Safeway Insurance Review & Complaints: Auto Insurance (2025)

Safeway Insurance is a family-owned and operated insurer, specializing in basic auto insurance policies. Safeway Insurance independent agents are the primary means of communicating with Safeway Insurance customers which means you will not be able to find Safeway car insurance quotes online. However, you can compare your Safeway Insurance rates to other top companies with our free comparison tool below.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Diego Anderson

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Licensed Real Estate Agent

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Safeway Insurance Overview

| Key Info | Provider Specifics | Source |

|---|---|---|

| Year founded | 1959 | safewayinsurance.com |

| Current executives | CEO: Christopher Hidalgo Chairman, President, Founder: William J. Parrillo | safewayinsurance.com |

| Numbers of employees | 201 - 500 employees | Glassdoor |

| Total sales/assets | $100 million - $500 million anually | Glassdoor |

| HQ address | 790 Pasquinelli Drive Westmont, IL 60559-1254 | Glassdoor |

| Phone number | 1-800-273-0300 | safewayinsurance.com |

| Company website | www.safewayinsurance.com | safewayinsurance.com |

| Premiums written | $272,778,000 | NAIC |

| Loss ratio | 66.84% | NAIC |

Looking for Safeway renters insurance? This Safeway Insurance review will focus on the Illinois-based regional car insurance company offering coverage in several states. Safeway’s auto insurance is family-owned and operated; they promise a more personal, affordable approach to car insurance.

Safeway Insurance also encourages anyone with less than perfect driving records to consider reaching out to their agents for additional coverage options. To find cheap car insurance, you must contact an agent in your area directly to receive rates. Keep in mind that the cheapest option may not always be the best option for your auto insurance needs.

Before beginning this Safeway Insurance Co. review, compare vehicle insurance rates by entering your ZIP code in our free tool above.

Are Safeway car insurance ratings positive?

You’re trusting an car insurance agency to be there for you during stressful moments like car accidents. It’s important your car insurance company has good customer service ratings and proves to be reliable. Let’s take a look at how Safeway Auto Insurance is rated by some of the leading rating agencies in the country. The following table shows how different agencies graded this company.

Safeway Insurance Company Business Ratings

| Rating's Agency | Safeway Insurance Ratings |

|---|---|

| A.M. Best | A "excellent" |

| Better Business Bureau | A+ |

| NAIC Complaint Index | 3.73 |

Overall, Safeway Insurance has decent reviews. Keep reading to go into more detail about what these ratings mean.

A.M. Best: On its website, Safeway Insurance Company claims to have an A rating, or excellent, from A.M. Best. Their rating is an indicator of financial stability.

Financial stability from your insurance company is important as it proves they will be able to cover any claims you may need to file.

You want to feel safe knowing your insurer can protect you if an accident occurs. According to A.M. Best’s rating, Safeway Insurance will be able to do that for you.

Better Business Bureau (BBB): Safeway Insurance has an A+ rating with the Better Business Bureau (BBB), with a total of 38 complaints on file in the past three years – not a high number for a company of this size.

They have been accredited since 1997. Thirteen customer reviews have been left on the BBB page, all of which are negative. They cite claims denial and problems with customer service.

Besides the negative customer reviews, the A+ rating from BBB is a positive sign and proves this insurance agency is worth looking into if they best fit your individual needs.

NAIC Complaint Index

The NAIC Complaint index collects complaint data from customers across the country. For the year 2019, Safeway Insurance has a complaint index of 3.73, higher than the national complaint index which is set at a base level of 1.00 for easier consumer comparison.

The major complaints consumers have with Safeway Insurance are related to customer service and filing claims. While customer reviews often need to be taken with a grain of salt, they are a good peek into what it’s like being a customer for a specific company.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the car insurance history of Safeway Auto?

Safeway Insurance Group was founded in 1959 and advertises itself as the largest privately-owned family-run insurance company in the United States. Its founder, William J, Parillo, still acts as President and Chairman for the company, while his brother is a major shareholder.

The company previously offered home insurance but sold off its property branch, Safeway Property Insurance, in 2015 to Florida Specialty Holdings. The company withdrew from Florida at the same time and now offers no coverage in that state.

What is Safeway Insurance’s market share?

Safeway Insurance Company is a relatively small company, especially compared to the top ten leading insurance companies that control most of the market share in the car insurance industry. According to the NAIC, Safeway Insurance’s market share in 2018 was 0.19 percent. Take a look at their market share rates over the past four years.

Safeway Insurance Market Share by Year

| Year | Safeway Insurance Market Share |

|---|---|

| 2018 | 0.18 % |

| 2017 | 0.19 % |

| 2016 | 0.19 % |

| 2015 | 0.18 % |

While they don’t control a large portion of the market, they do hold on to a steady amount year after year. They’ve proven to be consistent with their business, which is always a good sign for consumers.

What is Safeway Insurance’s position for the future?

While Safeway Insurance Company is a small company compared to more mainstream brands, they have decent ratings and have held on to a humble but steady amount of the market share over the past decade.

The services they provide to higher risk drivers makes them a worthwhile company to seek out if you have a poor credit history or a rocky driving history. They may be able to offer you the best insurance company for your budget.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How is Safeway Insurance’s online presence?

While Safeway has a website, they operate through independent agents and do not offer any online quoting. They are advertised as a budget insurance company, so we would anticipate that they offer reasonable rates compared to the average cost, particularly since their policies are very basic.

Safeway Insurance also has a Facebook page and a Twitter account. Otherwise, their online presence is minimal.

Does Safeway Insurance have commercials?

Safeway Insurance has very few commercials, most of which were aired around 2009 and 2010. Their commercials were often bilingual, allowing the company to reach out to a broader American audience.

What do Safeway Insurance employees have to say?

According to Glassdoor, employees rate working at Safeway Insurance as three out of five stars. However, there have only been 16 reviews. Considering there are between two hundred and five hundred Safeway employees, the limited number of reviews should be taken with a grain of salt.

Never be afraid to ask questions, choosing the right insurance company is important. If you’re requesting quotes from Safeway Insurance, do not hesitate to ask about employee satisfaction.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Are Safeway car insurance rates cheap?

If you’re looking for cheap car insurance rates from Safeway Insurance, you’re going to have to contact an agent in your area directly for quotes. The company does not provide free online quotes for potential clients.

However, they do claim to offer competitive rates for people with no driving experience in the United States and people with poor driving records.

What is Safeway Insurance availability & rates by state?

Safeway Insurance is only available in 12 different states. Take a look at the following list, is Safeway Insurance available where you live? If so, it may be worth reaching out to one of their independent agents.

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Georgia

- Illinois

- Louisiana

- Mississippi

- New Mexico

- Tennessee

- Texas

As we already mentioned, you must reach out directly to a Safeway Auto Insurance representative for auto insurance quotes and coverage options. You can search for nearby agencies on their website, and reach out to them directly for information about rates.

How does Safeway Insurance compare with the top five companies by market share?

Market share refers to how much of an available industry a certain company controls. The more market share a company has, the larger and more profitable they are.

Safeway Insurance is not a large auto insurance company compared to more recognizable brands like Geico, Progressive, or Allstate. However, that does not mean Safeway cannot offer competitive rates.

Check out the average rates from the top five insurance companies by market share in the twelve states where Safeway Insurance is available.

Safeway Car Insurance Competitor Rates by State

| States | Average Annual Car Insurance Rates | Average Allstate Rates | Average Geico Rates | Average Progressive Rates | Average State Farm Rates | Average USAA Rates |

|---|---|---|---|---|---|---|

| Illinois | $3,305.48 | $5,204.41 | $2,779.16 | $3,536.65 | $2,344.88 | $2,770.21 |

| New Mexico | $3,463.64 | $4,200.65 | $4,458.30 | $3,119.18 | $2,340.66 | $2,296.77 |

| Alabama | $3,566.96 | $3,311.52 | $2,866.60 | $4,450.52 | $4,798.15 | $2,124.09 |

| Tennessee | $3,660.89 | $4,828.85 | $3,283.42 | $3,656.91 | $2,639.30 | $2,739.28 |

| Mississippi | $3,664.57 | $4,942.11 | $4,087.21 | $4,308.85 | $2,980.48 | $2,056.13 |

| California | $3,688.93 | $4,532.96 | $2,885.65 | $2,849.67 | $4,202.28 | $2,693.87 |

| Arizona | $3,770.97 | $4,904.10 | $2,264.71 | $3,577.50 | $4,756.25 | $3,084.29 |

| Colorado | $3,876.39 | $5,537.17 | $3,091.69 | $4,231.92 | $3,270.77 | $3,338.87 |

| Texas | $4,043.28 | $5,485.44 | $3,263.28 | $4,664.69 | $2,879.94 | $2,487.89 |

| Arkansas | $4,124.98 | $5,150.03 | $3,484.63 | $5,312.09 | $2,789.03 | $2,171.06 |

| Georgia | $4,966.83 | $4,210.70 | $2,977.20 | $4,499.22 | $3,384.88 | $3,157.46 |

| Louisiana | $5,711.34 | $5,998.79 | $6,154.60 | $7,471.10 | $4,579.12 | $4,353.12 |

After you’ve received your quote from one of Safeway’s independent agents, refer to this table to see how it compares to these top competitors.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What is the average Safeway Insurance male vs. female car insurance rates?

Average rates by gender from Safeway Insurance are not readily available, however, take a look at the average rates people pay from Safeway’s leading competitors to compare how your quote holds up.

Safeway Car Insurance Competitor Average Annual Rates by Gender and Age

| Companies | Married 60-Year-Old Female | Married 60-Year-Old Male Rates | Married 35-Year-Old Female Rates | Married 35-Year-Old Male Rates | Single 25-Year-Old Female Rates | Single 25-Year-Old Male Rates | Single 17-Year-Old Female Rates | Single 17-Year-Old Male Rates |

|---|---|---|---|---|---|---|---|---|

| USAA | $1,449.85 | $1,448.98 | $1,551.43 | $1,540.32 | $1,988.52 | $2,126.14 | $4,807.54 | $5,385.61 |

| State Farm | $1,873.89 | $1,873.89 | $2,081.72 | $2,081.72 | $2,335.96 | $2,554.56 | $5,953.88 | $7,324.34 |

| Progressive | $1,991.49 | $2,048.63 | $2,296.90 | $2,175.27 | $2,697.73 | $2,758.66 | $8,689.95 | $9,625.49 |

| American Family | $1,992.92 | $2,014.38 | $2,202.70 | $2,224.31 | $2,288.65 | $2,694.72 | $5,996.50 | $8,130.50 |

| Travelers | $2,051.98 | $2,074.41 | $2,178.66 | $2,199.51 | $2,325.25 | $2,491.21 | $9,307.32 | $12,850.91 |

| Nationwide | $2,130.26 | $2,214.62 | $2,360.49 | $2,387.43 | $2,686.48 | $2,889.04 | $5,756.37 | $7,175.31 |

| Geico | $2,240.60 | $2,283.45 | $2,302.89 | $2,312.38 | $2,378.89 | $2,262.87 | $5,653.55 | $6,278.96 |

| Farmers | $2,336.80 | $2,448.39 | $2,556.98 | $2,557.75 | $2,946.80 | $3,041.44 | $8,521.97 | $9,144.04 |

| Allstate | $2,913.37 | $2,990.64 | $3,156.09 | $3,123.01 | $3,424.87 | $3,570.93 | $9,282.19 | $10,642.53 |

| Liberty Mutual | $3,445.00 | $3,680.53 | $3,802.77 | $3,856.84 | $3,959.67 | $4,503.13 | $11,621.01 | $13,718.69 |

Is the quote you received from a Safeway Auto Insurance agent competitive compared to these other agencies? Keep in mind, if you live in California, your gender will not be used as a determining factor for your auto insurance rates.

What are Safeway Insurance rates for commuting?

Specific commuter rates from Safeway Insurance may not be available, but we’ve pulled the average amounts people pay based on their commute length in most of the states where Safeway Insurance provides coverage. Find your state’s average rate below.

Average Annual Car Insurance Rates by Commute in States where Safeway Insurance is Available

| States | Average Annual Rates for 10 Miles Commute 6000 Annual Mileage | Average Annual Rates for 25 Miles Commute 12000 Annual Mileage |

|---|---|---|

| Alabama | $3,674.34 | $3,733.17 |

| Arizona | $3,784.32 | $3,835.73 |

| Arkansas | $4,094.75 | $4,128.65 |

| California | $3,363.65 | $4,015.59 |

| Colorado | $3,856.61 | $3,928.03 |

| Illinois | $3,237.56 | $3,304.35 |

| Tennessee | $3,631.16 | $3,690.62 |

| Texas | $3,896.19 | $3,960.49 |

Compare the rate you received from a Safeway agent to these numbers to ensure you’re getting your cheapest insurance.

What are Safeway Insurance rates based on coverage levels?

Sometimes it’s better to invest in an auto insurance policy with more comprehensive coverage. Maybe you live in a state with severe weather or want to protect the investment you made on your brand new car? Whatever the reason, extra coverage does not have to break the bank.

Ask about different coverage options from your Safeway Insurance agent. After you get your quote, compare it to the average rates people pay for different coverage levels in some of the states where Safeway Insurance is available. The details are in the table below.

Average Annual Car Insurance Rates by Coverage in States where Safeway Insurance is Available

| States | Average Annual Rates for Low Coverage | Average Annual Rates for Medium Coverage | Average Annual Rates for High Coverage |

|---|---|---|---|

| Illinois | $3,105.68 | $3,273.16 | $3,434.03 |

| California | $3,363.72 | $3,747.02 | $3,958.13 |

| Arizona | $3,458.15 | $3,867.94 | $4,103.99 |

| Tennessee | $3,505.05 | $3,648.53 | $3,829.08 |

| Alabama | $3,505.30 | $3,694.02 | $3,911.94 |

| Colorado | $3,639.50 | $3,884.62 | $4,152.84 |

| Texas | $3,814.10 | $3,860.74 | $4,110.18 |

| Arkansas | $3,939.51 | $4,085.23 | $4,310.35 |

More comprehensive coverage does not have to cost an excessive amount. You can protect yourself and your vehicle without paying an arm and a leg.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are Safeway Insurance rates based on credit history?

Do you know your credit score? Credit history has a huge impact on what you pay for car insurance. Check out what people pay on average based on their credit history in a few states where Safeway Insurance is available.

Average Annual Car Insurance Rates by Credit History in States where Safeway Insurance is Available

| States | Average Annual Rates with Good Credit | Average Annual Rates with Fair Credit | Average Annual Rates with Poor Credit |

|---|---|---|---|

| Alabama | $2,955.73 | $3,395.21 | $4,760.33 |

| Arizona | $2,953.86 | $3,473.21 | $5,003.01 |

| Arkansas | $3,389.60 | $3,874.16 | $5,071.34 |

| California | $3,689.62 | $3,689.62 | $3,689.62 |

| Colorado | $3,072.32 | $3,648.91 | $4,955.73 |

| Illinois | $2,583.89 | $3,004.69 | $4,224.29 |

| Tennessee | $2,859.13 | $3,414.23 | $4,709.31 |

| Texas | $3,014.49 | $3,581.83 | $5,188.70 |

Does your quote from Safeway compare to these average rates? If not, it may be time for some comparison shopping.

What are Safeway Auto Insurance rates based on driving record?

Another determining factor for your car insurance costs is your driving record. In most of the states where Safeway Insurance is available, these are the averages people are paying based on their driving records.

Average Annual Car Insurance Rates by Driving Record in States where Safeway Insurance is Available

| States | Average Annual Rates with Clean Record | Average Annual Rates with 1 Accident | Average Annual Rates with 1 DUI | Average Annual Rates with 1 speeding violation |

|---|---|---|---|---|

| California | $2,579.26 | $3,721.56 | $5,184.72 | $3,272.95 |

| Tennessee | $3,021.64 | $3,861.15 | $4,292.18 | $3,468.58 |

| Alabama | $3,086.33 | $3,859.19 | $4,224.88 | $3,644.62 |

| Arizona | $3,108.44 | $4,024.15 | $4,475.47 | $3,632.04 |

| Colorado | $3,175.09 | $4,100.69 | $4,629.17 | $3,664.33 |

| Arkansas | $3,306.20 | $4,284.74 | $4,946.08 | $3,909.78 |

| Texas | $3,328.16 | $4,303.39 | $4,464.00 | $3,617.80 |

Maintaining a clean driving record is always a best practice. A single driving incident can increase your rates by hundreds of dollars annually. A serious offense, like a DUI, may increase your payment by up to one thousand dollars.

While Safeway Insurance does not advertise any safe driving discounts, they do encourage people with poor driving histories to reach out to them for a quote. High-risk drivers with many offenses may get turned away by other leading commercial companies.

If this sounds like something you’ve experienced, a group like Safeway Insurance may be just the right fit.

What Safeway car insurance coverages are offered?

Safeway offers very basic auto insurance coverage options. They provide standard coverage for vehicle repairs, medical coverage, and will help you abide by specific state auto insurance laws.

On their website, they also say they can cover vehicle thefts, legal actions resulting from an accident, and can provide you with protection if you are ever in a collision with an uninsured driver. We’ve also discussed that Safeway Insurance will provide coverage for drivers with imperfect driving records or no prior experience driving in the United States.

Safeway Insurance may be a good option for high-risk drivers who have trouble receiving coverage from more mainstream companies.

For some drivers, Safeway Insurance may be the best option available. Remember, you must reach out directly to a Safeway Insurance agent to receive a quote.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are Safeway Insurance’s bundling options?

Safeway Insurance does not offer any bundling options at this time. Their focus seems to be primarily on very basic auto insurance coverage and coverage for high-risk drivers.

What are Discounts Offered by Safeway Insurance?

Safeway Insurance does not offer or advertise any insurance discounts or offer any on their website. They claim to be a straightforward, affordable option for basic car insurance needs.

What programs are available from Safeway Insurance?

The only program available through Safeway Insurance is auto insurance policies. They primarily focus on personal policies for individuals or families, not commercial auto insurance used for business purposes.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How do you cancel your Safeway car insurance policy?

To cancel your car insurance policy through Safeway, you must contact your agent directly and they will walk you through the process. Before accepting an offer from Safeway, be sure to ask your agent about their cancellation policy. Check if there is a cancellation fee or any type of refund.

You may also want to ask them when you will able to cancel the policy. It is always better to have this information ahead of time before signing your name to anything.

How many premiums are written by Safeway Insurance?

The number of premiums written by an insurance company indicates the level of growth of a company. The more premiums a company has written, the more business they are doing.

Check out Safeway Insurance’s number of written premiums between 2015 to 2018.

Safeway Insurance Premiums Written by Year

| Year | Number of Premiums Written |

|---|---|

| 2018 | $272,778,000 |

| 2017 | $260,234,000 |

| 2016 | $243,397,000 |

| 2015 | $219,461,000 |

Safeway Insurance has had a steady growth of written premiums, which is an indicator of success.

What is the loss ratio of Safeway Insurance?

In the insurance world, a loss ratio is the ratio of losses to premiums earned.

In other words, the difference between premiums earned versus claims the company has paid. Typically, anything between 60-70 percent is thought to be the industry standard. Take a look at the loss ratios for Safeway Insurance over the past four years.

Safeway Insurance Loss Ratio by Year

| Year | Loss Ratio |

|---|---|

| 2018 | 66.84% |

| 2017 | 76.19% |

| 2016 | 78.97% |

| 2015 | 70.48% |

If loss ratios are very high, that can be a sign of financial distress for the insurance agency. Safeway Insurance’s loss ratio has stayed in a relatively safe zone, indicating that they are a reliable financial entity.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How is the design of Safeway Insurance car insurance website/app?

Car insurance companies have started using both websites and phone apps to help make things easier for the consumer. Some companies let you store your insurance information in your app rather than on a physical card.

Applications are also a convenient way to pay your auto insurance bills and track a claim. However, Safeway does not use a phone app for their services.

They do, however, have a website and many local offices across the twelve states they provide services in.

Website

The Safeway website looks dated, and it can be difficult to find basic information, like the right claims phone number for your agent. If you choose to use Safeway Insurance, it’s probably a good idea to always keep your insurance card handy.

How easily can you find answers?

Finding answers on the Safeway web page quickly gets confusing. While their website does translate okay between a desktop computer and a phone, it takes a lot of guessing and clicking to find what you need.

For example, the claims page does not have the actual claims number listed on it. See what we mean in the image below.

Clicking on the Accident Tips or Auto FAQs blue buttons just reloads the same screen, still with no number. In order to find the actual number to call to file a claim, you need to select Accident Tips in the website’s upper right toolbar, not the blue-button on the bottom of the claims page.

You can see the toolbar in the next image.

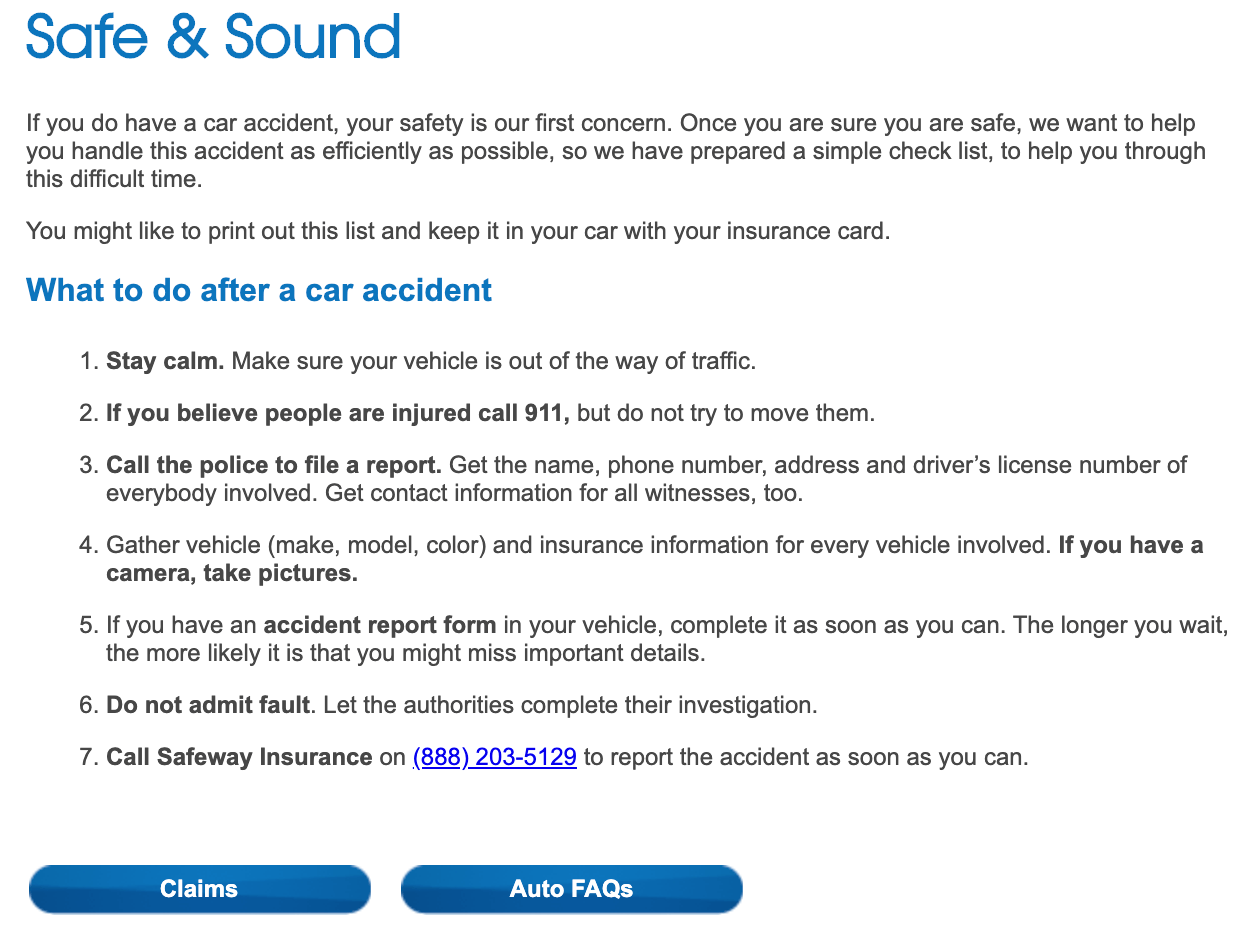

On the Accident Tips page of the website, there is a toll-free claim phone number listed with no indication that it is specific to any one state. It is not stated what the hours of operation are for this number. See the image below.

Trying to reach a Safeway Auto claims adjuster? Locating the right page on their website with the appropriate claims number is incredibly difficult. Doing this directly after experiencing an automobile accident would be incredibly frustrating.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Is the design a plus or minus?

Overall, the website is disjointed and confusing. The last thing you want to deal with after a car accident is a messy webpage. A clear, concise claims page that outlines where to direct claims and lists all options would be a good upgrade for this company’s site.

Safeway Insurance’s Claims Procedure

Ease of Filing a Claim

Safeway Insurance offers a straightforward process for filing claims, although it’s important to note that they do not provide online quotes or claims filing. To initiate a claim, policyholders should contact a Safeway Insurance agent directly. While this personalized approach can be beneficial for some, it may not be as convenient for those who prefer online interactions.

Average Claim Processing Time

The average claim processing time with Safeway Insurance can vary depending on the nature and complexity of the claim. Policyholders should reach out to their dedicated Safeway Insurance agent for specific information regarding claim processing times. Timely communication with the agent can help expedite the process.

Customer Feedback on Claim Resolutions and Payouts

Safeway Insurance has received mixed reviews when it comes to claim resolutions and payouts. Some customers have reported satisfactory experiences with timely settlements, while others have expressed concerns about the handling of claims. It’s advisable for policyholders to maintain open communication with their Safeway Insurance agent to ensure a smoother claims process.

Safeway Insurance Digital and Technological Features

Mobile App Features and Functionality

Safeway Insurance does not offer a mobile app for policyholders to manage their insurance accounts or file claims. The company primarily relies on interactions with independent agents for customer service and claims processing. As a result, customers looking for mobile app features may find this aspect lacking.

Online Account Management Capabilities

Safeway Insurance’s online presence is limited when it comes to account management. Policyholders may not have access to online account management tools typically offered by larger insurance companies. Instead, Safeway Insurance encourages customers to engage directly with their agents for policy-related inquiries and adjustments.

Digital Tools and Resources

While Safeway Insurance maintains a website, it lacks advanced digital tools and resources commonly found with larger insurers. Customers seeking online resources, such as detailed policy information, educational materials, or quote comparison tools, may find the company’s online offerings to be less comprehensive.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the pros & cons?

For pros, Safeway appears to have some decent reviews from BBB and A.M. Best. They also offer coverage for higher-risk drivers who need the peace of mind of having insurance, but are having difficulty receiving quotes from more mainstream companies.

That being said, unfortunately, the wide range of cons seem to outweigh the pros. The website is messy and hard to follow, and you must contact an agent directly to receive any sort of information about rates.

What’s the Bottom Line?

Safeway does not appear to bring in a lot of business through online searches; we found very limited information on a dated and poorly organized website.

Without details on the policies, it is hard to determine what kind of value they offer. With all of the negative reviews from customers about their customer service experiences, a high customer complaint ratio, and various claims complaints, that leaves us recommending that drivers look elsewhere for their auto insurance.

Frequently Asked Questions

What is Safeway Insurance?

Safeway Insurance is an insurance company that provides auto insurance coverage. They offer a range of insurance products and services to meet the needs of drivers.

How can I contact Safeway Insurance?

You can contact Safeway Insurance by visiting their website and accessing their contact information. They typically provide phone numbers, email addresses, and sometimes even live chat options for customer inquiries.

What types of auto insurance coverage does Safeway Insurance offer?

Safeway Insurance offers various types of auto insurance coverage, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and more. It’s best to check their website or contact them directly to get detailed information on the coverage options they provide.

How can I get a quote from Safeway Insurance?

To get a quote from Safeway Insurance, you can either visit their website and use their online quoting tool or contact their customer service. They will typically ask you for information such as your personal details, vehicle information, driving history, and coverage preferences to provide an accurate quote.

Are Safeway Insurance rates competitive?

Safeway Insurance rates may vary depending on several factors, including your location, driving record, the type of vehicle you drive, and the coverage options you choose. It’s recommended to obtain quotes from multiple insurance providers to compare rates and determine the most competitive option for your specific situation.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Diego Anderson

Licensed Real Estate Agent

Diego Anderson is a Real Estate Agent based in the Bay Area of California. Having received his Real Estate License at the age of 18, he wasted no time learning the ins and outs of the industry. With a focus on residential dual agency, he has a passion for supporting and educating families on their home buying and selling decisions. He is no stranger to new builds and new developments. He also r...

Licensed Real Estate Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.