile | Commuter | 2 | 4 |

| 0 | 2016 | COOK | 95TH STREET | Automobile | Commuter | 0 | 0 |

| 0 | 2016 | COOK | 87TH AND PULASKI | Automobile | C | 0 | 0 |

| 5 | 2016 | COOK | PRIVATE | Truck-trailer | Yard/Switch | 0 | 0 |

| 0 | 2016 | COOK | WENTWORTH AVENUE | Automobile | Freight Train | 0 | 0 |

| 20 | 2016 | COOK | 119TH ST | Automobile | Psgr Train | 1 | 1 |

| 0 | 2016 | COOK | 102ND ST | Automobile | Commuter | 0 | 0 |

| 3 | 2016 | COOK | KILBOURN | Automobile | Yard/Switch | 0 | 0 |

| 15 | 2016 | COOK | 59TH ST | Automobile | Freight Train | 0 | 1 |

| 0 | 2016 | COOK | ; CALDWELL AVE | Automobile | B | 0 | 0 |

| 1 | 2016 | COOK | RACINE AVE. | Automobile | Cut of Cars | 0 | 0 |

Railroad fatalities were minimal in Cook County. The most fatalities involving railroads were four fatalities in 2015.

Allstate America’s Best Drivers Report

Now that you’ve seen how crash fatalities affect Chicago, let’s look at how well motorists drive in the Windy City. Allstate provides a report on driving performance, which we’ve summarized in the data table below. This data was recorded in 2018. We’ll compare it to the 2019 Allstate report.

| 2018 Best Drivers Report Ranking | City | Average Years Between Claims | Relative Claim Likelihood (Compared to National Average) | 2018 Drivewise® Hard-Braking Events Per 1 1,000 Miles |

|---|---|---|---|---|

| 129 | Chicago, IL | 7.7 | 30.20% | 27.3 |

This data was recorded in 2018. We’ll compare it to the 2019 Allstate report.

Chicago dropped to rank 133 in the safest driving city in the U.S. The average years between claims increased to eight. Hard-braking events increased to 29 miles.

Ridesharing

With such a busy metropolitan area, Chicago is likely to have every major ridesharing service available in the U.S. Lyft, Uber, taxis, and other forms of carpool services are available for Chicago residents who want to save money on gas or simply don’t own a vehicle.

E-star Repair Shops

If you’ve recently been in a collision in Chicago, you’ll be searching for a car repair center in the city. This guide can help cut your search in half. Here are the top 10 repair shops in the Chicago area.

| Shop Name | Address | Contact Info |

|---|---|---|

| B&L AUTOMOTIVE REPAIR, INC. CF | 3830 N KEDZIE AVE CHICAGO IL 60618 | email: [email protected] P: (773) 463-1622 F: (773) 463-0920 |

| ERIE - LASALLE BODY SHOP - ERIE | 1005 W Huron Street CHICAGO IL 60642 | email: [email protected] P: (312) 337-3903 F: (312) 337-7486 |

| GERBER - CHICAGO/ELSTON AVE. | 4545 N Elston Ave CHICAGO IL 60630 | email: [email protected] P: (773) 725-7200 F: (773) 725-4829 |

| PAUL RIES & SONS | 3940 W ARMITAGE AVE CHICAGO IL 60647 | email: [email protected] P: (773) 227-8300 F: (773) 227-8544 |

| PAUL RIES AND SONS - II | 2233 West Grand CHICAGO IL 60612 | P: (312) 637-6740 |

| ERIE - LASALLE BODY SHOP - KEDZIE | 2440 S. Kedzie CHICAGO IL 60623 | email: [email protected] P: (773) 775-6767 F: (773) 775-5901 |

| FIX AUTO SKOKIE | 8015 N LAWNDALE SKOKIE IL 60076 | email: [email protected] P: (847) 676-0420 |

| SERVICE KING MORTON GROVE | 5940 OAKTON STREET MORTON GROVE IL 60053 | email: [email protected] P: (847) 965-2205 |

| CARSTAR SCOLAS COLLISION CENTER | 9110 OGDEN AVE BROOKFIELD IL 60513 | email: [email protected] P: (708) 485-7600 |

| CARSTAR WALLY'S WREX | 1200 E GOLF RD DES PLAINES IL 60016 | email: [email protected] P: (847) 298-6464 F: (847) 298-1218 |

Be sure to consult your car insurance company when you get estimates from any repair shop so they can issue a claimant check to the repair shop in order to cover damage expenses.

Weather

Chicago is one of the cities with mild summer temperatures and frigid winter temperatures. Weather can be unpredictable in Chi-town, but there is some consistency to temperatures and precipitation, which can be found in this data table.

| Chicago, IL Weather | Details |

|---|---|

| Annual high temperature: | 56.8°F |

| Annual low temperature: | 42.5°F |

| Average temperature: | 49.65°F |

| Average annual precipitation - rainfall: | 33.2 inch |

| Days per year with precipitation - rainfall: | 120 days |

| Annual hours of sunshine: | 2611 hours |

Even though the average low temperature is about 43 degrees, winter temperatures can reach 32 degrees or below (below 0 degrees Fahrenheit).

Another thing to consider is how natural disasters affect the Chicago area. The number of national disasters that occurred in Chicago, particularly Cook County, were 19, six disasters higher than the U.S. national average. In Chicago, most natural disasters that occur are flooding from rain.

To prepare for natural disasters, it’s essential to enroll in comprehensive car insurance to cover the cost of flood damage of your vehicle.

Comprehensive coverage pays for any damage caused by falling objects, vehicle theft, flooding, or any miscellaneous event that damages your vehicle.

Public Transit

Chicago’s public transit is called Ventra. Here’s a video explaining how to use Ventra.

Alternate Transportation

If you don’t want to use Ventra, you can use Chicago’s subway surface, known as “L.” Fares cost $2.50, but there are $5 commutes to and from O’Hare Airpot.

Free transfers between all “L” routes are available at designated locations. If you transfer to a transit bus, it will cost 25 cents.

Transfers are valid for two hours.

Here’s another video that gives comprehensive information to Chicago’s public transit system.

Parking in Metro Areas

Parking in Chicago can be quite expensive. The average price of parking in Chicago’s metropolitan area is $15 per hour. Places like the Hampton Inn Majestic Chicago Theater District Hotel charge as much as $30 per hour.

As you venture out from downtown Chicago, rates for parking are as low as six dollars.

Air Quality in Chicago

How much do cars pollute the air of Chicago? It’s one of the things environmentalists try to minimize and bring awareness to. The U.S. Environment Protection Agency (EPA) collected information regarding air quality numbers throughout the year. Here are the numbers.

| Chicago, IL Air Quality Index | Air Quality 2016 #'s | Air Quality 2017 #'s | Air Quality 2018 #'s |

|---|---|---|---|

| Days with AQI | 365 | 365 | 365 |

| Good Days | 151 | 157 | 117 |

| Days Moderate | 187 | 183 | 222 |

| Days Unhealthy for Sensitive Groups | 23 | 23 | 20 |

| Days Unhealthy | 4 | 2 | 6 |

| Days Very Unhealthy | 1 | - | - |

In 2018, the air quality was moderate most of the year. Only 117 days of the year were considered days with good air quality.

Military/Veterans

Over 24,00 miliary veterans who were in the Vietnam Conflict live in Chicago.

There are two military facilities near Chicago. The Naval Station Great Lakes location is one hour away from Chicago, while the Scott AFB Guide facility is over four hours away.

Other major car insurance companies such as Allstate, Esurance, and Geico offer military discounts. Nationwide, Progressive, and Travelers are some of the car insurance companies that do not offer car insurance discounts to military personnel.

If you’re in the military and are searching for discounts for car insurance, try USAA. USAA is specifically for active military, retired military, and immediate family of military personnel. Car insurance premiums from USAA are much cheaper in general.

These rates often rival other companies to their affordability and customer satisfaction results. Expert Insurance Reviews has a comprehensive guide of these rates on our Illinois car insurance guide, also.

Unique City Laws

Chicago hands-free driving law complies with Illinois state law that no driver shall be texting or handling a device while behind the wheel of a car — using a device while driving can result in fines and/or the suspension of your license.

There’s also a food truck law in Chicago. Those who want to start a food truck not only need a business license, but they will also need a permit to sell food from their food truck in Chicago. You can learn more about Chicago’s food truck law on Chicago’s government website.

What about tiny home laws? Even though tiny homes were proposed to Chicago two years ago, city officials agreed not to allow Tiny Homes in Chicago.

Parking laws are simple. If you park by a parking meter, you should deposit the correct change into the meter. Illegal parking will get a ticket and a fine. There’s a Q and A for motorists in Chicago if they’re wondering about a parking ticket.

Read more: Michigan Car Insurance Laws

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Chicago Car Insurance FAQs

Below are some commonly asked questions about Chicago car insurance.

Why is Chicago called the Windy City?

According to local Chicago lore, Chicago is called the Windy City because of the “hot air” blown in from politicians.

Why are Chicago’s winters so cold?

Chicago is right next to Lake Michigan, and it’s a few hundred miles away from the Canada border. Polar vortexes often cover the upper Mid-West and Northeast regions of the U.S.

How did Chicago get its name?

History.com reported: “The name Chicago comes from a Miami Indian word for the wild leeks that grew on the bank of the short Chicago River. Over the centuries the Miami, Sauk, Fox, and Potawatomi tribes all lived in the area.

How was the Chicago River reversed?

In 1892, the first phase of Chicago’s Sanitary and Ship Canal began. It took eight years to complete and roughly 40 million cubic yards of earth and rock were removed along the 28-mile canal. The project required innovative techniques that became the “Chicago school of earthmoving.”

By 1900, the first phase of the canal opened, with the river permanently reversed.

Which Chicago airport is closer to downtown?

The closest airport to downtown is Midway Airpot. It’s an easily accessed area that’s ideal for business travelers.

Conclusion

The sole purpose of this guide to give you some general information on the city of Chicago while guiding you to a car insurance premium that you can afford. Use this information to your advantage as you shop for car insurance coverage.

Also, refer to this guide for quick answers to frequently asked questions. Use our free quote tool with just your ZIP code to start comparing rates.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Frequently Asked Questions

What are some of the best car insurance companies in Chicago, Illinois?

Some of the top car insurance companies in Chicago, Illinois include State Farm, Allstate, Geico, Progressive, and Nationwide. However, the best company for you will depend on your individual needs and preferences.

What factors should I consider when choosing a car insurance policy?

When choosing a car insurance policy, it’s important to consider factors such as coverage options, deductibles, premiums, discounts, and customer service. You should also check the company’s financial strength and customer reviews to ensure that it’s a reputable and reliable insurer.

What types of coverage are available with car insurance policies?

Car insurance policies typically offer several types of coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). Each type of coverage provides different protections and benefits, so it’s important to choose a policy that meets your specific needs.

What is the minimum car insurance coverage required in Illinois?

In Illinois, drivers are required to carry liability insurance with minimum coverage limits of 25/50/20. This means that you must have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $20,000 in property damage liability coverage.

Can I get discounts on my car insurance policy?

Yes, many car insurance companies offer discounts for various reasons, such as having a good driving record, being a safe driver, bundling multiple policies, and owning a vehicle with safety features. It’s important to ask your insurer about available discounts to see if you’re eligible.

Can I customize my car insurance policy?

Yes, many car insurance companies offer customizable policies that allow you to choose the types and amounts of coverage you need. You can also adjust your deductibles and coverage limits to fit your specific budget and preferences.

How do I file a claim with my car insurance company?

To file a claim with your car insurance company, you should contact them as soon as possible after the accident or incident. You will need to provide information such as your policy number, the date and location of the incident, and any details about the damage or injuries. Your insurer will then guide you through the claims process and work with you to resolve the issue.

What should I do if my car is stolen?

If your car is stolen, you should contact the police immediately to file a report. You should also contact your car insurance company to report the theft and begin the claims process. Your insurer will guide you through the next steps, which may include providing documentation and working with the police to locate your vehicle.

What should I do if I’m involved in a car accident?

If you’re involved in a car accident, it’s important to stay calm and call for emergency assistance if necessary. You should also exchange contact and insurance information with the other driver, take photos of the scene and any damage, and gather contact information from any witnesses. You should then contact your car insurance company to report the accident and begin the claims process.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.