Best Colorado Car Insurance (2026)

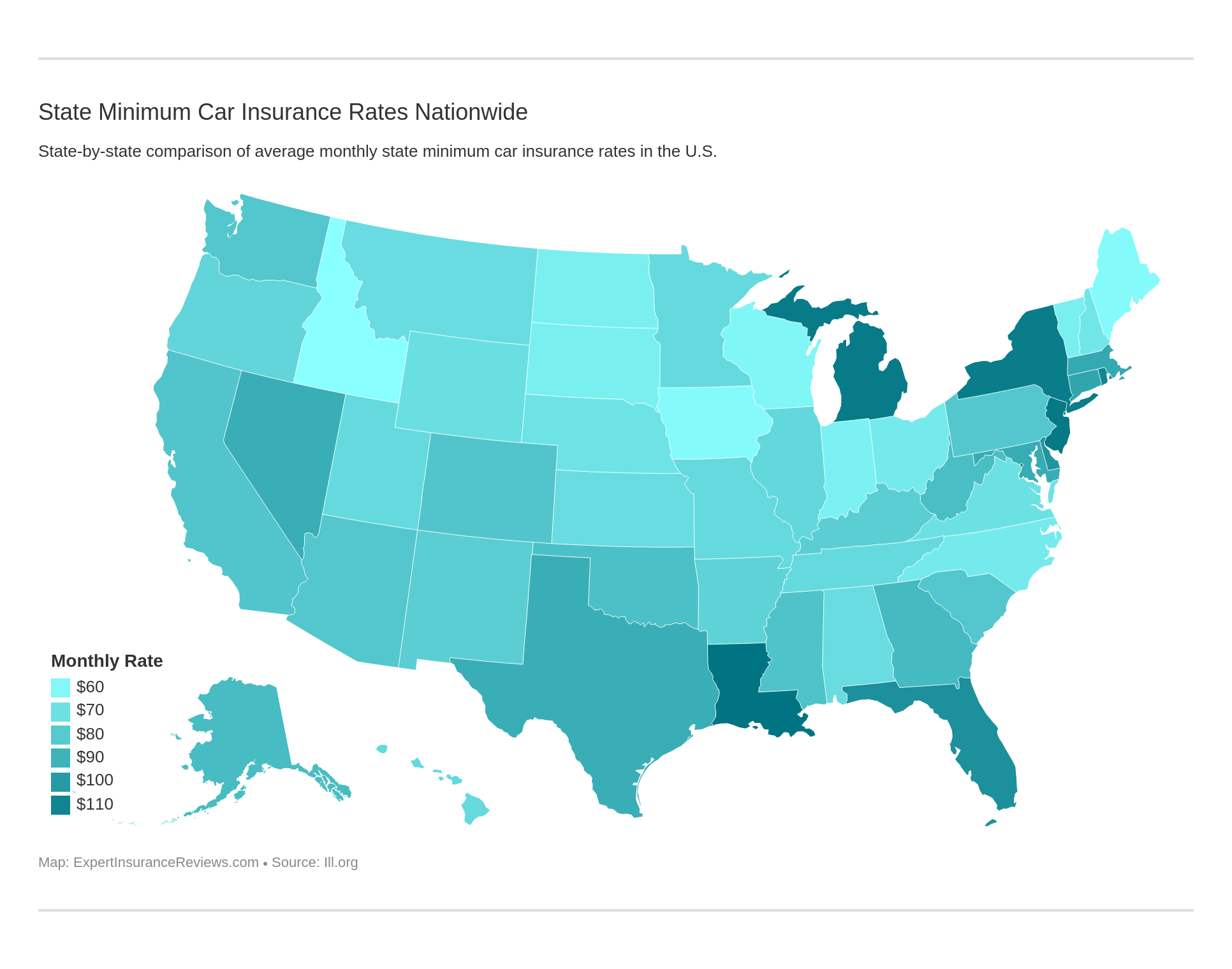

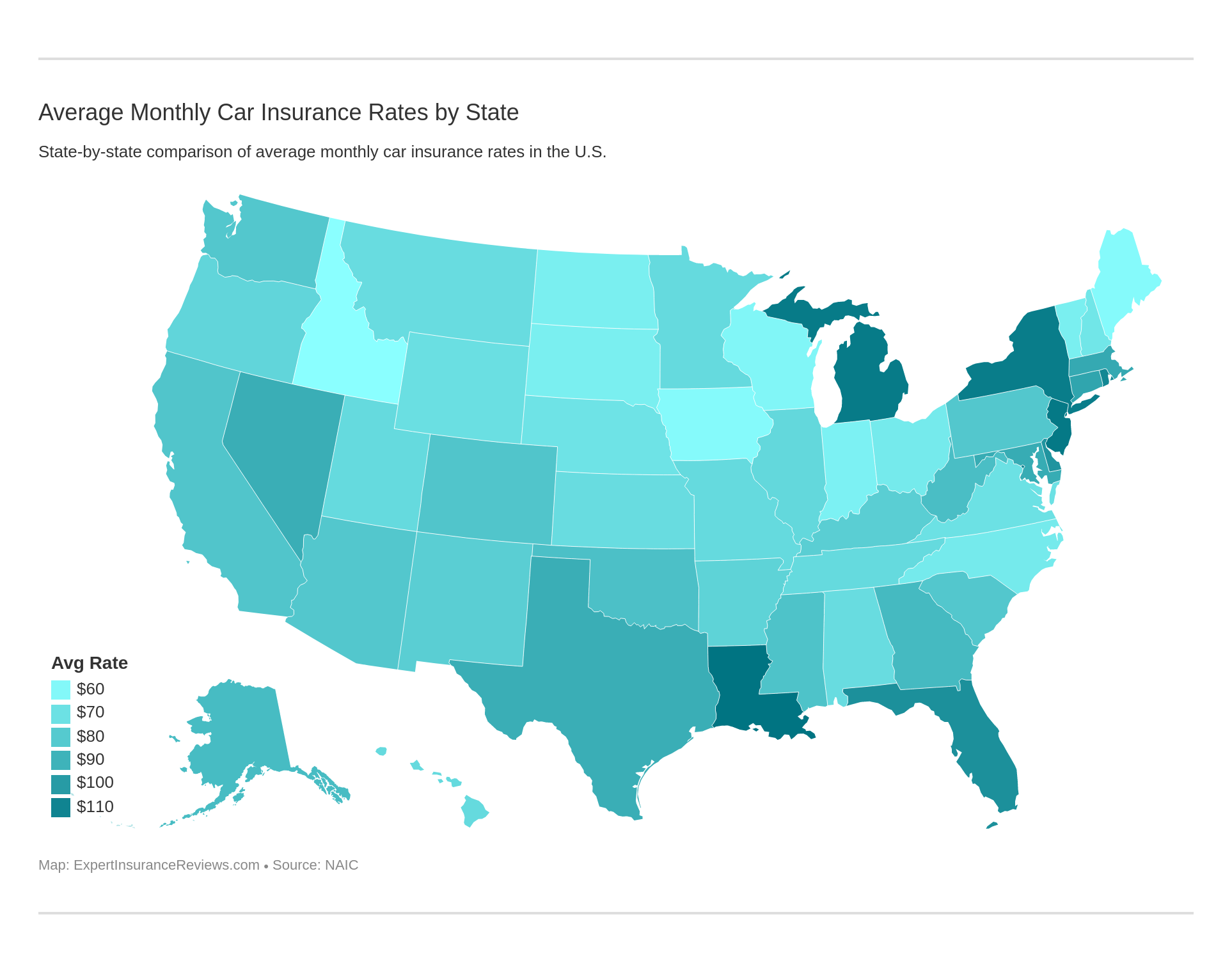

Minimum car insurance in Colorado averages $60 per month, which is close to what Americans typically pay. However, full coverage Colorado car insurance rates average $168, which is much higher. The best Colorado car insurance companies for affordable rates are usually State Farm and Geico.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shawn Laib

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Insurance and Finance Writer

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Colorado Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 88,740 Vehicle Miles Driven: 504.37 Billion |

| Vehicles | Registered: 4,813,966 Stolen: 16,000 |

| State Population | 5,695,564 |

| Most Popular Vehicle | Subaru Outback |

| Uninsured Motorists | 13.3% State Rank: 19 |

| Total Driving Fatalities | 2008-2017 Speeding: 1867 Drunk Driving: 1537 |

| Annual Average Premiums | Collision: $263.36 Comprehensive: $158.34 Liability: $477.10 |

| Cheapest Providers | GEICO Casualty & Safeco Ins Co of America |

- Colorado car insurance rates match the national average for minimum insurance policies but is one of the pricier states for full coverage

- Some of the cheapest Colorado car insurance companies include State Farm, Geico, and Auto-Owners

- To find the best Colorado car insurance rates, drivers should compare quotes, look for discounts, and pick the right amount of coverage

Colorado car insurance rates depend on a variety of factors, one of the most important of which is how much coverage you need. Minimum car insurance in Colorado tends to match the national average, while full coverage rates are on the higher end of the scale.

Regardless of how much coverage you want, finding affordable Colorado car insurance doesn’t have to be difficult. There are plenty of Colorado car insurance companies that can help you find the best coverage at a price that fits your budget.

Read on to learn more about Colorado auto insurance and which companies might have the lowest rates for you. Then, compare quotes and coverage options to find the best Colorado car insurance.

Colorado Car Insurance Coverage and Rates

Getting started on figuring out the best coverage mix and affordable rates for your needs can be overwhelming. Everyone seems to be trying to sell you on their coverage. If you listen to commercials, every car insurance company has the best coverage for the best rates. And for different needs, each car insurance company may be the best fit.

But how do you figure out the best coverage, rates, and insurance provider for you and your life?

To help your journey to the right coverage at the right rates, we’ve looked at relevant laws and data for car insurance coverage, the factors providers consider when adjusting your rates, rules of the road to keep you safe and keep your rates low, and more.

We’ve brought all the key pieces of this information together and organized them for you right here, so everything you need to know is in one place.

First off, let’s start by discussing price. For many, maybe even you, price is the biggest concern. Can I afford coverage? What do average coverage rates look like?

Where do these rates come from? How do you lower car insurance? These are just a few questions you may be asking yourself. We’ve got you covered. This table looks at average insurance rates for Colorado compared to average rates across the United States.

| Colorado Average | National Average | Percent Difference |

|---|---|---|

| $1,558 | $1,474 | 5.70% |

The national average for car insurance coverage is about $1,474, while Colorado residents pay an average of $1,558 each year for car insurance. This means, unfortunately for Centennial State drivers, that if you live in Colorado, you are paying almost six percent more for car insurance than drivers across the country.

Colorado Minimum Coverage

Despite the fact that 13 percent of drivers in Colorado are uninsured, the state, like most of the country, requires every driver to maintain at least minimum liability insurance coverage in order to legally drive on the road.

Why is this?

Minimum liability coverage ensures every driver has some financial protection both for themselves and other drivers on the road if they are ever in an accident that results in some form of bodily or property damage. While most states have some minimum liability coverage, the threshold amounts vary from state to state.

What does minimum liability coverage look like in Colorado? This table outlines the three different pieces of required minimum liability coverage in the state.

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 |

This is important to note because, since 2003, Colorado has been a “fault” state. This means if you are in a car accident, and it is determined that you are at fault, you are financially responsible for any damages (both to people and to property) that result from the accident.

Before 2003, Colorado was a “no-fault” state, which means drivers had to cover the cost of their own damages (or their insurance coverage had to cover the cost of damages), rather than the at-fault driver’s insurance paying for the cost of any damages.

The change to a “fault” system in 2003 benefits you as the driver because if you are not at fault, your insurance does not have to pay out claims; instead, the at-fault driver’s insurance coverage does.

Minimum coverage costs also vary from state to state.

Forms of Financial Responsibility

To protect yourself and other drivers on the road, proof of financial responsibility is required at all times. What is proof of financial responsibility? It is some form of validated proof that you have the funds, assets, or insurance coverage necessary to pay for any damages you are responsible for in the event that you are found to be at-fault in a car accident.

The primary way to provide this is through proof of insurance. The only other way to legally provide proof of financial responsibility in the Centennial State is to make a cash deposit of $65,000 with the Director of the Department of Revenue (this can be cash or government bonds/notes).

It is required for drivers to keep proof of insurance handy at all times when on the road. If you’re caught unaware and don’t have your physical insurance card in your glove box, Colorado is one of the 48 states in the country that currently accepts electronic copies of insurance when drivers are asked for proof of insurance at a traffic stop.

Premiums as a Percentage of Income

Knowing the average cost of insurance across the state and your minimum insurance requirements is great, but at the end of the day, what does this mean for your wallet? How much of your paycheck do you need to plan to allocate to car insurance coverage in Colorado?

Check out this table to find out how much of their income (in percentages), drivers in Colorado spend on car insurance coverage. You already know that in the dollar amount you will pay more for car insurance than the national average, but how does that translate to the percentage of disposable income?

We also compare the average percentage of disposable income spent on car insurance across the country to the Colorado averages.

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| Colorado Average | 2.13% | 2.16% | 2.15% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | -9% | -11% | -10% |

The good news for Colorado drivers is that despite the fact that average premium rates in the state are higher than the national average, the percent of disposable income spent on car insurance in Colorado is actually lower than the national average. In fact, it is between nine and 11 percent less than the national average.

This ultimately means Colorado residents have higher incomes than the national average and spend proportionally less on insurance coverage.

The national average includes drivers from every state in the country, which, while valuable information, doesn’t help you compare your cost for insurance against similar or nearby states.

To see how Colorado stacks up against its neighbors, we’ve compared the average percent of disposable income for the five closest states: New Mexico, Utah, Wyoming, Kansas, and Nebraska. All this information is in the below table.

| State Average | 2012 | 2013 | 2014 |

|---|---|---|---|

| Wyoming | 1.70% | 1.72% | 1.69% |

| Nebraska | 1.81% | 1.88% | 1.86% |

| Kanses | 1.94% | 1.98% | 2.04% |

| Colorado | 2.13% | 2.16% | 2.15% |

| Utah | 2.52% | 2.55% | 2.54% |

| New Mexico | 2.66% | 2.82% | 2.76% |

As the above table shows, Colorado has higher averages for the amount of disposable income spent on car insurance coverage than three out of its five neighbors. Only Utah and New Mexico have higher averages than Colorado.

Average Monthly Car Insurance Rates in CO (Liability, Collision, Comprehensive)

While minimum liability coverage keeps you legal on the road and provides some financial protection, it does not cover any personal or property damages you experience as a result of an accident. Minimum liability coverage only provides coverage for damages you cause to another driver’s person or property as the result of an accident.

In order for you to ensure you have financial protection for damages you experience, whether they are from an accident, weather, or some other form of damage, you need more than minimum liability coverage.

The additional core coverage options you can consider to begin protecting yourself beyond what is covered by liability insurance are collision, comprehensive, and full/combined.

Watch this video to learn more about these different kinds of protection and what each covers.

These core coverage types, as well as liability coverage, are included in the below table, with their average rates, so you can start to get a better understanding of what different kinds of coverage will buy you and how much you can expect to pay.

| Coverage Type | 2011-2015 Average Cost in Colorado | 2011-2015 National Average | Percent Difference |

|---|---|---|---|

| Liability | $477.10 | $516.39 | -7.61% |

| Collision | $263.36 | $299.73 | -12.13% |

| Comprehensive | $158.34 | $138.87 | 14.02% |

| Full/Combined | $898.79 | $954.99 | -5.88% |

We can use these numbers as a good starting point for considering costs, but they may not be reflective of exactly what you will pay. This is because these rates (from the National Association of Insurance Commissioners [NAIC]) are based on the minimum insurance coverage requirements in Colorado.

Additional Liability

While core coverage offers significantly more financial protection for you than minimum liability coverage alone does, it does not cover everything. Thankfully, you still have more options for coverage, if you feel what you get from core coverage is not sufficient.

What might be some reasons you want additional coverage? You already know 13 percent of drivers on the road in the Centennial State are currently uninsured (which puts Colorado at nineteenth in the nation for uninsured drivers). How can you protect yourself, in case you ever end up in a car accident with one of these drivers?

If this is something you are concerned about, you can opt to add uninsured/underinsured motorist coverage to your policy. This adds financial protection for you, should you find yourself in a car accident with an uninsured driver.

There are two more primary forms of additional liability coverage that you can consider:

- Medical Payments (MedPay) – provides additional medical cost coverage for you and anyone on your policy, beyond what is already covered under your core coverage policy

- Person Injury Protection (PIP) – provides additional medical cost coverage for anyone involved in an accident (regardless of who is at fault), beyond what is already covered under your core coverage policy

These additional liability coverage options are important to be aware of when considering how to build your policy to meet your needs. But just knowing your options is not enough when determining whether or not its a good idea to opt-in to any of these.

You also need to know if your insurance provider will be able to pay out on any claims you file, should you need to do so at some point.

In order to be able to determine whether or not your insurance provider (or an insurance provider you are considering) will be able to pay out on a claim, should you ever need to file one, you will need to look at something called loss ratio.

This data is provided by the NAIC and is generated by comparing the number of claims on which an insurance provider pays out against their premiums.

The key in looking at this loss ratio number is considering whether or not an insurance provider is paying out an acceptable number of claims. But what is a good range?

Ideally, you want to see your insurance provider’s loss ratio in the 60 to 80 percent range. If their loss ratio is above this range, they are likely paying out too many claims and losing money as a result.

If their loss ratio is below this range, they are likely not paying out enough claims (which means should you ever need to file a claim, your chances of a payout are reduced).

The NAIC provides loss ratio data for these additional liability options for the entire insurance market in a given state, not just loss ratio for a specific company.

However, they do not currently provide loss ratio data for PIP coverage in Colorado. The below table provides loss ratio numbers for your other two options, MedPay and Uninsured/Underinsured Motorist coverage.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 100% | 107% | 107% |

| MedPay | 84% | 81% | 78% |

Based on the NAIC data in the above table, the loss ratio for MedPay in Colorado is on the high side, but still within a healthy range.

However, the loss ratio for uninsured/underinsured motorist coverage is too high. For all three years shown, the loss ratio is above 100 percent, meaning insurance companies are losing money because they are paying out too much on claims for this coverage.

Add-ons, Endorsements, and Riders

If you feel you do not have enough coverage with core and additional liability on your policy, there are additional add-ons, endorsements, and riders you can consider. If these seem like they might be a good fit for you, you can speak to your insurance agency to learn more. These options include:

- Guaranteed Auto Protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan

- Personal Umbrella Policy (PUP) – provides protection in the event you are ever faced with a lawsuit as a result of your part in a car accident

- Rental Reimbursement – provides coverage if you have to rent a car if yours is damaged in a car accident and is unavailable to drive while it is being repaired

- Emergency Roadside Assistance – provides coverage for various roadside needs, like a flat tire, towing, etc.

- Mechanical Breakdown Insurance – provides repair coverage, often beyond what is covered by your vehicle’s warranty

- Non-Owner Car Insurance – provides insurance coverage when you don’t own a car

- Modified Car Insurance Coverage – provides coverage for vehicles with special modifications (ex. wheels/tires, specialty paint jobs, spoilers, etc.)

- Classic Car Insurance – provides coverage for vehicles that are considered collector’s items

- Pay-As-You-Drive or Usage-Based Insurance – insurance coverage that is specifically focused on individual driving habits

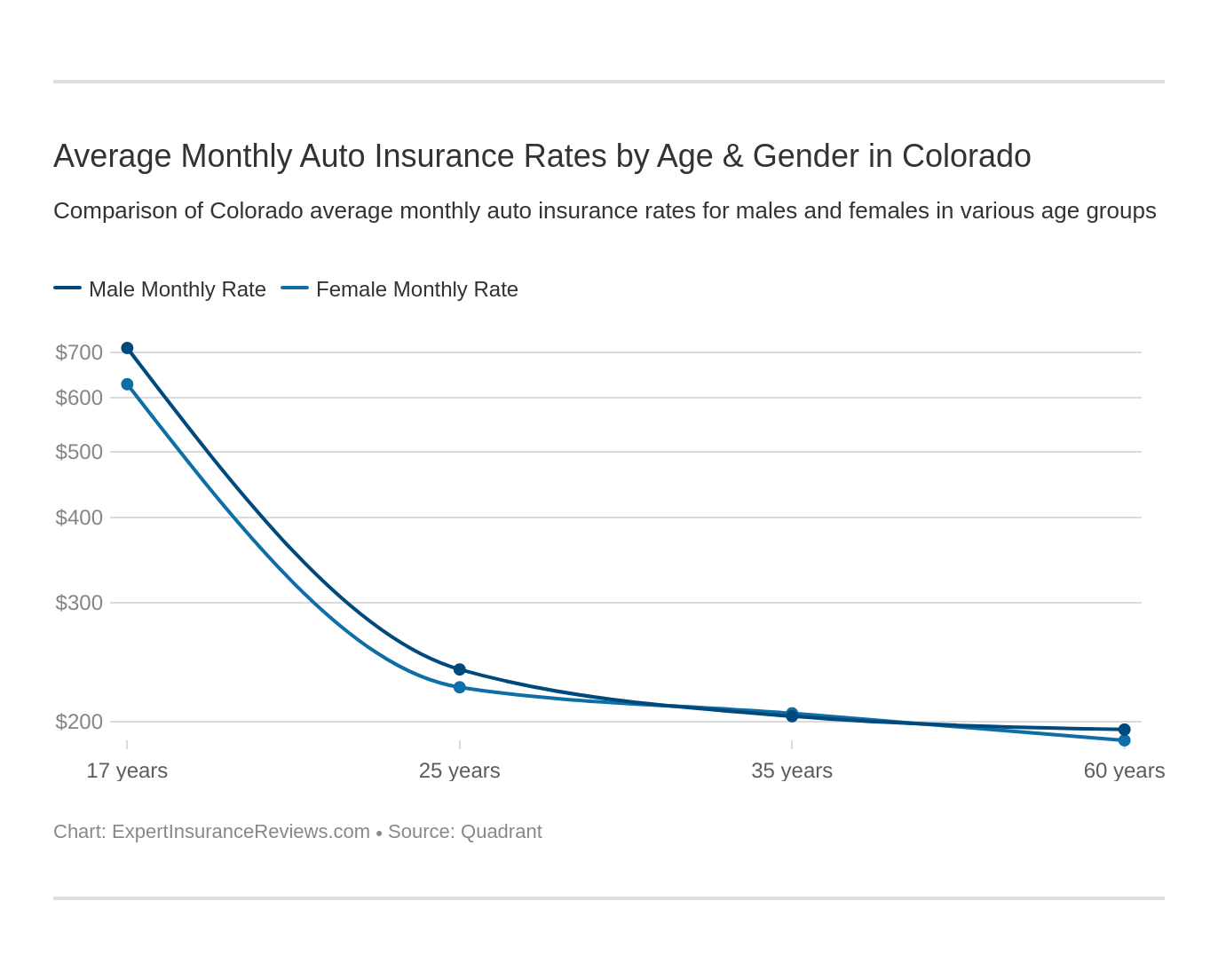

Average Car Insurance Rates by Age & Gender in CO

Car insurance companies look at a variety of factors when adjusting individual premium rates, which means that everyone’s rates vary, based on these factors.

One commonly used factor is gender, though this is gradually changing throughout the country. Currently, California, Hawaii, and a few other states have made it illegal for companies to include gender as a factor when adjusting their rates.

Unlike these states, at this point in time, insurance companies in Colorado can still use gender when adjusting rates. However, this is likely to change in the future, as Colorado has joined California, Washington, and other states in adding the option for drivers in the state to select a third gender option when self-identifying on their driver’s license.

Even if laws in the state do not change, if a significant enough number of residents in the state choose this option, insurance companies will eventually have to reconsider this practice.

Since insurance companies can still use gender as a factor in adjusting insurance rates in Colorado, let’s find out if men actually pay more in car insurance in the state than women do (as is commonly assumed). Check out this table to see how both gender and age can affect insurance rates in the Centennial State.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Safeco Ins Co of America | $5,559.53 | $6,061.99 | - | - | - | - | - | - |

| USAA CIC | $5,582.30 | $6,398.91 | $2,873.09 | $3,130.10 | $2,232.85 | $2,232.55 | $2,126.52 | $2,134.62 |

| State Farm Mutual Auto | $5,901.90 | $7,471.21 | $2,293.13 | $2,717.20 | - | - | - | - |

| GEICO Cas | $6,116.54 | $6,472.19 | - | - | - | $2,140.86 | $2,069.94 | $2,343.70 |

| American Family Mutual | $6,182.18 | $8,292.20 | $2,552.17 | $3,128.70 | $2,552.17 | $2,552.17 | $2,302.28 | $2,302.28 |

| AMCO Insurance | $6,292.06 | $8,057.66 | $2,863.59 | $3,094.73 | $2,490.00 | $2,536.58 | $2,226.47 | $2,354.68 |

| Progressive Direct | $8,765.26 | $9,802.10 | $2,926.11 | $2,846.92 | $2,593.20 | $2,426.75 | $2,250.01 | $2,245.05 |

| Farmers Ins Exchange 2.0 | $11,703.79 | $11,788.62 | $3,401.12 | $3,436.88 | $3,095.55 | $3,068.12 | $2,804.12 | $3,023.70 |

| Allstate F&C | $11,732.84 | $12,322.40 | $3,748.22 | $3,771.84 | $3,397.34 | $3,180.33 | $3,056.13 | $3,088.23 |

While not every insurance company listed has provided data for each of the age and gender variables we’ve examined in the above table, we have enough information to create a clear picture of how both gender and age can affect your insurance rates in Colorado.

Every company is different in how they approach factoring age and gender into their rates. For example, if you are insured by American Family Mutual, if you are a 17-year-old male you (or more likely your parents) can expect to pay 34 percent more in insurance premiums than if you were a 17-year-old female.

However, if Farmers Insurance Exchange 2.0 is your insurance provider, there is less than one percent difference in rates for male versus female 17-year-old drivers.

On average, based on the rates for the different companies listed in the table, 17-year-old male drivers can expect to pay about 13 percent more in insurance premiums than 17-year-old female drivers in Colorado.

By contrast, the difference between male and female drivers’ rates at 25 is about half that, with male drivers paying seven percent more on average.

Interestingly, at 35, married men pay almost 5 percent less for car insurance than married females of the same age pay. Of the companies listed, five of those that have relevant data actually charge married, 35-year-old females more for insurance than they do men of the same age and marital status.

The Quadrant data listed in this table is based on actual, purchased coverage by drivers in Colorado. This data covers a range of drivers and includes high-risk drivers, those who only purchase liability coverage, and drivers with additional coverage included in their policies.

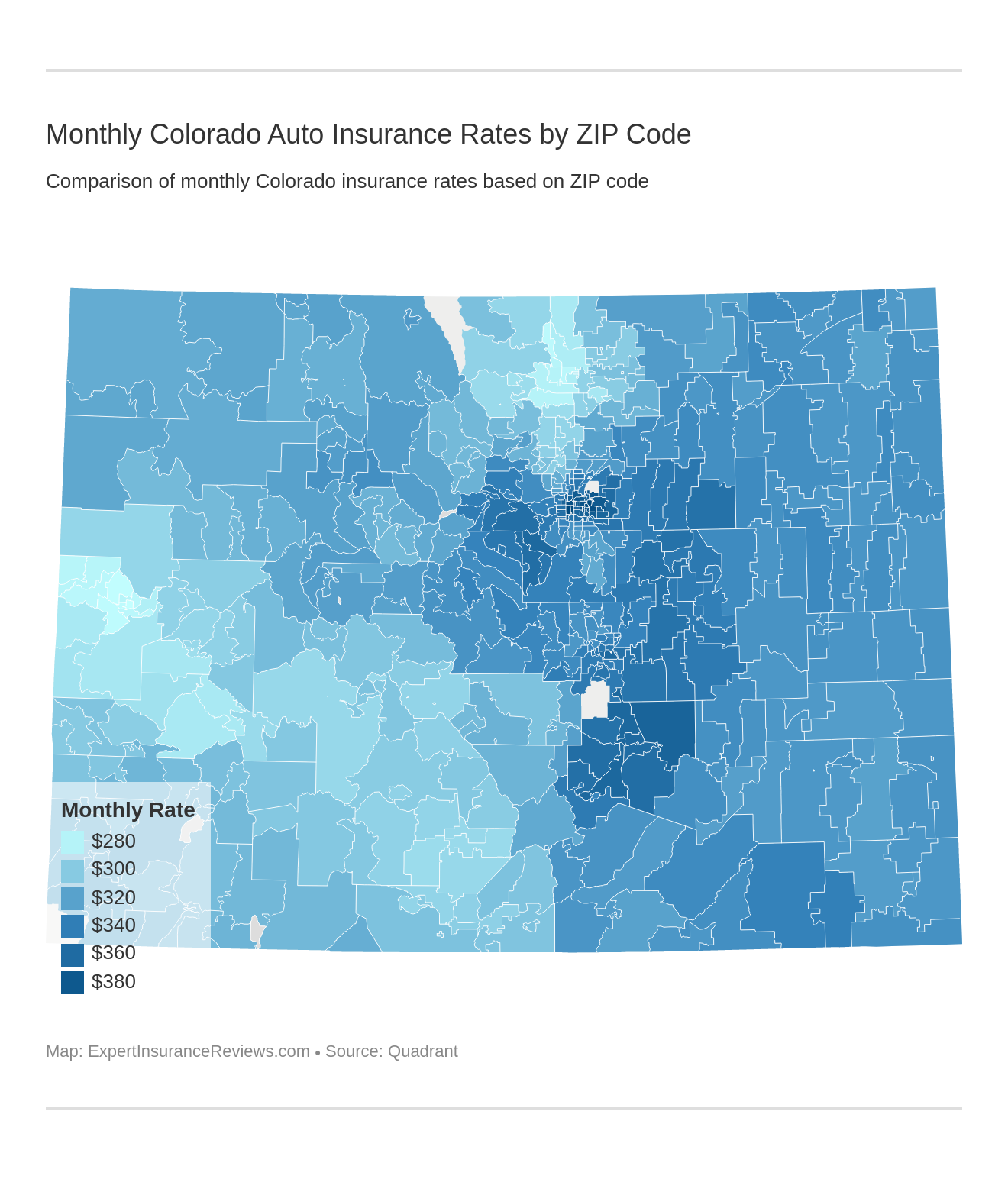

Cheapest Rates by ZIP Code

Not only do car insurance companies look at age and gender as factors when adjusting their rates, they also look at where you live. Ultimately they want to know if the area in which you live might affect the likelihood of you filing a claim.

In order to determine this, car insurance companies look at the crime rates, accident rates, vandalism data, and more for zip codes across the state. What they find can help determine the rate you eventually pay for your coverage.

If you live in the 80027 ZIP code, your average rate is about $3,570.45, while if you live in the 80219 ZIP code, your average rates are $4,762.40. This is a 33 percent increase between the two ZIP codes, in the same city.

Cheapest Rates by City

The average rate for insurance coverage (using the ZIP code data) in the state is $3,892.32. It should come as no surprise that Denver, as the largest city in the state, has the highest average rates for insurance coverage in the state, many of which are quite a bit higher than the state average. The lowest rates in the state can be found in Grand Junction, and are significantly lower than the state average.

We’ve calculated the average rates for the 10 largest cities in the Centennial State. Check out this table to see if your city is in the top 10, and if so, what the average rate is across the entire city.

| Rank (by Population) | City/Town | Annual Average |

|---|---|---|

| 1 | Denver | $4,412.74 |

| 2 | Colorado Springs | $4,101.67 |

| 3 | Aurora | $4,472.46 |

| 4 | Fort Collins | $3,388.15 |

| 5 | Lakewood | - |

| 6 | Thornton | $4,022.41 |

| 7 | Pueblo | $4,329.04 |

| 8 | Arvada | $3,868.20 |

| 9 | Westminster | $4,001.80 |

| 10 | Centennial | - |

These averages were calculated using the ZIP code data from the previous two sections. As you can see, while some of the zip codes in Denver (as we saw in the last section) have the highest average rates, based on city-wide averages, Denver is second to Aurora in terms of highest average rates.

The lowest rates are in Arvada, which is the eighth-largest city/town in Colorado.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Best Colorado Car Insurance Companies

Price is great and is definitely a compelling factor when you are considering which insurance provider is the best fit for you.

However, to make a truly informed decision, you need to look at more than just price. You need to consider whether or not the insurance provider you are looking at is a good company.

What do we mean by good? Here, we are referring to the companies with the best financial ratings (i.e. are they stable) and the best customer service scores. These should both be key pieces in your decision-making process.

But how do you find out whether or not a company has a good financial or customer service rating? There are companies like AM Best and JD Power that study insurance markets and generate data for you.

And lucky for you, we’ve collected the relevant data for Colorado and put it in the following sections so you don’t have to go looking for it yourself.

The Largest Companies Financial Rating

Why does the financial rating of a company matter? Aside from the obvious, that you want to make sure you choose an insurance provider that will likely be around for a while (and does not appear to be headed toward becoming insolvent any time soon), you want to know an insurance company can pay claims.

It is never guaranteed that an insurance provider will payout on a claim you file. However, you can increase your chances of your insurance provider paying out on a claim, should you ever need to file one, if you are confident in the financial status of that company.

As we mentioned, AM Best provides data that can help you make this determination. AM Best is a global credit firm focused specifically on the insurance industry. This means they specialize and truly understand the industry, the companies, and the consumer needs.

In this table, we’ve compiled AM Best financial rating data for companies in Colorado.

| Insurance Company | Rating | Outook |

|---|---|---|

| State Farm Group | A++ | Stable |

| USAA Group | A++ | Stable |

| GEICO | A++ | Stable |

| Progressive Group | A+ | Stable |

| Allstate Insurance Group | A+ | Stable |

| American Family Insurance Group | A | Stable |

| Farmers Insurance Group | NR | - |

| Liberty Mutual Group | A | Stable |

| Travelers Group | A++ | Stable |

| Nationwide Corp Group | A+ | Stable |

AM Best states that any company with a rating of A- or better has a stable financial outlook. Based on that, the data in the above table indicates that residents in Colorado can be confident in the financial stability (and therefore ability to pay claims) of nine of the ten largest insurance providers in the state.

That is not to say Farmers Insurance Group is not financially stable, however; it is simply that AM Best does not provide financial rating data for Farmers.

Companies with Best Ratings

Customer service is another factor to consider when choosing an insurance provider. You want to be confident that the insurance company that owns your insurance policy is willing and available to help you with questions, claims, etc.

Looking at customer service ratings is one way to determine the likelihood of your insurance provider offering solid customer service.

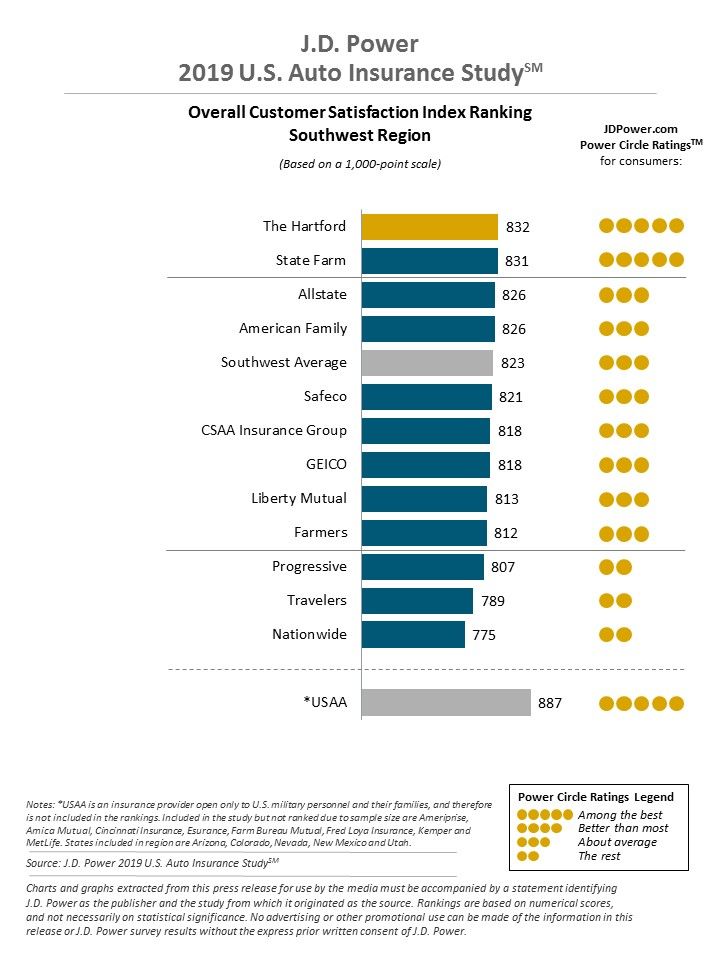

JD Power recently studied customer service satisfaction in the car insurance industry. The result is Customer Satisfaction Index Ratings for regions and states across the country. States with especially large populations (like California) have their own customer satisfaction index rating, while less populated areas are broken up by region.

Colorado falls within the Southwest region for this study, and the customer satisfaction index ratings for the area are below.

The largest company in Colorado, State Farm, which you already know has an A++ financial rating, has an “among the best” customer service rating, with 831 out of 1,000 points. USAA, the second-largest provider in the state, received 887 out of 1,000 points, thereby also receiving an “among the best” rating. Read our State Farm insurance review to learn more.

The remaining eight (of the top 10 providers in Colorado) fall somewhere within the “about average” and “the rest” ratings.

Companies with Most Complaints in Colorado

No matter how high a company’s customer satisfaction rating, they will still likely receive complaints from some of their insureds. The question is whether or not a company receives enough complaints for you to consider this one of the factors when making a decision.

To make sense of complaint data, each company is assigned a complaint ratio that enables you to make an “apples-to-apples” comparison between providers. Take a look at the below table to see the complaint data for the largest providers in the Centennial State.

| Insurance Company | Market Share | Premiums Written | Complaint Ratio |

|---|---|---|---|

| State Farm Group | 19.81% | $906,918 | 0.19 |

| USAA Group | 10.20% | $467,079 | 0.16 |

| GEICO | 9.89% | $452,585 | 0.28 |

| Progressive Group | 9.62% | $440,274 | 0.75 |

| Allstate Insurance Group | 8.49% | $388,445 | 0.34 |

| American Family Insurance Group | 8.41% | $384,892 | 0.3 |

| Farmers Insurance Group | 7.22% | $330,473 | NR |

| Liberty Mutual Group | 6.97% | $319,166 | 0.36 |

| Travelers Group | 2.82% | $129,187 | NR |

| Nationwide Corp Group | 2.00% | $91,547 | 0.17 |

Complaint ratios (in this case from the Colorado Department of Regulatory Agencies) are based on comparing the number of complaints a company receives to the number of premiums they have written. The resulting numbers are then compared to what is considered “average.”

In the above table, the average is represented as one. When a company’s complaint ratio is less than one, it means they receive fewer complaints than the average. By contrast, if a company’s complaint ratio is more than one, it means they receive more complaints than the average.

As you can see, the Colorado Department of Regulatory Agencies complaint data indicates all the companies rated have a below-average number of complaints, which is a good sign.

Progressive has the highest complaint ratio, at 0.75. This is consistent with their JD Power customer satisfaction rating. Recall Progressive was rated at a below-average “the rest” rating, with a total of 807 out of 1,000 points.

USAA and Nationwide, the second and tenth-largest companies in the state respectively, have the lowest complaint ratios. For USAA, this makes sense, as they have the highest customer satisfaction rating in the region, with 887 out of 1,000 points and an “among the best” rating.

Interestingly, however, Nationwide falls within the below-average “the rest” rating, with an even lower score than Progressive a 775 out of 1,000 points.

Please note, in the data provided by the Colorado Department of Regulatory Agencies, if more than one complaint ratio was provided for a company, we took the average and put it in the above table.

If you need to file a complaint, you can do so through the Colorado Department of Regulatory Agencies Division of Insurance. You can use their Consumer Complaint Portal to submit your complaint. If you have questions, you can call and speak to a consumer services analyst at:

- 303-894-7490 (if you live in Denver)

- 1-800-930-3745 (if you live outside Denver)

You can also send them both encrypted and unencrypted email (depending on your needs and how sensitive the information that you are sending is).

Cheapest Companies in Colorado

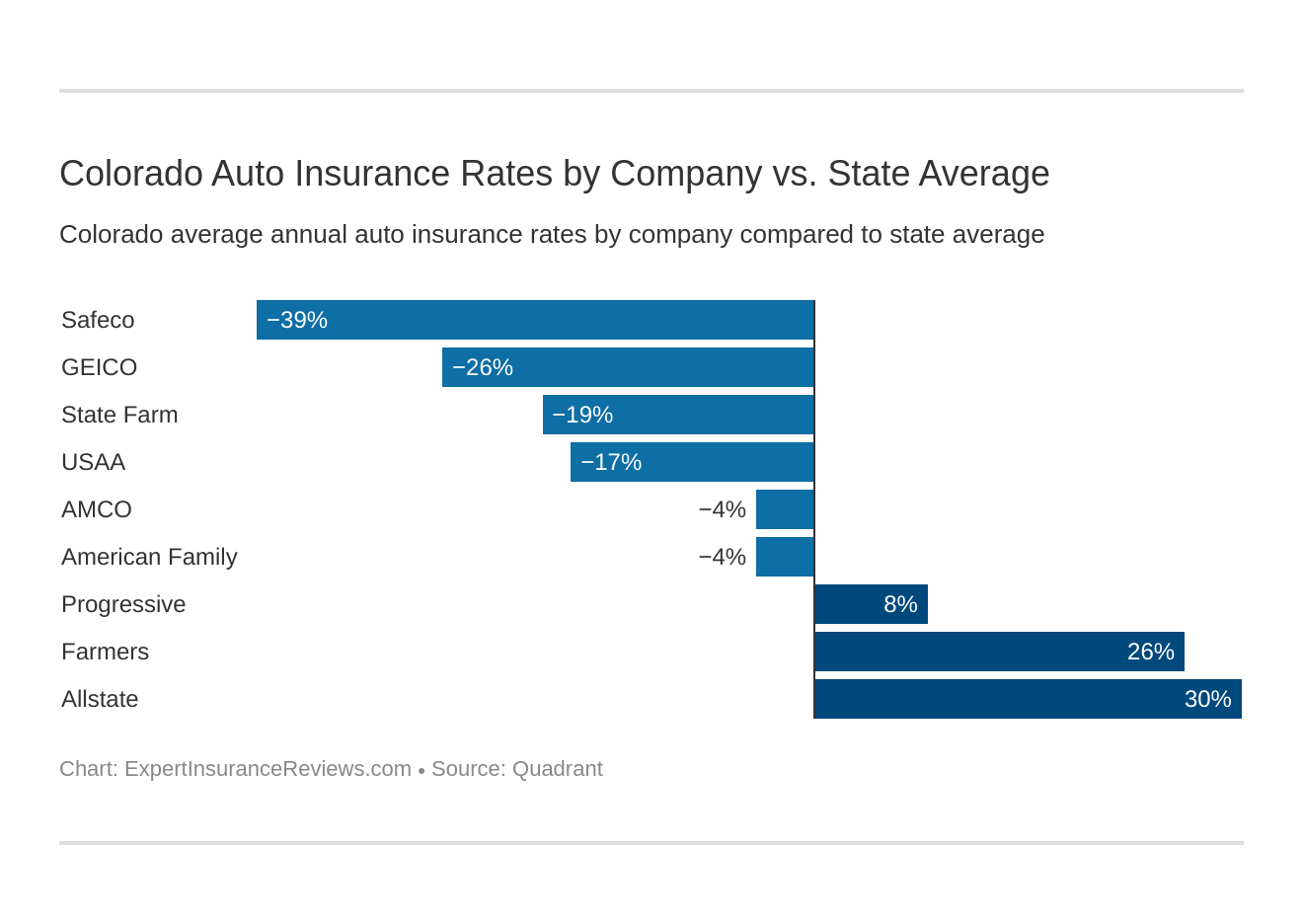

An average rate for car insurance across the state in Colorado is $3892.32. The below table compares the state average for the largest car insurance companies in Colorado against the overall state average to see how different companies compare.

| Company | Average | +/- Compared to State Average (rate) | +/- Compared to State Average (percent) |

|---|---|---|---|

| Allstate F&C | $5,537.17 | $1,645 | 29.71% |

| American Family Mutual | $3,733.02 | -$159 | -4.27% |

| Farmers Ins Exchange 2.0 | $5,290.24 | $1,398 | 26.42% |

| GEICO Cas | $3,091.69 | -$801 | -25.90% |

| Safeco Ins Co of America | $2,797.74 | -$1,095 | -39.12% |

| AMCO Insurance | $3,739.47 | -$153 | -4.09% |

| Progressive Direct | $4,231.92 | $340 | 8.02% |

| State Farm Mutual Auto | $3,270.76 | -$622 | -19.00% |

| USAA CIC | $3,338.87 | -$553 | -16.58% |

The rates for the largest companies in the state vary widely around the overall state average. Safeco Insurance Company of America is about 39 percent lower than the state average, while Allstate Fire and Casualty is almost 30 percent higher than the state average.

Out of the nine companies listed, six of them have insurance rates lower than the state average, while the remaining three are higher.

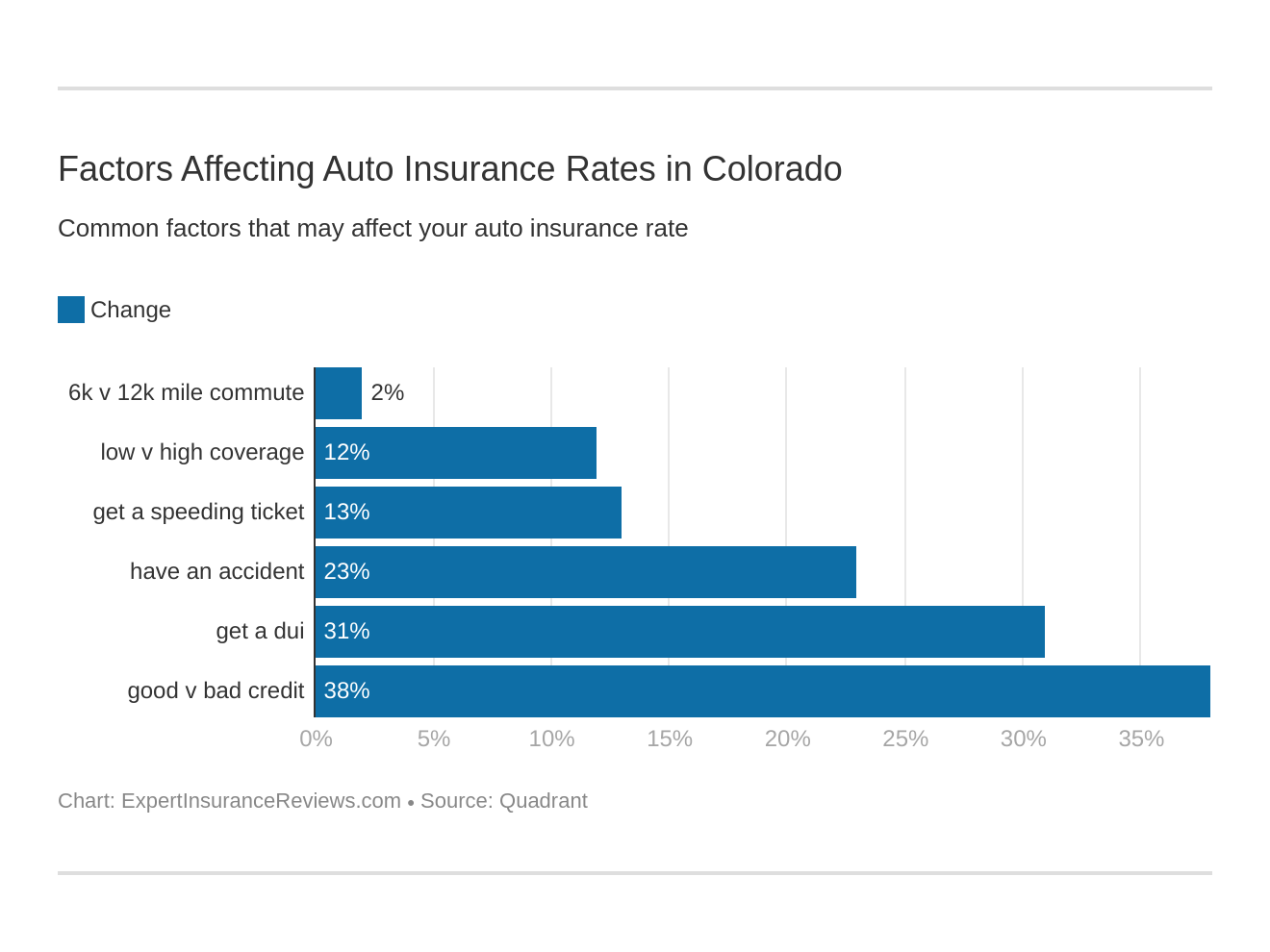

While their rates may vary, insurance companies generally consider the same variables when determining how to adjust your rates. It is important to know these variables, how they can affect your rates, and how much specific companies factor those variables into their rates.

You already know how age and gender can affect your rates in Colorado. But in order to get a full picture of the variables insurance companies consider, we need to look at commute, driving record, and credit score (yes, credit score).

Keep reading to learn more about these variables and how they may affect you when shopping for insurance.

Commute Rates by Companies

With such beautiful scenery and so many things to see and do across the state, its no surprise that Colorado residents spend a lot of time behind the wheel. This time spent driving is not limited to looking for adventure. Residents spend a significant amount of time commuting each day.

The average commute time for drivers in Colorado is 23.7 minutes. However, in Park County, drivers can expect the highest average commute of 44.2 minutes. The shortest commute time can be found in Hinsdale County at 8.2 minutes.

Residents in Denver, Colorado commute an average of 17 miles per day.

With all this commute information, it should come as no surprise that we’re pulling together data on how commute distances can affect your insurance rates. In general, the more you drive, the higher your rates, because more time on the road means more chances you might end up in a car accident.

| Insurance Company | 10 Mile commute (6,000 annual mileage) | 25 mile commute (12,000 annual mileage) | Percent increase |

|---|---|---|---|

| Liberty Mutual | $2,797.74 | $2,797.74 | 0.00% |

| GEICO | $3,025.45 | $3,157.93 | 4.38% |

| State Farm | $3,190.31 | $3,351.22 | 5.04% |

| USAA | $3,244.04 | $3,433.70 | 5.85% |

| American Family | $3,653 | $3,813 | 4.37% |

| Nationwide | $3,739 | $3,739 | 0.00% |

| Progressive | $4,232 | $4,232 | 0.00% |

| Farmers | $5,290 | $5,290 | 0.00% |

| Allstate | $5,537 | $5,537 | 0.00% |

If you’re a commuter, the above table should be good news for you. More than half of the largest insurance providers in the state choose not to increase their rates based on commute distance. The remaining companies only increase their rates between four and almost six percent for longer commute distances.

Commute distances are not the only factor affecting your rates.

Coverage Level Rates by Companies

As you might expect, different amounts of coverage come with different price tags. Low coverage necessarily costs less than high coverage. Deciding on the level of coverage you need requires looking at a number of variables, but the price is one way to get started.

Depending on your financial situation, whether you’d prefer to pay for additional coverage to protect yourself against possible eventualities, or you feel confident enough to take your chances, only you can decide whether high, medium, or low coverage is best for your lifestyle and needs.

Take a look at this table to start considering prices for different levels of coverage from different companies in Colorado.

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Liberty Mutual | $2,637.04 | $2,787.15 | $2,969.02 |

| GEICO | $2,785.20 | $3,034.95 | $3,454.92 |

| State Farm | $3,052.89 | $3,272.35 | $3,487.06 |

| USAA | $3,191.66 | $3,338.66 | $3,486.28 |

| American Family | $3,546.22 | $3,809.91 | $3,842.92 |

| Nationwide | $3,748.13 | $3,740.53 | $3,729.76 |

| Progressive | $3,915.86 | $4,244.39 | $4,535.53 |

| Farmers | $4,641.62 | $5,215.47 | $6,013.62 |

| Allstate | $5,236.91 | $5,518.14 | $5,856.45 |

Every company adjusts their rates differently depending on the coverage level you purchase. For example, Nationwide’s rates are roughly the same for all three coverage levels.

By contrast, Farmers increases their rates by about 12 percent from low coverage to medium coverage, and then by an additional 15 percent for high coverage (from low to high is a 30 percent increase).

Credit History Rates by Companies

How’s your credit score? Good? Fair? Poor? If it’s not already in good shape, you’ll want to prioritize improving it, in order to ensure it does not negatively affect your insurance rates.

Some companies consider credit score to be an indicator of whether or not you are at high risk when driving. This may seem odd, but in a non-linear way, it makes sense.

Insurance companies correlate financial responsibility with responsible choices in other areas of your life, including your driving habits. The better your credit score, the more responsible a driver they may consider you to be.

Experian reports that residents of the Centennial State have an average credit score of 688. This puts residents safely in the “good” credit score range (your score needs to be at least 670 in order to be considered good).

Check out this table to see if credit score really does affect your insurance rates and if so, by how much.

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| Liberty Mutual | $1,947.80 | $2,446.38 | $3,999.04 |

| USAA | $2,256.64 | $2,816.63 | $4,943.34 |

| State Farm | $2,352.76 | $2,918.53 | $4,541.00 |

| GEICO | $2,465.94 | $3,091.66 | $3,717.48 |

| American Family | $2,895.90 | $3,452.49 | $4,850.67 |

| Nationwide | $3,118.09 | $3,578.13 | $4,522.20 |

| Progressive | $3,768.17 | $4,108.11 | $4,819.49 |

| Allstate | $4,105.68 | $5,439.82 | $7,066.00 |

| Farmers | $4,739.93 | $4,988.44 | $6,142.35 |

No matter which provider you are considering, your credit score will have an effect on your rates. While increases vary from company to company, credit score has a fairly significant impact on your rates. If you have fair, rather than good, credit, you might consider Farmers because at 5 percent, they have the lowest increase for fair over good credit.

If your credit score is poor, your best bet is probably Progressive because they only increase their rates by 28 percent for poor credit (versus their rates for good credit).

To consider the above data from another perspective:

- Good Credit (670+) = average annual premiums: $3,072.32

- Fair Credit (580-669) = 5 – 32 percent increase: $3,648.91

- Poor Credit (300-579) = 28 – 119 percent increase: $4,955.73

Driving Record Rates by Companies

Perhaps the most logical way for insurance companies to adjust rates is based on your driving record. Companies want to know whether or not you have a good track record for responsible driving. If you do, your rates will be lower because your chances of filing a claim are likely lower.

If your driving record shows anything that raises a red flag (a speeding violation, DUI, etc.), your rates will likely be higher, because you are a higher risk for the insurance company.

As you might imagine, a driver with multiple speeding tickets will have higher rates than someone with fewer speeding tickets. However, not all moving violations or car accidents carry the same weight when insurance companies look at your driving record and adjust your rates accordingly.

For example, in many cases, a speeding ticket results in less of a rate increase than a car accident or a DUI does.

Check out this table to see what your driving record can mean for your insurance rates. We look at how different companies handle rate increases for a clean driving record, one speeding violation, one DUI, and one accident.

| Insurance Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| GEICO | $2,184.55 | $2,858 | $3,929 | $3,395 |

| USAA | $2,439.12 | $2,750.39 | $5,192.84 | $2,973.13 |

| Liberty Mutual | $2,450.68 | $2,891.61 | $2,978.75 | $2,869.91 |

| American Family | $2,762.77 | $3,132 | $5,122 | $3,915 |

| Nationwide | $2,873 | $3,163 | $4,991.57 | $3,930 |

| State Farm | $3,008.73 | $3,270.76 | $3,270.76 | $3,532.80 |

| Progressive | $3,665 | $4,278.14 | $3,869 | $5,115.10 |

| Farmers | $4,469 | $5,283.78 | $5,665.21 | $5,743.39 |

| Allstate | $4,723 | $5,351 | $6,643.37 | $5,431 |

This table makes it clear that all moving violations result in some kind of rate increase. However, to better understand just how much of a rate increase you can expect from different companies for different infractions, check out the below table. Using the data in the first table, we calculated the percent increase for each violation, compared to a clean record.

| Insurance Company | Percent Increase - 1 Speeding Violation | Percent Increase - 1 DUI | Percent Increase - 1 Accident |

|---|---|---|---|

| State Farm | 8.71% | 8.71% | 17.42% |

| Nationwide | 10.11% | 73.75% | 36.80% |

| USAA | 12.76% | 112.90% | 21.89% |

| Allstate | 13.29% | 40.66% | 15.00% |

| American Family | 13.36% | 85.40% | 41.71% |

| Progressive | 16.72% | 5.56% | 39.55% |

| Liberty Mutual | 17.99% | 21.55% | 17.11% |

| Farmers | 18.24% | 26.78% | 28.53% |

| GEICO | 30.84% | 79.84% | 55.42% |

Do you feel a need for speed? If so, State Farm may be your best bet, because they have the lowest rate increase for speeding tickets (8.7 percent). If you’ve recently been in a car accident, you might consider Allstate, as they have the lowest percent increase for a one-car accident at 15 percent.

It is interesting to note that while most companies more severely penalize you for a DUI than for a speeding ticket (seven out of the nine do so), some companies do not.

State Farm increases rates for one speeding violation and one DUI at the same rate of 8.7 percent, while Progressive actually has a lower rate increase for DUI (at 5.6 percent) than they do for speeding (16.7 percent).

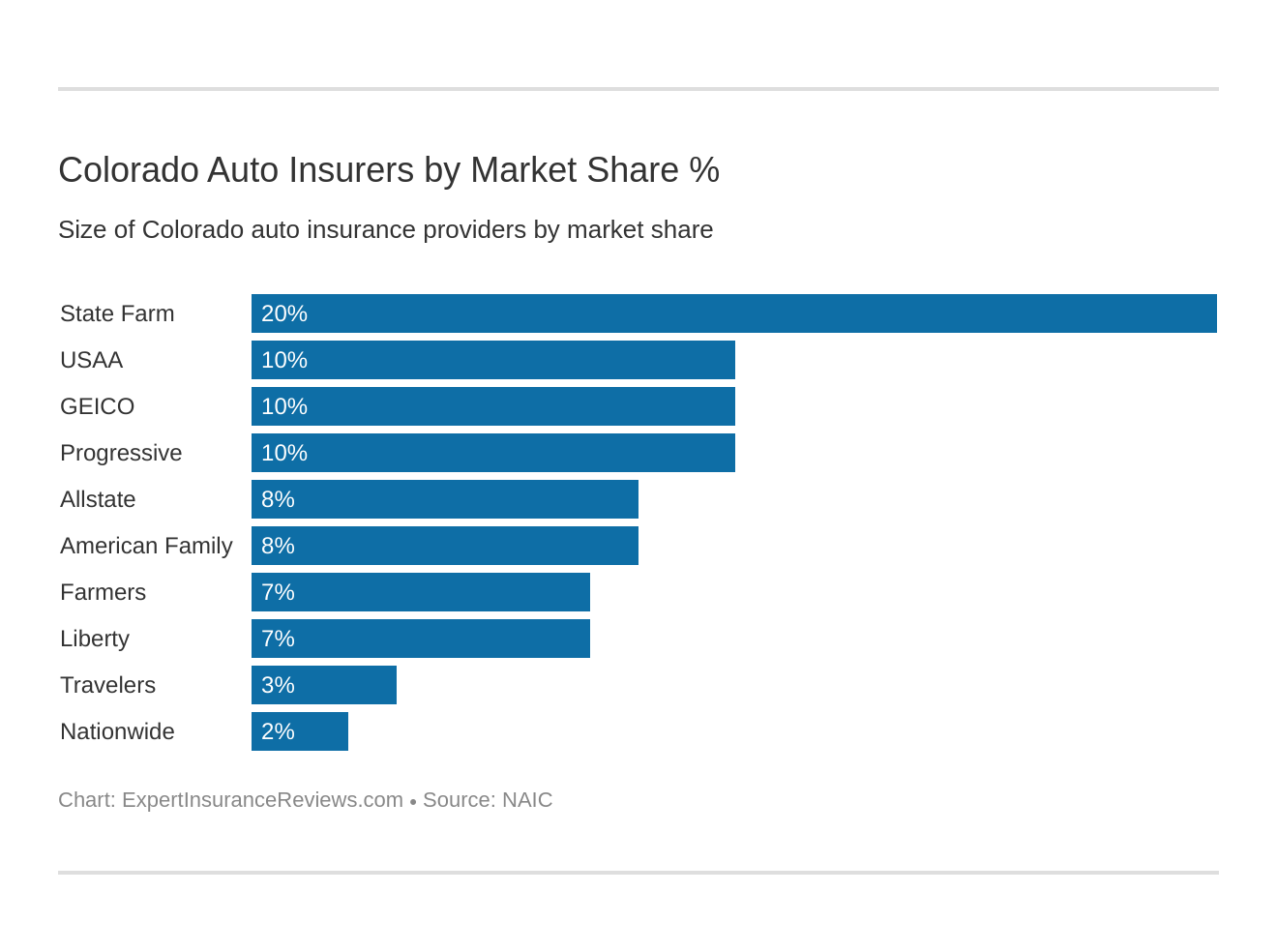

Largest Car Insurance Companies in Colorado

In line with considering the financial stability of an insurance provider when shopping for coverage is looking at company size.

Comparing companies based on the combination of their size (i.e. market share in Colorado), loss ratio, and complaint data allows you to gain a fuller picture of the companies and their ability to pay out on potential claims, respond to your needs, etc.

Check out this table to find out more about the market share and premiums written for the 10 largest insurance providers in Colorado.

| Insurance Company | Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $906,918 | 19.81% |

| USAA Group | $467,079 | 10.20% |

| GEICO | $452,585 | 9.89% |

| Progressive Group | $440,274 | 9.62% |

| Allstate Insurance Group | $388,445 | 8.49% |

| American Family Insurance Group | $384,892 | 8.41% |

| Farmers Insurance Group | $330,473 | 7.22% |

| Liberty Mutual Group | $319,166 | 6.97% |

| Travelers Group | $129,187 | 2.82% |

| Nationwide Corp Group | $91,547 | 2.00% |

Number of Insurers by State

You have a lot of options for insurance coverage in Colorado, beyond the top nine or ten companies we’ve considered so far. There is a combined total of 858 licensed insurers in the Centennial State. These are divided into two categories:

- Domestic – there are 10 domestic insurers in Colorado. Domestic insurers are those insurance providers who are incorporated in the state.

- Foreign – there are 848 foreign insurers in Colorado. Foreign insurers are those insurance providers who are incorporated somewhere outside the state.

Regardless of where a company is incorporated, it must follow the insurance laws set out by the state. This means that regardless of the laws in other states, or in the state in which a provider is incorporated, in order to legally operate in the Centennial State, insurance providers must follow Colorado state laws.

Colorado Laws

We know you’re probably ready to get out on the open road and experience what Colorado has to offer. However, before you get started on your next adventure, it’s important you become aware of a few more key pieces of information.

You need to know the car insurance laws that apply to you, so you can be sure you are following them. You also need to be aware of the vehicle and driver’s licensing laws, to make sure you are legal while on the road. This will help enable you to avoid possible suspension of your license, driving privileges, and more.

There are a few laws the car insurance companies must follow that you need to be aware of, so you know how you are protected when sharing the road with other drivers, autonomous vehicles, and ridesharing companies.

We’ve made it easy for you by compiling all this information in one place. Keep reading to learn more about these laws, how to register your vehicle in Colorado, how to renew your driver’s license, and more.

Car Insurance Laws

As we’ve alluded to in the previous few sections, there are a number of state-specific insurance laws written for both insurance providers and insureds. These are important to know both to keep you out of trouble and to ensure you understand what is required of your insurance provider.

You already know that Colorado requires minimum liability insurance for all drivers on the road. But there are a number of other laws of which you should be aware, including what is expected of your insurance provider with regard to windshield coverage, ways high-risk drivers can obtain insurance, and more.

Keep reading to find out more about Colorado car insurance laws and which may apply to you.

How State Laws for Insurance are Determined

In general, states follow a specific process to enact laws. Colorado is no exception. When the Centennial State determines a new insurance law needs to be developed, the process remains the same.

Typically, if an individual, advocacy group, agency, etc. has something they’d like to turn into a law, they write a bill. The bill will provide, in detail, the proposed law, the significance, and the “why” behind it.

This bill is then provided to the state legislature. The Colorado legislature, in this case, reviews the bill and convenes to determine its viability. If the group agrees the bill outlines something that is both beneficial to and necessary for residents of the state, the bill is signed into law.

Read over the following sections to learn more about the car insurance laws currently in place in Colorado.

Windshield Coverage

Ever gotten a chip or crack in your windshield? It can be frustrating (not to mention startling if it happens because a rock hits your windshield when you’re driving on the highway). This can be a hassle when you have to get it repaired or replaced.

Colorado does not require insurance companies to provide a particular amount or type of windshield repair/replacement coverage. They can choose to include it as an option in their comprehensive coverage policy, however.

Ultimately this means you can purchase windshield coverage if you believe you need it, or you can plan to pay out-of-pocket the next time you need a repair or replacement.

High-Risk Insurance

Have you had a few too many speeding tickets lately? If so, you might be considered a high-risk driver, which means you might be struggling to get car insurance coverage.

Often, car insurance companies do not voluntarily provide car insurance coverage to high-risk drivers because its riskier for them (i.e. you may have a higher chance of filing claims or having claims filed against you).

If you’ve been struggling to obtain car insurance, Colorado has a solution for you. The Colorado Motor Vehicle Insurance Plan (CO AIP) was created to help high-risk drivers obtain car insurance coverage so they can legally drive in the state.

In order for both domestic and foreign insurance providers to legally sell insurance policies in the Centennial State, they must participate in the CO AIP program. The benefit to insurance companies is that the risk of insuring high-risk drivers is dispersed equally across insurance providers.

This is done by mandating that each company cover a percentage of high-risk drivers that is commensurate with its market share.

We know that State Farm has 19.81 percent of the insurance market in Colorado, which means they are expected to provide coverage for 19.81 percent of the high-risk drivers who apply for insurance coverage through CO AIP.

If you find yourself needing assistance from CO AIP, you must do the following in order to apply:

- You must be a licensed driver in Colorado

- Your vehicle must be registered in the state

- You must indicate in your application that you’ve tried and failed to obtain insurance for the past 60 days

If you are currently facing the following, you will likely need to resolve these before applying for CO AIP:

- You have unpaid insurance premium payments

- Your insurance policy was canceled because you failed to have your vehicle inspected by the insurance company

- You included false information on your CO AIP application

When you successfully obtain insurance coverage through the CO AIP, you will be required to purchase at least minimum liability coverage (but at higher limits than the average driver). You should expect your premium rates to be quite a bit higher than drivers who are not considered high risk. Check out this table to see what this means for you.

| Required Insurance | CO State Minimum Limits | CO AIP Minimum Limits |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Property Damage Liability | $15,000 per accident | $50,000 per accident |

Because you are a high-risk driver, your minimum liability requirements are between 300 and 500 percent higher than average drivers in Colorado. If you would like additional core coverage, you can speak with your insurance agent to find out your options.

If you have questions about the CO AIP, their website is a good place to start. You can also call them at:

- 303-894-7499 (if you live in Denver)

- 1-800-930-3745 (if you live anywhere else in the state)

If your license has been suspended for any reason, you will be required to file an SR-22 form as a part of the reinstatement process.

This form will be necessary in order for you to obtain minimum liability insurance coverage. You are required to maintain the SR-22 form for a minimum of three years, and if you let it lapse during that three-year period, your license may be suspended again.

The form must be filed with the Colorado Division of Motor Vehicles. You can hand-deliver or mail the form to 881 Pierce Street, Lakewood Colorado.

Low-Cost Insurance

While Colorado does have a program in place for high-risk drivers, it does not currently have a commensurate program for low-income families.

At this time, the only states in the country that offer a form of government-funded assistance to help low-income families obtain and maintain car insurance coverage are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Colorado

Insurance fraud is an ongoing and growing problem in the United States. According to the Insurance Information Institute (III), almost ten percent of the money insurance providers lose is due to fraud. This is damaging to the insurance companies, the insurance industry as a whole, and you as the insured. Fraud is not a victimless crime.

Colorado, like most of the states in the country, takes fraud seriously. The state attorney general’s office is responsible for investigating allegations of fraud.

But what is fraud, exactly? According to the Colorado Attorney General, fraud includes:

- Offering false information

- Making false claims

- Staging accidents

- Any impropriety or malpractice by an insurance agent

You can file a complaint through the state Attorney General Office’s online complaint filing system. If you have questions, you can contact the Colorado Attorney General’s Office by calling 720-508-6000 or you can email them at [email protected].

If someone is criminally convicted for fraud, they may face three years in prison and a fine of up to $100,000.

Statute of Limitations

Should you find yourself in a situation in which you need to file a claim or lawsuit for any personal injury or property damage that results from an accident, the statute of limitations to do so in Colorado is three years.

State Specific Laws

So far every law we’ve examined has been governed by the state of Colorado. However, what we’ve looked at up until now is fairly standard across the United States, with some minor variations from state-to-state. For example, every state has some form of a minimum liability insurance coverage law (though the minimum limits tend to vary).

However, there are some laws specific to Colorado. One such law states it is illegal to drive with headphones on or in your ears. It is also required for you to both call the police and leave a note if you ever hit a parked car and are unable to find the owner.

To keep you safe in the sometimes hazardous Colorado weather, the state also has laws specific to chains on your tires. “Code 15,” which is part of the chain law, states that when it is active (it is not always in effect), you cannot drive on state and federal highways unless you have:

- Snow tires with at least a 1/8-inch tread,

- Tires certified as “all-weather” that include a mud and snow (M/S) mark and a 1/8-inch tread,

- Four-wheel drive with a 1/8-inch tread, or

- Chains (or other forms of traction devices) on at least two of your tires

Vehicle Licensing Laws

For you to legally drive in Colorado, your car must be registered with the state. If you do not register your vehicle or you allow your vehicle registration to lapse/expire, you may face suspension of your driver’s license, fees, and more.

In order to register a vehicle in Colorado, you must have the following documentation:

- Vehicle title

- Secure and Verifiable ID

- Proof of Colorado Vehicle Emissions (this is only required in some counties; to find out if emissions requirements apply to you, you can contact the county motor vehicle office in your area)

- Proof of insurance

- Affidavit of Non-Use of Vehicle (if you need to register a vehicle that you will not be using or that will temporarily be driven out-of-state under insurance in another state).

If you purchase a new vehicle, you must register it within the first 60 days after you take ownership. If you move to Colorado, you must register any vehicles you own within 90 days of establishing residency.

If you are new to Colorado, you will need to:

- Change your title from out-of-state to a Colorado title

- Send your proof of insurance and emissions (if applicable) to the county clerk

- Register your vehicle in person at your local county Motor Vehicle office

When you register (or re-register) your vehicle, you will be required to pay some fees, the amount of which are determined by the weight and type of your vehicle as well as where you live and what kind of license plate you choose.

If you need to renew the registration for your vehicle, you can do so using the online vehicle registration tool, In order to do this, you’ll need to be prepared with:

- Your vehicle license plate number

- Your vehicle’s VIN number

- Your vehicle’s current emissions (if this is applicable; as we already noted, it is not required in every county)

- Your current Colorado insurance

- A valid payment method

Real ID

According to the Department of Homeland Security (DHS), Colorado is currently one of the 48 states that are compliant with the 2005 REAL ID Act. The state has been compliant since 2012.

The REAL ID Act was enacted by DHS in the aftermath of 9/11 as a way to ensure what happened on that tragic day does not happen again. It requires that every state in the country ensure there is a form of identification compliant with federal requirements.

Starting in October of 2020, this form of identification will be required in order to fly commercially and access nuclear power plants and military installations. However, in the case of the latter two, having a REAL ID-compliant form of identification does not guarantee you access.

What does REAL ID look like in Colorado?

Colorado’s REAL ID driver’s license is signified by either a black or gold circle with a white star in the middle.

In order to obtain a REAL ID in the Centennial State, you must do so in-person at a Colorado DMV location. When you visit, you must bring the following documents with you:

- Proof of identification

- Proof of U.S. residency (passport, permanent resident card, etc.)

- Two proofs of Colorado residency

- Proof of Social Security Number (if you do not currently hold a valid Colorado driver’s license)

Penalties for Driving Without Insurance

As we’ve discussed, you are required to maintain minimum liability insurance in Colorado in order to drive legally in the state. If you are found to be driving while uninsured, you face some serious consequences in Colorado. This table outlines what may happen to you if you are caught driving while uninsured.

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | $500 minimum fine | $1,000 minimum fine |

| License Revoked | license suspension until you can show proof to the DMV that you are insured | license suspension for 4 months |

| Points Penalty | 4 points against your license | 4 points against your license |

| Community Service | Courts may add up to 40 hours community service | Courts may add up to 40 hours community service |

If you do have insurance, and you are pulled over at a traffic stop without proof, you may still face some consequences.

The law enforcement officer has the capability of checking on your insurance coverage status during the stop (there is a database he or she can use to check). But because the state requires you to carry proof of insurance at all times, you may still be ticketed.

In Colorado, you have options for proofs of insurance. If you are at a traffic stop and asked to provide it, the state accepts the following forms:

- Your insurance card

- A copy of your insurance policy

- A printout/fax of your insurance policy

- A mobile insurance card (i.e. one on your phone)

- An email from your insurance agent

Teen Driver Laws

If you’re ready to learn to drive in Colorado, you need to be 15 in order to start your journey.

- If you’ve just turned 15, you will be required to enroll in some form of state-accepted driver education. When you’re practicing your driving, you will need to have a legal guardian (or an acceptable stand-in like a grandparent) or driving instructor with you in the vehicle.

- If you are 15-and-a-half when you apply, you can do so without being enrolled in driver education. However, you are required to take a driver awareness training.

- If you are 16 when you first apply, you can practice driving while being supervised by anyone as long as they are at least 21 years old.

Whether you are 15, 15-and-a-half, or 16 when you apply for your learner’s permit in Colorado, you will be required to hold it for a minimum of a year. During this time period, you will need to log 50 hours of driving practice, at least 10 of which need to be at night.

At 16, if you’ve already met the requirement of holding the learner’s permit for a period of at least a year, you can apply for an intermediate license, which you will again need to hold for a year. For the first six months you can drive unsupervised, but with no passengers.

For the second six months, you may have one passenger. For the entirety of the year, you will be restricted from driving between midnight and 5:00 a.m.

Once you’ve either held the intermediate license for one year or turned 18 (whichever happens first), you will be able to obtain your full, unrestricted license.

Older Driver License Renewal Procedures

In Colorado, drivers who are age 66 or older are considered part of the “older” population. Some states have different licensing requirements for older drivers than for those who are part of the general population.

In the Centennial State, most of the licensing requirements for the general population and older population are the same. Both must renew their licenses every five years and both must provide proof of adequate vision at every license renewal.

However, while the general population has the option to renew by mail or online (either two times in a row online or every other renewal through the mail, with the other renewals being done in person), the older population can only renew by mail (not online) every other renewal.

New Residents

If you’ve recently moved to Colorado, once you establish residency, you will need to obtain a license in the state. If you have a valid driver’s license from another state, you are not required to take a written exam or driving skills test.

If you do not have your old license, you can bring a motor vehicle record from your previous state of residence. This will also allow you to avoid needing to take the written or driving skills tests.

The motor vehicle record must be recent (dated within the last 30 days) and you must be able to provide proof that your driver’s license has only recently expired (within the last year).

You will need to obtain this license in-person at a driver licensing office. You will need to bring the following with you when you visit:

- Your previous driver’s license

- Your birth certificate

- Your social security card

- Two proofs of Colorado residency

If you are under the age of 21, you will also need to bring a signed Affidavit of Identity and an Affidavit of Liability or Guardianship. The Affidavit of Identity will need to be notarized.

License renewal procedures

When you renew your license, which you already know must be done every five years, you can do so at a Colorado DMV location. To avoid the chaos and the lines, you can make an appointment. You will need to bring the following with you when you visit the DMV:

- Your expired license

- Your social security card (you aren’t actually required to bring this, but you need to know your social security number, and it is recommended that you also bring the card)

- Proof of your current address

- Your renewal fee

At every other license renewal, if you are eligible, you can choose to renew your license through the mail, rather than in-person. To find out if you are eligible to renew your license through the mail, you can do so by visiting the Colorado Department of Revenue Division of Motor Vehicles website.

You may also be able to renew online. You can find out if you are eligible to do so using the same website.

Negligent Operator Treatment System (NOTS)

Driving recklessly is dangerous for you and other drivers on the road. One way states attempt to curb reckless driving is to attach points to your driver’s license (and thereby your driving record) each time you are convicted of a moving violation.

Typically, there is a threshold that, if exceeded, results in your license being suspended. You may also face fines and even jail time. Different states have different names for these programs. California titled their program the Negligent Operator Treatment System (NOTS).

If you’ve been convicted of violating a traffic law while your vehicle was in motion, you have been found guilty of a moving violation. This can include speeding, running a red light, driving under the influence, etc.

It may seem that non-moving violations occur when your vehicle is stationary. This is true, but non-moving violations are not limited to only when your vehicle is not moving. They can also occur when your vehicle is in motion.

The difference is whether or not the infractions are reported to the department of licensing or insurance companies. Moving violations are, while non-moving violations are not. These can include driving without a seat belt and distracted driving.

In Colorado, the system is referred to as the Driver’s License Point System. If you amass 12 or more points in a year, your license will be suspended and if you amass 18 or more within a two-year period, your license will be suspended. The below table provides more detail on the points system license suspensions.

| Details | 17 & Under | 18-21 | 21 and over |

|---|---|---|---|

| Within any one-year period | 6 or more | 9 or more | 12 or more |

| Within two-year period | - | 12 or more | 18 or more |

| Under 18 | 7 or more | - | - |

| Between 18 and 21 | - | 14 or more | - |

But how many points are various moving violations worth? The below table looks at some of the moving violations that can cause you to accumulate points.

| Moving Violation | Points |

|---|---|

| Hit and Run - Injuries/Death | 12 |

| Hit and Run - Property Damage | 12 |

| Failing to Report and Accident | 12 |

| DUI | 12 |

| Driving While Aabiity impaired | 8 |

| Underage Drunk Driving | 4 |

| Driving without a license | 3 or 6 |

| Failure to use a turn signal | 2 |

| Driving without proof of insurance | 4 |

| Speeding (5-9 MPH over) | 1 |

| Speeding (10-19 MPH over) | 4 |

Rules of the Road

To keep your driving record clean, thereby keeping your insurance rates low, you need to know the rules of the road. Knowing and following the rules of the road will help you to avoid racking up points on your driving record.

Rules of the road like posted speed limits are obvious. However, more subtle rules like keep right and move over laws can be more difficult to find and ensure you are following. But keep calm, we’ve got your back. We’ve outlined the details of some key rules of the road to make sure you know how to stay safe.

Check out the next few sections to find out more about the rules of the road you need to follow. We also take a look at some of the insurance laws providers are required to follow with regard to coverage for ridesharing companies and autonomous vehicles.

Fault vs. No-Fault

As we’ve already mentioned, Colorado is a “fault” state. However, this is a fairly recent change. Before 2003, Colorado was a “fault” state. What does all this mean for you?

- At-Fault System – If you are in a car accident, the individual responsible for the car accident is also financially responsible for any damages (both to people and to property) that result from the accident.

- Fault System – If you are in a car accident, drivers have to cover the cost of their own damages (or their insurance coverage has to cover the cost of damages).

Seat belt and car seat laws

One of the ways Colorado State lawmakers work to keep you safe is by setting (and ensuring enforcement of) seat belt laws. While federal seat belt laws have been in place for decades, state-specific laws have been enacted in more recent years. Colorado’s seat belt laws were put in place in 1987.

Under these laws, everyone in a vehicle must be properly secured with the appropriate safety restraint when the vehicle is moving.

Children must be correctly secured in child safety seats.

- If your child is younger than the age of 1 and weighs less than 20 pounds, he or she must be belted in a rear-facing child restraint

- If your child is between the ages of 1-3 and weighs between 20 and 40 pounds, he or she must be belted in an appropriate child restraint

- If your child is between the ages of 4-7, he or she must be belted in a booster seat

- If your child is between the ages of 8-15 and weighs more than 60 pounds, he or she must be belted in an adult seat belt

All adults ages 16 and older are permitted to sit in the front seat. However, regardless of whether you sit in the front or the back of a vehicle, you must be correctly seat-belted in an adult restraint.

It is a secondary offense if you or someone in your vehicle is not appropriately seat-belted. This means while law enforcement cannot pull you over specifically for that offense, they can pull you over for something else (for example, speeding), and then they can also ticket you for the seat belt infraction.

For a first offense, you can expect to pay a minimum of between $71 and $81 fine.

Passengers are not allowed to ride in the bed of a pickup truck unless there is an enclosed cargo area.

Keep Right and Move Over Laws

In Colorado, if you are driving slower than the surrounding traffic, you are expected to move to the right. Additionally, on the highway, if the speed limit is 65 MPH or higher, the left lane should be kept for passing only.

If you are on the road and see an emergency vehicle, any vehicle with flashing lights, any road maintenance vehicles, any utility vehicles, etc. you are required to move away from where the vehicle(s) is parked, as long as it is safe to do so.

Speed Limits

Driving above the posted speed limit will result in a moving violation that includes both a fine and points added to your driver’s license.

To avoid this, you should be aware of the speed limits across the state, as well as make sure you always pay attention to and follow posted speed limit signs. Below are the maximum speed limits in the Centennial State, according to the Colorado General Assembly.

| Road Type | Speed Limit |

|---|---|

| Narrow, winding mountain highway/blind curve | 20 MPH |

| Any business distrcit | 25 MPH |

| Any residential district | 30 MPH |

| Open mountain highways | 40 MPH |

| open highways not part of the interstate | 55 MPH |

| open highways that are part of the insterstate | 65 MPH |

| Maximum speed limit in the state | 75 MPH |

Despite the fact that these are the maximum possible speed limits for various road-types, that does not mean this will be the posted speed limit for every section of the road. Instead, the speed limit will vary (within the maximum range) based on what is deemed safe, as determined by road safety studies.

No matter what the posted speed limit, drivers in Colorado are expected to reduce their speed based on the weather, road, and traffic conditions. This is known as driving in both a “reasonable and prudent” manner.

Ridesharing

Have you recently taken a ride through a ridesharing company like Uber or Lyft? If so, you should be aware of the laws imposed upon transportation network companies (TNCs) by the state to keep you safe as both a passenger and a driver sharing the road.

In order for TNCs to legally operate in the state, they must do the following:

- Annually apply for a business application

- Annually have all vehicles used for rides through the applicable applications be inspected

- Perform a criminal background check of all drivers

- Only hire drivers that are 21 or older

- Ensure all drivers have a valid driver’s license

- Ensure all drivers have proof of insurance

- Ensure all drivers are medically fit to drive

- Ensure drivers do not provide rides through the TNC application for more than 12 hours straight

- Regularly obtain and review a driving history report

All TNCs must carry liability insurance of at least $500,000. In Colorado, a number of insurance companies offer coverage for TNCs. These include Allstate, Farmers, GEICO, MetLife, Safeco, State Farm, and USAA.

If you ever need to file a complaint against a TNC, you can do so through the online transportation complaint form offered by the Colorado Department of Regulatory Agencies Public Utilities Commission.

If you have questions, concerns, or need to check on the status of your complaint, you can do so by calling 303-894-2070, option #2 or by sending them an email at [email protected].

Automation on the Road

There is a growing interest in driverless cars across the country. As the testing and deployment of these vehicles increases, more and more states are enacting laws to keep residents safe.

In Colorado, autonomous vehicles are permitted to be deployed on the road. However, these vehicles are not currently required to maintain liability insurance coverage. Colorado is one of the more lenient and supportive states when it comes to the deployment and use of autonomous vehicles.

The state requires any autonomous vehicle to be able to use turn signals and follow traffic laws. When companies plan to test their vehicles in the state, they must assert the vehicles are capable of complying with these laws.

Safety Laws

Beyond the rules of the road we’ve already covered, Colorado has a number of laws in place to help keep you safe when you’re on the road in the Centennial State. We will spend some time going into more detail on several of these laws. However, one visibility-based safety law enacted in Colorado relates to windshield tinting.

For sedans, SUVs, and vans:

- Windshield: non-reflective 70 percent visible light transmission (VLT) tint can be placed on the top four inches of the windshield

- Front side windows: a minimum of 28 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Backside windows: a minimum of 28 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Rear window: a minimum of 28 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

In Colorado, if your back window is tinted, you are required to also have dual side mirrors. You cannot use either red or amber tint (though other tint colors are permitted). If any of these laws are violated, you may face a misdemeanor and a fine of between $500 and $5,000.

Check out the next few sections to learn more about laws Colorado has on the books to ensure your and other drivers’ safety on the road. This includes specifics regarding driving under the influence and distracted driving.

DUI Laws

Driving while under the influence is a dangerous, and illegal, decision. No matter how much fun you’ve had or how much of a hassle it may be to determine the best way to get home if you didn’t plan ahead, you should NEVER drink and drive.

If you’re caught drinking and driving, the ramifications will be serious and long-reaching, and the resulting DUI will remain on your record for life. And that’s just what you may face.

Let’s not forget the potentially tragic results of such a decision. If you choose to drink and drive, you accept that in doing so, you may end up severely injuring and possibly even killing someone.

Colorado’s driving while ability impaired (DWAI) level is 0.05, while the blood alcohol level (BAC) is 0.08. The high BAC (HBAC) level is 0.15-0.2 and above.

Responsibility.org looks at alcohol-impaired driving data for every state in the country; according to their data, Colorado had 177 alcohol-impaired driving fatalities in 2017. Looked at another way, they had 3.2 alcohol-impaired driving fatalities per 100,000 population. The national average in 2017 was 3.4 per 100,000 population.

If you’re caught driving under the influence, you can expect to face the following:

| Penalty | 1st DUI | 2nd DUI | 3rd DUI |

|---|---|---|---|

| Fine | $600-$1000 | $600-$1500 | $600-$1500 |

| Jail Time | 5 days-1 year | 10 days - 1 year | 60 days - 1 year |

| License Revoked | 9 months | 1 year | 2 years |

| Additional Requirements | 24-48 hours public service | 48-120 public service hours | 48-120 public service hours |

In addition to the possible tragedy and longtime consequences associated with DUI, if you are convicted, your insurance rates are nearly guaranteed to increase. Find out the best auto insurance after a DUI.

Next time (and every time after) you plan to have some fun, plan for it. Take advantage of one of the several ridesharing companies that operate in the Centennial State. Consider selecting a designated driver. Don’t drink and drive.

Marijuana-Impaired Driving Laws

As we’re sure you’re aware, marijuana is fully legalized and decriminalized in Colorado. According to Responsibility.org, any driver can be convicted of DUI if it is found that there are at least five nanograms of active tetrahydrocannabinol (THC) in his or her system.

However, it is illegal to drive if you have any kind of substance in your system that impairs your ability to do so.