How do I track the progress of my State Farm car insurance claim? (2026)

If you're wondering how to track the progress of your State Farm car insurance claim, visit your online account, mobile app, or call an agent to get started. On average, expect your State Farm claim to get resolved within 12 days. We'll help you understand more about the State Farm auto claims process below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Jun 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jun 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Create an account to file a claim and then log in at statefarm.com

- After you file a claim, you can check the status online

- Contact customer service at 1-800-732-5246 24/7

After filing an accident claim, you may be wondering how to track the progress of your State Farm car insurance claim. You can easily track your claim’s progress through the State Farm mobile app or on the company’s website.

In addition, you may call customer service for more assistance with your claim. State Farm receives four out of five stars for its claims-paying reputation according to our State Farm insurance review.

Looking to compare cheap car insurance rates? Enter your ZIP code into our free comparison tool above to get instant auto insurance quotes from State Farm and the best insurance companies near you.

How to Track Your State Farm Car Insurance Claim

To track progress, check online or by using the mobile app to determine if your claim is approved.

After your claim gets approved, State Farm will send a direct deposit to your bank account or issue a check to you for the repair minus your deductible.

Schimri Yoyo Licensed Agent & Financial Advisor

Deductible questions are answered in our article titled “Car Insurance Deductibles: An Expert Guide.”

Alternatively, State Farm will pay the repair shop if you use one in the company’s network. If your car is totaled and the costs of repairs are more than the car is worth, State Farm pays the cash value minus your deductible. If you have an outstanding loan on the vehicle, the lender is paid the insurance proceeds.

Check out the table below to see how long the claims process takes on average for State Farm and other top providers:

Car Insurance Average Claims Length by Provider

| Insurance Company | Claims Length (Days) |

|---|---|

| Allstate | 16 |

| American Family | 19 |

| Amica Mutual | 12 |

| Auto-Owners Insurance | 14 |

| Erie | 10 |

| Farmers Insurance | 18 |

| Geico | 14 |

| Liberty Mutual | 17 |

| Nationwide | 13 |

| Progressive | 15 |

| State Farm | 12 |

| The Hartford | 15 |

| Travelers | 16 |

| USAA | 11 |

As you can see, State Farm claims usually get resolved within 12 days, while it could take 13 days with Nationwide (Learn More: Nationwide vs. State Farm Car Insurance).

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Steps for Filing a Claim with State Farm

You can benefit from knowing how to file a car insurance claim. State Farm has an interactive website that guides you through the online process. You can file a claim by using your agent’s help also.

The steps are:

- Select Claim Type: You can file a claim online or by using the State Farm mobile app if you’re a policyholder, were involved in an incident with the vehicle of a State Farm customer, or if you’re an insurance company with a customer that had an incident with a State Farm customer.

- Give Accident Information: The information needed to start a claim is the date, time, location, description of the incident, the vehicles involved, and a description of the damages.

- Virtual Estimation Tool: State Farm has a unique virtual estimation tool that allows you to upload photos of the damages and get a repair estimate before taking the vehicle to the repair shop. You can use your own repair shop or one of the repair shops in the State Farm Select Service® program.

- Claim Number: After you file a claim, you will receive the claim number and use this number to track the progress of your car insurance claim with State Farm.

After filing a claim, use the claim number to check the status of your car insurance claim on the State Farm claim status page. Click the “Log In” tab. Provide your username and password to log in.

Tracking a Claim with State Farm

State Farm ranks well as the best car insurance company for paying claims because tracking your claim online or using the mobile app is easy.

Ready to compare rates? Use our free quote tool below to instantly compare rates from the best car insurance companies near you.

Frequently Asked Questions

How do I get a claim number from State Farm?

Go to statefarm.com and select the “claims” tab. Follow the steps to get an online account and start a claim. You do not need all the information required to create a claim. After you enter the information you have, you will be assigned a claim number that you can use after that to track the progress of your car insurance claim with State Farm.

Where do I get the State Farm mobile app?

You can download the State Farm mobile app in the Apple App Store or Google Play Store.

How long does it take to process a claim at State Farm?

If you work with your agent after submitting the claim, the process takes a few weeks for routine claims that don’t involve personal injuries. Filing a claim online and using the virtual estimator is the fastest way to process a claim.

Why is my State Farm claim taking so long?

Case complexity and high claim volumes could contribute to State Farm taking longer to investigate your claim.

Why does State Farm deny so many claims?

State Farm, like other insurers, often denies claims due to insufficient evidence, lack of coverage, or policy exclusions.

How do I negotiate with State Farm for a claim?

What happens if I disagree with State Farm’s decision on my car insurance claim? If you’d like to negotiate with State Farm after a claim, gather the necessary documentation and clearly communicate your concerns to the adjuster about your desired settlement amount.

If you feel State Farm mishandled your claim and you’d like to shop for a new provider, enter your ZIP code into our free quote comparison tool below to get started.

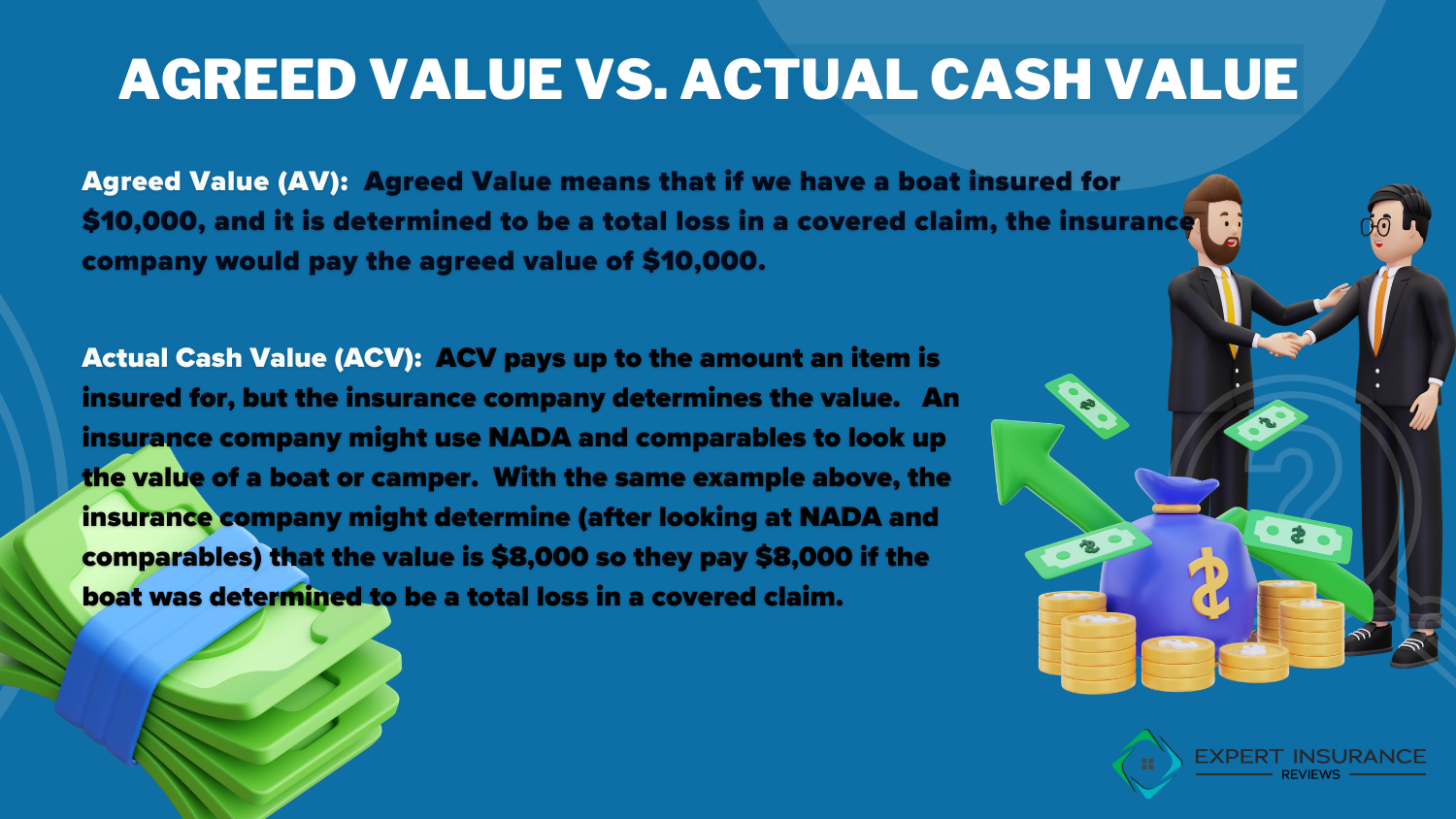

How does State Farm determine actual cash value?

Like many other top providers, State Farm figures out a car’s actual cash value by assessing its condition before the loss and considering factors such as age, mileage, and market value.

Does State Farm have a good reputation for paying claims?

Yes, according to a 2023 J.D. Power claims satisfaction survey, State Farm scored a 891 out of 1,000, which is higher than the industry average of 878.

How often are insurance claims denied?

On average, 10-15% of car insurance claims get denied.

Learn More: What should I do if my car insurance claim is denied?

What is one of the most common reasons for a claim being rejected by an insurance company?

One of the most common reasons a car insurance claim gets denied is because a claim falls outside the policy terms, including if an incident involved excluded drivers or if the policy lapsed.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.