Best Kansas Car Insurance (2026)

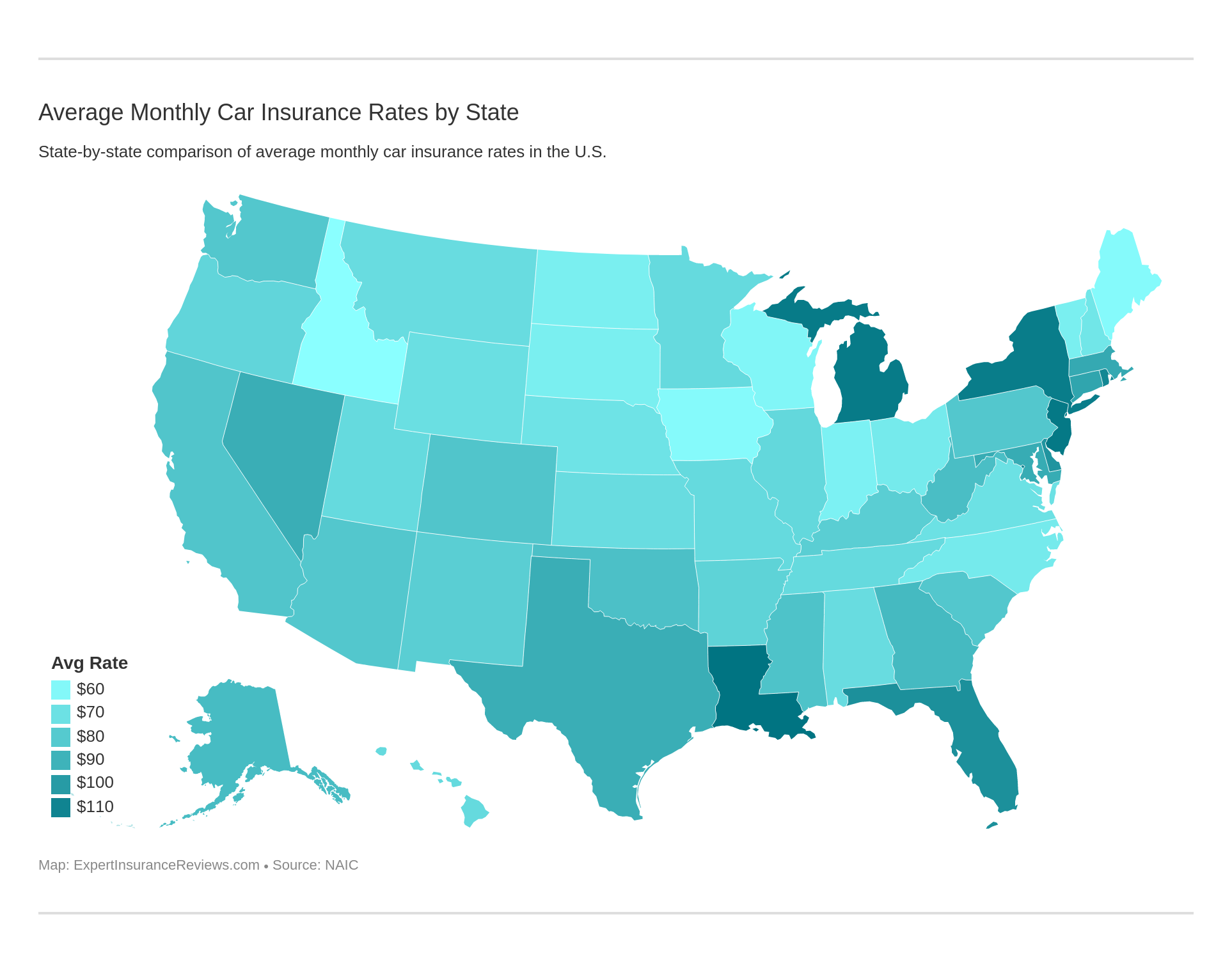

Kansas auto insurance rates average $72 per month while Kansas minimum car insurance requirements are 25/50/25 for bodily injury and property damage coverage. The insurance companies American Family and USAA have the cheapest auto insurance in Kansas. Drivers should compare multiple car insurance quotes in Kansas to find the best deal.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Apr 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Kansas Statistics Summary | Details |

|---|---|

| Miles of Roadway | 140,654 |

| Vehicle Registered | 2,538,531 |

| Population | 2,911,505 |

| Most Popular Vehicle in Kansas | Ford F150 |

| Uninsured/Underinsured % and State Rank | 7.20 % / Rank 44 |

| Speeding Fatalities | 94 |

| DUI Fatalities | 88 |

| Average Liability Coverage | $342 |

| Average Collision Coverage | $251 |

| Average Comprehensive Coverage | $225 |

| Cheapest Car Insurance Companies in Kansas | America Family Mutual, USAA |

Kansas is home to the flattest elevation in the U.S. Despite the uninsured driver percentage, Kansas has a low crash fatality rate per year as compared to other states. If you’re a resident of Kansas, expect to pay higher than usual comprehensive car insurance coverage rates due to the high chance of your motor vehicle being damaged by weather (for instance, Kansas sees a lot of tornadoes).

So how can motorists be better prepared for potential twisters of costs? The first steps are in this Kansas car insurance guide. We’ve collected car insurance data, fatality statistics, licensing law information, safety law information, and transportation to better serve our reader’s interest.

As you pursue car insurance premiums that better fit your budget, you will also find which car insurance companies are best for you. Start comparing rates by entering your ZIP code in our FREE tool at the bottom of this article.

Kansas Car Insurance Coverage and Rates

The best car insurance coverage and rates are up to motorists pursuing coverage. Sometimes the best option is the bare minimum coverage. To start things off, we’ll talk about the car culture of Kansas, the minimum car insurance coverage, forms of financial responsibility, and how premiums affect a motorist’s annual income.

Kansas Minimum Insurance Coverage

The minimum insurance coverage in Kansas is as follows:

- $25,000 for injury to any one person

- $50,000 for injury to more than one person

- $25,000 for personal property damage

Kansas residents are required to have two types of liability car insurance coverage which are property damage and bodily injury.

Property damage protects your assets if you are found responsible for a covered motor vehicle accident. It covers damage you may cause to the property or motor vehicle of another party. Bodily injury guard your assets if you’re found responsible for a covered motor vehicle accident, including medical expenses associated with bodily harm sustained by the other parties.

When you apply for liability coverage at any car insurance company, they will offer these additional liabilities due to car insurance laws in Kansas. The rates may higher than the U.S. average, so explore quotes from different car insurance providers to find the best deal.

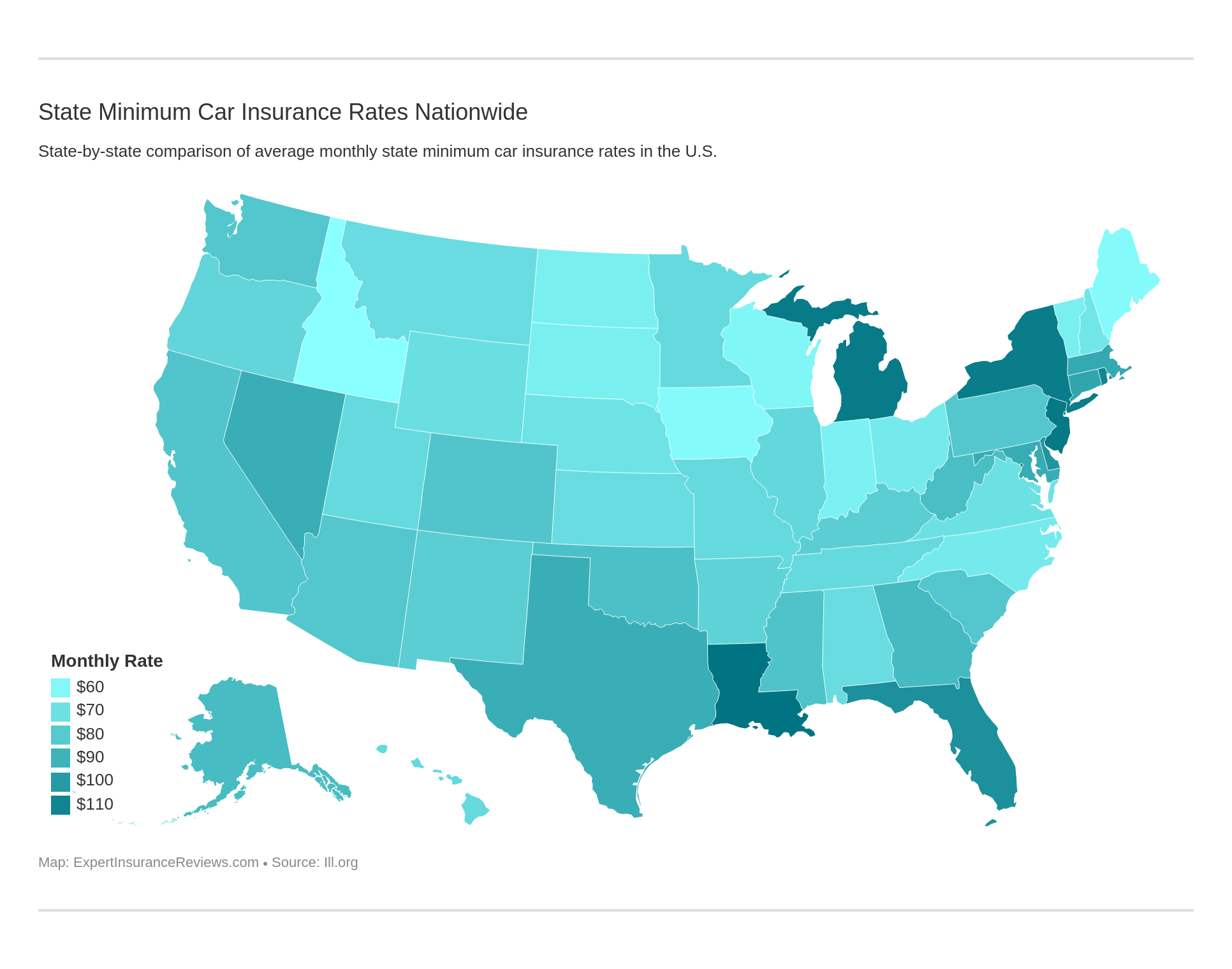

Minimum coverage costs vary from state to state.

Forms of Financial Responsibility

The universal code of any motorist is to have proof of insurance. Whether you’re visiting Kansas or living in the agricultural state, you must have proof that you are a licensed and insured driver.

The way to prove that is to carry forms of financial responsibility in case you have to go the DMV, or if you’re in a car accident or pulled over by law enforcement.

Forms of financial responsibility include a valid driver’s license, vehicle registration, car insurance identification card, and car insurance invoice with the policy number listed on it.

Due to the innovative tools such as smartphones, be sure to keep a digital copy of your insurance information on your smartphone. Some law enforcement officers and DMV officials will accept an electronic form of financial responsibility.

Premiums as a Percentage of Income

How can car insurance rates affect your income? Surprisingly enough, car insurance rates (or premiums) don’t take as much of your income as you might think.

In 2014, most car insurance policyholders across the U.S. spent less than three percent of their annual income on car insurance premiums. But what’s it like for Kansas. We tracked that data for you in the table below. Use the up and down triangles to sort through the highs and lows of dollar amounts and percentages.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Kansas | $851 | $41,634 | 2.04% | $816 | $41,140 | 1.98% | $786 | $40,424 | 1.94% |

| Missouri | $845 | $36,690 | 2.30% | $820 | $35,616 | 2.30% | $799 | $35,958 | 2.22% |

| Nebraska | $806 | $43,277 | 1.86% | $774 | $41,110 | 1.88% | $751 | $41,599 | 1.81% |

| Oklahoma | $986 | $40,879 | 2.41% | $931 | $38,623 | 2.41% | $903 | $37,298 | 2.42% |

| Countrywide | $982 | $40,859 | 2.40% | $951 | $39,192 | 2.43% | $924 | $39,473 | 2.34% |

In comparison to the U.S. average, Kansas policyholders paid about two percent of their income for car insurance. The amounts in dollars and cents fluctuated but Kansas maintained a steady car insurance rate in three years.

Do you want to know the percentage you spend on car insurance? Try out our free calculator tool below to find out what percentage comes out of your income per year.

CalculatorPro

Average Monthly Car Insurance Rates in KS (Liability, Collision, Comprehensive)

Core coverages are different policy packages a potential policyholder can choose from. Some people like to go with the bare minimum, which is liability coverage.

Since Kansas requires certain additional liabilities, a policyholder won’t be able to deny those perks to shave off the cost. The data table below will show the average costs of core coverage in Kansas.

| Core Coverage Type | Coverage Amount |

|---|---|

| Liability | $342 |

| Collision | $251 |

| Comprehensive | $225 |

| Full | $819 |

Collision and comprehensive are the cheaper of the four, and that’s because collision and comprehensive car insurance don’t cover the same as a liability and full coverage car insurance.

See, collision car insurance coverage safeguards your assets in case additional costs of property damage isn’t covered by liability car insurance. Comprehensive covers accidents involving falling objects, damage due to theft, storm damage, and other factors that damage your personal property (i.e. your vehicle).

Read more: Does my car insurance cover damage caused by a lightning strike?

Additional Liability

We mentioned additional liability before. One was bodily injury and the other was property damage. Both are covered in liability car insurance coverage.

Sometimes you’ll see terms like bodily injury and personal injury used interchangeably. All those terms are covered by Medical Payments (MedPay) and Personal Injury Protection (PIP).

MedPay is compensation to policyholders and passengers to cover medical bills after being injured in a car accident. PIP compensates policyholders regardless of who is at fault and provides additional compensation for documented losses such as lost wages.

Uninsured motorist coverage protects you if you’re in an accident with an at-fault driver who doesn’t carry liability insurance. Underinsured motorist coverage, on the other hand, steps in when you’re in an accident with an at-fault driver whose liability limits are too low to cover the damage or medical expenses.

If you’re in an accident with an at-fault driver who doesn’t carry liability insurance, uninsured motorist coverage will compensate you for losses or injuries. An at-fault driver whose liability limits are too low to cover the damages or medical expenses can be covered by underinsured motorist coverage.

Usually, these two coverage are together as uninsured/underinsured coverage or UUM.

Since Kansas is required to have these coverages built into their core coverage policies, you won’t see how much they are until you receive the car insurance bill. But we can share the loss ratio of MedPay, PIP and UUM.

Loss ratio is essentially money being paid out in claims from a car insurance company and the money they earn from policyholders. The table below will show you average loss ratios in Kansas.

| Additional Liability Coverage | Loss Ratio 2015 | Loss Ratio 2014 | Loss Ratio 2013 |

|---|---|---|---|

| Medical Payment (MedPay) | 91.87 | 76.29 | 92.60 |

| Personal Injury Protection (PIP) | 66.52 | 61.19 | 61.82 |

| Uninsured/Underinsured Motorist (UUM) | 76.27 | 69.42 | 66.73 |

In three years, MedPay was close to 100. That means, for example, is for every $100 spent in 2015, car insurance companies paid at least $91.87 in MedPay. It doesn’t mean medical bills were under $100. It’s an estimate of how to describe loss ratio.

Any loss ratio that exceeds 100 indicates a car insurance company that’s not earning money. Low loss ratios indicate car insurance companies that don’t pay out claims.

Add-ons, Endorsements, and Riders

- Guaranteed Auto Protection (GAP) – Car insurance that pays the difference between the value or actual cash value of a damaged or stolen vehicle and the amount owed on the car, usually under a loan or lease.

- Personal Umbrella Policy (PUP) – This car insurance option provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

- Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

- Emergency Roadside Assistance – Most car insurance companies provide this. This is a car insurance coverage perk that sends out locksmiths and towtrucks in case a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

- Mechanical Breakdown Insurance – Often referred to as Equipment Breakdown Insurance, this car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

- Non-Owner Car Insurance – Simply put, this is car insurance coverage for a motorist who has liability insurance but does not own a car.

- Modified Car Insurance Coverage – High-performance parts and custom paint jobs are covered by Modified Car insurance coverage. Alert your car insurance company that your car is custom-built. (For more information, read our “Does car insurance cover paint jobs?“).

- Classic Car Insurance – Classic cars can be treasures to gear-heads. The parts are just as rare and require costly repair if damaged. Classic Car Insurance covers those high costs.

- Pay-As-You-Drive or Usage-Based Insurance – Car insurance coverage that’s determined by how much you drive your car.

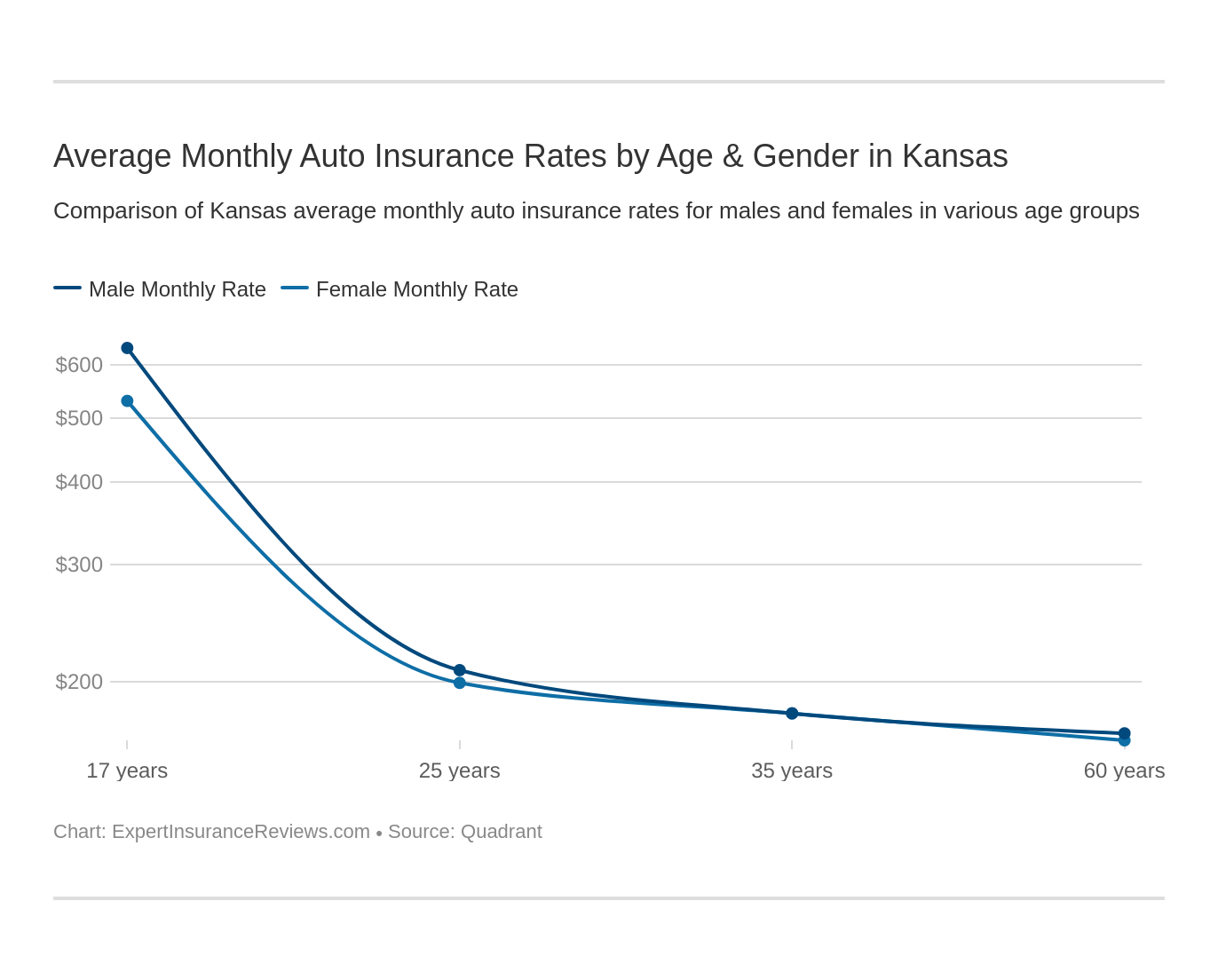

Average Car Insurance Rates by Age & Gender in KS

Age, gender and marital status can determine how much you pay for car insurance. Younger drivers take more risks than older drivers, and single drivers can be more active than drivers that are married. Listed below is a table describing the rates you can expect to see from car insurance companies.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $7,475 | $8,345 | $2,852 | $2,961 | $2,762 | $2,694 | $2,460 | $2,532 |

| American Family | $3,254 | $3,903 | $1,689 | $1,896 | $1,689 | $1,689 | $1,525 | $1,525 |

| Farmers | $6,879 | $7,121 | $2,870 | $3,019 | $2,551 | $2,532 | $2,279 | $2,380 |

| GEICO | $4,612 | $6,194 | $2,915 | $2,129 | $2,525 | $2,469 | $2,549 | $2,372 |

| SAFECO | $10,904 | $12,182 | $2,610 | $2,826 | $2,383 | $2,576 | $2,266 | $2,529 |

| Allied NW | $3,738 | $4,586 | $2,123 | $2,263 | $1,828 | $1,887 | $1,625 | $1,754 |

| Progressive | $8,765 | $9,892 | $2,832 | $3,035 | $2,396 | $2,286 | $1,933 | $2,015 |

| State Farm | $4,734 | $6,039 | $2,010 | $2,269 | $1,789 | $1,789 | $1,565 | $1,565 |

| Travelers | $8,451 | $13,204 | $2,154 | $2,554 | $2,106 | $2,145 | $2,044 | $2,073 |

| USAA | $4,761 | $5,009 | $1,868 | $1,957 | $1,415 | $1,445 | $1,294 | $1,311 |

Single, young male drivers pay the most for car insurance premiums. Some 25-year-old males and females pay a $1,000 less than those who are under 25. Other companies charge over $10,000 for young drivers. Based on the table, the cheapest rates based on age, gender, and marital status are reserved for those who 35 years and older.

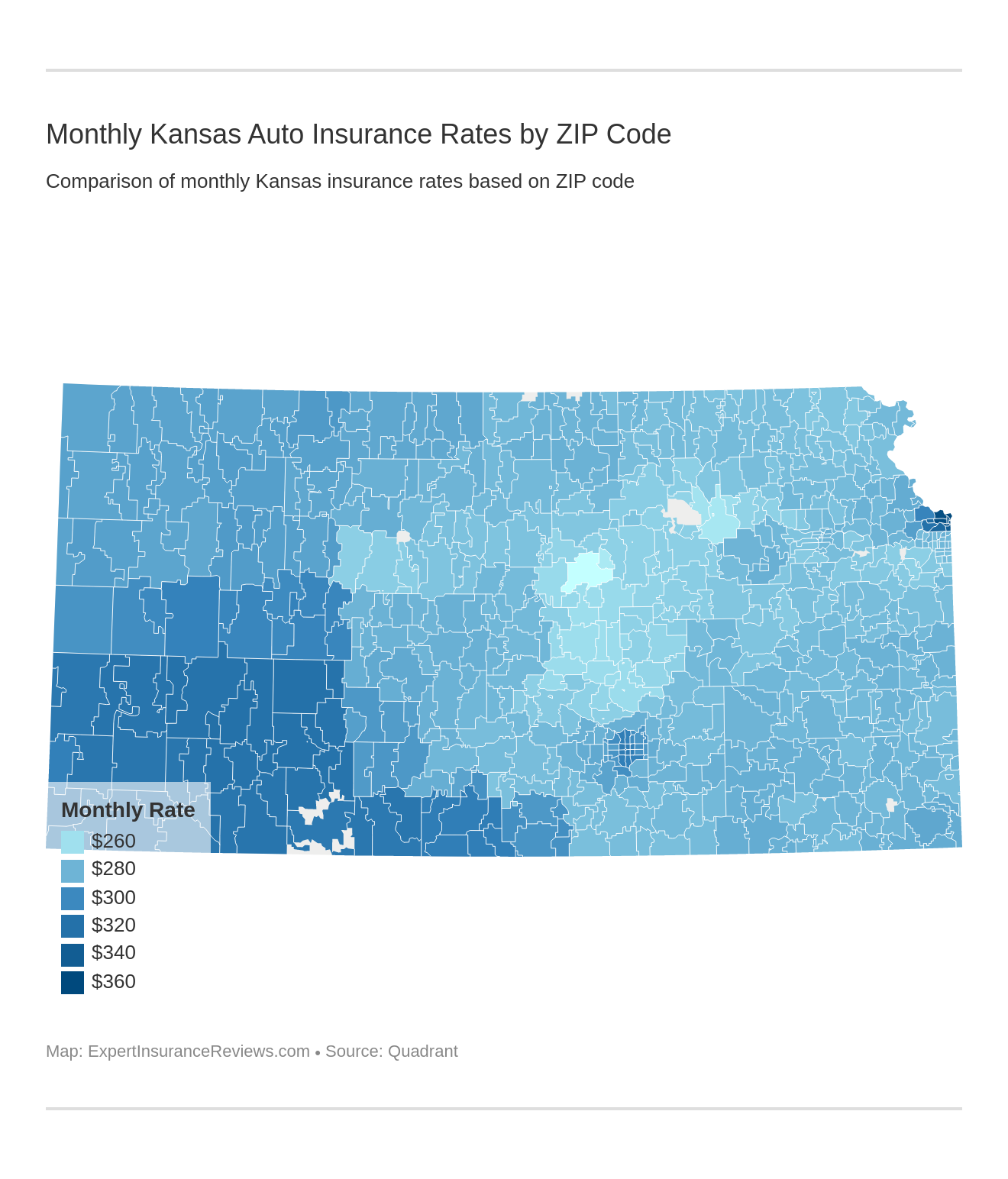

Cheapest Rates by Kansas ZIP Code

Is car insurance premiums different for each ZIP code in Kansas? The answer is yes. Each ZIP code has an average annual rate. Some annual rates are the same for different ZIP codes but expect to pay less or more based on where you live. Below is a table that thoroughly shows the estimated rates for each ZIP code.

| Zipcode | Annual Average | Allstate | American Family | Farmers | GEICO | SAFECO | Allied NW | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 66115 | $4,318.12 | $6,181.07 | $2,456.88 | $4,047.31 | $3,824.21 | $6,513.43 | $2,672.84 | $5,944.54 | $3,177.15 | $5,667.95 | $2,695.84 |

| 66104 | $4,257.23 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,950.36 | $3,164.07 | $5,667.95 | $2,695.84 |

| 66102 | $4,233.28 | $6,181.07 | $2,456.88 | $4,445.70 | $3,824.21 | $6,513.43 | $2,672.84 | $4,710.33 | $3,164.54 | $5,667.95 | $2,695.84 |

| 66105 | $4,217.19 | $6,181.07 | $2,456.88 | $4,376.60 | $3,824.21 | $6,513.43 | $2,672.84 | $4,797.32 | $3,151.92 | $5,501.77 | $2,695.84 |

| 66101 | $4,216.05 | $6,181.07 | $2,456.88 | $4,176.21 | $3,824.21 | $6,513.43 | $2,672.84 | $4,781.85 | $3,190.20 | $5,667.95 | $2,695.84 |

| 66118 | $4,212.34 | $6,181.07 | $2,456.88 | $4,094.35 | $3,824.21 | $6,513.43 | $2,672.84 | $4,826.68 | $3,190.20 | $5,667.95 | $2,695.84 |

| 66160 | $4,174.73 | $6,181.07 | $2,456.88 | $3,796.38 | $2,896.90 | $6,513.43 | $2,672.84 | $6,107.66 | $2,758.41 | $5,667.95 | $2,695.84 |

| 66103 | $4,097.95 | $5,360.29 | $2,456.88 | $4,148.64 | $3,824.21 | $6,513.43 | $2,672.84 | $4,487.50 | $3,151.92 | $5,667.95 | $2,695.84 |

| 66106 | $3,944.33 | $5,360.29 | $2,456.88 | $4,180.19 | $3,824.21 | $5,347.58 | $2,672.84 | $4,571.67 | $3,113.66 | $5,220.21 | $2,695.84 |

| 66112 | $3,924.22 | $6,181.07 | $2,456.88 | $4,060.41 | $3,073.89 | $5,347.58 | $2,672.84 | $4,715.82 | $3,138.87 | $5,209.79 | $2,385.02 |

| 67868 | $3,855.65 | $5,045.84 | $2,351.02 | $4,264.45 | $3,858.77 | $5,174.70 | $2,642.76 | $4,862.84 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67853 | $3,838.60 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,969.78 | $2,848.89 | $4,943.42 | $2,577.23 |

| 67854 | $3,835.59 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,933.19 | $2,874.30 | $4,952.02 | $2,577.23 |

| 66111 | $3,833.58 | $5,360.29 | $2,456.88 | $3,992.39 | $3,073.89 | $5,347.58 | $2,672.84 | $4,698.30 | $3,138.87 | $5,209.79 | $2,385.02 |

| 67841 | $3,833.27 | $5,045.84 | $2,262.97 | $4,097.40 | $3,858.77 | $5,174.70 | $2,544.45 | $4,992.41 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67851 | $3,830.89 | $5,045.84 | $2,351.02 | $4,042.92 | $3,858.77 | $5,174.70 | $2,642.76 | $4,775.67 | $2,896.54 | $4,943.42 | $2,577.23 |

| 67837 | $3,828.09 | $5,045.84 | $2,262.97 | $4,133.90 | $3,858.77 | $5,174.70 | $2,544.45 | $4,904.13 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67882 | $3,826.88 | $5,045.84 | $2,312.08 | $4,133.90 | $3,858.77 | $5,174.70 | $2,579.23 | $4,808.14 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67953 | $3,826.20 | $5,045.84 | $2,312.08 | $4,256.61 | $3,858.77 | $5,174.70 | $2,544.45 | $4,713.46 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67835 | $3,825.54 | $5,045.84 | $2,262.97 | $4,160.00 | $3,858.77 | $5,174.70 | $2,544.45 | $4,839.15 | $2,848.89 | $4,943.42 | $2,577.23 |

| 67801 | $3,824.90 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,888.64 | $2,857.74 | $5,040.02 | $2,577.23 |

| 67849 | $3,821.64 | $5,045.84 | $2,263.27 | $4,097.40 | $3,858.77 | $5,174.70 | $2,579.23 | $4,832.48 | $2,835.47 | $4,952.02 | $2,577.23 |

| 67859 | $3,819.33 | $5,045.84 | $2,312.08 | $4,281.56 | $3,858.77 | $5,174.70 | $2,544.45 | $4,606.41 | $2,848.89 | $4,943.42 | $2,577.23 |

| 67843 | $3,817.80 | $5,045.84 | $2,312.08 | $3,914.76 | $3,858.77 | $5,174.70 | $2,579.23 | $4,936.47 | $2,835.47 | $4,943.42 | $2,577.23 |

| 67846 | $3,817.24 | $5,045.84 | $2,351.02 | $3,888.68 | $3,858.77 | $5,174.70 | $2,642.76 | $4,793.47 | $2,896.54 | $4,943.42 | $2,577.23 |

| Zipcode | Annual Average | Allstate | American Family | Farmers | GEICO | SAFECO | Allied NW | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 67401 | $2,954.93 | $3,880.12 | $1,917.57 | $3,335.46 | $2,617.54 | $4,289.55 | $2,179.81 | $3,531.77 | $2,397.91 | $3,403.81 | $1,995.72 |

| 67470 | $3,067.59 | $3,880.12 | $1,917.57 | $3,439.40 | $3,092.66 | $4,289.55 | $2,179.81 | $3,570.32 | $2,483.27 | $3,827.48 | $1,995.72 |

| 66502 | $3,083.72 | $3,880.12 | $1,924.47 | $3,472.56 | $2,704.64 | $4,432.67 | $2,387.85 | $3,650.70 | $2,528.96 | $3,845.78 | $2,009.51 |

| 66506 | $3,088.18 | $3,880.12 | $1,924.47 | $3,489.20 | $2,704.64 | $4,432.67 | $2,387.85 | $3,524.55 | $2,528.96 | $3,999.86 | $2,009.51 |

| 66503 | $3,108.05 | $3,880.12 | $1,924.47 | $3,506.54 | $2,704.64 | $4,432.67 | $2,387.85 | $3,779.91 | $2,532.48 | $3,922.37 | $2,009.51 |

| 66535 | $3,130.32 | $3,880.12 | $2,029.99 | $3,491.58 | $2,704.64 | $4,432.67 | $2,387.85 | $3,855.14 | $2,533.22 | $3,978.44 | $2,009.51 |

| 67117 | $3,131.94 | $3,795.40 | $2,031.28 | $3,218.74 | $3,092.66 | $4,463.05 | $2,166.52 | $3,353.46 | $2,502.82 | $4,208.33 | $2,487.19 |

| 67460 | $3,133.52 | $3,795.40 | $1,982.93 | $3,205.27 | $3,092.66 | $4,685.08 | $2,132.78 | $3,509.90 | $2,502.82 | $4,105.48 | $2,322.87 |

| 67443 | $3,135.45 | $3,795.40 | $1,982.93 | $3,205.27 | $3,092.66 | $4,685.08 | $2,132.78 | $3,529.21 | $2,502.82 | $4,105.48 | $2,322.87 |

| 67456 | $3,136.99 | $3,880.12 | $1,982.93 | $3,214.52 | $3,092.66 | $4,685.08 | $2,132.78 | $3,459.32 | $2,494.11 | $4,105.48 | $2,322.87 |

| 67062 | $3,139.21 | $3,795.40 | $2,031.28 | $3,298.59 | $3,092.66 | $4,463.05 | $2,166.52 | $3,336.52 | $2,512.60 | $4,208.33 | $2,487.19 |

| 67428 | $3,140.20 | $3,795.40 | $1,982.93 | $3,240.58 | $3,092.66 | $4,685.08 | $2,132.78 | $3,541.35 | $2,502.82 | $4,105.48 | $2,322.87 |

| 67107 | $3,140.92 | $3,795.40 | $1,982.93 | $3,294.06 | $3,092.66 | $4,685.08 | $2,132.78 | $3,485.33 | $2,512.60 | $4,105.48 | $2,322.87 |

| 67416 | $3,145.73 | $3,880.12 | $1,917.57 | $3,283.28 | $3,092.66 | $4,685.08 | $2,532.72 | $3,528.93 | $2,494.41 | $4,046.79 | $1,995.72 |

| 67476 | $3,147.28 | $3,880.12 | $1,982.93 | $3,240.58 | $3,092.66 | $4,685.08 | $2,132.78 | $3,547.05 | $2,483.27 | $4,105.48 | $2,322.87 |

| 67114 | $3,148.20 | $3,795.40 | $2,031.28 | $3,336.59 | $3,092.66 | $4,463.05 | $2,166.52 | $3,398.17 | $2,502.82 | $4,208.33 | $2,487.19 |

| 67546 | $3,148.46 | $3,795.40 | $1,982.93 | $3,258.73 | $3,092.66 | $4,685.08 | $2,132.78 | $3,596.10 | $2,512.60 | $4,105.48 | $2,322.87 |

| 67425 | $3,151.76 | $3,880.12 | $1,917.57 | $3,179.18 | $3,092.66 | $4,685.08 | $2,532.72 | $3,704.52 | $2,483.27 | $4,046.79 | $1,995.72 |

| 67448 | $3,159.41 | $3,880.12 | $1,917.57 | $3,312.41 | $3,092.66 | $4,685.08 | $2,532.72 | $3,636.64 | $2,494.41 | $4,046.79 | $1,995.72 |

| 67151 | $3,160.18 | $3,795.40 | $2,031.28 | $3,363.21 | $3,092.66 | $4,463.05 | $2,166.52 | $3,481.57 | $2,512.60 | $4,208.33 | $2,487.19 |

| 67502 | $3,161.51 | $3,795.40 | $2,058.84 | $3,287.64 | $3,038.99 | $4,280.21 | $2,443.88 | $3,781.53 | $2,663.50 | $4,013.64 | $2,251.46 |

| 67442 | $3,162.68 | $3,880.12 | $1,917.57 | $3,487.51 | $3,092.66 | $4,685.08 | $2,532.72 | $3,505.33 | $2,483.27 | $4,046.79 | $1,995.72 |

| 67491 | $3,165.42 | $3,795.40 | $1,982.93 | $3,468.14 | $3,092.66 | $4,685.08 | $2,132.78 | $3,585.62 | $2,483.27 | $4,105.48 | $2,322.87 |

| 67073 | $3,170.77 | $3,795.40 | $1,937.11 | $3,206.57 | $3,092.66 | $4,685.08 | $2,337.13 | $3,655.54 | $2,483.27 | $4,192.08 | $2,322.87 |

| 67053 | $3,174.16 | $3,795.40 | $1,937.11 | $3,536.09 | $3,092.66 | $4,463.05 | $2,337.13 | $3,565.72 | $2,483.27 | $4,208.33 | $2,322.87 |

American Family, GEICO, Allied NW, and USAA have the cheapest rates by ZIP code, while companies like Allstate and SAFECO carry higher premiums for policyholders.

Cheapest Rates by Kansas Cities

ZIP codes can be tricky sometimes. Some car insurance may not base your rates through ZIP code but will base your rates on what city you live in. Let’s sort through the table to find out which city has the cheapest car insurance premium and the city with the most expensive premium.

| City | Annual Average |

|---|---|

| KANSAS CITY | $4,087.49 |

| PIERCEVILLE | $3,855.65 |

| INGALLS | $3,838.60 |

| JETMORE | $3,835.59 |

| ENSIGN | $3,833.26 |

| HOLCOMB | $3,830.89 |

| COPELAND | $3,828.09 |

| WRIGHT | $3,826.88 |

| RICHFIELD | $3,826.20 |

| CIMARRON | $3,825.54 |

| DODGE CITY | $3,824.90 |

| HANSTON | $3,821.64 |

| KISMET | $3,819.33 |

| FORT DODGE | $3,817.80 |

| GARDEN CITY | $3,817.24 |

| FORD | $3,812.40 |

| MONTEZUMA | $3,810.87 |

| KENDALL | $3,808.37 |

| HUGOTON | $3,805.58 |

| BUCKLIN | $3,803.94 |

| SPEARVILLE | $3,803.16 |

| SUBLETTE | $3,802.88 |

| MINNEOLA | $3,801.29 |

| MOSCOW | $3,799.41 |

| DEERFIELD | $3,798.29 |

| City | Annual Average |

|---|---|

| SALINA | $2,954.93 |

| NEW CAMBRIA | $3,067.59 |

| MANHATTAN | $3,093.32 |

| SAINT GEORGE | $3,130.31 |

| NORTH NEWTON | $3,131.94 |

| MCPHERSON | $3,133.52 |

| GALVA | $3,135.45 |

| LINDSBORG | $3,136.99 |

| HESSTON | $3,139.21 |

| CANTON | $3,140.20 |

| MOUNDRIDGE | $3,140.92 |

| ASSARIA | $3,145.73 |

| ROXBURY | $3,147.28 |

| NEWTON | $3,148.20 |

| INMAN | $3,148.46 |

| BROOKVILLE | $3,151.76 |

| GYPSUM | $3,159.41 |

| WALTON | $3,160.18 |

| FALUN | $3,162.68 |

| WINDOM | $3,165.42 |

| LEHIGH | $3,170.77 |

| GOESSEL | $3,174.16 |

| HALSTEAD | $3,174.34 |

| PEABODY | $3,179.34 |

| OGDEN | $3,179.94 |

Salina, Kansas is the cheapest city with an annual rate of $2,955. The most expensive city is Kansas City, Kansas with an annual rate of $4087.

Best Car Insurance Companies in Kansas

We don’t choose which car insurance companies are better. In this section, we show you the average annual rates, ratings, and other relevant data of the best insurance companies.

We don’t rate car insurance companies, but we can give you the rundown on who conducts financial ratings and consumer compliance ratings. That way, you can judge which car insurance company is right for you.

Largest Companies Financial Rating

Firstly, what are financial ratings?

Financial ratings are third-party opinions that judge a car insurance company’s ability and willingness to meet financial obligations.

These financial obligations are divided into two types of financial ratings, which are financial strength rating and debt rating.

- Financial Strength Rating is an estimation of an insurer’s ability to meet its obligations to policyholders.

- Debt Rating is an estimation of an issuer’s creditworthiness to meet financial obligations such as senior debt, surplus notes, commercial paper, etc.

Ratings are not a recommendation to hold a financial obligation, purchase or sell.

Let’s examine the companies with the best financial ratings in Kansas.

Top Agencies' Monthly Financial Rankings

| Company | AM Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| Allstate | A+ | $83,243 | 0.95% | 4.64% |

| Erie Insurance | A+ | $96,155 | 1.10% | 5.41% |

| Farmers | NR | $16,014 | 0.18% | 6.18% |

| Geico | A++ | $58,908 | 0.67% | 6.19% |

| Liberty Mutual | A | $35,342 | 0.40% | 5.09% |

| Nationwide | A+ | $65,509 | 0.75% | 5.00% |

| Progressive | A+ | $72,965 | 0.83% | 4.88% |

| State Farm | A++ | $148,326 | 1.70% | 5.31% |

| Travelers | A++ | $27,997 | 0.32% | 5.20% |

| USAA* | A++ | $24,957 | 0.29% | 6.00% |

A.M. Best is one of the third-party agencies that judges car insurance companies across the U.S. The companies with the best financial ratings happen to be the largest in Kansas. Most of the large companies appear to be in good financial standing with grades A and A+.

Companies with the Best Rating

How are these companies with policyholders? J.D. Power provided consumer satisfaction ratings in their latest study in a press release. We’ve provided the results in the table below.

| Company | J.D. Power Point (based on a 1,000-point scale) | J.D. Power Circle Ratings |

|---|---|---|

| Allstate | 844 | 4 |

| American Family | 823 | 3 |

| Auto Club of Southern California | 837 | 3 |

| Auto-Owners Insurance | 856 | 5 |

| Central Region Average | 832 | 3 |

| Farm Bureau Mutual | 822 | 3 |

| Farmers | 817 | 2 |

| GEICO | 838 | 4 |

| Liberty Mutual | 811 | 2 |

| Nationwide | 807 | 2 |

| Progressive | 823 | 3 |

| Safeco | 819 | 2 |

| Shelter | 858 | 5 |

| State Farm | 828 | 3 |

| Travelers | 832 | 3 |

| USAA* | 907 | 5 |

USAA holds strong with the best overall consumer rating. USAA is only available to military service members and their immediate families. The other companies, however, are available to everyone. Shelter, Auto-Owners Insurance and Allstate are the top three with over 800 points and five circle ratings from J.D. Power.

Companies with the Most Complaints in Kansas

No company is without complaints. It’s fair to talk about complaints against car insurance companies. Some may even say that it’s good to have complaints.

How so? With complaints, there is room to correct issues with policies or claims. If no one complains, the errors will go unnoticed. In the table below, we’ll see the number of complaints about each major car insurance company.

| Rank | Company | Market share | Complaint index |

|---|---|---|---|

| 4 | Allied | 2.22% | 0.64 |

| 13 | Allstate | 4.00% | 1.2 |

| 8 | American Family | 11.65% | 0.86 |

| 3 | Farm Bureau | 7.05% | 0.62 |

| 6 | Farmers | 5.29% | 0.77 |

| 9 | GEICO | 4.18% | 0.98 |

| 15 | Key | 0.92% | 4.77 |

| 1 | Nationwide | 1.30% | 0.44 |

| 11 | Progressive | 11.55% | 1.01 |

| 10 | Safeco | 1.83% | 1 |

| 12 | Shelter | 3.19% | 1.06 |

| 7 | Standard | 2.88% | 0.83 |

| 5 | State Farm | 19.21% | 0.71 |

| 14 | Traders | 0.99% | 3.28 |

| 2 | USAA | 5.06% | 0.56 |

State Farm saw the most complaints in 2017 with over 1,400 complaints. Again, complaints against car insurance companies don’t mean the company is bad.

Cheapest Insurance Companies in Kansas

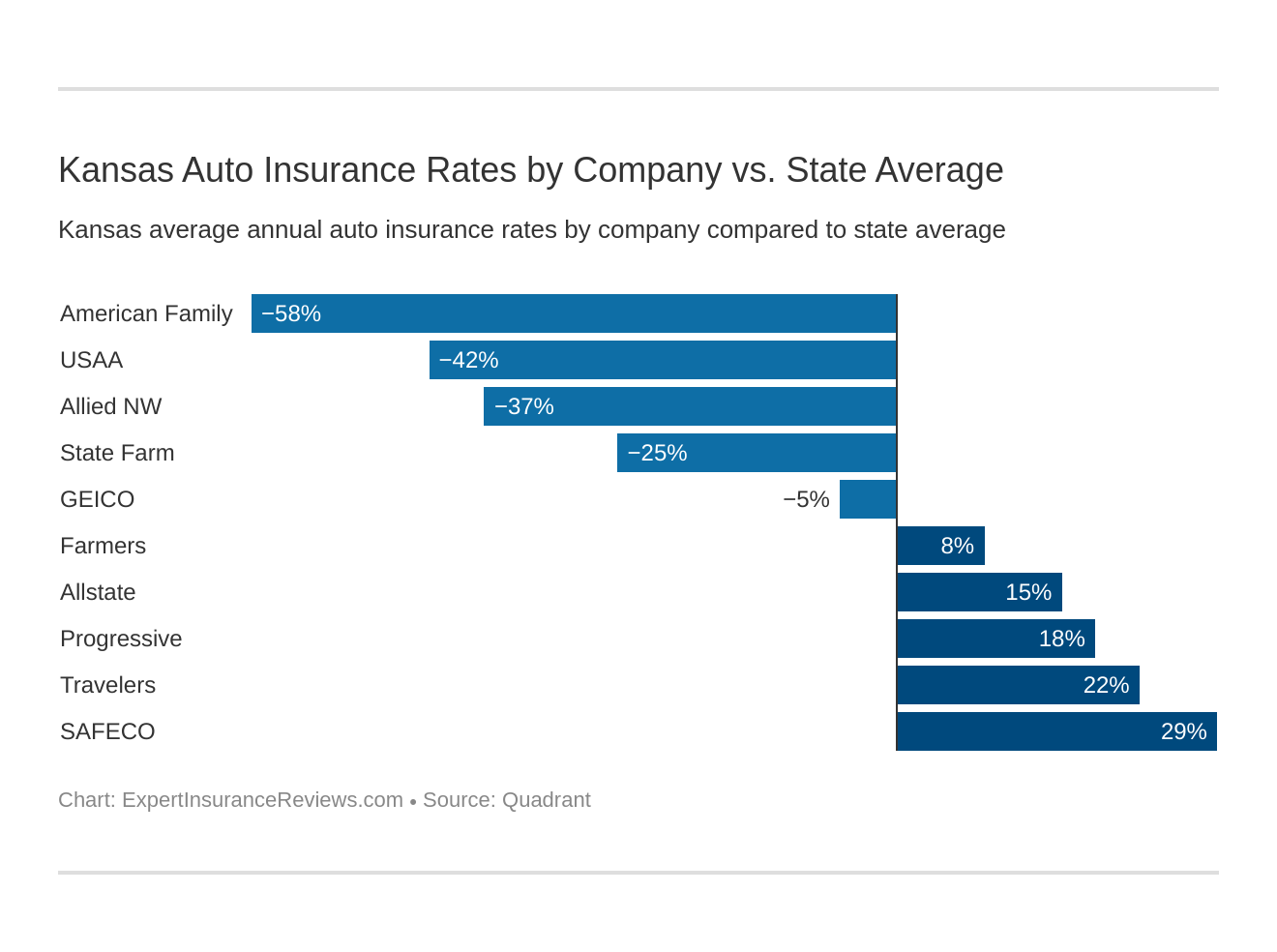

You may have jumped right to this section to make your search for cost-efficient go much faster. The largest car insurance companies have a national presence, so we’ve gathered data with annual estimates you can compare.

| Company | Annual Average | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Allstate | $4,010.00 | $617.00 | 15.39% |

| American Family Mutual | $2,146.00 | -$1,247.00 | -58.08% |

| Farmers | $3,704.00 | $311.00 | 8.39% |

| GEICO | $3,221.00 | -$172.00 | -5.35% |

| SAFECO | $4,784.00 | $1,391.00 | 29.08% |

| Allied NW | $2,476.00 | -$917.00 | -37.06% |

| Progressive | $4,144.00 | $751.00 | 18.13% |

| State Farm | $2,720.00 | -$673.00 | -24.74% |

| Travelers | $4,341.00 | $948.00 | 21.85% |

| USAA* | $2,383.00 | -$1,010.00 | -42.40% |

The negative dollar amounts indicate that the company premium is a certain amount below Kansas’ average annual rate. Therefore, American Family’s average is $1,247 less than the Kansas average annual rate for car insurance companies.

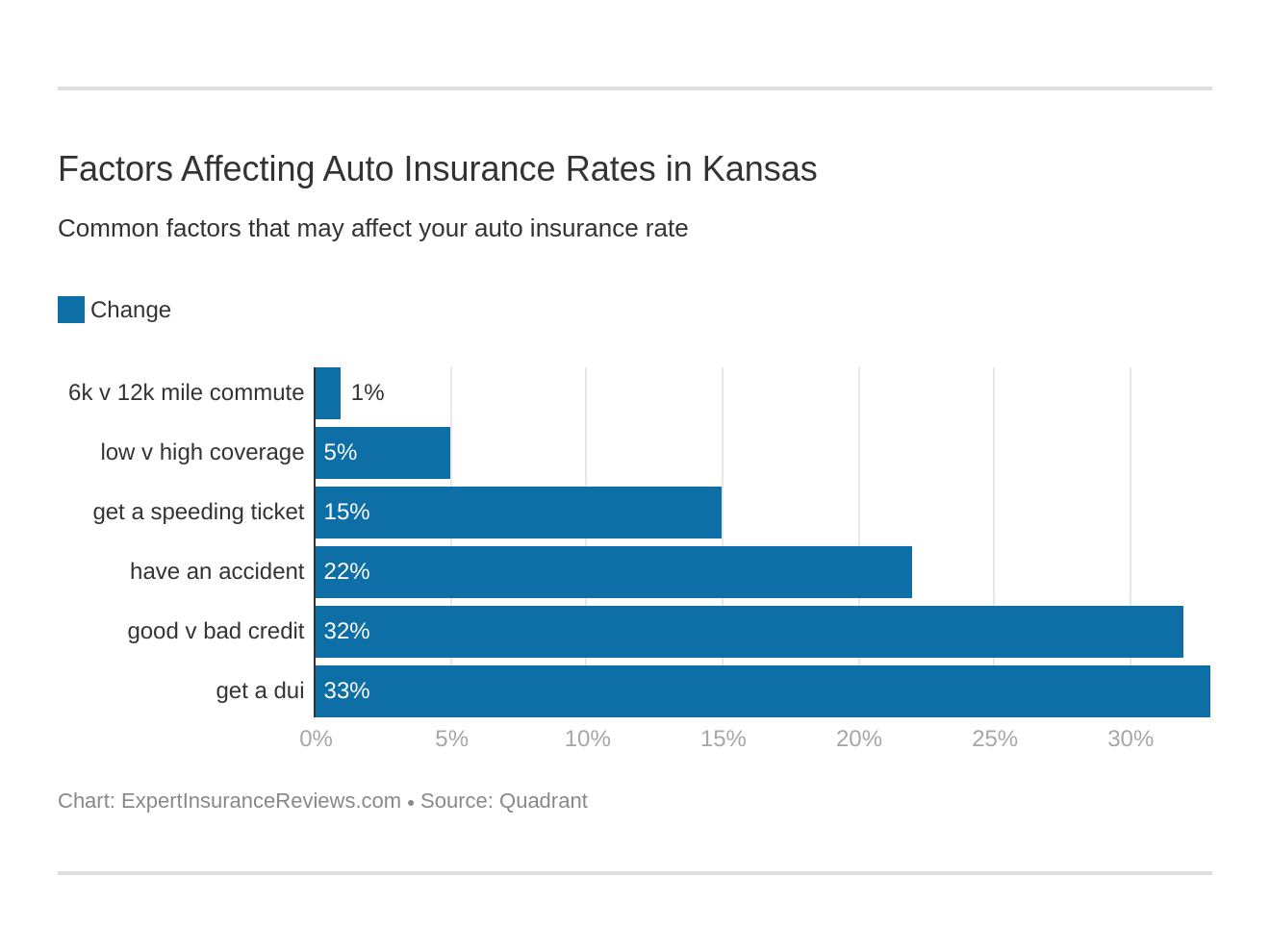

Commute Rates by Companies

If a car insurance company asks you about how often you drive your vehicle, expect your yearly commute to affect your annual premium. This table goes into detail about those rates.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,010 | $4,010 |

| American Family | $2,119 | $2,174 |

| Farmers | $3,704 | $3,704 |

| GEICO | $3,152 | $3,290 |

| Liberty Mutual | $4,784 | $4,784 |

| Nationwide | $2,476 | $2,476 |

| Progressive | $4,144 | $4,144 |

| State Farm | $2,652 | $2,788 |

| Travelers | $4,341 | $4,341 |

| USAA | $2,313 | $2,452 |

Most companies in the table charge the same rate regardless of estimated miles traveled per year. The cheapest companies on the list don’t.

Coverage Level Rates by Companies

We talked about core coverage earlier in the guide. Let’s take this opportunity to examine the details of each coverage level rate in the table below. Remember, you can sort the table from lowest to highest or highest to lowest by clicking the up and down triangles.

| Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allied NW | $2,606 | $2,448 | $2,371 |

| Allstate | $3,894 | $4,001 | $4,134 |

| American Family | $2,016 | $2,168 | $2,254 |

| Farmers | $3,555 | $3,684 | $3,871 |

| GEICO | $3,129 | $3,216 | $3,315 |

| Progressive | $3,928 | $4,112 | $4,391 |

| SAFECO | $4,673 | $4,773 | $4,906 |

| State Farm | $2,622 | $2,727 | $2,809 |

| Travelers | $4,124 | $4,347 | $4,551 |

| USAA | $2,304 | $2,376 | $2,466 |

Low coverage levels can be considered the bare minimum coverage or liability coverage. Medium coverage is liability coverage with a collision or comprehensive coverage added to it. High coverage, of course, is full (combined) coverage.

Some coverages are not far away from each other in price. It may more cost-efficient to choose the higher coverage if it’s only a few dollars away from medium or high coverage.

Credit History Rates by Companies

There’s no question about it. The better your credit, the less money you’ll pay to car insurance companies.

How come? Consider credit ratings as financial reputation points. Those with good credit ratings have a better chance of negotiating discounts than those with poor credit.

If you’ve been dropped by a car insurance company because of an unpaid premium, expect some higher premiums from the next car insurance provider.

| Company | Annual Rates with Poor Credit | Annual Rates with Fair Credit | Annual Rates with Good Credit |

|---|---|---|---|

| Allstate | $4,971 | $3,772 | $3,288 |

| American Family | $2,802 | $1,984 | $1,653 |

| Farmers | $4,363 | $3,472 | $3,276 |

| GEICO | $5,005 | $2,648 | $2,010 |

| Liberty Mutual | $4,784 | $4,784 | $4,784 |

| Nationwide | $2,749 | $2,421 | $2,257 |

| Progressive | $4,757 | $3,991 | $3,684 |

| State Farm | $3,960 | $2,367 | $1,833 |

| Travelers | $5,021 | $4,083 | $3,921 |

| USAA | $3,258 | $2,135 | $1,755 |

Regardless of which company you choose, those in the poor credit rating percentile will likely pay more money for car insurance premiums per year than those with fair and good credit.

Driving Record Rates by Companies

Car insurance companies pay close attention to your driving record as well. From accidents to traffic violations, you will be issued premiums based on your driving performance. Let’s look at some annual rates to give you an idea of what you could pay based on your driving record.

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,468 | $4,038 | $4,651 | $3,885 |

| American Family | $2,109 | $2,259 | $2,109 | $2,109 |

| Farmers | $3,124 | $4,015 | $3,914 | $3,762 |

| GEICO | $2,024 | $3,319 | $5,130 | $2,409 |

| Liberty Mutual | $3,615 | $5,422 | $5,326 | $4,775 |

| Nationwide | $1,857 | $2,137 | $3,781 | $2,127 |

| Progressive | $3,829 | $4,477 | $3,999 | $4,273 |

| State Farm | $2,526 | $2,914 | $2,720 | $2,720 |

| Travelers | $3,174 | $4,130 | $5,680 | $4,381 |

| USAA | $1,744 | $2,346 | $3,442 | $1,997 |

Some car insurance companies are lenient and don’t increase the rate of annual premiums due to speeding or DUI. However, consecutive DUIs and speeding violations may increase your premiums. It’s best to strive for a clean record to ensure you pay the most cost-efficient premiums offered by car insurance companies.

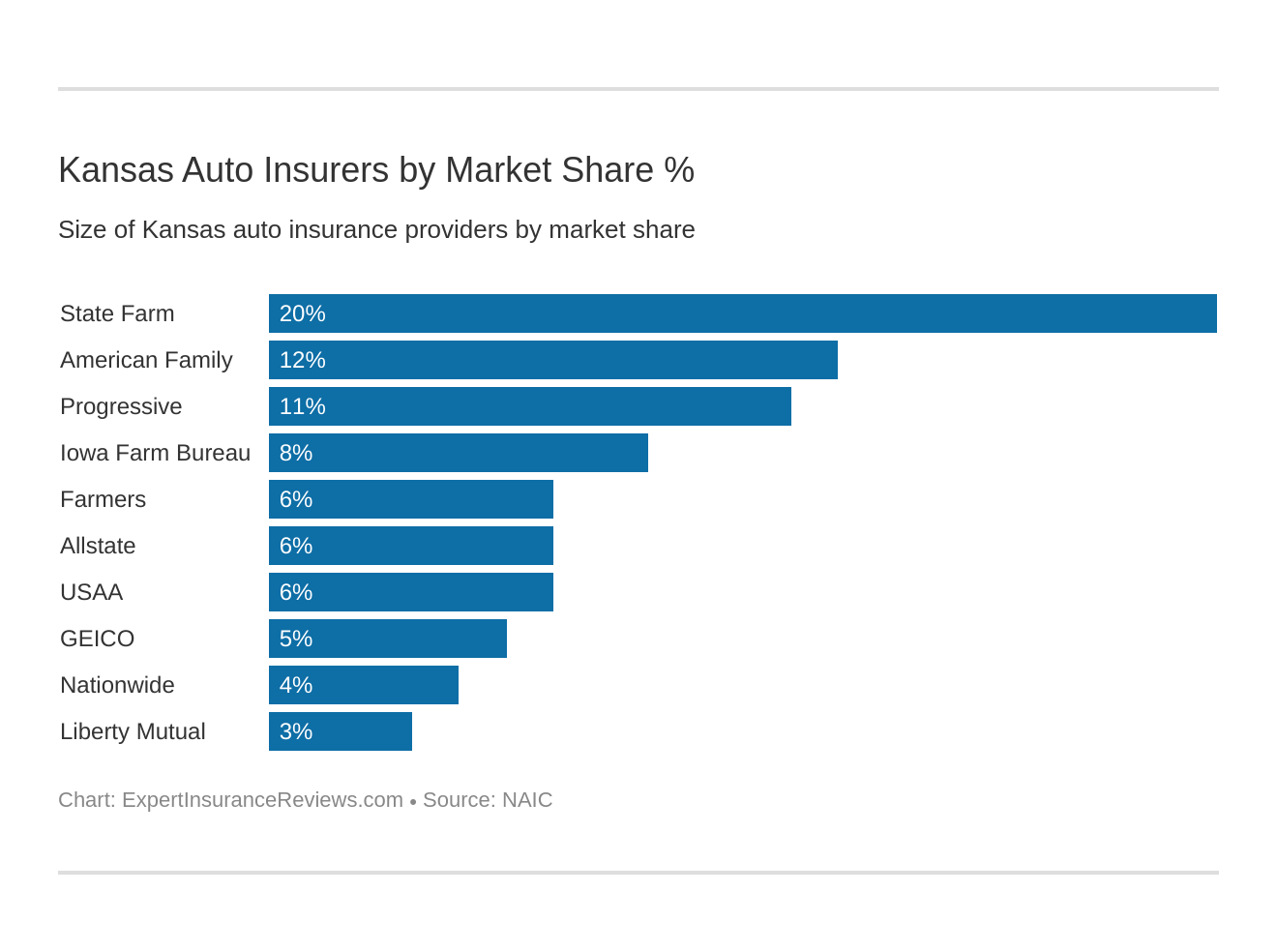

Largest Car Insurance Companies in Kansas

Which companies have the strongest presence in Kansas? More than likely, the largest companies in Kansas are on the list of top financial ratings in the state as well. You’ll notice market share as one of the items we compared.

According to Adam Hayes of Investopedia, “Market share represents the percentage of an industry, or a market’s total sales, that is earned by a particular company over a specified time period.”

We’ve provided the stats of Kansas’ largest car insurance companies in the table below.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 6 | Allstate | $106,161 | 57.26% | 5.74% |

| 2 | American Family | $227,157 | 65.57% | 12.29% |

| 5 | Farmers | $119,885 | 53.98% | 6.48% |

| 8 | GEICO | $91,086 | 71.81% | 4.93% |

| 4 | Iowa Farm Bureau | $138,914 | 64.96% | 7.51% |

| 10 | Liberty Mutual | $61,418 | 57.55% | 3.32% |

| 9 | Nationwide | $81,476 | 62.46% | 4.41% |

| 3 | Progressive | $199,252 | 59.35% | 10.78% |

| 1 | State Farm | $374,079 | 64.37% | 20.23% |

| 7 | USAA | $102,544 | 71.90% | 5.55% |

| **Rank Total** | **Company state Total** | $1,848,756 | 63.50% | 100.00% |

The lowest market share percent was held by Liberty Mutual, but the highest market share percent was held by State Farm.

Number of Insurers in Kansas

Domestic insurers are car insurance companies that received its license to operate in a specific state (Kansas by following the statutory laws and requirements of the state and hosting its headquarters there. However, foreign insurers are car insurance companies that are located in one state but writes policies for clients in other states.

| Type of insurer | # of Insurers |

|---|---|

| Domestic | 25 |

| Foreign | 898 |

| Total | 913 |

The number of foreign insurers outnumbers domestic insurers in Kansas.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Kansas State Laws

It’s unlikely to remember all laws of the State of Kansas. This guide, however, will give you the essentials you’ll need to know to once you’re insured. We’ll cover some car insurance laws, the statute of limitations of Kansas.

Kansas Car Insurance Laws

Understanding law, in general, can be complicated. When bills or laws are enacted they are sometimes written in legal jargon that’s very intimidating for those who may be searching for answers on Kansas car insurance laws. We’ll break down that legal jargon to simple summaries in each sub-section.

How Kansas Insurance Laws are Determined

The National Association Of Insurance Commissioners (NAIC) classifies Kansas as a Flex Rating state. Flex-rating laws will allow an insurer to adjust its rates as long as the percentage change is above a target threshold. Any rate increase above the threshold will bring scrutiny to ensure that it’s not unreasonable.

Windshield Coverage

Car insurance companies in Kansas are not required by law to pay for damaged windshields. Kansas motorists could pay a deductible for a windshield if it’s damaged. Car insurance companies may use aftermarket parts that are of like kind and quality. (For more information, read our “Does my car insurance cover damage to my windshield?“).

Most companies will include windshield coverage that may be included in comprehensive coverage, also. Even though some companies may charge you a deductible, some companies may not charge you anything. Ask a car insurance agent about windshield repair and replacement deductibles as you shop for coverage.

High-Risk Insurance

High-risk drivers may not be able to find voluntary car insurance due to the number of car accidents, traffic violations, or DUIs they have on their driving record. There is a program in Kansas called the Kansas Automobile Insurance Plan (KSAIP).

Motorists who are considered too high a risk to insure must enroll in KSAIP. It’s the last resort to drive with car insurance.

To be eligible for KSAIP, a motorist must try to find voluntary insurance for 60 days.

If they cannot find car insurance coverage in those 60 days, a motorist may be eligible for KSAIP. KSAIP assigns a motorist to a car insurance company. After three years, the motorist may choose voluntary car insurance options. If car insurance companies still consider a motorist a high-risk, the motorist can re-apply to KSAIP.

Low-Cost Insurance

Kansas is one of many states that does not provide state government car insurance programs. Only three states in the U.S. provide government-funded car insurance and they are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Kansas

The rule of law on fraud is universal. There are some specifics for each state. Kansas defines insurance fraud as someone who tries to make money from insurance transactions by deceiving companies, agencies, or other motorists. Insurance fraud is a criminal offense in Kansas.

Kansas Department of Insurance gives several examples of car insurance fraud.

Drive Down – A driver signals another driver to intentionally hit the passing car.

Hit & Run – A fraud claim where criminals say they were in an accident and can’t identify the other driver and call the police to verify.

Paper Accidents – A vehicle owner makes up a car accident by making false police and insurance reports.

Policy Misrepresentation – A vehicle owner uses another person’s address, misrepresenting their commute from home to work to receive a lower premium from a car insurance company.

Owner Give-Up – The vehicle owner plans to destroy their vehicle to collect insurance money.

Risky Repairs – A car repair shop owner offers to gouge or hide the repair cost to gain more money from car insurance companies.

Sideswipe – A driver in the inside lane of a dual left-turn lane in a busy intersection drifts into the outer lane, intentionally forcing a collision.

Swoop & Squat — This scam occurs when a passing vehicle suddenly pulls in front of another vehicle causing the vehicle behind the passing vehicle to stop abruptly. As a result, it causes a collision. This scam usually conducted by two parties with both of them collecting compensation for property damage and personal injury.

Statute of Limitations

When you’re injured in a car accident or when your car is damaged, the statute of limitations begins. The statute of limitations is a time limit in which you can file a claim or pursue legal action against another motorist or car insurance company.

In Kansas, the statute of limitations for personal injury is one year from the event, accident, etc. The statute of limitations for property damage is two years.

Kansas’s Specific Laws

Kansas has several laws dedicated to used cars. These laws provide options, compensations, and protections for buyers of used vehicles in Kansas who get less than what the seller promised.

New-Car Lemon Laws – Kansas is one of the states that cover some used cars under new-car lemon laws. In Kansas, lemon laws pertain to recent-model vehicles purchased as used cars.

If the car’s problems were reported to the manufacturer or dealer during the warranty period or after the vehicle was delivered to its first owner (usually 12 months after the vehicle was delivered), you may be entitled to compensation if you buy that car used.

According to Nancy Wagner of It Still Runs, “Kansas state law says the manufacturer or dealer must replace the vehicle with a comparable vehicle under warranty or accept the return of the vehicle and refund the purchase price minus an allowance for the use of the vehicle.”

Unfair and Deceptive Acts and Practices Law – If a dealer or seller gave you false information on a car you purchased, you can use the Unfair and Deceptive Acts and Practices Law to pursue legal action.

This law applies to cars sold “as is”, also. If the dealer or seller failed to give you information about the vehicle’s problems, you can also use this act to pursue legal actions against the seller.

Kansas Vehicle Licensing Laws

Let’s talk about what you’ll need to do to get a driver’s license in Kansas. No motorist can drive in any state without a driver’s license.

Read more:

- Can I buy car insurance without a driver’s license?

- How to Get Car Insurance Without a License: An Expert Guide

But don’t worry, we’ll get you the information you need to become a licensed driver in Kansas. First, we’ll talk about the new REAL ID compliance law, then move onto different laws and procedures that you’ll need to know as a resident and motorist in the state of Kansas.

REAL ID

REAL ID will become the standard for all driver’s licenses and identification cardholders. The REAL ID is an identification card or driver’s license that verifies that you are a U.S. citizen and it allows you to board domestic flights in the U.S. On October 2020, it will be required by law for individuals to have Real IDs.

Forty-seven states are Real ID compliant. Two states have filed for an extension for Real ID compliance, and New Jersey’s version of Real ID compliance is currently under review.

Check out this short video to get Homeland Security’s explanation on REAL IDs.

https://youtu.be/C7S2VEc4l94?list=PLXWway_rv-jV76xGxOFHmEVugiisA9E1n

Kansas is compliant with the REAL ID Act. Federal agencies will accept any Real ID Kansas driver’s licenses and identification cards at federal facilities and nuclear power plants.

To receive your REAL ID in the state of Kansas, you’ll need:

- proof of U.S. citizenship

- Social Security Number

- proof of residency in Kansas

- and valid proof of name change (in case you were married, divorced, adopted, etc.)

Penalties for Driving without Insurance

Driving without insurance can lead to fines, your vehicle could be towed, and/or you could face jail time. Law enforcement and courts are strict on drivers who drive without insurance. Kansas is no different.

The 1st Offense is $300 to $1000 and/or confinement in jail for up to six months. Your license and registration will likely be suspended until you obtain car insurance. The reinstatement fee is $100 and you will have to enroll in an SR22 insurance certificate for three years.

The 2nd offense is $800 to $2500 and/or confinement in jail for one year. Your license and registration will likely be suspended until you obtain car insurance. The reinstatement fee is $300 if your driver’s license is revoked within a year. If not, the reinstatement fee is $100.

The 3rd offense is $800 to $2500 and/or confinement in jail for up to two years. Your license, registration, and driving privileges will be revoked. The reinstatement fee is $300 if your driver’s license is revoked within a year.

Teen Driver Laws

We’ve put the teen driver laws in a table to make this section as concise as possible.

| Minimum entry age | Mandatory holding period | Minimum amount of supervised driving | Minimum age | Unsupervised driving prohibited | Restriction on passengers (family members excepted unless otherwise noted) | Nighttime restrictions | Passenger restrictions |

|---|---|---|---|---|---|---|---|

| 14 | 12 months | 25 hours, in learner phase; 25 hours before age 16; 10 of the 50 hours must be at night | 16 | 9 p.m. - 5 a.m. | no more than one passenger younger than 18 | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

Kansas has one of the youngest age requirements in the U.S. Teens that ae 14 years old can begin the learning phase of driving. They have to drive for at least 12 months with adult supervision.

Teens must have at least 25 hours of supervised driver training in the learning phase and 25 hours before age 16. Ten of those hours must nighttime driving training.

During the learning phase, a teen can obtain a learner’s permit but can’t drive without supervision.

In the intermediate stage, a conditional license is issued. Teens between 16 and 17 are allowed to drive unsupervised from 9 a. m. to 5 p. m. No more than one passenger under the age of 18 unless accompanied by a licensed adult.

These restrictions can be lifted after six months of driving with a conditional license or until the teen turns 17 years old, whichever comes first.

Older Driver License Renewal Procedures

Older drivers renew their licenses differently than other drivers in Kansas. Drivers over the age of 65 will have to renew their driver’s licenses every four years. Upon renewal, older drivers will have to take a vision test.

New Residents

Out-of-state motorists who are seeking to have their driver’s license transfer to a Kansas driver’s license have to follow a procedure. First, you should collect all the necessary documents proving that you’re a U.S. citizen. Those documents include your current (unexpired) driver’s license, social security number, birth certificate and proof of car insurance.

If you recently got residency in Kansas, you have up to 90 days to obtain a Kansas driver’s license. Full-time college students who are from other states and military members are exempt from the license and registration residency rules.

License Renewal Procedures

Driver’s license holders in Kansas have to renew their licenses every eight years. You can renew them at a local Kansas DMV or you can renew your license and vehicle registration online.

If your license is expired, you’ll have to report to the DMV in person with proof of residency, social security number, proof of insurance, and birth certificate. The Kansas DMV will administer a required vision test. The results must be satisfactory for you to get your renewed license.

Negligent Operator Treatment System (NOTS)

Kansas does not have a points system (NOTS), but the state does record all traffic and road violations. A consistent traffic and road violation record could negatively impact your income and possibly land you a couple of months in jail. The result would drive up car insurance rates and place a nasty stain on your legal record.

Rules of the Road

Just like the rules of car insurance, there are rules motorists must abide by on the roadways. Laws are designed to keep us safe. Sometimes, motorists unintentionally break the law, but the law still has to take effect. This part of the guide will help you identify the laws of the road.

Fault vs. No-Fault

Kansas is under no-fault insurance law.

The Insuruance Information Institute says no-fault insurance law is when every motorist must file a claim with their own insurance company after an accident, regardless of who was at fault. In states with no-fault laws, motorists must purchase PIP as part of their auto insurance policies.

Since additional liabilities such as bodily injury and property damage are part of the Kansas car insurance requirements, you won’t be able to miss this law.

Seat Belt and Car Seat Laws

All drivers and passengers 14 and older are required to be secured in seat belts.

Backseat passengers caught without a seat belt violate a secondary offense, which is a fine of $30. Other violations of the seat belt law are standard offenses or primary offense. Primary offenses have fines of $60.

Individuals younger than 18 are not permitted to ride in the cargo area of a pickup truck.

Children three years old and younger must be in a child restraint. Children four through seven who weigh less than 80 pounds; and children four through seven who are less than 57 inches tall must be in a child restraint or booster seat.

Children 8-13 years old; children four through seven years old who weigh more than 80 pounds; and children four through seven years old who are taller than 57 inches must be in a seat belt.

Violation of improperly seating minors in motor vehicles carries a $60 fine.

Keep Right and Move Over Laws

Like many other states, Kansas has a keep right and move over law. The means that right lanes are designed for slower traffic, and left lanes are designed for express traffic and traffic turning left. If you’re safely passing other drivers, it’s okay to use the left lanes.

Speed Limits

Speed limits are there for many reasons. There are some rural roadways in Kansas. Kansas is one of those states where the speed limit is higher than some states’ average speed limits.

Kansas is home to some of the lushest rural land and has one of the biggest cities in the central region of the U.S. Rural, urban, and limited access road speed limits are 75 mph.

Ridesharing

Ridesharing is popular in the urban areas of Kansas. Uber and Lyft are the driving force competing for commuting Kansas residents. Farmers, GEICO, and USAA offer car insurance coverage for rideshare drivers. Also, rideshare companies require their drivers to carry the minimum coverage.

Automation on the Road

Kansas is one fo four states where testing or approval to test for automation on the road failed. But you haven’t seen the last of automation on the road for Kansas. There’s too much innovation in the U.S. for them not to give testing a second chance.

Safety Laws

We mentioned safety in some of the sub-sections above, but we didn’t talk about safety in terms of DUI law, marijuana-impaired law or laws about distracted driving. Let’s review those laws.

DUI Laws

It’s simple. If you drive under the influence of alcohol, you have violated the law. You’re likely to face a hefty fine, suspended license, and jail time for DUI. In Kansas, the offenses for DUI are as follows:

| Offense | Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 30 day suspension then 330 day restriction | 48 hours mandatory OR 100 hours community service | $500-$1000 | must complete substance abuse evaluation and treatment program; vehicle impouded for up to 1 year |

| 2nd Offense | 1 year suspension then IID for 1 year | 90 days -1 year | $1000-$1500 | must complete court ordered substance abuse program; vehicle impounded up to 1 year |

| 3rd Offense | 1 year suspension then IID for 1 year | 90 days - 1 year | $1500-$2500 | must complete court ordered substance abuse program; vehicle impounded up to 1 year |

| 4th Offense | 1 year suspension; court may revoke license plate or temporary registration for up to 1 year; after year is completed, IID for 1 year | 90 days -1 year | $2500-up | must complete court ordered substance abuse program; vehicle impounded up to 1 year |

Jail time and fines get more intense the more times you commit DUI. There was a washout of ten years, which means that a DUI offense will reset to one (or the offense is forgiven by the state law).

Marijuana-Impaired Driving Laws

For now, there are no marijuana-impaired driving laws. However, law enforcement may arrest you and impound yours for driving under the influence of drugs. Many laws are bundled under DUI or DWI (driving while impaired). Regardless if CBD is legal, it’s safer to drive sober.

Distracted Driving Laws

There isn’t a handheld ban in Kansas yet. Young drivers, likely hold a learner’s permit or intermediate license (conditional license in some states), are not allowed to use cellphones while driving. All drivers are banned from texting and driving. In some Kansas cities, drivers are banned from using any handheld device.

Driving in Kansas

Now that you’ve got the gist of what the car insurance and road laws are like in Kansas, let’s see what it’s like to drive in Kansas. We’ll start things out with some vehicle theft numbers, then talk about fatal crash reports provided by the NHTSA. Finally, we’ll look at average transportation times and methods of travel.

Vehicle Theft in Kansas

Vehicle theft is as unpredictable as an accident a motorist will encounter. Attaching comprehensive coverage to your car insurance policy will fight the unexpected losses from vehicle theft. Always lock your vehicle door and be sure all windows are up to deter thieves.

For those who have had their vehicles stolen, the law does eventually catch them. Each year law enforcement and data analysts put together crime research data to show the vehicles that are likely stolen in Kansas. That information is available below.

| Make/Model | Rank | Year of Vehicle | Thefts |

|---|---|---|---|

| Chevrolet Impala | 7 | 2004 | 98 |

| Chevrolet Pickup (Full Size) | 1 | 1999 | 439 |

| Chevrolet Pickup (Small Size) | 10 | 1998 | 88 |

| Dodge Caravan | 8 | 2002 | 89 |

| Dodge Pickup (Full Size) | 5 | 2001 | 160 |

| Ford Pickup (Full Size) | 2 | 2003 | 415 |

| GMC Pickup (Full Size) | 6 | 1999 | 113 |

| Honda Accord | 3 | 1996 | 319 |

| Honda Civic | 4 | 2000 | 220 |

| Jeep Cherokee/Grand Cherokee | 8 | 2000 | 89 |

Although the Ford F150 is the most popular car in Kansas, thieves have targeted Chevrolet pickup truck more than any other vehicle in Kansas.

Vehicle Theft by City

How does vehicle theft affect each city? The table here shows how many thefts were recorded in 2017. Click the up and down triangles to determine which city had the most thefts and which city had the least.

| City | Motor Vehicle Thefts |

|---|---|

| Abilene | 3 |

| Altamont | 0 |

| Alta Vista | 0 |

| Andale | 0 |

| Andover | 16 |

| Anthony | 3 |

| Arkansas City | 33 |

| Atchison | 27 |

| Atwood | 1 |

| Auburn | 0 |

| Augusta | 17 |

| Basehor | 15 |

| Baxter Springs | 6 |

| Bel Aire | 3 |

| Belle Plaine | 4 |

| Beloit | 1 |

| Bucklin | 0 |

| Burlington | 6 |

| Burns | 0 |

| Caney | 0 |

| Cheney | 1 |

| Cherryvale | 4 |

| Claflin | 0 |

| Clay Center | 3 |

| Clearwater | 2 |

| Coffeyville | 21 |

| Colby | 8 |

| Colony | 0 |

| Columbus | 5 |

| Concordia | 6 |

| Council Grove | 1 |

| Derby | 38 |

| Dodge City | 38 |

| Edwardsville | 20 |

| El Dorado | 36 |

| Ellinwood | 5 |

| Ellsworth | 1 |

| Emporia | 27 |

| Eudora | 8 |

| Fairway | 6 |

| Fort Scott | 16 |

| Fredonia | 3 |

| Frontenac | 6 |

| Galena | 7 |

| Garden City | 35 |

| Gardner | 18 |

| Garnett | 0 |

| Girard | 3 |

| Goddard | 7 |

| Goodland2 | 3 |

| Grandview Plaza | 0 |

| Great Bend | 30 |

| Halstead | 0 |

| Haven | 1 |

| Hays | 22 |

| Haysville | 20 |

| Herington | 2 |

| Hesston | 0 |

| Hiawatha | 6 |

| Hillsboro2 | 11 |

| Holcomb | 1 |

| Holton | 4 |

| Horton | 2 |

| Hutchinson | 138 |

| Independence | 26 |

| Iola | 10 |

| Junction City | 27 |

| Kanopolis | 0 |

| Kingman | 5 |

| Lansing | 11 |

| Larned | 6 |

| Leavenworth | 142 |

| Leawood | 26 |

| Lenexa | 97 |

| Le Roy | 0 |

| Liberal | 16 |

| Lindsborg | 2 |

| Louisburg | 3 |

| Maize | 3 |

| Marysville | 3 |

| McLouth | 1 |

| McPherson | 24 |

| Meade | 2 |

| Merriam | 111 |

| Montezuma | 0 |

| Moran | 0 |

| Mulberry | 0 |

| Mulvane | 13 |

| Neodesha | 1 |

| Newton | 24 |

| North Newton | 1 |

| Norton | 3 |

| Nortonville | 0 |

| Oberlin | 0 |

| Olathe | 152 |

| Osage City | 5 |

| Osawatomie | 1 |

| Oswego | 0 |

| Overland Park | 274 |

| Paola | 9 |

| Park City | 24 |

| Parsons | 22 |

| Pittsburg | 68 |

| Pleasanton | 1 |

| Rose Hill | 2 |

| Russell | 8 |

| Sabetha | 3 |

| Salina | 111 |

| Scott City | 0 |

| Seneca | 1 |

| Shawnee | 138 |

| South Hutchinson | 5 |

| Sterling | 2 |

| Tonganoxie | 8 |

| Topeka | 768 |

| Troy | 0 |

| Ulysses | 4 |

| Valley Center | 23 |

| Valley Falls | 5 |

| Wellington | 32 |

| Wellsville | 0 |

| Westwood | 5 |

| Wichita | 2,478 |

| Winfield | 21 |

Wichita, Kansas had over 2,400 vehicle thefts while 24 other cities in Kansas didn’t have any vehicle thefts. You’re likely to see vehicle thefts in more populated areas.

Road Fatalities in Kansas

It’s essential to Expert Insurance Reviews to give you all the vital information we can muster. Crash reports will inform you about the chances of danger on the roadways of Kansas.

These reports are the reasons for strict laws and costly premiums. Accidents aren’t planned, but they still cause a great deal of harm to motorists and cost a lot of money for motorists and car insurance companies alike.

Most Fatal Highway in Kansas

Kansas has many highways. The most notable and most dangerous highway is Interstate-70. Geotab states that Kansas’ section of Interstate-70 has seen 134 fatal car accidents over the last ten years. Interstate-70 is part of the oldest U.S. interstate system which was established in 1956.

Fatal Crashes by Weather Conditions and Light Conditions

Weather conditions in Kansas are some of the most dangerous the U.S. has ever seen. Kansas has seen weather events such as tornados, hail storms, ice, heavy rain, and lightning. Let’s see how weather and light conditions affect Kansas in the provided data table below.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 7 | 29 | 5 | 0 | 91 |

| Rain | 7 | 5 | 9 | 1 | 0 | 22 |

| Snow/Sleet | 3 | 0 | 2 | 0 | 0 | 5 |

| Other | 8 | 1 | 4 | 3 | 0 | 16 |

| Unknown | 141 | 33 | 81 | 18 | 0 | 273 |

| TOTAL | 209 | 46 | 125 | 27 | 0 | 407 |

Most people died from unknown causes in the daylight, as seen in the data. The second most fatalities happened from unknown conditions at night. Unknown numbers can be a lot of things such as the weather. More than likely, the fatal crashes happened during normal conditions.

Fatalities (All Crashes) by County

Let’s examine a crash report that shows us all total crashes in Kansas. The crash report numbers are separated by county instead of the city. Also, we’re showing a five-year trend.

| County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | Fatalities per 100k (2014) | Fatalities per 100k (2015) | Fatalities per 100k (2016) | Fatalities per 100k (2017) | Fatalities per 100k (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Allen County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 7.92 | 0 | 0 |

| Anderson County | 0 | 1 | 1 | 2 | 1 | 0 | 12.79 | 12.8 | 25.45 | 12.69 |

| Atchison County | 1 | 0 | 0 | 1 | 3 | 6.05 | 0 | 0 | 6.13 | 18.53 |

| Barber County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Barton County | 1 | 2 | 2 | 1 | 0 | 3.66 | 7.36 | 7.44 | 3.78 | 0 |

| Bourbon County | 0 | 1 | 1 | 0 | 0 | 0 | 6.78 | 6.83 | 0 | 0 |

| Brown County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 10.38 | 0 | 10.42 |

| Butler County | 2 | 6 | 3 | 2 | 0 | 3.04 | 9.06 | 4.5 | 2.99 | 0 |

| Chase County | 1 | 1 | 1 | 0 | 0 | 37.69 | 37.66 | 38.01 | 0 | 0 |

| Chautauqua County | 0 | 2 | 0 | 0 | 0 | 0 | 59.07 | 0 | 0 | 0 |

| Cherokee County | 1 | 2 | 0 | 0 | 3 | 4.82 | 9.74 | 0 | 0 | 14.99 |

| Cheyenne County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clark County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 12.5 |

| Cloud County | 0 | 1 | 1 | 1 | 0 | 0 | 10.87 | 11 | 11.18 | 0 |

| Coffey County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Comanche County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 56.59 | 0 |

| Cowley County | 1 | 2 | 0 | 0 | 2 | 2.79 | 5.59 | 0 | 0 | 5.68 |

| Crawford County | 2 | 1 | 2 | 0 | 1 | 5.09 | 2.55 | 5.12 | 0 | 2.56 |

| Decatur County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dickinson County | 0 | 1 | 0 | 4 | 4 | 0 | 5.21 | 0 | 21.23 | 21.37 |

| Doniphan County | 1 | 1 | 2 | 1 | 0 | 12.76 | 12.85 | 25.93 | 13.05 | 0 |

| Douglas County | 0 | 5 | 1 | 2 | 0 | 0 | 4.23 | 0.83 | 1.66 | 0 |

| Edwards County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 34.57 | 0 |

| Elk County | 0 | 2 | 0 | 0 | 0 | 0 | 77.73 | 0 | 0 | 0 |

| Ellis County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.48 | 0 |

| Ellsworth County | 1 | 0 | 0 | 0 | 2 | 15.75 | 0 | 0 | 0 | 32.28 |

| Finney County | 1 | 1 | 3 | 0 | 0 | 2.69 | 2.69 | 8.12 | 0 | 0 |

| Ford County | 1 | 4 | 1 | 1 | 0 | 2.86 | 11.53 | 2.89 | 2.92 | 0 |

| Franklin County | 1 | 0 | 3 | 1 | 0 | 3.92 | 0 | 11.75 | 3.9 | 0 |

| Geary County | 0 | 1 | 2 | 1 | 1 | 0 | 2.73 | 5.69 | 2.97 | 3.07 |

| Gove County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Graham County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Grant County | 1 | 0 | 0 | 0 | 0 | 12.82 | 0 | 0 | 0 | 0 |

| Gray County | 0 | 1 | 1 | 0 | 0 | 0 | 16.46 | 16.61 | 0 | 0 |

| Greeley County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Greenwood County | 0 | 2 | 0 | 0 | 0 | 0 | 32.09 | 0 | 0 | 0 |

| Hamilton County | 1 | 0 | 0 | 0 | 0 | 37.61 | 0 | 0 | 0 | 0 |

| Harper County | 2 | 2 | 1 | 1 | 0 | 34.32 | 34.6 | 17.64 | 17.91 | 0 |

| Harvey County | 0 | 3 | 0 | 0 | 0 | 0 | 8.62 | 0 | 0 | 0 |

| Haskell County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 24.81 | 0 |

| Hodgeman County | 0 | 1 | 0 | 1 | 0 | 0 | 53.76 | 0 | 54.08 | 0 |

| Jackson County | 0 | 2 | 1 | 0 | 0 | 0 | 15.06 | 7.54 | 0 | 0 |

| Jefferson County | 1 | 2 | 2 | 1 | 1 | 5.31 | 10.63 | 10.61 | 5.27 | 5.27 |

| Jewell County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Johnson County | 10 | 11 | 10 | 13 | 8 | 1.75 | 1.9 | 1.71 | 2.2 | 1.34 |

| Kearny County | 1 | 0 | 0 | 0 | 0 | 25.39 | 0 | 0 | 0 | 0 |

| Kingman County | 0 | 1 | 0 | 0 | 1 | 0 | 13.1 | 0 | 0 | 13.68 |

| Kiowa County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Labette County | 1 | 0 | 1 | 0 | 0 | 4.81 | 0 | 4.92 | 0 | 0 |

| Lane County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Leavenworth County | 1 | 5 | 3 | 3 | 3 | 1.27 | 6.32 | 3.74 | 3.7 | 3.69 |

| Lincoln County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Linn County | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 20.63 | 10.26 |

| Logan County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 35.29 | 0 |

| Lyon County | 2 | 2 | 2 | 1 | 1 | 6.03 | 6.03 | 5.98 | 3 | 2.99 |

| Marion County | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 16.71 | 0 |

| Marshall County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 10.22 | 0 | 0 |

| Mcpherson County | 1 | 3 | 3 | 1 | 6 | 3.46 | 10.48 | 10.56 | 3.49 | 21.03 |

| Meade County | 0 | 0 | 2 | 0 | 2 | 0 | 0 | 47.19 | 0 | 48.24 |

| Miami County | 1 | 1 | 3 | 1 | 1 | 3.04 | 3.05 | 9.11 | 2.99 | 2.97 |

| Mitchell County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 32.13 | 0 | 0 |

| Montgomery County | 2 | 2 | 1 | 3 | 0 | 5.87 | 5.98 | 3.05 | 9.26 | 0 |

| Morris County | 0 | 1 | 0 | 0 | 0 | 0 | 17.77 | 0 | 0 | 0 |

| Morton County | 1 | 0 | 0 | 0 | 0 | 32.89 | 0 | 0 | 0 | 0 |

| Nemaha County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 9.91 | 0 | 0 |

| Neosho County | 3 | 1 | 1 | 0 | 0 | 18.38 | 6.15 | 6.23 | 0 | 0 |

| Ness County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Norton County | 0 | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 36.79 | 18.42 |

| Osage County | 1 | 1 | 1 | 0 | 3 | 6.26 | 6.3 | 6.33 | 0 | 18.82 |

| Osborne County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Ottawa County | 2 | 1 | 0 | 0 | 0 | 33.17 | 16.84 | 0 | 0 | 0 |

| Pawnee County | 1 | 1 | 0 | 0 | 0 | 14.66 | 14.78 | 0 | 0 | 0 |

| Phillips County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Pottawatomie County | 2 | 2 | 1 | 2 | 1 | 8.8 | 8.65 | 4.24 | 8.34 | 4.12 |

| Pratt County | 0 | 2 | 0 | 0 | 0 | 0 | 20.63 | 0 | 0 | 0 |

| Rawlins County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 40 | 40.24 | 0 |

| Reno County | 3 | 1 | 1 | 3 | 4 | 4.71 | 1.57 | 1.58 | 4.79 | 6.42 |

| Republic County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Rice County | 0 | 1 | 0 | 0 | 0 | 0 | 10.08 | 0 | 0 | 0 |

| Riley County | 1 | 4 | 0 | 1 | 0 | 1.31 | 5.18 | 0 | 1.35 | 0 |

| Rooks County | 2 | 0 | 0 | 0 | 0 | 38.43 | 0 | 0 | 0 | 0 |

| Rush County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 32.73 | 0 | 0 |

| Russell County | 0 | 1 | 0 | 0 | 1 | 0 | 14.2 | 0 | 0 | 14.48 |

| Saline County | 2 | 1 | 5 | 0 | 3 | 3.6 | 1.8 | 9.09 | 0 | 5.51 |

| Scott County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 20.07 | 0 | 20.42 |

| Sedgwick County | 25 | 15 | 11 | 15 | 14 | 4.91 | 2.93 | 2.14 | 2.92 | 2.73 |

| Seward County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 4.5 | 4.59 |

| Shawnee County | 9 | 6 | 5 | 3 | 6 | 5.04 | 3.36 | 2.8 | 1.68 | 3.38 |

| Sheridan County | 2 | 1 | 0 | 0 | 0 | 79.94 | 40.39 | 0 | 0 | 0 |

| Sherman County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 16.81 | 0 |

| Smith County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 27.5 | 0 |

| Stafford County | 0 | 1 | 1 | 0 | 2 | 0 | 23.72 | 23.89 | 0 | 47.87 |

| Stanton County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Stevens County | 1 | 0 | 0 | 1 | 0 | 17.12 | 0 | 0 | 17.94 | 0 |

| Sumner County | 1 | 2 | 1 | 1 | 1 | 4.28 | 8.55 | 4.32 | 4.33 | 4.35 |

| Thomas County | 3 | 1 | 2 | 0 | 1 | 38.28 | 12.66 | 25.49 | 0 | 12.97 |

| Trego County | 3 | 1 | 1 | 2 | 0 | 103.63 | 34.41 | 35.1 | 70.22 | 0 |

| Wabaunsee County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 29.07 | 0 | 0 |

| Wallace County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Washington County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 18.45 |

| Wichita County | 0 | 1 | 0 | 0 | 0 | 0 | 46.21 | 0 | 0 | 0 |

| Wilson County | 0 | 2 | 0 | 2 | 0 | 0 | 22.6 | 0 | 22.96 | 0 |

| Woodson County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Wyandotte County | 9 | 9 | 13 | 17 | 11 | 5.54 | 5.49 | 7.88 | 10.28 | 6.65 |

Sedgwick County had the most deaths over five years. Sedgwick County is within the city of Wichita, Kansas. This metropolitan area is heavily populated, so the chances for car accidents increase.

Traffic Fatalities

Traffic fatalities involve collisions with other vehicles, animals, pedestrians, and structures like retaining walls. The NHTSA provided us with some traffic fatality data, which you can view below.

| Traffic Fatality Summary | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total (C-1) | 386 | 431 | 386 | 405 | 350 | 385 | 355 | 429 | 461 | 404 |

| Rural | 315 | 345 | 314 | 326 | 271 | 298 | 276 | 322 | 313 | 308 |

| Urban | 71 | 86 | 72 | 79 | 79 | 87 | 79 | 105 | 147 | 95 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 1 | 1 |

Even though urban areas are more populated, there were traffic fatalities in rural Kansas than urban cities in Kansas.

Fatalities by Person Type

This table describes the fatalities by the type of vehicle. Person type signifies which vehicle the person died in died. Let’s review the table and compare the fatality rates.

| Occupants | # in 2014 | % in 2014* | # in 2015 | % in 2015* | # in 2016 | % in 2016* | # in 2017 | % in 2017* | # in 2018 | % in 2018* |

|---|---|---|---|---|---|---|---|---|---|---|

| Passenger Car | 136 | 35 | 136 | 38 | 151 | 35 | 157 | 34 | 136 | 34 |

| Light Truck - Pickup | 86 | 22 | 58 | 16 | 72 | 17 | 84 | 18 | 67 | 17 |

| Light Truck - Utility | 58 | 15 | 48 | 14 | 64 | 15 | 72 | 16 | 64 | 16 |

| Light Truck - Van | 16 | 4 | 14 | 4 | 21 | 5 | 28 | 6 | 11 | 3 |

| Large Truck | 4 | 1 | 16 | 5 | 16 | 4 | 15 | 3 | 21 | 5 |

| Other/Unknown Occupants | 7 | 2 | 11 | 3 | 5 | 1 | 9 | 2 | 7 | 2 |

| Total Occupants | 307 | 80 | 283 | 80 | 331 | 77 | 366 | 79 | 306 | 76 |

| Light Truck - Other | 0 | 0 | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 0 |

| Total Motorcyclists | 48 | 12 | 44 | 12 | 52 | 12 | 56 | 12 | 64 | 16 |

| Pedestrian | 23 | 6 | 24 | 7 | 41 | 10 | 33 | 7 | 29 | 7 |

| Bicyclist and Other Cyclist | 7 | 2 | 3 | 1 | 5 | 1 | 5 | 1 | 5 | 1 |

| Total Nonoccupants | 30 | 8 | 28 | 8 | 46 | 11 | 39 | 8 | 34 | 8 |

| Other/Unknown Nonoccupants | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| Total | 385 | 100 | 355 | 100 | 429 | 100 | 461 | 100 | 404 | 100 |

*Sum of Percents May Not = 100 Due to Individual Cell Rounding

Again, we see major differences in state. Trucks are the most popular vehicles in Kansas, yet there were more fatalities in passenger cars than trucks.

Fatalities by Crash Type

Now that you know what the crash report looks like for person type, let’s review the crash data for crash type.

| Crash Type | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 355 | 429 | 461 | 404 |

| Single Vehicle | 218 | 226 | 241 | 205 |

| Involving a Large Truck | 65 | 81 | 95 | 85 |

| Involving Speeding | 128 | 107 | 104 | 94 |

| Involving a Rollover | 135 | 151 | 153 | 112 |

| Involving a Roadway Departure | 230 | 241 | 263 | 231 |

| Involving an Intersection (or Intersection Related) | 70 | 107 | 103 | 96 |

Each crash type in the table explains the details of the crash. Single-vehicle crashes in 2017 and roadway departure fatalities in 2016 had the highest fatalities rates in the data table.

Five-Year Trend for the Top 10 Kansas Counties

What were the top counties in Kansas with the highest fatality rate? This crash report narrows it down to ten counties.

| Rank | County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | % of Total (2014) | % of Total (2015) | % of Total (2016) | % of Total (2017) | % of Total (2018) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Sedgwick County | 50 | 50 | 57 | 57 | 72 | 13 | 14 | 13 | 12 | 18 |

| 2 | Johnson County | 21 | 24 | 30 | 33 | 23 | 5 | 7 | 7 | 7 | 6 |

| 3 | Wyandotte County | 16 | 18 | 22 | 40 | 19 | 4 | 5 | 5 | 9 | 5 |

| 4 | Shawnee County | 22 | 12 | 32 | 15 | 18 | 6 | 3 | 7 | 3 | 4 |

| 5 | Leavenworth County | 7 | 10 | 12 | 13 | 14 | 2 | 3 | 3 | 3 | 3 |

| 6 | Ellsworth County | 4 | 2 | 0 | 2 | 11 | 1 | 1 | 0 | 0 | 3 |

| 7 | Mcpherson County | 4 | 6 | 8 | 3 | 11 | 1 | 2 | 2 | 1 | 3 |

| 8 | Atchison County | 3 | 2 | 1 | 1 | 10 | 1 | 1 | 0 | 0 | 2 |

| 9 | Reno County | 9 | 4 | 14 | 9 | 9 | 2 | 1 | 3 | 2 | 2 |

| 10 | Butler County | 7 | 11 | 9 | 12 | 8 | 2 | 3 | 2 | 3 | 2 |

| Sub Total 1.* | Top Ten Counties | 166 | 154 | 211 | 209 | 195 | 43 | 43 | 49 | 45 | 48 |

| Sub Total 2.** | All Other Counties | 219 | 201 | 218 | 252 | 209 | 57 | 57 | 51 | 55 | 52 |

| Total | All Counties | 385 | 355 | 429 | 461 | 404 | 100 | 100 | 100 | 100 | 100 |

As pointed out int the “All Crashes” data table, the highest fatality rate was in Sedgwick County. The lowest fatality rate was Butler County.

Fatalities Involving Speeding by County

Let’s narrow the crash data even further. Here’s a crash report that lists fatalities that involved speeding by county.

| County | Fatalities (2014) | Fatalities (2015) | Fatalities (2016) | Fatalities (2017) | Fatalities (2018) | Fatalities per 100k (2014) | Fatalities per 100k (2015) | Fatalities per 100k (2016) | Fatalities per 100k (2017) | Fatalities per 100k (2018) |

|---|---|---|---|---|---|---|---|---|---|---|

| Allen County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 7.92 | 0 | 0 |

| Anderson County | 0 | 1 | 1 | 2 | 1 | 0 | 12.79 | 12.8 | 25.45 | 12.69 |

| Atchison County | 1 | 0 | 0 | 1 | 3 | 6.05 | 0 | 0 | 6.13 | 18.53 |

| Barber County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Barton County | 1 | 2 | 2 | 1 | 0 | 3.66 | 7.36 | 7.44 | 3.78 | 0 |

| Bourbon County | 0 | 1 | 1 | 0 | 0 | 0 | 6.78 | 6.83 | 0 | 0 |

| Brown County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 10.38 | 0 | 10.42 |

| Butler County | 2 | 6 | 3 | 2 | 0 | 3.04 | 9.06 | 4.5 | 2.99 | 0 |

| Chase County | 1 | 1 | 1 | 0 | 0 | 37.69 | 37.66 | 38.01 | 0 | 0 |

| Chautauqua County | 0 | 2 | 0 | 0 | 0 | 0 | 59.07 | 0 | 0 | 0 |

| Cherokee County | 1 | 2 | 0 | 0 | 3 | 4.82 | 9.74 | 0 | 0 | 14.99 |

| Cheyenne County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clark County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 12.5 |

| Cloud County | 0 | 1 | 1 | 1 | 0 | 0 | 10.87 | 11 | 11.18 | 0 |

| Coffey County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Comanche County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 56.59 | 0 |

| Cowley County | 1 | 2 | 0 | 0 | 2 | 2.79 | 5.59 | 0 | 0 | 5.68 |

| Crawford County | 2 | 1 | 2 | 0 | 1 | 5.09 | 2.55 | 5.12 | 0 | 2.56 |

| Decatur County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dickinson County | 0 | 1 | 0 | 4 | 4 | 0 | 5.21 | 0 | 21.23 | 21.37 |

| Doniphan County | 1 | 1 | 2 | 1 | 0 | 12.76 | 12.85 | 25.93 | 13.05 | 0 |

| Douglas County | 0 | 5 | 1 | 2 | 0 | 0 | 4.23 | 0.83 | 1.66 | 0 |

| Edwards County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 34.57 | 0 |

| Elk County | 0 | 2 | 0 | 0 | 0 | 0 | 77.73 | 0 | 0 | 0 |

| Ellis County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 3.48 | 0 |

| Ellsworth County | 1 | 0 | 0 | 0 | 2 | 15.75 | 0 | 0 | 0 | 32.28 |

| Finney County | 1 | 1 | 3 | 0 | 0 | 2.69 | 2.69 | 8.12 | 0 | 0 |

| Ford County | 1 | 4 | 1 | 1 | 0 | 2.86 | 11.53 | 2.89 | 2.92 | 0 |

| Franklin County | 1 | 0 | 3 | 1 | 0 | 3.92 | 0 | 11.75 | 3.9 | 0 |

| Geary County | 0 | 1 | 2 | 1 | 1 | 0 | 2.73 | 5.69 | 2.97 | 3.07 |

| Gove County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Graham County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Grant County | 1 | 0 | 0 | 0 | 0 | 12.82 | 0 | 0 | 0 | 0 |

| Gray County | 0 | 1 | 1 | 0 | 0 | 0 | 16.46 | 16.61 | 0 | 0 |

| Greeley County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Greenwood County | 0 | 2 | 0 | 0 | 0 | 0 | 32.09 | 0 | 0 | 0 |

| Hamilton County | 1 | 0 | 0 | 0 | 0 | 37.61 | 0 | 0 | 0 | 0 |