Will my car insurance rates increase if I file a claim with Allstate? (2026)

Your car insurance rates will increase by around 41% if you file a claim with Allstate. However, the actual Allstate rate increase depends on fault, accident severity, your state's fault laws, and driving record. We'll explain how claims impact your auto insurance rates and more below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Jun 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jun 5, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Filing a claim with Allstate does not guarantee your premiums will increase

- Allstate will look at several factors when you file a claim

- If you have accident forgiveness on your policy, your rates should not go up

If you’re an Allstate customer and filed a claim, you might ask yourself, “Will my car insurance rates increase if I file a claim with Allstate?” Generally, your rates will go up after an Allstate claim. However, the amount it increases depends on factors such as fault, driving record, and accident severity.

Learn the answer to this below, and check out tips and advice about how to file a car insurance claim. You can also read our article “Allstate Auto Insurance Review & Complaints” to learn more.

Rates go up after a claim? Enter your ZIP code into our free quote tool above to instantly compare car insurance prices from the top companies near you.

An Allstate Car Insurance Claim Will Usually Raise Rates

You’ll usually pay around 41% higher auto insurance rates after filing an Allstate claim, regardless of whether you’re at fault or not. However, various factors impact how much they go up after a claim, such as driving record, fault, and accident severity.

Check out the table below to see how much your Allstate premiums could go up after a claim:

Full Coverage Car Insurance Monthly Rates for Clean Record vs. One Accident by Provider

| Insurance Company | Clean Record | One Accident | Dollar Increase | Percent Increase |

|---|---|---|---|---|

| Allstate | $160 | $225 | $65 | 41% |

| American Family | $117 | $176 | $59 | 50% |

| Erie | $58 | $82 | $24 | 41% |

| Farmers | $139 | $198 | $59 | 42% |

| Geico | $80 | $132 | $52 | 65% |

| Liberty Mutual | $174 | $234 | $61 | 34% |

| National General | $161 | $266 | $105 | 65% |

| Nationwide | $115 | $161 | $47 | 40% |

| Progressive | $105 | $186 | $81 | 77% |

| State Farm | $86 | $102 | $16 | 19% |

| The General | $232 | $327 | $95 | 41% |

| Travelers | $99 | $139 | $40 | 40% |

| USAA | $59 | $78 | $19 | 32% |

| U.S. Average | $119 | $173 | $53 | 45% |

If you’re considered a riskier driver, you’ll usually get charged a higher amount — simply being in an accident may cause Allstate to put you in this category. Learn more about how to find the best car insurance for a bad driving record.

Also, as it notes on the Allstate website, the amount of money the company must pay out for the claim can impact if your insurance premium will increase. For instance, a fender bender that causes minor damage to your vehicle will not be as expensive to repair and resolve as an accident where your vehicle was totaled.

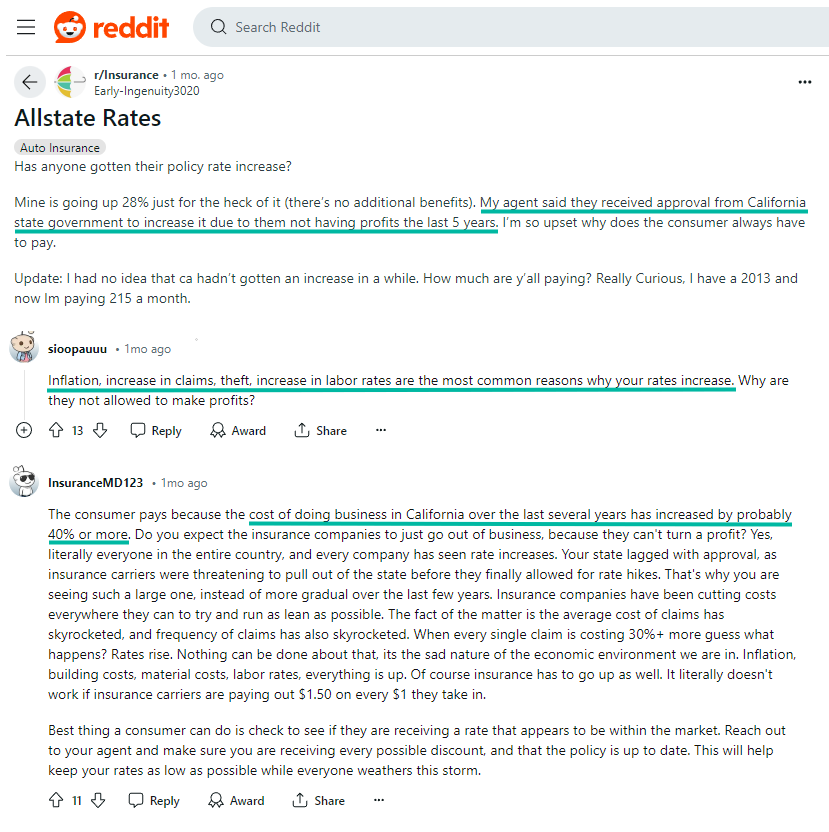

In addition, outside factors, such as inflation and company profit loss, could prompt Allstate to raise rates. For example, one Reddit user in California says their Allstate rates went up 28% after the provider received approval from the state to increase them.

Another Reddit user notes that inflation, higher claims, and theft are other reasons your rates go up, while another claims state insurance regulations in California are to blame.

A key reason car insurance costs are rising so fast right now has to do with how the industry is regulated. Here’s what to know. https://t.co/qGl2OzCZyu

— The New York Times (@nytimes) May 18, 2024

While you might be tempted to skip filing a claim if the damage is minor, you should still contact Allstate to let them know about the accident.

Accident Forgiveness Could Prevent Rate Hikes After Allstate Claims

According to the Allstate website, if you add the optional accident forgiveness program to your auto insurance policy, your rates should not go up after a claim, even if the accident was your fault.

You can check your insurance policy to see if you have this in place; if not, you may want to call your agent, if you have one, to see about adding this car insurance coverage to your policy.

Why No-Fault Insurance Claims May Lead to Higher Allstate Rates

No-fault insurance is one of the types of car insurance coverage that will pay for your medical bills and those of your passengers if you are in an accident that was your fault and caused injuries. Some states include no-fault coverage in their list of car insurance requirements, while others don’t, so you may not need it for your policy.

If you do have it, and the accident was your fault, Allstate will consider how much it is paying for medical expenses in the claim before deciding if your rates will increase.

Read More: What is no-fault in car insurance?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Why Premiums Increase After Filing an Insurance Claim With Allstate

Unfortunately, your Allstate car insurance rates will increase by around 41% after filing a claim. However, Allstate will weigh many factors to determine by how much, including your driving record, the amount being paid out, and if you have accident forgiveness as part of your full coverage car insurance before deciding to raise your rates.

Shout out to Allstate customers who use our Drivewise app! A national survey found, on average, Drivewise customers:

📞 handle their phones 44% less while driving

🚀 spend 23% less time driving at high speeds

🚙 have an 11% lower rate of hard braking https://t.co/5GeR2nydjm— Allstate (@Allstate) April 19, 2024

Ready to compare your Allstate rates against the best insurance companies in your area? Enter your ZIP code into our free quote tool below to get started on your journey to cheap car insurance rates after an accident.

Frequently Asked Questions

Will Allstate raise your rates after your first accident?

Unless you have Allstate accident forgiveness, expect your car insurance rates to increase by around 41% after an accident.

Does Allstate raise rates after a comprehensive claim?

Even if you’ve never made a comprehensive auto insurance claim, your insurer may re-evaluate your driving record and raise your premium if your claim indicates you are a risky driver.

Why does Allstate keep raising rates?

In 2024, Allstate has been raising rates to catch up with recent losses and maintain profits due to inflation and increased claims.

Ready to shop around for a better deal? Use our free quote comparison tool below to instantly find cheap car insurance from top providers in your area.

What happens if I make a lot of Allstate insurance claims?

Filing multiple insurance claims could lead Allstate to not to renewing the policy.

How many claims before Allstate drops you?

There isn’t a limit on the amount of car insurance claims you can file with Allstate. However, filing more than one claim a year could result in policy cancellation with some providers.

Learn More: Will your car insurance be cancelled after an accident?

Does your insurance go up after a claim that is not your fault with Allstate?

Yes, even if you weren’t at-fault for an accident, your car insurance rates will go up after filing an Allstate claim.

How much does insurance increase after a claim with Allstate?

Expect your car insurance rates with Allstate to go up by around 41% after filing a claim.

Do I have to pay a deductible if I was not at-fault with Allstate?

Yes, car insurance deductibles are always required when filing a claim, even if you’re not at fault for the accident.

Does Allstate handle claims well?

Yes, according to J.D. Power’s recent study, J.D. Power has an 882 out of 1,000 for claims satisfaction, which is higher than the industry average.

Is Allstate accident forgiveness worth it?

Allstate accident forgivesness could be worth it for many drivers who want to avoid rate increases after their first at-fault accident. However, the program isn’t free, so you must weigh the potential savings against the higher rates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.