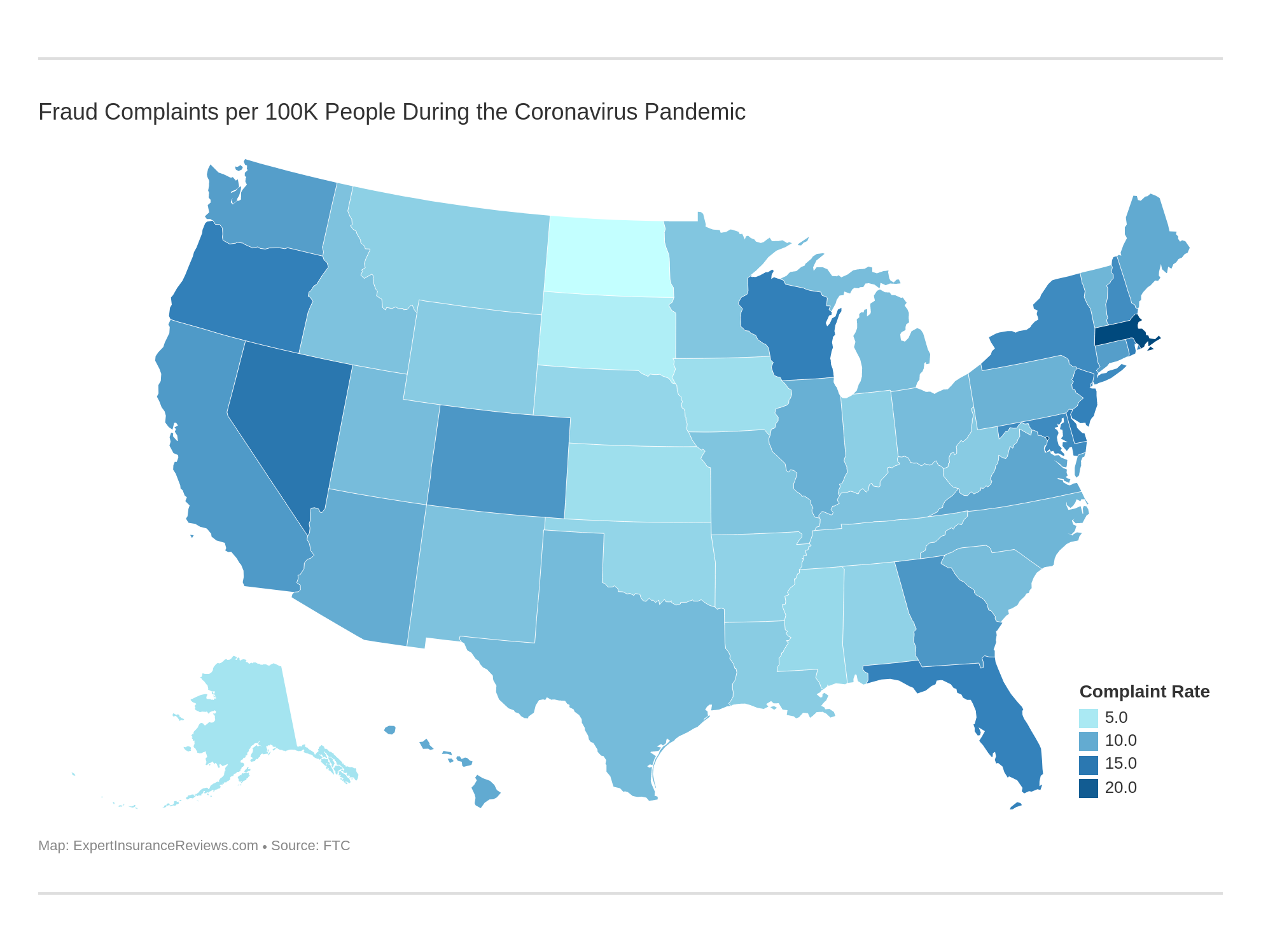

11 Worst States for Coronavirus Fraud (Statistics +Money Lost)

Since the start of the pandemic, there have been 34,000 coronavirus fraud reports filed to the Federal Trade Commission. Maryland and New York are the worst states for coronavirus fraud schemes, including identity theft and do-not-call scams. Fraudsters take advantage of the panicked atmosphere of COVID-19 and target the elderly, who are susceptible to scammers due to declining cognitive conditions.

Read moreFree Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

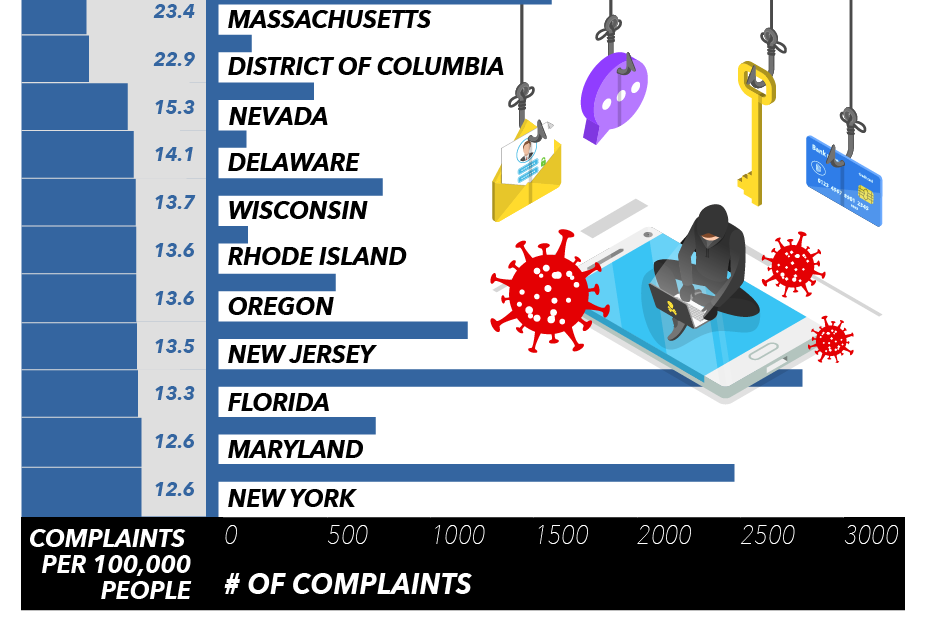

Quick Stats from January to May 2020:

- The 11 worst states for coronavirus fraud average 1,012 complaints each

- The state with the most complaints averages 23 per 100,000 residents

- U.S. residents lost over $5 million to credit card fraud in under five months

Today, the coronavirus pandemic has hurt us financially and made many people desperate. As a result, fraud and scams have surged. From the start of the pandemic in January until May, the Federal Trade Commission registered over 34,000 fraud complaints.

Government bodies are urging citizens to beware, practice vigilance, and to not let their guard down. That’s why we present the 11 worst states for coronavirus fraud.

At the end of the article, we cover ways to prevent COVID-19 fraud so you’ll be prepared if you find yourself on a phony website or receive a fraudulent email.

Fraudsters target innocent Americans, like you, who have been financially hurt in this uncertain period. This is especially true if your job is in one of the hardest-hit industries during this coronavirus pandemic.

And if you’re furloughed or out of work, you might find it difficult to even pay your regular bills. One of the best ways to put a little money in your pocket is to save on your auto insurance rate. There are a few ways you can do this, including getting familiar with car insurance by state.

If you’re ready to jump right in and get a car insurance quote, enter your ZIP code into our free online quote comparison tool to get the best car insurance rates in your area based on your demographic information.

In this article, we’ll cover coronavirus fraud employment, COVID-19 scams, false claims, phony websites, and coronavirus advice.

Now, which states are the worst for coronavirus fraud? Let’s get started.

11 Worst States for Coronavirus Fraud

While every state had its share of COVID-19 fraud, some have been hit harder than others. The list includes some of the largest states in America to some of the smallest. In addition, population density differed significantly as well. From sea to shining sea, let’s go.

Tragically, the COVID-19 pandemic has also pushed the United States into an economic recession. We’ve also studied the most and least recession-ready metros across the country, and the findings in that research overlap with a lot of the information about the information we found on the worst states for coronavirus fraud.

Read more: 5 Industries Hit Hardest by Coronavirus

#11 – New York (tied)

New York, the Empire State, comes in tied for number 11 on this list of the 11 worst states for coronavirus fraud. Of the states in our worst 11 list, it has the second-highest number of complaints at 2,460 from the beginning of January until May 10. Because it has a population of 19.5 million, its number of complaints per 100,00 people is 12.6. Its complaints are divided into three categories.

- Fraud attempts: 1,296

- Identity theft attempts: 193

- Do-not-call scams: 137

All other complaints are not categorized. There are many frauds aimed at people living in New York. These frauds include imposter frauds, veterans scams, and selling fake health care products.

Police arrested one New York man for selling fake test kits through a YouTube account. The tests promised to deliver “fast results” about infection from coronavirus. He was undone when he failed to deliver results to his customers.

Police have arrested other fraudsters in New York. One of those was a man who stockpiled medical supplies and marked up the prices significantly, taking advantage of the pandemic.

Law enforcement organizations have labeled this fraud as unlawful hoarding and price gouging. Both New York fraudsters are facing tens of thousands of dollars in fines. Both are facing jail time for breaking anti-fraud laws as well.

#11 – Maryland (tied)

Maryland, the Old Line State, comes in tied number 11 on this list of the 11 worst states for coronavirus fraud. Of the states in our worst 11 list, it has the fifth-highest number of complaints at 762 from the beginning of January until May 10.

Maryland’s number of complaints per 100,000 people is 12.6 because it has a population of around 6 million. Its complaints are divided very unevenly between our three categories. The table below shows the fraud attempts, identity theft attempts, and do not call scams in Maryland.

Federal Trade Commission Coronavirus Complaints in Maryland

| Fraud Attempts | Identity Theft Attempts | Do Not Call Scams |

|---|---|---|

| 404 | 53 | 40 |

All other complaints are not categorized. There are numerous frauds besetting taxpayers in Maryland. One rather creative fraud is a bitcoin scam targeted at the Hispanic community.

In this scam, fraudsters convince their targets that Bitcoin is an established currency where they can track their portfolio progress. When targets want to cancel their agreements, the fraudsters threaten to expose them to Immigration and Customs Enforcement.

Another popular fraud in Maryland seems to be insurance fraud. In these cases, people posing as insurance agents persuade people to buy insurance and then pocket the premium.

Information, in these instances, can help. Knowing whether your health insurance covers coronavirus or other policy details can keep these fraudsters at bay.

Auto insurance fraud is also possible. This is because numerous car insurance companies are issuing rebates or credits due to the lack of driving during stay-at-home orders. To keep up on the fraud rules in Maryland, check out our Maryland Car Insurance Laws guide.

As we’ll see, these types of frauds or scams are not necessarily unique to Maryland. Fraudsters and scammers are practicing them throughout the country and in the 11 worst states for coronavirus fraud and others as well.

#9 – Florida

Florida, the Sunshine State, comes in at number 9 on this list of the 11 worst states for coronavirus fraud. Of the worst 11 states on this list, it has the highest number of complaints at 2,800 from the beginning of January until May 10. That is 340 more complaints than the nearest state.

Florida’s number of complaints per 100,000 persons is 13.3 because it has a population of over 21 million people. Of our three categories, complaints are highest in fraud attempts.

- Fraud attempts: 1,431

- Identity theft attempts: 102

- Do-not-call scams: 244

All other complaints are not categorized. In Florida, there are numerous frauds and scams targeting Florida residents. One targets people who are afraid of COVID-19. Here, a fraudster in a white coat or protective gear goes door to door. They approach residents and gain entrance to their homes. From there, they rob the target.

Another common fraud practice in Florida has a robocall offering false hopes of financial relief. A message states that the target can save money on their electric bill.

From there, the target needs to submit their credit card or other personal information to receive financial relief. The other side of that fraud occurs when a robocall plays a message saying the victim’s electricity will be turned off.

#8 – New Jersey

New Jersey, the Garden State, comes in at number 8 on this list of the 11 worst states for coronavirus fraud. With around 1,200 complaints from the beginning of January until May 10, it has the third-highest number of complaints of all states on our list.

Because it has a population of around 9 million people, its complaints per 100,000 people are 13.5. The highest number of cases are categorized as fraud attempts. The second-highest is identity theft cases. The third-highest is do-not-call scams.

New Jersey has set up a task force to fight fraud. A key goal of the state government has been to educate the public.

The NJ task force notes several types of common COVID-19 fraud in the Garden State. Some include phishing scams, app scams, and investment scams.

Also, New Jersey has made an emphasis on fighting hoarding and price gouging scams. In nearby New York City, there have been reports of people hoarding medical supplies. They then mark up the price—sometimes as high as 100 percent more—and sell them to people across the country.

This common coronavirus behavior has been a focus on numerous state and federal task forces. Some officers have found fraudsters with enough medical supplies to fill a hospital. New Jersey’s rules are strict. With one conviction of unlawful hoarding/price gouging, a person must pay a $10,000 fine. With a second conviction, that fine is $20,000.

New Jersey takes fraud seriously. Theft of more than $200 has a penalty of up to 18 months in prison and a $10,000 fine. These punishments are the same for car insurance fraud. For residents of the Garden State, knowing the New Jersey car insurance laws can provide some clarity on what is legal and what is not.

#7 – Oregon (tied)

Oregon, The Beaver State, comes in tied for number 7 on this list of the 11 worst states for coronavirus fraud. With nearly 570 complaints from the beginning of January until May 10, it ranks sixth for the number of complaints. With a population of 4.2 million, Oregon registers 13.6 complaints per 100,000 persons. Most of Oregon’s complaints are for fraud attempts.

- Fraud attempts: 325

- Identity theft attempts: 29

- Do-not-call scams: 34

The other complaints are not categorized. In May, the Oregon state attorney general announced a partnership with the U.S. attorney general. Together, they would form a combined state and federal team to fight fraud during the COVID-19 pandemic. They have attempted to educate the public about common scams.

Two scams that target Oregon residents more often than others are health scams and cryptocurrency scams.

For the health scams, a fraudster might go door to door, promising a test for the coronavirus. Fraudsters might also send emails or set up websites selling cures for COVID-19.

For the Oregon cryptocurrency scams, a scammer might ask a person through phone or email to invest in an initial coin offering. The promise is that a small investment could lead to huge amounts of money. The scammer then takes the money and wires it through a complex cryptocurrency network. This makes it difficult to recover.

A news station in Oregon covered the latest scams affecting residents of The Beaver State. They include a voicemail that was left on one person’s phone. The scam uses language that incites fear.

It then follows that language up with a pitch to talk to “one of our health agents.” Its goal was to sell insurance and then to get a person’s payment and personal information.

That’s a form of health insurance fraud. There are also auto insurance fraudsters. Understanding Oregon car insurance laws can help you stay informed and aware.

#7 – Rhode Island (tied)

Rhode Island, The Ocean State, comes in at number 7 on this list of the 11 worst states for coronavirus fraud. With 144 complaints from the beginning of January until May 10, it has the second-lowest number of complaints of these 11 worst states.

Because it has a population of just over 1 million, its complaints to 100,000 people ratio is still very high at 13.6. Check out the table below to see the fraud attempts, identity theft attempts, and do-not-call scams in Rhode Island.

Federal Trade Commission Coronavirus Complaints in Rhode Island

| Fraud Attempts | Identity Theft Attempts | Do Not Call Scams |

|---|---|---|

| 71 | 3 | 23 |

The rest of the complaints are uncategorized. Rhode Island has already suffered at the hands of fraud since the pandemic started. Two men were arrested in Rhode Island who tried to file fake applications for small business assistance.

One lives in Rhode Island and the other in Massachusetts. The two men applied for assistance citing numerous employees at different business entities. In fact, there were no employees working at these businesses.

Many citizens have stopped receiving unemployment benefits. A spokesperson says that might be due to frozen accounts locked due to suspicious activity.

Rhode Island is investigating thousands of unemployment claims for fraudulent activity. Auto insurance fraud is another popular mode of fraud. It steals from either individual policyholders or companies. For more information about auto insurance and fraud in Rhode Island, check out our Rhode Island insurance guide.

#5 – Wisconsin

Wisconsin, The Badger State, comes in at number 5 on this list of the 11 worst states for coronavirus fraud. With 795 complaints from the beginning of January until May 10, it ranks fourth on this list for most complaints. Because it has a population of nearly 6 million, it registers 13.7 complaints per 100,000 people. Most of its complaints are for fraud attempts.

- Fraud attempts: 452

- Identity theft attempts: 19

- Do not call scams: 21

The rest of the complaints are uncategorized. Through the Attorney General’s Office, Wisconsin has set up teams to investigate fraudulent activity. One principal fraud listed is imposter fraud.

The state government has told Wisconsin residents to be aware of someone posing as a government employee. These include agents of the IRS and Medicare employees. In both cases, the person will ask for money or personal information.

Another is the hack-ransom scam. Here, a website will pretend to give key information about COVID-19. When you download the file, it transmits malware onto your computer. The malware locks your computer. The fraudsters behind the website will demand a ransom to unlock your computer.

Common scams include fake nonprofits looking for donations and websites selling fake testing kits. Another is a phishing email that looks like it’s from the Centers for Disease Control and Prevention.

A member of the Attorney General’s Office noted that many scams create pressure. He says this is unlike how a government agency or would interact with a citizen. It’s a tell-tale sign that the email or call is a scam.

#4 – Delaware

Delaware, The First State, comes in at number 4 on this list of the 11 worst states for coronavirus fraud. With 136 complaints from the beginning of January until May 10, it has the lowest number of complaints of any state on this ranking.

Because it has a population of just 970,000, it registers 14.1 complaints per 100,000 people. Its complaints are tilted toward fraud attempts. The following table shows the fraud attempts, identity theft attempts, and do-not-call scams for Delaware.

Federal Trade Commission Coronavirus Complaints in Delaware

| Fraud Attempts | Identity Theft Attempts | Do Not Call Scams |

|---|---|---|

| 65 | 10 | 10 |

The rest of the complaints are uncategorized. In late April, the U.S. attorney general and the Delaware attorney general formed a task force to fight coronavirus fraud. They spelled out common types of fraud that affects the entire population.

The task force also named two types of fraud that are directed at seniors: government imposter and family member imposter frauds.

We’ve already covered government imposter fraud. For the other type of imposter fraud, a fraudster impersonates a family member, relative, or friend. The fraudster states they need a large amount of money quickly. They do this by citing financial circumstances. A particular one involves the “trapped overseas” gambit. Here, fraudsters play on the desperation of a manufactured situation.

Fraudsters then dupe seniors into transferring money to help out someone close to them. Instead, fraudsters pocket that money and use it personally. Seniors are also vulnerable to insurance fraud as well. Education can help prevent this, such as reading our Delaware auto insurance review.

#3 – Nevada

Nevada, The Silver State, comes in at number 3 on this list of 11 worst states for coronavirus fraud. With 463 complaints from the beginning of January until May 10, it is in the lower half of the states with the most complaints in our ranking. With a population of a little more than 3 million, it registers 15.3 complaints per 100,000 persons. The majority of its complaints are for fraud attempts.

- Fraud attempts: 203

- Identity theft attempts: 63

- Do-not-call scams: 44

The rest of the complaints are uncategorized. To combat fraud throughout the state, The U.S. attorney general and the Nevada attorney general formed a task force in early April. Part of their initiative was to educate Nevada citizens about the most common types of coronavirus fraud.

One unusual type of fraud was reported: pet fraud. Fraudsters pressured targets into sending large amounts of money as deposits for a pet they wanted to buy.

This is true for regular pets and may be true for those wanting to own an exotic pet. The target had to use a wiring method that was not traceable. The fraudsters then took the money and disappeared.

#2 – District of Columbia

The District of Columbia, the Capital of America, comes in at number 2 on this list of the 11 worst states for coronavirus fraud. With its 161 complaints from the beginning of January until May 10, the District has the third-smallest number of complaints on this list.

Because its population is around 700,000, it registers 22.9 complaints per 100,000 residents. The following table shows the fraud attempts, identity theft attempts, and do-not-call scams for Washington, D.C.

Federal Trade Commission Coronavirus Complaints in D.C.

| Fraud Attempts | Identity Theft Attempts | Do Not Call Scams |

|---|---|---|

| 80 | 9 | 10 |

The rest of the complaints are not categorized. The District has created a task force to combat coronavirus fraud. It has warned residents of the common types of fraud. These include people trying to sell vaccines or cures. There are also phishing scams where someone poses as a major health organization and attempts to gain personal information.

In April, police arrested one man for fraudulent activity. The man created a company to sell medical supplies. These included masks, hand sanitizers, and personal protective equipment.

He advertised through Twitter for his website CoronavirusProtectionMasks.org and attracted dozens of customers for his medical supplies. Some people questioned this solicitation, retweeting at New York State Governor Cuomo and the FBI.

The customers that actually purchased supplies never received them. This, along with other missteps, led to the man’s downfall. Police also charged him with a nonprofit scam. He said that donations to his company would go to building hospitals in China and other philanthropic endeavors. Of course, he pocketed the donations personally.

#1 – Massachusetts

Massachusetts, The Bay State, comes in at number 1 on this list of the 11 worst states for coronavirus fraud. With 1,613 complaints from the beginning of January until May 10, it has the second-highest number of complaints of any state on this list.

Because it has a population of about 7 million, it registers 23.4 complaints per 100,000 residents. Of our three categories, complaints are highest in fraud attempts.

- Fraud attempts: 1,206

- Identity theft attempts: 31

- Do-not-call scams: 55

The rest of its complaints are uncategorized. Frauds have hit Massachusetts particularly hard. The U.S. attorney has told Massachusetts’ hospitals specifically to beware of any scams such as price gouging or unlawful hoarding.

Fraudsters are also going door-to-door to sell COVID-19 cures or vaccines. Further, cybercrime is scamming people out of money.

Multiple organizations in Massachusetts have issued material to educate the public about common scams. The one headline arrest was the Massachusetts man who partnered with a man from Rhode Island. Together, they sought to acquire money from the small business assistance program. They were both caught and are awaiting trial.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Most Common Types of Year-Round Fraud

Frauds can occur in numerous ways and snare innocent people along the way. In some cases, it might be easy to tell that there has been a fraud. In other cases, a person might be duped for a number of months, even for several years. Here are a few commonly known cases of fraud that people can look out for.

Bank Account Fraud

Bank account fraud occurs when a fraudster gains access to a person’s bank account. To do this, a fraudster might convince someone to download a file through email.

This email contains malware, which reads through the person’s computer for sensitive or identifying information. The fraudster then gains a person’s bank account number, among other information.

Bank account fraud is similar to credit card fraud but might be considered more serious. Because credit card fraud uses none of the victim’s actual money, it has less of a financial impact compared to bank account fraud. When a fraudster gains control of a bank account, they can liquidate it. This demonstrably impacts the victim very quickly.

Credit Card Fraud

Credit card fraud occurs when an individual receives or steals credit card information of the victim. The fraudster then uses this credit card information to make illicit purchases, sometimes from all over the globe.

This person can receive a target’s credit card information through various frauds that require people to provide their credit card information for a purchase.

They can also receive this credit card information from stealing the card itself. In some cases, they may clone the card through a credit card reader, like the types that are used in everyday stores.

Sometimes, a person won’t find out that their credit card information has been stolen for weeks or even months. By then, the fraudster will have racked up numerous illicit purchases, skyrocketing the balance and damaging credit scores.

Insurance Fraud

During the COVID-19 pandemic, fraudsters are conducting frauds in an old-fashioned way: insurance fraud.

Fraudsters might call a victim pretending to be an insurance agent for a major company. They then could persuade the victim that they could save money on a premium or be better covered under a new insurance plan.

These fraudsters will then ask for the victim’s credit card or bank information to process the refund or sign up for another plan. After the call is completed, the fraudsters will then use that information to run up purchases on a credit card. They may also find a way to remove money from a person’s bank account.

This is even more complicated due to the recent protests and riots that affect commercial insurance. Fraudsters may try to take advantage of this situation by setting up bogus organizations that portray themselves as a group accepting donations to bail people out of jail.

Insurance fraud may also be first-party fraud as well. This means that the person holding the policy may commit fraud. This can happen often during the car insurance claims process or even before.

There are reports of people setting their cars on fire and filing false claims during the coronavirus pandemic.

Fortunately, many states have insurance fraud government agencies as well. Some are specifically for insurance fraud. For instance, Minnesota has a Fraud Bureau. If you had fraud relating to Minnesota car insurance or other types, you could report the fraud through its website. Many states have the same organizations.

Investment Fraud

Investment fraud occurs when a third-party promises investors large, quick gains for their investment with minimal risk. The most well-known type of investment fraud is the Ponzi scheme. This happens when someone approaches numerous clients about gaining a large amount of money through the stock market very quickly.

The ring-leader of the Ponzi scheme pockets some of the new investors’ money and uses the rest to attract new investors. They then use new investors’ money to pay the first investors. And so on.

Ponzi schemes usually collapse if the source of new investors dries up or many investors demand their payout all at once. Bernie Madoff is the most notorious example of a Ponzi scheme leader. He defrauded his investors an estimated $65 billion.

Nigerian Letter Fraud

Nigerian letter fraud is third-party fraud. It occurs when a fraudster sends an email or letter to the victim saying they have a large amount of money owed to them. The email or letter includes details about how to receive that money.

Often, the victim needs to send the fraudster their bank account information. Then, the fraudster promises to process the large amount of money to the victim quickly.

Although these frauds are well-known, people still fall prey to them. These frauds combine numerous psychological tactics to create a sense of urgency in the victims.

Like many frauds, the victim is led to believe that they will receive a significant amount of money, all with little risk attached. Certain organizations suggest that Americans lose millions of dollars to these frauds every year.

Tax Fraud

Tax fraud is an unusual one in this list, mostly because it may be first-party fraud or third-party fraud. With first-party tax fraud, a person might lie on their taxes to claim deductions or lower gross income. This is all in an attempt to lower the amount they will pay on taxes.

With third-party tax fraud, a fraudster might steal a person’s information and file the taxes for them. The fraudster, then, will receive the person’s tax refund. This often occurs long before this person actually files a tax return.

When they do, the person receives a notification from the IRS. It says that they have already filed a return. And by then, the fraudster is long gone.

Common Fraud During the Coronavirus Pandemic

The COVID-19 pandemic has led to a new age among fraudsters. While many techniques of the fraudsters remain, their tactics and subject matter are different. Because of the uncertain nature of the future, many people are desperate.

And this has led to a ripe atmosphere for fraudsters to steal information and money. Numerous websites cite the following frauds occurring now on a state level and not just in the 11 worst states for coronavirus fraud. They are occurring around the country.

Cryptocurrency Investment

Cryptocurrency fraud is similar to other forms of investment fraud. Fraudsters promise victims a large reward for a small investment. Victims are lured into a trap, where their money is never used for investments. Instead, it is re-routed through a large cryptocurrency network. It is difficult, then, for police or organizations to track the money.

Fraudsters across the country are setting up these traps. As we saw in the case of Maryland, some cryptocurrency investment frauds have targeted minority communities. When the victims confronted the fraudsters, the fraudsters threatened to report the victims to the ICE.

Door-to-Door Salespersons of COVID-19 Testing Kits or Vaccines

Since the coronavirus pandemic began, scammers and fraudsters have tried to leverage the fear and uncertainty surrounding the coronavirus. One of these methods has been to promote the sale of cures or vaccines.

They may do this through emails or through text messages. Some scammers and fraudsters are taking it to the next level. They act as door-to-door salespersons of these cures or vaccines.

A fraudster, for instance, might approach a victim’s door wearing a white coat or personal protective equipment. They say they are from a medical organization and are selling testing kits, cures, or vaccines.

The fraudsters talk to the target for a time, using psychological tactics to create a sense of desperation and urgency. And then they sell them the fake cures or vaccine.

Although many state governments are warning people of this fraudulent activity, some people are still buying. While a person might decide to buy in cash, some might give up their credit card information as well. Then, the fraudster would be committing imposter fraud as well as credit card fraud.

Government Agent Imposter

Since the start of the COVID-19 pandemic, there has been a surge in government agent imposter fraud. In these cases, a fraudster will call the victim posing as a government agent.

The agency is often the Internal Revenue Service, Medicare, or Social Security. The fraudster then promises the victim financial relief. Often, these are quick stimulus checks or a small business loan.

The fraudster, in these cases, is usually after personal information. The information might be the victim’s bank account number, their credit card, or their Social Security number. Once the fraudster has this information, they can access those accounts or use the information for identity theft.

Health Organization Phishing Scams

Phishing scams are designed to steal personal information from the victim. Often, the scammers will use an email from a well-known company with a request to update information. Those who do so will have their information stolen.

Scammers often fool people into downloading files containing malware that lock up computers. The scammers then demand a ransom to fix them.

Phishing scams in the COVID-19 pandemic tend to use high-authority health websites like the World Health Organization or the CDC as templates for their scam emails. Often, they suggest the victim clicks on a link to update personal information.

Another type asks a person to share their personal information to check how many people have COVID-19 in their neighborhood. These scams are not just over email. More scammers are using text message alerts to convince people to share their information.

Once the scammers have access to a victim’s personal information, they can access bank accounts and credit cards. They can also use the information for identity theft.

Nonprofit Donation Scams

Every time there is a crisis, fraudsters appear to take advantage of the desperation and fear of individuals. In some cases, they go a step further and take advantage of the positive intentions of victims.

This comes in many forms, but the one besetting the world during the coronavirus pandemic is a tricky one. It is the creation of a false nonprofit organization.

One of the individuals arrested in Washington, D.C. was charged with this crime. He set up a fake nonprofit organization and advertised through Twitter. The organization was building schools in China. Donations went to that and other philanthropic ventures.

Many people sent donations, but they were never used for those purposes. Instead, the fraudster pocketed the money personally. Many other fraudsters are doing the same.

These fake nonprofits are often advertised through social media. This is a hotbed of fraudulent activity because social media creates an anonymous environment. Fraudsters also might send emails out claiming their organization needs donations. When a person gives a donation, it goes right into the fraudster’s wallet.

Senior Fraud

Seniors are the target of many frauds. During the COVID-19 pandemic, one of those is the “distressed person” fraud. In this fraud, the senior receives a message. It states that a family member, relative, or friend is in trouble and needs help.

The distressed person is often overseas. The help is always money. The message often includes a bank account or way to send the money quickly.

This fraud is a variant of the fake accident ploy. In that fraud, a fraudster calls the senior looking for money to cover their child’s hospital bills. Seniors, in general, are targeted with many telemarketing scams. The reason, partly, is that seniors use the phone more often. They are also accustomed to it. Fraudsters use this to their advantage.

Seniors are also susceptible to other imposter frauds. These include a fraudster posing as an agent or representative for a Medicare insurance company like the Medicare wing of Thrivent Financial.

These fraudsters use traditional means to get a victim’s personal information, credit card information, or bank information. But they may target seniors specifically because of the age group’s declining cognitive abilities.

Stimulus Refund Check Scams

Fraudsters are not just promising to tell you who has COVID-19 in your neighborhood or that they have the cure for the virus. They are hijacking government processes as well. In this case, fraudsters are after your stimulus refund check.

Fraudsters often steal refund checks by setting up fake websites. These promise targets that they can expedite their check. When the victim enters their login credentials, the fraudsters can try to get to the target’s paycheck before the target can.

In other situations, they are after personal information rather than the check itself. In this type of fraud, fraudsters take advantage of the confusing rollout of the stimulus checks.

Victims often receive a message that their stimulus check is on the way. Then, the sender says they can expedite it. But only if a victim provides them personal information.

The fraudsters then take that information, which may include bank accounts, and drain the victim of their money. With their process, the fraudsters can go a step further and use the information for identity theft.

Unlawful Hoarding and Price Gouging

When the first COVID-19 cases started hitting the United States, certain individuals started making trips across states. Their goal was to buy up all the health-related products in an area, knowing that the demand would jump up considerably during the pandemic.

There went the hand sanitizers, the medical masks, the spray disinfectants, the hand wipes. The individuals started selling the medical supplies for outrageous markups, profiting off a desperate public that was deathly afraid of contracting COVID-19. Soon, the state governments became involved.

Unlawful hoarding and price gouging might seem like an unusual type of fraud. It goes hand-in-hand with capitalism, a relationship between supply and demand.

State governments see unlawful hoarding and price gouging as profiting off a crisis. The individuals selling these items were tracked down and issued government warnings.

Some were issued fines. A man was recently arrested in Brooklyn for having a stash of medical equipment enough to supply an entire hospital. For the consumer, it means paying far more for a medical product than during normal times.

It might be the most obvious fraud on this list. It’s out in the open with the only buffer between seller and customer the proactive state governments.

Targeted Age Groups and Money Lost During COVID-19 Pandemic

Fraud attempts seem to affect some age groups more than others. Seniors seem particularly susceptible. But is this the case during the coronavirus pandemic?

According to the Federal Trade Commission, not really. Most fraud attempts are scattered around five age groups. And all of those are between 20 to 69 years old. Recorded fraud attempts for each age group between 20 to 69 are between 1,400 and 1,900 from the beginning of January until May 10.

Of those five groups, fraudsters have targeted 60- to 69-year-olds least, with 1,400 registered complaints. Fraudsters have targeted 30- to 39-year-olds most, at 1,900 registered complaints.

Each end of the complete spectrum is targeted much less. 19-year-olds and younger have 250 registered complaints. 80-year-olds and older have around 180 registered complaints. What is interesting is the money lost.

Notwithstanding 70-year-olds and older, the money lost rises per age group. This is even though fraudsters may have targeted the older age groups less.

30- to 39-year-olds have lost $2.8 million, for instance. 50- to 59-year-olds and 60- to 69-year-olds have each lost $3.8 million. There may be factors that make older groups more predisposed to fraud attacks. This includes declining cognitive functions in some seniors.

Fraudsters also target different age groups with different frauds. A commonplace fraud against millennials is shopping fraud or getting lured in by a great deal.

Fraudsters also target millennials with credit card fraud, stealing credit card numbers through a number of tactics.

For seniors, common frauds are lottery or sweepstakes frauds. Frauds might also target seniors more with imposter fraud. In these, the fraudster impersonates a government agent and attempts to steal information. The agencies are generally Medicare, the Social Security Administration, or the Internal Revenue Service.

Imposters might also act as car insurance agents to present a discount or refund to customers. Car insurance companies may be small or large, from Titan Insurance to its parent Nationwide.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

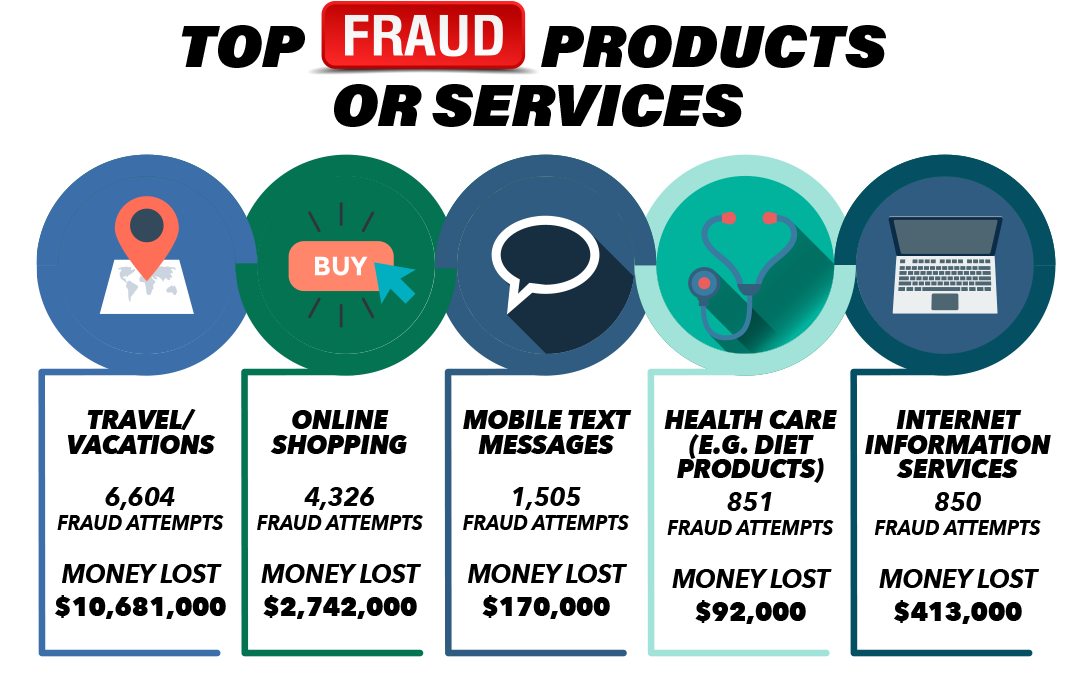

Fraudulent Products & Services and Money Lost During COVID-19 Pandemic

When it comes to fraud products, there are five that stand out during the coronavirus pandemic. There is a wide split between the number of attempts per each fraud product from the beginning of January until May 10.

The highest is travel or vacation fraud with 6,600 attempts. The two lowest are health care fraud and internet information services fraud at around 850 attempts.

Travel or vacation fraud is rampant during this COVID-19 pandemic. Because so many travel plans were canceled, fraudsters are taking advantage of this uncertain environment.

They set up fake websites promising your vacation refund. Or they call you personally impersonating a travel agent, company, or airline. In these conversations, they promise to re-book your flight or refund your trip and just need some information. This includes your identifying information and credit card.

Online shopping fraud is another insidious one in today’s landscape. In this fraud, fraudsters set up a website purporting to sell numerous goods. These are often health-related items.

When you check out with your items, the fraudsters receive your personal information along with whatever you have paid. With e-commerce booming due to quarantines and shelter-in-place orders, fraudsters are raking in with this type of fraud. It is the second-most common type of fraud with around 4,300 attempts.

Mobile text message is the third-leading type of fraud with 1,500 attempts. In this fraud, fraudsters send a message to your mobile phone. Often, this message is coronavirus-related.

An example of fraud through a text message is a message stating there is someone in your neighborhood that has tested positive for COVID-19. If you click on the message, it will take you to a page where you can find out who has contracted it. These messages take advantage of people’s fear of the virus and people wanting as much information as possible.

Health care fraud is the fourth-leading type of fraud. There are many different types of fraud here and we have covered a few in the preceding sections. One of those examples is the door-to-door health salesperson selling test kits.

Another is a fraudster calling a victim’s phone and telling them they have found a cure or vaccine for COVID-19. Another might be considered unlawful hoarding and price gouging.

Unlawful hoarding and price gouging is when individuals hoard medical supplies and sell the supplies at extremely high markups.

The FTC has recorded 851 fraud attempts in the category of health care fraud. The last type of fraud listed is internet information services fraud. In this type of fraud, fraudsters may send you an email looking for your personal information.

This is similar to a phishing attack. In other instances, fraudsters try to persuade a victim to download something onto their computer. This causes the computer to lock. Then, the fraudsters demand ransom so that you can unlock your computer. There are many more types of fraud in this category.

What is interesting is that IIS frauds are actually the third-most-costly fraud out of the five. Over $400,000 has been lost in IIS frauds compared to just $92,000 for health care frauds and $170,000 for mobile text message fraud.

Travel or vacation fraud is by far the costliest fraud with nearly $10.7 million lost. Online shopping frauds are a distant second with around $2.7 million lost.

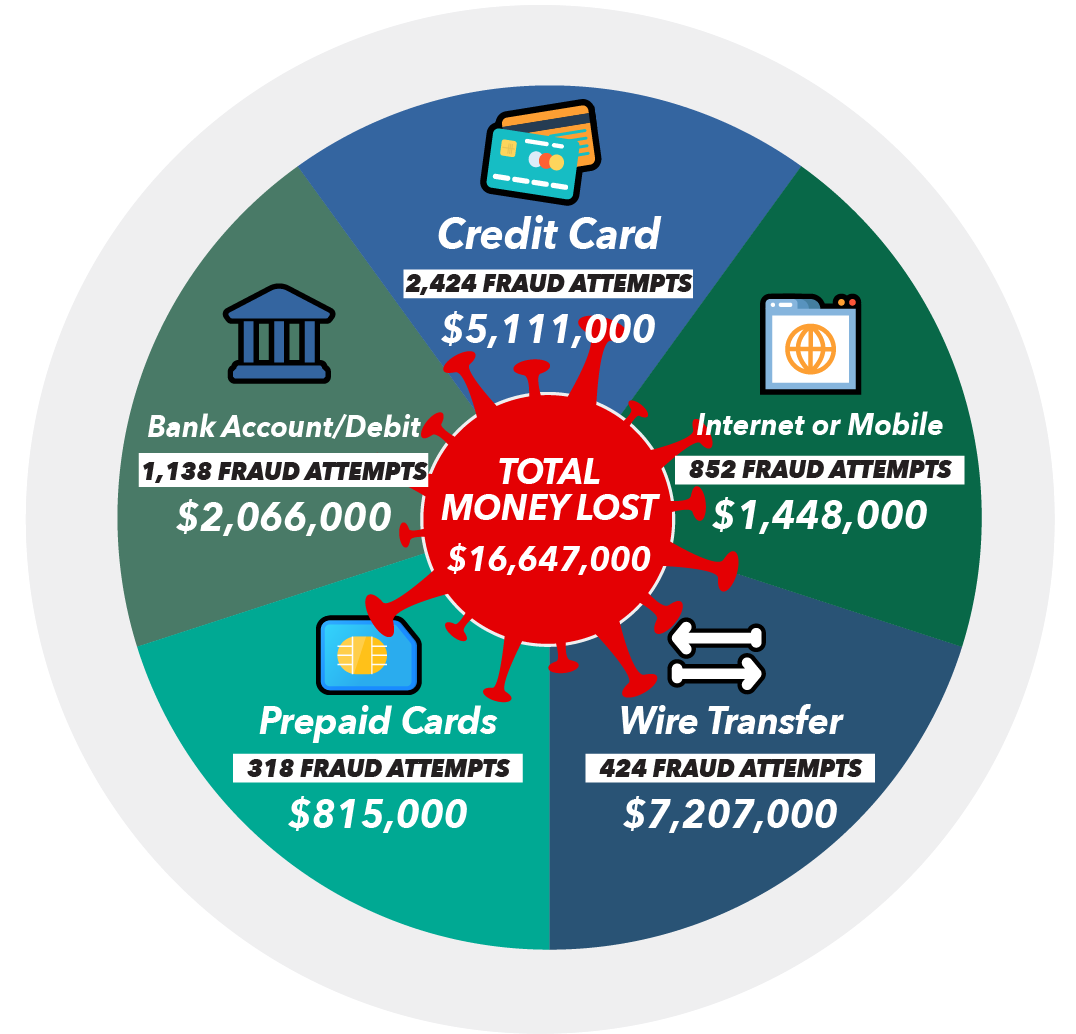

Money Lost by Payment Methods During COVID-19 Pandemic

We’ve seen that fraudsters dupe people in a variety of ways. To go along with those ways, fraudsters pick and choose which methods to finish the fraud—the mode in which they’ll steal money from you. For the coronavirus pandemic, the FTC created the top five modes that fraudsters steal money from you.

This data covers the time period from the beginning of January until May 10. The most often used method is credit cards. Fraudsters have used a victim’s credit card over 2,400 times to steal money from them. This, surprisingly, isn’t the costliest mode at a little over $5 million stolen.

Fraudsters use bank accounts or debit cards second-most to steal money. During the pandemic, they have used this method more than 1,100 times. The total money stolen? $2 million.

The third most is the internet or mobile. At 850 attempts, fraudsters have used this mode much less than the previous two modes. With $1.4 million stolen, the money fraudsters have stolen from this mode reflect that reduced usage.

The fourth-most used is wire transfer. Although fraudsters have used this method just 400 times, the amount stolen is much higher than all four other categories at $7.2 million.

The fifth-most used is prepaid cards. There are anecdotal stories of fraudsters using this last method to steal even tens of thousands of dollars. Here, fraudsters have used it around 300 times for $815,000 stolen.

It appears that while credit card fraud is the most-often used, wire transfers are the costliest. A factor playing into this is that a wire transfer can be for an infinite amount of money and is done once and relatively quickly.

Credit card fraud, on the other hand, needs first the credit card stolen and then purchases are racked up quickly. There is oversight from the credit card company as well.

All of these modes combine for $16.6 million stolen. And that’s just the number that is reported. The number may be much higher with some people not reporting to the FTC. That number might either be high or low depending on how many people have been targeted as well.

A complaint with the FTC doesn’t necessarily mean fraudsters have succeeded. One aspect of all of this is certain. The coronavirus pandemic has provided an environment conducive to fraudsters.

How to Spot and Avoid Fraud Year Round

When dealing with an uncertain time period like the COVID-19 pandemic, it’s easy to fall prey to scams and frauds. However, there are steps we can all take to fight off the scammers and fraudsters. The following list is not exhaustive and contains contributions to fighting fraud from the AARP.

Freeze your credit. If you feel like a fraudster has your credit card or personal information, freezing your credit is a counteraction you can take. By freezing your credit, you prevent a fraudster from opening new accounts in your name. This renders their information on you worthless. You need to call all three major credit monitoring agencies to do this.

Stop giving away your Social Security number. While there are some businesses that need your Social Security number, most don’t. These include doctor’s offices, dentists, and other organizations. The Social Security Administration and Medicare will never call asking for your Social Security number as well. These may be imposter frauds.

Don’t answer calls from numbers you don’t recognize. It seemed there was a time when we’d answer a call from any number. Now, it seems that time has faded. Scammers and fraudsters may find your number and call it directly. Taking advantage of your uncertainty as to who is calling, they will spin a scam in their favor.

Add your number to the Do-Not-Call registry. The DNC registry with the FTC is a list from 2003 that bans telemarketers from calling your number. Although it is not perfect, it can reduce the number of marketing calls to your phone. This might make it easier to spot scammers as well. If you’re not receiving numbers from telemarketers, any person calling to sell something might be an immediate red flag.

Watch out for the fear-based scam. In these, fraudsters say they have your personal data and perhaps your browsing history. They may blackmail you into keeping this information private, which many do due to embarrassment. Reporting to the FTC or your state fraud bureau may be the best solution in these situations.

Along with the fear-based scam, watch out for the recovery scam. In this case, fraudsters will contact you, attempting to help you recover from a scam. Like with other scams, they may appear legitimate. Again, they want your personal information or for you to send an upfront fee for their help. Often, the same fraudsters who ripped you off in the first place will be the ones attempting the recovery scam.

Ways to Prevent Falling Victim to COVID Fraud

There are some specific ways to prevent fraud during the coronavirus pandemic as well.

Keep informed through legitimate news sources. Then, you’ll know progress about any medicine to treat COVID-19, any vaccine, or the distribution of any test kits. This will reduce the fraudster’s attempts to sell you any of those things. This, even if they sound convincing or say they are from a legitimate organization.

Ignore any email that promises you something very large and important for very little of your time and effort. An example of this is an investment fraud that requires just a small upfront cost with promises of a large, quick return. Many fraudsters make up companies and cite progress with a drug that’ll cure COVID-19. This drug will raise the stock price of the company quickly and you need to invest right now to take advantage.

Beware any person going door to door to sell health products, including test kits. As of now in the United States, test kits are available, but you need a prescription or note from your doctor. The selling of test kits directly to customers is, at this point, something that is not happening. These are fraudsters and scammers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Complete Rankings of All States for Coronavirus Fraud

The following list contains all 50 states and the District of Columbia ranked using our criteria in the 11 worst states for coronavirus fraud ranking. There are five columns: rank, state, population, number of complaints, and number of complaints per 100,000 persons. The number of complaints is a combination of fraud attempts, identity theft attempts, and do-not-call scams.

Federal Trade Commission Coronavirus Complaints All States

| Rank | States | Population | # of Complaints | Complaints per 100,000 Residents |

|---|---|---|---|---|

| 1 | Massachusetts | 6,902,149 | 1,613 | 23.4 |

| 2 | District of Columbia | 702,455 | 161 | 22.9 |

| 3 | Nevada | 3,034,392 | 463 | 15.3 |

| 4 | Delaware | 967,171 | 136 | 14.1 |

| 5 | Wisconsin | 5,813,568 | 795 | 13.7 |

| 6 | Rhode Island | 1,057,315 | 144 | 13.6 |

| 7 | Oregon | 4,190,713 | 568 | 13.6 |

| 8 | New Jersey | 8,908,520 | 1,207 | 13.5 |

| 9 | Florida | 21,299,325 | 2,827 | 13.3 |

| 10 | Maryland | 6,042,718 | 762 | 12.6 |

| 11 | New York | 19,542,209 | 2,460 | 12.6 |

| 12 | New Hampshire | 1,356,458 | 168 | 12.4 |

| 13 | Georgia | 10,519,475 | 1,224 | 11.6 |

| 14 | Colorado | 5,695,564 | 660 | 11.6 |

| 15 | California | 39,557,045 | 4,500 | 11.4 |

| 16 | Washington | 7,535,591 | 829 | 11.0 |

| 17 | Connecticut | 3,572,665 | 393 | 11.0 |

| 18 | Virginia | 8,517,685 | 877 | 10.3 |

| 19 | Maine | 1,338,404 | 135 | 10.1 |

| 20 | Hawaii | 1,420,491 | 143 | 10.1 |

| 21 | Arizona | 7,171,646 | 713 | 9.9 |

| 22 | Illinois | 12,741,080 | 1,224 | 9.6 |

| 23 | Pennsylvania | 12,807,060 | 1,209 | 9.4 |

| 24 | Vermont | 626,299 | 57 | 9.1 |

| 25 | North Carolina | 10,383,620 | 940 | 9.1 |

| 26 | Texas | 28,701,845 | 2,505 | 8.7 |

| 27 | Utah | 3,161,105 | 272 | 8.6 |

| 28 | Ohio | 11,689,442 | 1,000 | 8.6 |

| 29 | South Carolina | 5,084,127 | 433 | 8.5 |

| 30 | Michigan | 9,995,915 | 846 | 8.5 |

| 31 | Kentucky | 4,468,402 | 363 | 8.1 |

| 32 | Idaho | 1,754,208 | 142 | 8.1 |

| 33 | New Mexico | 2,095,428 | 169 | 8.1 |

| 34 | Missouri | 6,126,452 | 487 | 7.9 |

| 35 | Minnesota | 5,611,179 | 440 | 7.8 |

| 36 | Tennessee | 6,770,010 | 505 | 7.5 |

| 37 | Wyoming | 577,737 | 43 | 7.4 |

| 38 | West Virginia | 1,805,832 | 134 | 7.4 |

| 39 | Louisiana | 4,659,978 | 342 | 7.3 |

| 40 | Indiana | 6,691,878 | 473 | 7.1 |

| 41 | Montana | 1,062,305 | 74 | 7.0 |

| 42 | Arkansas | 3,013,825 | 205 | 6.8 |

| 43 | Alabama | 4,887,871 | 331 | 6.8 |

| 44 | Oklahoma | 3,943,079 | 262 | 6.6 |

| 45 | Nebraska | 1,929,268 | 126 | 6.5 |

| 46 | Mississippi | 2,986,530 | 189 | 6.3 |

| 47 | Iowa | 3,156,145 | 187 | 5.9 |

| 48 | Kansas | 2,911,510 | 169 | 5.8 |

| 49 | Alaska | 737,438 | 40 | 5.4 |

| 50 | South Dakota | 882,235 | 41 | 4.6 |

| 51 | North Dakota | 760,077 | 24 | 3.2 |

The results for all states are varied. Some states have up to 23 complaints per person. Some states have as low as three complaints per person. The 10 states on the higher end are more likely to be dense and urban. Five of those states are in the northeast. The 10 states on the lower end are more likely to be rural and sparsely populated. Five of those states are in the Midwest.

The state with the highest number of complaints is California with 4,500. The state with the lowest is North Dakota with 24.

A Warning from Experts about COVID-19 Fraud

We’ve covered the 11 worst states for coronavirus fraud. Then, we outlined different types of fraud and what frauds look like during the COVID-19 pandemic. Lastly, we shared about money lost from these frauds. But, still, we wanted more commentary on frauds and scams during the coronavirus era.

For that, we turned to experts from all over the country. The answers cover everything from different types of COVID-19 frauds to the psychological tricks scammers use to steal your money, as well as how you can protect yourself when a fraudster or scammer tries to steal your money.

“I am one of the country’s leading experts in scams, identity theft, and cybersecurity, and I am a lawyer who teaches white collar crime at Bentley University. I also am an author of 10 books including the award-winning ‘Truth About Avoiding Scams’ and ‘Identity Theft Alert.’

Coronavirus scams have become so prevalent, I now have a special section on my scam blog devoted solely to COVID-19 scams. On my blog, I warn people of these scams and describe 40 COVID-specific scams in detail.

Scammers have a knowledge of psychology that Freud would have envied, and they are able to take advantage of all of our emotions. Many coronavirus-related scams relate to fear and greed.

Scams involving luring people into investing in companies with purported cures or treatments for the coronavirus are quite prevalent. Many other scams involve emails or text messages luring people into clicking on links that purport to provide critical information about COVID-19, but in truth only download malware or lure people into providing personal information that will be used to make them victims of identity theft.

Scams related to the CARES Act stimulus checks are also rampant. All demographic groups are susceptible to coronavirus scams just as everyone is affected by the pandemic.

Sadly, you can’t trust anyone. The best thing anyone can do to avoid many of these scams is to avoid clicking on links or downloading attachments unless you have absolutely verified that the communications bringing these links and attachments are legitimate. Also, limit the information you access in regard to COVID-19 to reputable sources.”

His site is dedicated to educating people on scams and identity theft schemes.

“The best way to protect yourself from scams is by never giving out your information over the phone or email, under any circumstances, unless you personally initiated contact with a reputable party.

Scam calls and emails can seem legitimate and still be false, so if you’re convinced by one, do some research to find the official support number of the party that’s contacting you, whether it’s a governmental agency or a company you’re familiar with. Then, reach out to that party directly and ask whether that contact was legitimate.

The past few months have been ripe for pandemic-related scams because fraudsters like to use fear and anxiety to their advantage.

Even in more normal times, enterprising scammers will contact strangers by phone and weave faux tales about urgent debts that will get the person on the receiving end of the call thrown in jail if they’re not taken care of ASAP.

If you’re not on the up-and-up with modern fraud tactics, it’s easy to see why you might jump into action to avoid punishment. During the COVID-19 pandemic, scammers are preying on fear as they always do. It’s just a fresh type of fear. Some are peddling false COVID-19 miracle cures, while others are pretending to sell low-cost coronavirus tests.

There are plenty of COVID-19 scams that aren’t directly related to this virus itself, however. There have already been numerous reports of incidents where scams have requested personal information via phone or email to help the victim get his or her stimulus check, for example.

Another common form of fraud is the charity scam, where fake charities—egregious as it may sound—contact victims to solicit donations. Fraud is often aimed at older demographics who may not be as familiar with modern scam tactics.”

Credit Card Insider covers debt repayment tactics, identity theft prevention, and more.

“People will be likely to fall for fraud at these strange times because we are quite simply over-intaking information and have become desensitized to what is in front of us.

It’s no surprise that all of our screen time is up and while we may be more tech-savvy, we are developing a sense of belief that all companies are doing the right thing to help people in these times.

This makes us lazy with how much effort we are putting into fact-checking and researching. During this time, age and gender won’t really have an effect on the type of people falling for these scams.

Rather, it will be based more on current situations. Many people are losing jobs and money, and an offer which would perhaps offer you ‘one upfront cost and no money to pay for the first year’ could prove to be irresistible for people, and they will go ahead before checking further.

The best advice I can give people is to take their time with these things. Do your research and make sure what is being offered is legitimate. Perhaps get someone else to check over the offer, deal, or message, too. It is not uncommon for people to will themselves to believe something, especially when they are feeling desperate.

Times are tough, but getting this wrong will only make it tougher for you. Even if companies, insurance, and/or the legal system is able to help you, you could be seeing a prolonged amount of time before seeing that money again.”

His company gives car repair lessons and reviews auto parts and products.

“Unfortunately, online fraud has become far too prevalent, and most people have already encountered some form of it. Fraudsters are creative and innovative, resulting in a wide range of scams that are too numerous to list. Examples include tech support fraud, romance scams, crowdfunding scams, phishing, cryptojacking, charitable donation fraud, and even COVID-19 testing scams.

In nearly every instance of fraud, fraudsters are seeking either money or personal information. You should automatically be on your guard when either one is being sought.

In many cases, scammers will pose as someone you trust, whether that be a family member, your bank, a government official, or a company you purchase products or services from. If you get a strange and unexpected request from someone like that, don’t give out personal information or send money.

Contact that person or company directly to see if that’s where the request is actually coming from. (Also, don’t assume your caller ID is accurate—con artists have access to technology that can help them misidentify themselves.)

If you’re feeling pressured to make a decision in a hurry, that is also a red flag. Scammers want to pressure you into acting quickly. If you are feeling pressured, slow things down. Look the company up online to see what you learn.

If nothing else, talk to a friend or family member to gain their perspective. The more time you take to think something through, the more likely it is that you’ll be able to spot problems with what you’re being told.

When you do make payments, you are often better off using a credit card, which often has fraud protection features. A legitimate company or government agency will not require you to do things like wire money or use a gift card for payment.

Finally, you can sign up for free scam alerts at ftc.gov/scams. And, if you think you are the victim of online fraud or identity theft, you should consider contacting an attorney to protect your rights and help you sort through any problems resulting from the scam.”

He is a cybersecurity specialist and an expert in blockchain, cryptocurrency law, and SEC regulations.

Bottom Line: With Proper Education, You Can Avoid COVID Fraud

The coronavirus pandemic has changed our lives. It has turned the world into an uncertain place where real fears play out every day in our communities and the news. The COVID-19 pandemic has decreased our mobility, hurt major industries, and cost Americans millions of jobs.

Tumultuous and uncertain times provide a breeding ground for fraudsters and scammers. It’s not just in our list of the 11 worst states for coronavirus fraud. It’s all around the country. Playing off fear and desperation, these fraudsters and scammers concoct impossible to believe stories or fear tactics.

They do this all to steal your personal information and money. It seems cheap to use these tactics while people are scrambling. But fraudsters and scammers take advantage of people in vulnerable positions.

The techniques they use during normal times are some of the ones used during this pandemic. They act as imposters, sell health products, or promise get-rich-quick schemes. However, the subject matter in these times is much different.

Whether it’s fake testing kits or stealing your stimulus check, the fraudsters are taking advantage of this pandemic and the world it has created.

You can protect yourself through numerous means. Never give out your personal information to someone you don’t know. Especially don’t do so over the phone. Don’t download attachments from a person you don’t know or hand over credit card information through email or over the phone. Verify each website or email for authenticity. Generally, fraudsters and scammers will miss something, even if it’s just a small detail.

For more information about how COVID-19 has affected our society, check out this article about COVID-19 and mobility during stay-at-home orders.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Methodology: Finding the Worst States for Coronavirus Fraud

For this study, we looked at two main sources of data. Those were the complaint index from the Federal Trade Commission (FTC) complaint index and state population statistics from the U.S. Census Bureau. We researched both sets of statistics on May 11, 2020. While the U.S. Census Bureau’s state population data remains fixed, the FTC data is updated daily to reflect the previous day’s complaints.

This meant that May 11’s data was from the beginning of January until May 10. The FTC complaint index provided us data broken down in numerous ways. It gave us the fraud attempts, identity theft attempts, and do not call scams for each state and the District of Columbia.

We additionally took complaints organized by age group targeted, fraud products sold, and payment mode. In each category, we analyzed the money lost for each subgroup.

From the U.S. Census Bureau’s state population statistics, we analyzed all 50 states according to population and number of complaints. The top 11 were organized in the ranking at the start of this article.

We hope you enjoyed this article on the 11 worst states for coronavirus fraud and are now more informed about fraud during the COVID-19 pandemic.

We know that the coronavirus pandemic is a difficult time and saving money is at a premium. Lowering your auto insurance rate can help and one of the best ways to do that is to compare rates from different companies.

Plug in your ZIP code into our free online quote generator to find the best auto insurance rates in your area based on your demographics.

Frequently Asked Questions

Who is at risk for coronavirus?

Everyone is at risk of contracting the novel coronavirus. However, two groups are at more risk than others. One of those groups is the elderly or people age 60 or older and the other is people with compromised immune systems. Both of these groups are more at risk of dying from COVID-19.

To combat this, some supermarkets have designated shopping times for the elderly. Various health organizations have asked people with compromised immune systems to be extremely cautious of prevention tips like social distancing.

Can someone who died from coronavirus be buried?

Someone who has died from coronavirus can be buried. There is no known specific harm in this practice. Someone who has died from COVID-19 can also be cremated. Whether a family can choose between one or another depends on national, state, or local regulations governing these practices.

Is a headache a symptom of COVID-19?

If a person is infected with coronavirus disease, they may experience a number of health effects. The three most common are fever, dry cough, and headache. The COVID-19 disease may cause other pneumonia-like symptoms, including shortening of breath. The shortening of breath is a particularly dangerous sign and anyone experiencing such should seek immediate medical attention.

What is the mortality rate of COVID-19 versus influenza?

The mortality rate for COVID-19 is presumed to be much higher than for influenza, though a total breakdown of statistics won’t occur until the pandemic is over. The mortality rate for COVID-19 is between 3-4 percent, whereas it is consistently below 1 percent for influenza. A great deal depends on the state of medical care in a particular country, state, or local municipality.

Are masks effective against the coronavirus?

The international health community and governments across the world have been debating the efficacy of wearing a mask to stop transmission of COVID-19. Research studies have turned up different conclusions.

Some researchers have stated they hold no use in prohibiting the spread of COVID-19. Others say they could reduce it, at least by a little. For further guidelines, look to your national, state, and local regulations. Each might have different policies for wearing one in public.

Can antibiotics treat COVID-19?

No, they do not. The reason is that the coronavirus is a virus, whereas antibiotics treat bacterial infections. As of now, there are very few options for treating someone with coronavirus. Governments and researchers are rushing to find a medicine that will fight the virus. The medicines researchers are testing include drugs used to fight other major viruses like Ebola and basic vitamins like Vitamin C.

Can COVID-19 spread through food?

There is no evidence that COVID-19 can spread through food. Although coronavirus might find its way onto the surface of food, proper hygiene and food preparation habits should get rid of it. Washing hands, washing food, cooking food to a high enough temperature should all rid the food of the coronavirus.

What is the recovery time for COVID-19?

The recovery time for COVID-19 depends a great deal on the severity of the case. At the moment, the average recovery time for patients with mild cases is about two weeks. For patients with more severe cases of COVID-19, the recovery time might be between three and six weeks.

How bad is COVID-19?

COVID-19 can range from mild to no symptoms all the way to hospitalization and death. It affects the elderly more severely with younger people, in general, spared from the worse symptoms.

Can you get COVID-19 from kissing?

Yes, any type of sexual activity or proximity to other people can expose you to the virus. That’s why it’s recommended that people stay six feet apart in public and if you’re going to engage in sexual activity, to make sure you and the other person (persons) are virus-free.

Can I recover at home from COVID-19?

Yes, you can recover at home if you have COVID-19. In fact, it’s recommended.

What are some emergency warning signs for COVID-19?

COVID-19 is a respiratory illness caused by the SARS-CoV-2 virus that spreads mainly through respiratory droplets when an infected person talks, coughs, or sneezes. While some people may not show any symptoms, others may experience a range of symptoms that can vary in severity. Some warning signs of COVID-19 are:

- Headache: This can range from mild to severe and is often accompanied by other symptoms like fever and body aches. Headaches are not uncommon with respiratory illnesses and can also be a sign of dehydration or stress.

- Fever: A fever is a common symptom of COVID-19, and it is often one of the first signs of infection. A fever is when the body temperature rises above normal (98.6°F or 37°C). It’s important to note that not everyone with COVID-19 will have a fever, and some people may have a fever without any other symptoms.

- Body aches: Muscle or body aches can also be a symptom of COVID-19. These aches can be mild to severe and can affect any part of the body. They are often accompanied by other symptoms like fever and headache.

- Flu-like symptoms: Other flu-like symptoms may include cough, sore throat, fatigue, and congestion or runny nose. These symptoms can range from mild to severe and can be similar to those of the seasonal flu.

It’s important to note that these symptoms can also be caused by other illnesses, so it’s important to consult a healthcare professional if you are experiencing any of these symptoms or have been in close contact with someone who has tested positive for COVID-19. Additionally, some people with COVID-19 may not experience any symptoms at all, but can still spread the virus to others.

Does cooking meat kill the coronavirus?

Cooking meat at a high temperature is a common method of preparing meat that is effective in reducing the risk of foodborne illness caused by harmful bacteria and germs. When meat is exposed to high heat, such as through grilling, baking, or frying, the high temperature can destroy most of the bacteria and germs present on the meat’s surface or inside the meat.

What can COVID-19 do to your lungs?

COVID-19 attacks the lungs and can eventually shut them down, causing death or the use of a ventilator.

Who is at risk for severe COVID-19?

The older the person, the more likely they will have a severe case of COVID-19. Other risk factors are conditions that cause difficulty in lung function (asthma, smoking, etc), may also influence a person to have a severe case of the coronavirus.

Can COVID-19 spread through bodies of water?

No, COVID-19 does not spread through bodies of water. It can spread through people who are in close proximity, however, meaning multiple people who swimming or are involved in another activity in water can spread the disease.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.